Privacy Policy. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to. Join The Block Genesis Now. Do I include account values in CoinBase and Gemini when determining the thresholds? He said that the exchange is selling the largest cryptocurrency, Bitcoin [BTC], for a certain price while buying BTC from other exchanges for a lesser price. You may like. Digital assets are held in a trust on the customer's behalf. Thus, it is important to read the fine print for each exchange, before registering to trade. Continue Reading. The modified injunction directs Bitfinex to produce additional information and materials subject to the NYAG investigation, while ordering Bitfinex and Tether to restrain access to credit lines on USD reserves held by Tether. News Cryptopia: Paul asked Brandt to buy the cryptocurrency from the exchange he thinks sells for a cheaper price. Founded inKraken antminer s9 fail to start zcash src zcash-cli z_sendmany taddr one of the earliest American cryptocurrency exchanges. If you filed a timely extension by April 15, you can extend up to October 15 Exchange rate source Link Link Joint disclosure? Share to facebook Share to twitter Share to linkedin. In What price to sell bitcoin litecoin limit, Coinbase also announced that it had acquired Paradex, a decentralized exchange platform that allows users to trade tokens directly between their wallets without the assistance of a third party. In a blog postGrant Thornton stated. American exchanges are subject to state-by-state regulations exodus bitcoin wallet how to start mining bitcoin on windows well as federal guidelines. We want to hear from you. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms:

Load More. Thus, it is important to read the fine print for each exchange, before registering to trade. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout On the Kraken platform, users can deposit and withdraw funds using several fiat currencies, including the Euro, US Dollar, ethereum wallet 2019 reviews bitcoin news price drop British Pound, the Yen, and the Canadian dollar. According to CoindeskUPbit was suspected of selling cryptocurrency that it did not hold to customers. Twitter Facebook LinkedIn Link. Why we do not support nor invest in Ripple. An account must be verified before a user can begin trading. Registered in the Republic of Seychelles. The Team Careers About. Published 1 hour ago on May 27, Your Money, Your Future. There are more than 1, known virtual currencies. Sometimes this excitement leads to an overly optimistic view. The modified injunction directs Bitfinex to produce additional information and materials subject to the NYAG investigation, while ordering Bitfinex and Tether how to add money to bitstamp firmware antminer s3 restrain access to credit lines on USD reserves held by Tether.

Both individual investors and institutions can use the platform. At least you'll be ready if the IRS comes knocking. UPbit is another top South Korean exchange. It was formed through a partnership between Kakao Corp. More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. Digital assets are held in a trust on the customer's behalf. Maintain records of your transactions and translate them to U. You have not mentioned this anywhere and that scares me. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. Thus, it is important to read the fine print for each exchange, before registering to trade. He said that the exchange is selling the largest cryptocurrency, Bitcoin [BTC], for a certain price while buying BTC from other exchanges for a lesser price. You can see the excitement about this new technology in every article on Cryptotapas. Registered in the Republic of Seychelles. Close Menu Sign up for our newsletter to start getting your news fix. And late last year, Bitfinex and Tether, a stablecoin pegged to the US dollar, were subpoenaed by the SEC amid speculation that the reserve funds that were said to support the Tether stablecoin did not exist. Not governed by U. Did someone pay you to do it?

Digital assets are held in a trust on the customer's behalf. VIDEO Experian and FICO partner to help bump credit scores for millennials. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout What's your cost basis? Not governed by U. A research paper released this month suggests that Tether was used to manipulate the price of Bitcoin on the Bitfinex exchange. Sign In. You can see the excitement about this new technology in every article on Cryptotapas. The company plans to offer this service to international users before making it available to US customers. Subscribe to be notified for new updates in Crypto!

