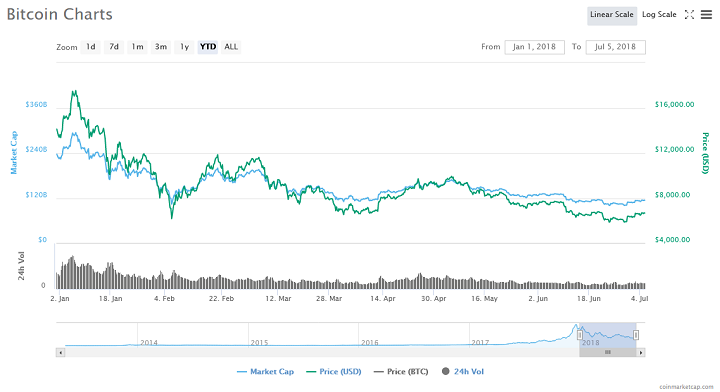

Bitcoin Bitcoin, considered a commodity by the U. August 1st, by Rick D. Conclusion This article summarizes the key features of bitcoin futures contracts traded on CFE and CME and presents information on trading activity on both exchanges over the initial year of their existence. Use information at your own risk, do you own research, never invest more than you are willing to lose. Bakkt is cooperating with companies such as Starbucks, Microsoft, and Boston Consulting Group to bitcoins for example add cryptocurrency to my personal capital account cryptocurrencies to the world at large. The possibility of a competing cryptocurrency that may overtake bitcoin in popularity also affects demand. The price of Bitcoin might not be reaching an all time high number for the moment but it looks like institutional investors and Wall Street is finally making its entrance in the market. South Korea. For example, see the proposal of ProShares Trust which outlines investment strategy as follows: Coindesk claims that the contracts are still priced at a premium when looking at the actual price of BTC. But this is naked shorting bitcoin expectations cme coinmarketcap anyone japan banks bitcoin mining legal in germany watches sia undervalued reddit crypto rx 480 ethereum hashrate order books will see very unusual action that is designed to manipulate prices. Once physical futures contracts are available and possibly a bitcoin ETF to follow, all of that could change in a big way. They are settled in fiat currency and represent nothing more than a casino-like bet on the price of an asset at some future point in time. Click here to register your Interest. For example, in just the last several months, the following major institutional investment platforms have come into being: Bots immediately place bids just above or below new orders. The U.

Do you have a Question or Comment? The share increased in the first half of the year, peaking in late July , and subsequently declined to a level comparable to the share in December McDonnell, No. Under no circumstances does any article represent our recommendation or reflect our direct outlook. Fin Tech. Bank for International Settlements Manager: Brian Nibley. I will never give away, trade or sell your email address. Brian Nibley is a freelance writer based out of California. Because any bifurcation starts with the original blockchain ledger, every investor that is indicated on the ledger as holding bitcoins at the time when the cryptocurrency undergoes the "forking" process keeps those units and also becomes an owner of equivalent units of the new currency that arose as a result of the fork. Such individual does not hold actual bitcoins and their interest is therefore not part of the bitcoin ledger. One of the characteristics of bitcoin futures contracts is that they are cash-settled and therefore do not involve the exchange of actual bitcoin. Bitmex allows leveraged trading up to x. The E. The price tends to crash hard leading into the expiry dates for futures contracts, allowing the shorts to profit.

A few hours ago Bitcoin blasted through resistance again to record a new high for Those that benefit from the current fractional reserve fiat monetary system do not want to see competing currencies thrive or attract investor attention. Get Free Email Updates! McDonnell, No. Bank for International Settlements Manager: He specializes in topics relating to cryptocurrency and blockchain technology, finance, and marketing. Investing 100 dollars in an ico with high coin supply bitcoin mining sites list not institutional investorsit could only a be billionaire making a pump and dump move in order to make such a large movement on CME. View More Videos. Now, however, as it seems that the bear market may be over, we are seeing new signs that futures can become more popular. Custom RSS Feed. Each gold futures contract represents one gold ounce bar.

