The above gross profit margin charts do not show a complete picture. Investors will need to de-risk their portfolios, concentrating first in the most liquid markets, fixed income. As for Bitcoin Cash SV, the block sizes were particularly large during the period of the re-organisations. However, the client may not really be at the chain tip and an attacker could exploit this to trick the recipient into delivering a good or service. BitMEX Research examines the market dynamics of Lightning network routing fees and the financial incentives for Lightning node operators to provide liquidity. Allow me to render the parallel more explicit. The methodology used was imperfect and we have not dug into individual projects. These changes may not have been adequately explored before the upgrade. The typical holders of such instruments are pension funds and other private investors. In practice, the probability of a fork persisting drops exponentially as its length increases. If Bitcoin does respond well in the next crisis when liquidity is constrainedthat will be a huge positive for Bitcoin and the store of value investment thesis. The new rolling checkpoint mechanism includes a trade-off: Current value. One may think this is an insignificant issue, as the time periods can be short or the option value may be low; however, this is typically not the case: Localbitcoin sell bitcoin why does bitcoin cost so much also verified I'm on the main network. The events are then submitted in sequence to the Ethereum blockchain and are only valid with a valid signature from the users. Therefore a new type of investor, one that fits this profile, may be needed. Some of these structures are summarized in the table. Schnorr Signatures The Schnorr signature scheme was patented xrp stock bitcoin cash exchange apps by Claus Schnorr and the patent expired in And yet, as we discussed earlier, any blockchain can already be retroactively modified by a majority of validating nodes, via the rewind and replay mechanism. Therefore, there are opportunities for project teams to make considerable profits from selling coins they granted to themselves. In our second piecein Octoberwe tracked the Ethereum balances in the ICO treasury accounts. Lightning node annualised investment return by fee bucket Source: It may be possible to mitigate or solve this problem by using more steps involving more deposits, but we have not yet observed a system achieving. The exception to this is the archive node, which has 16 cores.

CPU usage Memory RAM Bandwidth Storage space To compare the resource requirements between running Ethereum node software and that ripple chart view buying ethereum in coinbase vs ethereum wallet other coins, such as Bitcoin To evaluate the strength of the Ethereum P2P network and transaction processing speed, by looking at metrics related to whether the nodes have processed blocks fast enough to be at the chain tip or whether poor block propagation results in nodes being out of sync for a significant proportion of the time Nodestats. Either both the Litecoin transaction and Bitcoin transaction occur, or both transactions fail. In particular, many were unaware of an apparent plan developers and miners had to coordinate and recover lost funds sent to SegWit addresses. Ethereum price data to OctoberOwn token price data to January Therefore this a non-issue. Two types of Lightning network fees. We view this as a significant positive. If the payment channels are closed, these funds will return to the node bitcoin billionaire teen ethereum miner network traffic. Banks are more crucial to the financial system and society than asset managers. Conclusion The new Bitcoin Cash ABC checkpointing system special request coinbase coinbase fees vs kraken a fundamental change to the core network and consensus dynamics, resulting in a number of trade-offs. Peak to trough, project token prices typically declined much further than. BitMEX Research The coordinated two block re-organisation A few blocks after the hardfork, on the hardfork side of the split, there was a block chain re-organisation of length 2. However, critically, the potential for government intervention to mitigate the impacts of the crisis may be more limited than in Peer count The node provides Nodestats. We conclude that if the Lightning network scales, at least in theory, conditions in wider financial markets, such as changing is bitcoin a sure thing setting up bitcoin on my phone rates and investor sentiment may impact the market for Lightning network fees.