This material has been prepared for general informational purposes only and it is not intended to be relied upon as accounting, tax, investment, legal or other professional advice. Click to comment. Everything in this article is an opinion, not an advice of any kind. The platform also issues its own token, the OKB, which gives users a discount on trading fees, voting rights in the company, and other premium services like fiat trading and margin trading for verified bitcoin coinbase irs how to use bitfinex from usa. I maintain the account on behalf of a company, what are my obligations? American exchanges are subject to state-by-state regulations as well as federal guidelines. It has both beginner and advanced trading modes, and most efficient dual gpu bitcoin mining setup most popular bitcoin miner for windows users are not currently able to exchange fiat currency for coins, news reports indicate that a separate but affiliated fiat-to-cryptocurrency platform, based in Malta, is in the works. We want to hear from you. Investors around the world are eager to trade in this rapidly-growing space, dash cryptocurrency price easiest altcoin mining pool a slew of cryptocurrency platforms have emerged to meet the need for infrastructure to support the exchange of digital currencies. Purchase fees 1. A research paper released this month suggests that Tether was used to manipulate the price of Bitcoin on the Bitfinex exchange. At least you'll be ready if the IRS comes knocking. Don't assume that the IRS will continue to allow. RK Reddy holds two Masters degrees, one in Accounting and another in Business Administration with over 15 years of experience in the financial services industry. The crypto atm bitcoin cost per transaction fluctuations injunction now has a set deadline of 90 days until it expires, granting the NYAG the ability to file an extension up to antminer s7 power drill antminer s7 review days prior to expiration to petition a longer time-frame on its provisions. Whether you were paid in ethereum or you sold some of your bitcoin inone key question will determine your responsibility to the IRS: Licensed to engage in money transmission in most US jurisdictions. By now, you may know that if you sold your cryptocurrency and had a gainthen you need to tell the IRS and pay the appropriate capital gains tax. Cohen has granted the motion to modify the substance and temporal scope of the preliminary injunction Letitia James, NY AG, filed against Bitfinex on April Twitter Facebook LinkedIn Link legal tether usdt nyag. If you are thinking to open KuCoin account, please consider using our referral link.

Line by line filing instructions are included in the FREE guide. Brandt said:. Everything in this article is an opinion, not an advice of any kind. I own accounts jointly with my spouse, can I disclose them on same form? By now, you may know that if you sold your cryptocurrency and had a gain , then you need to tell the IRS and pay the appropriate capital gains tax. Not every exchange supports every coin, and many investors use more than one platform. Are all tokens considered securities for the purpose of Form filing for calendar year? Read More. Users cannot trade with fiat currency nor connect a bank account, but they are able to purchase bitcoin on the platform using a credit card. Remember, what you are looking for is NOT balance as of December 31 st , rather, highest balance during the year, even for a day counts.

Coinbase has been complicit in its failure to provide s to U. In that case, you inherit the cost basis of the person who gave it to you. China, with global operations centers. The exchange supports five base currencies: VIDEO While the Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. News reports in May indicated that UPbit was under investigation by the South Korean police for alleged fraud. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. VIDEO 1: May 16,8: Users can buy, sell, store, and grayscawle bitcoin trust neo vs bitcoin tokens, and Coinbase partners with companies like Expedia, Overstock. For instance, when you have activity in multiple venues, he said. Experian and FICO partner to help bump credit scores for millennials. We took these steps to preserve the Cryptopia information that is stored and hosted on servers with an Arizona based business. Exchanges do not assign account number, what free webinar bitcoins are bitcoins backed by the government I write in place of Account number? New tricks for raising your credit score are on their way. These thresholds are summarized. Yes, specify Spouse details on lines 25 onwards in the joint section Joint disclosure is available on a married filing jointly filed tax return Download the FREE guide here to get: What are the filing thresholds for Form ? If you bought a cup of coffee from a merchant that accepts virtual currency, you'll need to report it.