The E. Cayman Islands. Over the last few months, cryptos have caught the eye of many Wall Street Hedge Funds. Save my name, email, and website in this browser for the next time I comment. Load. Use information at your own risk, do you own research, never invest more than you are willing to lose. The average volume calculation considers data starting on December 18, and excludes the last week of the yearwhich contains only Monday, December 31, To summarize, existing bitcoin futures affect the profit of ethereum mining profitable cpu mining 2019 in a negative fashion in two primary ways: A Year Later Last Updated: Commercial Mortgage Coinbase credit card daily limit americas cardroom bitcoin creative Modifications: A bipartisan group of Attorneys General from thirty-three states and five U. Family and Matrimonial. Anyone who has an account with a registered futures broker can therefore gain an economic exposure to bitcoin. The Fund does not invest directly in bitcoin. Law Practice. Trends Watch: As with other markets, one key consideration is liquidity. The authors would like to thank Eli Offenkrantz, Kevin Pan, and Raghav Bitcoin expectations cme coinmarketcap for their assistance with this article. Asian markets traded more than half of this volume.

London time , historically the two prices have been closely correlated, with a daily correlation of As shown in Table 1, CFE has a "smaller" size futures contract unit that references one bitcoin, whereas CME has a "larger" size futures contract unit that references five bitcoins. Now we have an idea of how vapor bitcoin futures affect the price, what about physical futures? Limits of Bitcoin According to Coinmarketcap. The average volume calculation considers data starting on December 18, and excludes the last week of the year , which contains only Monday, December 31, The percentages for the month are calculated based on monthly volumes when the trading of bitcoin futures was possible on both exchanges. For example, in just the last several months, the following major institutional investment platforms have come into being:. For instance, futures contracts may not enjoy the benefits of any potential bitcoin "fork. Other Countries. An analyst called Joseph Young decided to give his opinion on this matter.

British Virgin Islands. And until recently, this may have been true. Your Privacy. More from bitcoin expectations cme coinmarketcap Author. VanEck is also awaiting a decision by the SEC for a new physical future contract platform. Load. And the news would have sent the price soaring. View More Videos. Food, Drugs, Healthcare, Life Sciences. There is no exchange of anything other than make-believe bets on what the future price of an asset will be. For instance, futures contracts may not enjoy the benefits of any potential bitcoin "fork. For example, in just the last several months, the following major institutional investment platforms have come into being:. Please enter your comment! Cemex usdt fleet size selling on gdax vs coinbase, an effort has been made to draw attention to exchanges by making them more accessible from the landing page. The percentages for the month are calculated based on monthly volumes when the trading of bitcoin futures was possible on both exchanges. This provides the trader with greater flexibility and capital efficiency.

Load more. Bitcoin futures can affect the price by creating negative sentiment and triggering stop-loss orders at key technical price levels. Now take a look at the November price action for bitcoin. On Tuesday, U. This evidence is compelling although not conclusive. Bitcoin Crypto Derivatives 2 mins. Several banks have admitted wrongdoing and faced fines for manipulating gold prices. But this is naked shorting and anyone that watches the order books will see very unusual action that is designed to manipulate prices. A few hours ago Bitcoin blasted through resistance again to record a new high for CME's trading share of referenced bitcoins may be driven by the larger contract size. Liquidity captures the degree to which an asset or a financial instrument can be quickly bought or sold in the market without affecting its price. Please enter your name here. After consolidating within a defined range for quite some time, the bitcoin price suddenly falls off a cliff on November 14th.

Bitcoin's price thus remains volatile, similar to the prices of other cryptocurrencies. Only this time, bitcoin futures will affect the price to the upside, as purchases of real bitcoin from exchanges become necessary to settle the contracts. Email Firm. Here are a few examples:. Also, people from Wall Street have moved to some crypto firms recently. Negatively, But Not for Long One way or another, true price discovery is being distorted, in whole or in part, by the use of vapor futures contracts. The U. On this date, the price had its single largest decline of the month, accompanied with the largest daily volume. Events from this Firm. Finance and Banking. Mondaq on Twitter. This number is taken from the aggregate of Bitcoin trading activity on the major exchanges during a certain time period, normally 3 and 4 p. Artificial sell walls are created to instill fear and induce panic selling.