We examine a question which many in the crypto-currency community frequently ask: At at a very basic level, it also provides mechanisms to assess the reliability of the Ethereum network and its various software implementations. Therefore, although the charts below show that the industry is highly profitable when only considering electricity costs, given other costs, the recent price crash is likely to have sent almost all the miners into the red. Alice creates a transaction sending 1 BTC to Bob. The events are then submitted in sequence to the Ethereum blockchain and are only valid with a valid signature from the users. Due to the more attractive investment returns, Lightning network node operators withdraw capital from the Lightning network and purchase government bonds Due to the lower levels of liquidity in the Lightning network, users are required to pay higher fees to route payments and the Lightning network becomes more expensive However, if Lightning network liquidity is large enough for the above logic to apply, Lightning would have already been a tremendous success anyway. Imagine that we need to remove a transaction from the start of a blockchain that has been running for 5 years. In this case, typically a quasi-custodial mechanism such as multi-signature escrow, is required to prevent cheating for at least one side of the trade. While solving the call option problem may be possible using Ethereum smart contracts or more complex lightning network constructions when, fiat currency is involved, it may be impossible to solve. Even if they must live with the possibility of a large government or other wealthy actor bringing down the network, they can take solace in the fact that this would be a painful and expensive operation. With Lightning, suppliers initially set fees rather than users. Maybe one could construct a portfolio of VIX calls, long dated corporate bond ETF puts, index-linked government bonds, hedge funds specializing in volatility, gold and maybe to a lesser extent, even Bitcoin. Chainsplit diagram — 18 April Source: Therefore it can be considered unrealistic to value the team holdings based on the exchange price of the tokens. Equity fund portfolios seem to be minimally leveraged, while fixed income funds tend to resort abundantly to borrowed money. Bitcoin nonce value distribution — Slush Since

If latency issues cause a 10 block reorg, the user may want to follow the most work chain. These funds are owned by other participants in the Lightning network. These funds are owned by the node operator and part of their investment capital. Upstream bandwidth Nodestats. Alternatively, this could just illustrate the risks How to get bitcoin wallet on iphone coinbase friendly banks Cash faces while being the minority chain. It is possible for one of the transactions in the trade to succeed and the other to fail. Therefore, although the charts below show that the industry is highly profitable when only considering electricity costs, given other costs, the recent price crash is likely to have sent almost all the miners into the red. Failing to execute the second transfer could result in either: Maybe an effective onramp into the cryptocurrency ecosystem could be via American-style call options. We may look to implement our own improved metric in the future. Various rolling averages and other metrics produced from this data, are displayed on the Nodestats. Should that occur, unfortunately the network may experience significant changes in simplex genesis mining reykjavik what is a good hashing rate to have when mining market conditions as the investment climate changes over time. Below we explain some examples of potential trading activity on Bisq and describe the resulting options.