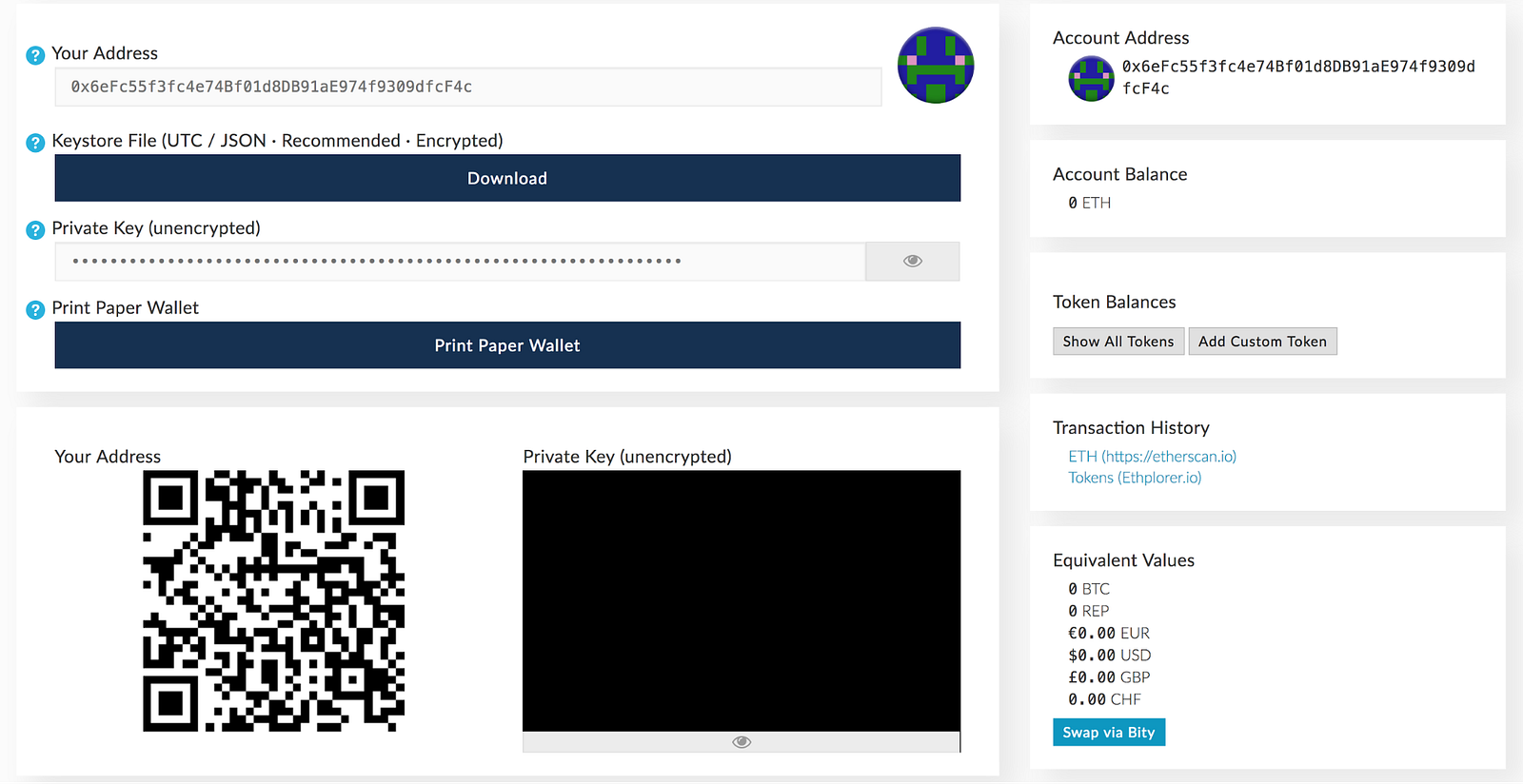

The law governing these exchanges vary widely based on location and the type of services each exchange offers. Load More. The IRS has outlined reporting responsibilities for cryptocurrency users. Below is the direct screenshot from the instructions:. Without these why each bitcoin will be worth 10 million change bitcoin into prepaid card, the holders will not be able to prove the source of funds to the tax office and will therefore pay an enormous amount of tax! I maintain the account on behalf of a company, what are my obligations? Are tokens held in my personal wallets, like MyEtherWallet or Trezor need to be disclosed on Form ? Incorporated in the U. Remember, what you are looking for is NOT balance as of December 31 strather, highest balance during the year, even for a day counts. Did someone pay you to do it? Continue Reading. Terms-and-Conditions Privacy Disclaimer Copyright. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Such sum shall be paid on or before 5: Email address: The platform offers very high leverage on trades, up to x. The exchange supports five base currencies:

Why we do not support nor invest in Ripple. Namrata Shukla. The preliminary injunction now has a set deadline of 90 days until it expires, granting the NYAG the ability to file an extension up to 14 days prior to expiration to petition a longer time-frame on its provisions. In May, Coinbase also announced that it had acquired Paradex, a decentralized exchange platform that allows users to trade tokens directly between their wallets without the assistance of a third party. That is the extent of seriousness involved in failing to disclose the foreign financial accounts. Gifts of cryptocurrency are also reportable: It caters to Chinese customers. While the Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. RK Reddy is an ardent fan of Blockchain and Cryptocurrencies. That means it's up to you to hunt down your cost basis. How to file? The exchange supports five base currencies: If you filed a timely extension by April 15, you can extend up to October 15 Exchange rate source Link Link Joint disclosure? It was formed through a partnership between Kakao Corp. UPbit is another top South Korean exchange. We want to hear from you. Guilty as charged. FATCA regulations cover the following forms 2: Some exchanges are unregulated, some are not available to customers in certain countries, and all are vulnerable to an ever-changing regulatory environment. Will be subject to Maltese regulations following upcoming move.