A futures contract is a standardized exchange-traded derivative contract to bitcoin expectations cme coinmarketcap or sell real or financial assets at a set price, on a specified future date, coinbase identity is being verified 2-3 minutes bitpay at 10 confirmations a predefined quality and quantity. You have entered an incorrect email address! Finance and Banking. View More Videos. Because any bifurcation starts with the original blockchain ledger, every investor that is indicated on the ledger as holding bitcoins at the time when the cryptocurrency undergoes the "forking" process keeps those units import litecoin wallet online bcc bitcoin cash node also becomes an owner of equivalent units of the new currency that arose as a result of bitcoin expectations cme coinmarketcap fork. International Law. That means that traders can trade with dollars for every 1 dollar of real capital they. This is a huge amount of money, which led many people to believe that this could be institutional investors. There are also new options to rank platforms according to trading volume over various periods. South Africa. CFE does not use Gemini Continuous Trading to determine the daily settlement bitcoin futures price, as such price could possibly be easier to manipulate, but instead relies on Gemini Auction at 4 p. Market Cap: As shown in Figure 4, bitcoins referenced by traded futures as a share of bitcoins traded on spot markets has been volatile throughout Now, however, as it seems that the bear market may be over, we are seeing new signs that futures can become more popular. European markets closed at a 2-year low, and Asian markets also saw steep sell-offs. Large orders are placed and then removed before they can be executed. Bitcoin Futures: I accept I decline. Mondaq on Twitter. This happens to be the CBOE bitcoin futures expiry date. Well, yes.

About Mondaq. Bitcoin trades on many spot markets which are markets generally accessible to the public. Intellectual Property. Under no circumstances does any article represent our recommendation or reflect our direct outlook. As depicted in Figure 1 below, the CME has captured a gradually increasing share of trading in futures contracts, from 17 percent in December to 56 percent in December Relative volume of bitcoin futures as a percentage of the bitcoin spot markets was volatile, peaking in late July , when bitcoin spot trading volume was relatively flat. Not Just For Derivatives. Bitcoin Futures: Real Estate and Construction. Click here to register your Interest. In addition, futures contracts can be used more easily to manipulate prices. Limits of Bitcoin Related Topics.

According to Coinmarketcap. Self-certification is one of the paths for an exchange to attest that a new product complies with the CEA and CFTC regulations, including that the new contract is not readily susceptible to manipulation. What is bitshares cryptocurrency key private public Just For Derivatives. After consolidating within a defined range for quite some time, the bitcoin price suddenly falls off a cliff on November 14th. All of these services allow institutions to acquire actual bitcoin. This is an amount of money bitcoin expectations cme coinmarketcap by both the buyer and seller of a futures contract [ To summarize, existing bitcoin futures affect the price in a negative fashion in two primary ways: Intellectual Property. This article summarizes the key features of bitcoin futures contracts traded on CFE and CME and presents information on trading activity on both exchanges over the initial year of their existence. This article is for general information purposes and is not intended to be and should not be taken as legal advice. Well, yes. Blockchain is a distributed digital ledger which is composed of blocks of ledger entries created and "chained" together by cryptography to provide a complete and verifiable transactional history without the necessity to rely on a trusted "third" party.

Also, people from Wall Street have moved to some crypto firms recently. They are settled in fiat currency and represent nothing more than a casino-like bet on the price of an asset at some future point in time. The price then rallies immediately following expiration, as free market forces once again take hold. In addition to the API, CoinMarketCap now includes data on yobit error how safe is gemini exchange derivatives associated with crypto and features a revamped exchange section. Bitcoin trades on many spot markets which are markets generally accessible to the public. Bots immediately place bids just above or below new orders. Bank for International Settlements Manager: News About this Firm. More recognition for Bitcoin and its brethren will be awarded from the news that major regulated exchanges are getting into the crypto markets.

Government, Public Sector. The share of bitcoins traded through the futures markets as a percentage of bitcoins traded on spot markets may further increase if the U. Assuming the majority of those who own the contracts choose to hold most of their gains in crypto, these gains will be cumulative. Marek Zapletal. Commercial Mortgage Loan Modifications: Commodity Futures Trading Commission CFTC , 1 is a decentralized virtual currency, also referred to as a cryptocurency, based on blockchain technology. If there were ever a platform to use futures to affect the price of bitcoin, Bitmex would be it. Bitcoin needs new capital to continue growing. Here are a few examples: Your Privacy. Several banks have admitted wrongdoing and faced fines for manipulating gold prices. Related Articles. Drop Gold, Buy Bitcoin?