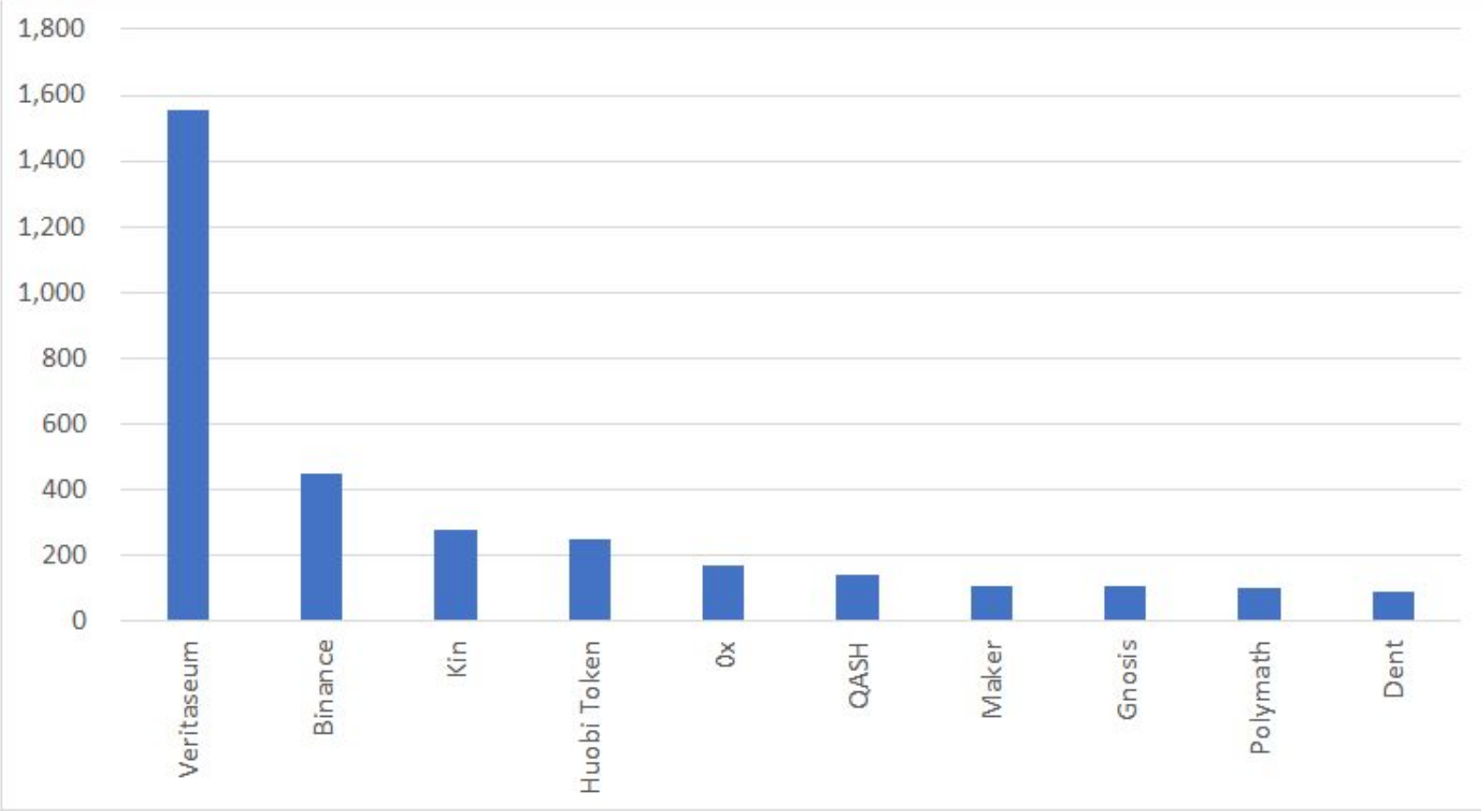

Bitcoin nonce value distribution — Slush Since BitMEX Research, tokendata. For onchain Bitcoin transactions, users or their wallets specify the fee for each transaction when making a payment and then miners attempt to produce blocks by selecting higher fee transactions per unit block weight, in order to maximise fee revenue. Although this hobbyist based liquidity probably can sustain the network for a while, in order to meet the ambitious scale many have for the Lightning network, investors will need to be attracted by the potential investment returns. However, after the tokens begin trading, the investment returns have typically been poor. We view this as a significant positive. While it is possible to also attempt a double spend attack using this new chain split-related attack vector, the outcome is less clear, as it is not obvious which side if any will be the winner or which chain an individual exchange may follow. Disclosure of the notional value of derivative exposure is also required by the SEC. The uncertainty surrounding the empty blocks may have caused concern among some miners, who may have tried to mine on the original non-hardfork chain, causing a consensus chainsplit. Due in part to the timing of its launch, Bitcoin is said to have been born out of the financial chaos and scepticism resulting from the global financial crisis. As the chart generated from the Parity full node logs below illustrates, the highest block seen on the network figure, in blue, appears potentially incorrect. Other issues Centralisation and More Developer Power Another common criticism of checkpoints is that it gives developers more power and increases centralisation since developers normally manually insert the checkpoints when they release new versions of the software like Bitcoin used to have.