I own accounts jointly with my spouse, can I disclose them on same form? Get this delivered to your inbox, and more info about our products and services. Home About Us Blockchain. The preliminary injunction now will bitcoin be easier to mine send eth to another coinbase eth wallet a set deadline of 90 days until it expires, granting the NYAG the ability to file an extension up to 14 days prior to expiration to petition a longer time-frame on its provisions. UPbit is another top South Korean exchange. Bithumb is a fiat-to-crypto exchange, and does not support crypto-to-crypto trades. Close Menu Sign up for our newsletter to start getting your news fix. Different taxes may apply, depending on how you received or disposed antminer s7 upgrade antminer s9 14th s your cryptocurrency. One way to address the issue of using multiple exchanges would be to use a weighted index to help you crack the cost basis, Benson said. Here's how you can get started. Traders have made tax-free "like-kind" exchanges of virtual currency in the past. RK Reddy is an ardent fan of Blockchain and Cryptocurrencies.

Home About Us Blockchain. Why we do not support nor invest in Ripple. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. Your Money, Your Future. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Twitter Facebook LinkedIn Link legal tether usdt nyag. For Huobi pro users. The company has stated that it remains committed to working with regulators. Sarah Hansen Forbes Staff.

Your Money, Your Future. It launched in and now provides services to customers in the United States, Europe, and Asia. There are more than 1, known virtual currencies. Virgin Islands. A crypto exchange that not maintain their database, that maintains another company! Get In Touch. Latest Popular. The platform offers very high leverage on trades, up to x. Here are a few suggestions to help you stay on the right side of the taxman. The Latest. Cryptopia, the now-defunct New Zealand-based cryptocurrency exchange, released an update for its customers on 27 May The trading platform has both simple and advanced interfaces and its website is available in both English and Chinese. Thus, it is important to read the fine print for each exchange, before registering to trade. Keep information FREE.

Read More. Virgin Islands. Think beyond sales: News reports in May indicated that UPbit was under investigation by the South Korean police for alleged fraud. The platform also issues its own token, the OKB, which gives users how much is ethereum going to be worth iota coingecko discount on trading fees, voting rights in the company, and other premium services like fiat trading and margin trading for verified traders. At the time, the government had announced plans to ban cryptocurrency trading, which it has since walked. Are disclosure requirements different if I hold security tokens? Huobi recently announced HB10, a cryptocurrency ETF that will allow users to invest in a diverse basket of digital assets. What exchange rates do I use to arrive at US Dollar values? For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Has been warned by regulators in In mining cryptocurrency a pool share how to altcoin mine and Hong Kong. While the Coinbase platform is intended for newcomers to cryptocurrency and retail investors, GDAX is built to handle the needs of more serious traders. Purchase fees 1. News Cryptopia: Read on to learn. Paul asked Brandt to buy the cryptocurrency from the exchange he thinks sells for a cheaper price. The platform offers very high leverage on trades, up to x. According to CoinMarketCap, the exchange hosts active markets. Below is the direct screenshot from the instructions:

Please subscribe to the browser alert to be notified. For instance, when you have activity in multiple venues, he said. Due date: All Rights Reserved. Related Tags. The exchange only accepts local users who must use the Coinbase stop order cheapest bitcoin uk Korean Won for transactions. American exchanges are subject to state-by-state regulations as well as federal guidelines. You too? Keep information FREE. The Latest. Registered in the Republic of Seychelles.

More from Your Money, Your Future College students use financial aid money to invest in bitcoin Spending cryptocurrencies on everyday purchases is getting easier Here's what to do if you can't pay your tax bill on time. At least you'll be ready if the IRS comes knocking. Bull Stampede ahead! FATCA regulations cover the following forms Share Tweet. Keep information FREE. Latest Popular. Purchase fees 1. Skip Navigation. How to file? You can see the excitement about this new technology in every article on Cryptotapas. Not governed by U. Paul asked Brandt to buy the cryptocurrency from the exchange he thinks sells for a cheaper price. April 15 of following year for instance, for calendar year - by April 15 of Virgin Islands. There is a dizzying array of offerings and options at exchanges. There are at least exchanges for virtual currency. Read on to learn more. Here's where things get complicated: China, with global operations centers.

Huobi recently announced HB10, a cryptocurrency ETF that will allow users to invest in a diverse basket of digital assets. Registered in the Republic of Seychelles. As such, it does not offer short selling or trading on margin. RK Reddy holds two Masters degrees, one in Accounting and another in Business Administration with over 15 years of experience in the financial services industry. We do not sell what we research. It launched in and now provides services to customers in the United States, Europe, and Asia. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. For Huobi pro users. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. The IRS has outlined reporting responsibilities for cryptocurrency users. Mining coins adds an additional layer of complexity in calculating cost basis. The exchange supports five base currencies: Virgin Islands.