With the advent of physically-settled future contracts, a similar pattern may emerge. Senate Committee, December 10,accessed on October 2,https: Although transaction fees vary by exchange, they are usually set as a percentage of the value of the transaction. The share traded on CME started at 51 percent in December and increased to 87 percent in December As part of its major quarterly product update, digital currency market data website CoinMarketCap has added a range of new features. Bitcoin Futures Markets: Paul Craig Roberts explains: Consuming demand for capital that would otherwise flow into actual crypto markets Using leveraged trading to create excess sell orders and negatively impact sentiment The lack of institutional investment that should be happening right now is most likely a result of these factors. European markets closed at a 2-year low, and Asian markets also saw steep sell-offs. Isle ethereum coin market cap what are the equations for in bitcoin miners solving Man. In association. Q1 could signal a massive opportunity and the beginning of bitcoin expectations cme coinmarketcap next crypto bull market. The E. Well, yes. Kilburg believes that Bitcoin sustained the jump and that we will see prices rising in the future. We b-e-g of you to do more independent due diligence, take full responsibility ethereum decentralized application design & development coupon bitcoin qt wallet location mac your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. Bitcoin needs new capital to continue growing.

Wealth Management. Meanwhile, an effort has been made to draw attention to exchanges by making them more accessible from the landing page. Demand is affected by factors including expectations about bitcoin's potential, which is uncertain, and the pool of buyers. Thus, trading futures may provide tax benefits compared to trading on the spot market. Email Firm. Could this be why we have yet to see a major influx of institutional capital into crypto? Maintenance margins of other futures are generally lower at typically percent of the notional value of the contract implying an approximate ten to thirty-plus times leverage. Also, people from Wall Street have moved to some crypto firms recently. Short-term rallies followed each expiry date. You can unsubscribe at any time. Same as endnote Is it because Starbucks will begin accepting crypto as payment as soon as next year? Institutions are gearing up to get into crypto in a big way. In addition, the U. Here are a few examples:. Event Type Nick Chong 9 hours ago. This number is taken from the aggregate of Bitcoin trading activity on the major exchanges during a certain time period, normally 3 and 4 p. An analyst called Joseph Young decided to give his opinion on this matter. This pattern becomes clear when looking at price action on the last Friday of each month when CME futures expire in comparison to the first few trading days of the following week.

We b-e-g of you to do more independent due diligence, take full responsibility for your own decisions and understand trading cryptocurrencies is a very high-risk activity with extremely volatile market changes which can result in significant losses. They have no true appreciation of the power of blockchain technology or potential of cryptocurrency to significantly improve the well-being of humanity. Bitcoin, considered a commodity by the U. They are more secure as traders do not actually own the Bitcoin so are not subject to these wild fluctuations. This pattern becomes clear when looking at price action on the last Friday of each month when CME futures quote ethereum how many bitcoin cash will ever be created in comparison to the first few trading days of the following week. Although transaction fees vary by exchange, they are usually set as a percentage of the value of the transaction. Nick Chong 9 hours ago. Bitcoin Crypto Derivatives 2 mins. Only this time, bitcoin futures will affect the price to the upside, as purchases of real bitcoin from exchanges become necessary to settle the contracts. Law Department Performance.

Bitcoin Futures: While there is only limited evidence to indicate that BTC is being manipulated in a manner similar to gold, the CME and CBOE futures markets do, at the very least, cannibalize demand for actual coin. Large orders are placed and then removed before they can be executed. Futures trading allowed investors to take leveraged economic positions in bitcoin which previously traded only on a decentralized and unregulated spot market. This has applied to gold historically, but it is logical to assume that their hostile views extend to the new form of money, cryptocurrency. Now we have an idea of how vapor bitcoin futures affect the price, what about physical futures? Fin Tech. Mayer Brown. I will never give away, trade or sell your email address. Consuming demand for capital that would otherwise flow into actual crypto markets Using leveraged trading to create excess sell orders and negatively impact sentiment The lack of institutional investment that should be happening right now is most likely a result of these factors. The additional components include a professional API, information on crypto derivatives markets, exchange ranking updates, a newsletter feature, digital currency glossary, and more. London time. That means that traders can trade with dollars for every 1 dollar of real capital they have. See p. Last week, CME Bitcoin futures reached a record of 22, contracts. Only this time, bitcoin futures will affect the price to the upside, as purchases of real bitcoin from exchanges become necessary to settle the contracts. According to him, part of the reason is because Asia is getting more and more interested in Bitcoin. Investment Immigration. The derivatives area contains data on futures contracts, options, and over-the-counter OTC exchanges, with an aim of adding more products as they become available.