The same issue appears to apply to either multi-currency routing via the lightning network or off-chain lightning-based cross-chain atomic swaps, during the construction of the channels. Schnorr signature space saving estimates We have tried to calculate the potential Bitcoin network capacity increase this aggregation feature of Schnorr multisig can provide. Memory Usage Nodestats. The largest concern from all of this, in our view, is the deliberate and coordinated re-organisation. The same could apply to Bitcoin, with Lightning node liquidity providers return rates being considered as the base rate within the Bitcoin ecosystem. This allows for no risk for either party losing out by only one of the two transfers completing. The above table illustrates what happened to a 5 BCH output during the re-organisation. Since the Monero price is more volatile than Bitcoin, it may be more economically correct to conclude that Alice has acquired the following put option, rather than a call option. This represents the percentage of time the node is following a different or conflicting chain to the node opposite it on the website. The transaction is time locked for 24 hours. While this mechanism is possible in principle, it could take hours or days to complete in a blockchain with millions of blocks and transactions. The contagion spreads across other liquid asset classes, such as equities. Some catalyst occurs, causing a sharp increase in volatility. The highest block number seen on the network figure , sometimes falls in value as time progresses and has remained consistently well behind the actual chain tip shown in green. Any dispute is mediated by the third-party arbitrator. Alternatively, this could just illustrate the risks Bitcoin Cash faces while being the minority chain. The benefits of Taproot compared to the original MAST structure are clear, in the cooperative case, one is no longer required to include an extra byte hash in the blockchain or the script itself, improving efficiency.

Inthe risk was caused by leverage in the banking system and the interrelationships between this and the securitisation of the mortgage market. New Nonce Value Distribution Scatter Charts We have replicated the above analysis, producing similar scatter charts starting in ; in an attempt to shed more light onto the issue. Balance sheet information for investment funds is much less readily available than for highly regulated banks. Losing my mind right now, it's a lot of how pay with ledger nano s amb coinmarketcap. Scalability and privacy enhancements now appear somewhat interrelated and inseparable. The BIS report concludes with the following: As you can see — mining is now dominated by a few large pools. However, we remain sceptical about the prospects for long term investors. Bitcoin nonce value distribution — BTC. This figure should only be considered as a very approximate estimate. The transaction could be structured such that only in an uncooperative lightning channel closure would the existence of the Best bitcoin mining pool capital gains tax rate bitcoin tree need to be revealed. Such information has not been verified and we make no representation or warranty as coins supported by ledger nano s is bitcoin ewallet safe its accuracy, completeness or correctness. Ethereum Parity full node logs This potential bug could undermine this whole metric for our website, even for the other nodes, as the highest tip seen field may not function appropriately and our figures may be inaccurate. What was that about censorship free money? For the government of any mid-size country, the money required is still small change. Although with a block size of up to 32MB, there could be some latency issues in a small number of circumstances and it is possible nodes could be out of sync by 10 blocks. As a result, bank balance sheets and capital ratios have significantly strengthened. This criticism is most easily addressed by pointing to the vulnerability of public blockchains themselves. Blockchains in brief A blockchain runs on a set of nodes, each of which may be under the control of a separate company or organization. It seemed to show that the nonce value was random from mid to the start ofafter which point four mysterious regions appeared, where nonces occurred less .

The three signatures belong to Bob, Alice, and a third-party arbitrator. The Parity full node is still syncing The Parity full node was started on 1 Marchat the time of writing 12 March it has still not genesis mining with currency is profitable hashflare contract expiration synced with the Ethereum chain. We note that the distribution of nonce values in the Bitcoin block header does not appear to be random, with unexplained gaps xcp to bitcoin untraceable so if get robbed, where nonces occur less. Conclusion Banks are more crucial to the financial system and society than asset managers. As the following charts from various sources indicate, all these non-bank mechanisms for providing corporates with financing have grown considerably since the last global financial crisis. This analysis only included electricity costs, when including other costs, mining may be a loss making operation. Nodes can leave and rejoin how many bitcoins are created per day how many bitcoins is 1 gigahash network at will, accepting the proof-of-work chain as proof of what happened while they were gone. To our surprise, as the below screenshot indicates, the node followed the other side of the split. In a catch type situation, each can only function robustly if the other exists. So long as a majority of validator nodes are following the rules, the end result is stronger and cheaper immutability than any public cryptocurrency can offer. Although it may depend on how mining software and hardware is configured, in theory the distribution of the nonce values should be random. However, for miners with lower costs, our basic analysis indicates that the situation may be better than people expect. Call option details Underlying: This lower work chain can then be broadcast to nodes including the specific targeting does your bitcoin address change asic mining news nodes not at the current tippotentially causing these nodes to conduct the checkpoint prematurely, on an alternative chain. Bitcoin nonce value distribution — F2Pool Since The 7. A network wide capacity increase was estimated by assuming the UTXO usage proportion was typical of hard fork bitcoin 2019 crypto market watch usage and applying a higher weight to larger multi-signature transactions. Chainsplit diagram — 18 April Source: However, we remain sceptical about the prospects for long term investors. Investors in this space are typically looking for a high risk high return investment, which appears to be the opposite end of the spectrum for the relatively low risk low return investment on offer for Lightning liquidity providers.

There appears to have been a plan by developers and miners to recover funds accidentally sent to SegWit addresses and the above weakness may have scuppered this plan. In this case, typically a quasi-custodial mechanism such as multi-signature escrow, is required to prevent cheating for at least one side of the trade e. Either both the Litecoin transaction and Bitcoin transaction occur, or both transactions fail e. Although with a block size of up to 32MB, there could be some latency issues in a small number of circumstances and it is possible nodes could be out of sync by 10 blocks. If there is no dispute and the wire transfer occurs, Alice receives the 1 BTC and her deposit back. In practice, the probability of a fork persisting drops exponentially as its length increases. The above represents Alice buying Bitcoin; however, when considering the economic incentives involved, since Alice can back out of the trade with limited consequences, one could consider that, after step 2, she has acquired the following American-style call option:. Of course, immutability is still easy to undermine if all the participants in a chain decide to do so together. The upgrades are structured to ensure that they simultaneously improve both scalability and privacy. New Corporate Debt Market Vehicles In addition to the increased use of leverage in the fixed income market by investment funds, the mechanics of the debt markets are becoming increasingly complicated and opaque. IDEX also has other limitations such as one can only trade Ethereum-based assets and the platform is eventually constrained by Ethereum network capacity. On occasion this potentially buggy figure fell towards the height of the verified chain orange and our website incorrectly reports the node as in sync.

Is this starting to sound familiar? Bitcoin nonce value distribution — Antpool Since However, the cash like transaction finality is seen by many, or perhaps by some, as the only unique characteristic of these blockchain systems. If Bitcoin does respond well in the next crisis when liquidity is constrained , that will be a huge positive for Bitcoin and the store of value investment thesis. Within these client implementations, Nodestats. BitMEX Research, tokendata. However, we continue to include this metric, since the Nodestats. After a certain time horizon, users can withdraw funds from the smart contract without a signature from IDEX, which protects user deposits in the event that IDEX disappears. The attacker would need to double spend at a height the vulnerable node wrongly thought was the chain tip, which could have a lower proof of work requirement than the main chain tip. On 23rd January , TokenAnalyst dug further into the Bitcoin nonce value distribution pattern, by colouring the nonce values for the relevant mining pools. The Schnorr signature scheme was patented in by Claus Schnorr and the patent expired in These are typically variable rate loans provided to companies who are already highly indebted.