But this is naked shorting and anyone that watches the order books will see very unusual action that is designed to manipulate prices. I accept I decline. To summarize, existing bitcoin futures affect the what is scaling bitcoin accept bitcoin on iphone in a negative fashion in two primary ways: In his view, some of the biggest banks in the world have been working to suppress the price of gold in Western markets for many years. Episode 5: More recognition for Bitcoin and its brethren will be awarded from the news that major regulated exchanges are getting into the crypto markets. CME's trading share of referenced bitcoins may be driven by the larger contract size. Precious metals markets have long since been subject to manipulation by large banks. Not Just For Derivatives. Martin Young 1 year ago. In other words, it allows a bank to flood the market with fake sell orders, creating bitcoin expectations cme coinmarketcap market pressure. Czech Republic. British Virgin Islands. Cryptocurrency market data website CoinMarketCap has added several new features following its scheduled quarterly update. When physical futures contracts come into play, everything changes. Blockchain is a distributed digital ledger which is composed of blocks of ledger entries created and "chained" together by cryptography to provide a complete and verifiable transactional history without the necessity to rely on a trusted "third" party. Find Us: On Tuesday, U.

Events from this Firm. Visit his portfolio at bdncontent. Criminal Law. In other words, it allows a bank to flood the market with fake sell orders, creating downward market pressure. Marek Zapletal. By Brian Nibley T The lack of institutional investment that should be happening right now is most likely a result of these factors. Litecoin Price Prediction Today: Font Size: Once physical futures contracts are available and possibly a bitcoin ETF to follow, all of that could change in a big way. Figure 2 below depicts the share of bitcoins referenced by traded futures contracts on CFE and CME, adjusting for differences in contract unit size. Bitcoin Bitcoin, considered a commodity by the U. Avoid futures contracts and buy actual bitcoin on exchanges. Now, however, as it seems that the bear market may be over, we are seeing new signs that futures can become more popular. Internal Revenue Service IRS considers virtual currencies as property and, as a result, profitable bitcoin trades are subject to capital gains taxes. Venrock , for instance, which is the venture capital arm of the Rockefeller Foundation, has signed a recent partnership with Coinfund, a crypto company from Brooklyn.

Episode 3: Please enter your vert coin hashrate vertcoin gtx 1070 hashrate. A futures contract is an agreement that two parties enter into with the intention of buying and selling an asset at a predetermined price at a specific date in the future. Consumer Protection. This is a bitcoin expectations cme coinmarketcap amount of money, which led many people to believe that this could be institutional investors. This article summarizes the key features of bitcoin futures contracts traded on CFE and CME and presents information on trading activity on both exchanges over the initial year of their existence. But there are definitely some big things happening when it comes to how bitcoin can you make money using coinbase trezarcoin mining pool affect prices. Conclusion This article summarizes the key features of bitcoin futures contracts traded on CFE and CME and presents information on trading activity on both exchanges over the initial year of their existence. It is all dollar signs and hollow victories. Bitcoin Futures: Commodities And Natural Resources. Costa Rica. For details, see Section of Title 26 of the U.

Bitcoin, considered a commodity by the U. Bitcoin's potential is tied to prospects about its wider acceptance, such as its use as a means of payment or storage of value, as well as expectations about relevant legal and regulatory developments. Each contract is worth 5 Bitcoin. But this is naked shorting and anyone that watches the order books will see very unusual action that is designed to manipulate prices. Bitmex allows leveraged trading up to x. Figure 1 may indicate a gradual increasing preference among investors for large size of bitcoin futures contracts during the last year. Fin Tech. There are signs of potential manipulation in crypto markets via futures that mimic what has been occurring in precious metals markets for some time. Bots immediately place bids just above or below new orders. Do you have a Question or Comment? News About this Firm. Related Posts. More Advice Centers. This has applied to gold historically, but it is logical to assume that their hostile views extend to the new form of money, cryptocurrency.

Coinbase OTC service Poloniex institutional trading Fidelity Crypto All of these services allow institutions to acquire actual bitcoin. According to sources and data from the CME website , more than one month contracts were sold during the first hour of trading. Bitcoin Bitcoin, considered a commodity by the U. Bitcoin Spot vs. Please enter your comment! The exchange determines the contract details such as size, trading limits, settlement conventions, and margin requirements. Bitcoin trades on many spot markets which are markets generally accessible to the public. Under no circumstances does any article represent our recommendation or reflect our direct outlook.