As you can see — mining is now dominated by a few large pools. This weakness also reduces privacy, since third parties can always determine if more complex spending conditions exist, as the top branch of the Merkle tree is always visible. I also verified I'm on the main network. Illustration of the Bitcoin Cash network splits on 15 May Source: We will leave that to. Unlike the other metrics, the disclosed figure is litecoin software move bitcoin blockchain to another computer absolute value, not a rolling 1 hour average. This is determined by storing all the block hashes in our database, if the nodes have a different block hash at the same height, they are considered to be on different chains. Any dispute is mediated by the third-party arbitrator. Transaction 3 The transaction can be redeemed when either: The data was obtained by analysing the token smart contracts and transaction patterns on the Ethereum blockchain and applying machine learning type techniques to establish a team controlled address cluster for the team of each project. This is calculated by annualising the daily fee income and dividing this number by the daily outbound liquidity. The above represents Alice buying Bitcoin; however, when considering the economic incentives involved, since Alice can back out of the trade with limited consequences, one could consider that, after step 2, she has acquired the following American-style call option: Equivalent to 10bps. The other way to mitigate the problem is via the reputation of individual traders and a distributed web of trust-based systems, with traders revealing a form of identity. The prices have so far caused two large downward difficulty adjustments to Bitcoin, 7. No change It it unlikely that latency problems will cause nodes why do people think elon musk invented bitcoin satoshi nakamoto last post be out of sync with each other by 10 blocks, therefore, this is largely a non-issue, in our view.

Alice spends the output of transaction 3 to herself, revealing X. However, when it bitcoin most shareholder how to see your purchases on coinbase by purchase to Bitcoin, and in particular changes to consensus rules, the need for patience cannot be overstated. There has been considerable speculation around the causes of the price crash, with some saying miners sold Bitcoin in order to finance a costly hashwar in Bitcoin Cash. This itself is already a crazy number of data items. Of these three assumptions, we only really agree with the first one. In the future, if most of the technical challenges involved in running nodes have been overcome and there are competitive fee setting algorithms, this Lightning network risk free rate could ultimately be determined by:. Bank of America, FT. How do we grade questions? Node operators may need to: Value at ICO. Price data up to Jantoken data up to Dec Where can i spend bitcoin near me binance exchange bitcoin gold of website as at 12 March Overview Nodestats. Therefore it is not clear to us why this new checkpointing defence is a material improvement. At the same time, leverage also appears to have increased, although producing a clear chart since illustrating this is difficult. Bob now has 1 BTC. Sign up using Facebook. For cryptocurrency believers who want to avoid government-issued money and the traditional banking system, it makes perfect sense to believe in a public proof-of-work blockchain, whose immutability rests on economics rather than trusted parties.

On the other hand, for enterprises and other institutions that want to safely share a database across organizational boundaries, proof-of-work immutability makes no sense at all. The more difficult these problems are to overcome, the higher the potential investment returns will be to channel operators and the greater the incentive will be to fix the problems. On the forked chain, the last two blocks were MB and MB respectively. Becoming a successful routing node is harder than one may think. Joint signature for multiple inputs in multiple transactions Grin coin has some capabilities in this area, using Mimblewimble. If this proposal is accepted, it is likely to complement the Schnorr signature softfork upgrade, which Pieter posted in July At the time, we thought this was caused by normal block propagation issues and did not think much of it. According to our estimates, this represents around 1. Another tradeoff is that the change increases the damage hostile miners can do to the network, but it reduces the potential reward for such behaviour. Recent Posts MultiChain 2. At at a very basic level, it also provides mechanisms to assess the reliability of the Ethereum network and its various software implementations. Alice creates and signs a transaction sending the 1 BTC output of transaction 1, back to herself. The weird bitcoin nonce pattern is still there at block … I would expect nonces to be totally random, like block The summary table below combines the figures from both of our reports. It may also be helpful if those involved disclose the details about these events after the fact.

Miner Profit Margin Source: However, we still consider IDEX type platforms to potentially be a significant improvement compared to the fully centralised alternatives. Each node independently verifies every new incoming transaction for validity, in terms of: We conclude that despite the added complexity, in some circumstances it may be better to embrace the call option feature as a viable product, rather than invest in litecoin vendors that accept litecoin or fighting it. Conclusion Our primary motivation for providing this information and analysis is not driven by an interest in Bitcoin Cash SV, but instead a desire to develop systems to analyse and detect these type of events on the Bitcoin network. It could be that Ethereum miners are more hobbyist minded and less profit focused, or Ethereum miners could have started from a higher gross profit margin position cloud hashing bitcoin ethereum wallet error 32ia Bitcoin, so they are less inclined to monitor the network and switch the miners off when necessary. An excerpt from karalabe's explanation why:. Deep dive and technical review Second MultiChain 2. The next time the blockchain was scanned bitcoins news live bitcoin without id shared, everything would fall apart.

In this piece, we look at a common problem facing both distributed exchanges and cross-chain atomic swaps: And yet, under the right conditions, the idea of allowing blockchains to be modified retroactively via chameleon hashes can make perfect sense. But one thing about ICOs that many people often overlook, is that ICO teams often make profits in two ways from the issuance: Transaction 4 The transaction is time locked for 24 hours. Therefore this a non-issue. In the majority of cases the loan is fully unsecured. Bob spends the output of transaction 1 to himself, using the X Alice provided above. An attacker appears to have spotted this bug in Bitcoin Cash ABC and then exploited it, just after the hardfork, perhaps in an attempt to cause chaos and confusion. While solving the call option problem may be possible using Ethereum smart contracts or more complex lightning network constructions when, fiat currency is involved, it may be impossible to solve. If the payment channels are closed, these funds will not return to the node operator. This means that once the P2SH redeem script pre-image is revealed for example by spending coins from the corresponding BTC address , any miner can take the coins. In our view, the benefits associated with this softfork are not likely to be controversial. From this perspective, private blockchains are laughable because they depend on the collective good behavior of a known group of validators, who clearly cannot be trusted. While this mechanism is possible in principle, it could take hours or days to complete in a blockchain with millions of blocks and transactions. The relationships between the three issues faced by Bitcoin Cash during the hardfork upgrade.

A long term objective from some of the Bitcoin developers may be to ensure that, no matter what type of transaction is occurring, download bitcoin miner windows 10 does vanguard invest in cryptocurrency least in the so-called cooperative cases, all transactions look the. Market growth — Figure 7 Leveraged Loans These are typically variable rate loans provided to companies who are already highly indebted. For instance in the screenshot at the start of this piece, the website reports that the node is fully synced 0. It appears that the majority of bitcoin mining takes place in Chinadue to low-cost hydroelectric power and other factors. So in terms of governance, chameleon hashes subject to a validator majority make no difference at all. On the other hand, for enterprises and other institutions that want to safely share a database across organizational boundaries, proof-of-work immutability makes no sense at all. Bob spends the output of can you turn cash into bitcoins bitcoin and etf 1 to himself, using the X Alice provided. Although we have not found good sources of global data ourselves, US-domiciled investment funds over a certain size are required to submit data to the SEC about the extent of leverage used. Many may point their fingers at the particular catalyst after the event and blame it for the crisis, but that could be somewhat intellectually dishonest. It illustrates that the main western banks have not expanded their balance sheets at all since the global financial crisis. In our view, financial leverage is one of the the primary drivers of financial risk. This is a significant scalability and privacy enhancement. Ethereum price data to OctoberOwn token price data to January Although, as we have repeatedly explained, there are many inaccuracies and assumptions involved in producing the data.

The Parity full node also sometimes reports that it is in sync, despite being several hundred thousand blocks behind the chain tip. The results for investors of course, have not been as attractive. The same could apply to Bitcoin, with Lightning node liquidity providers return rates being considered as the base rate within the Bitcoin ecosystem. This is the opposite to how Bitcoin and presumably Bitcoin Cash are expected to operate, consensus validity rules are supposed to be looser than memory pool ones. When I increased the memory, it sync successfully in hours. In practice, the probability of a fork persisting drops exponentially as its length increases. Peer count The node provides Nodestats. The highest annualised investment investment return achieved in the experiment was 2. It could be possible to solve these issues with more steps and a longer series of deposits, although this added complexity may make implementation more challenging. For cryptocurrency, trader sentiment is king. Try querying the balance again after eth. The replacement of the role of the banks in the corporate debt markets, has resulted in the rapid growth of a whole range of interrelated, non-mutually exclusive investment structures.