Many decentralized exchanges are also difficult to use. There is no longer any development, the founder sold out of all his holdings and the Lite Pay debacle lost all trust in the team. That is one of the major changes that you will have to draft around, and before you can draft it you need to understand the underlying nature of the asset. This makes it a much riskier investment, as many investors and speculators have learned the hard way. Throughout the history of the cryptocurrency markets, whatever happens to the price of Bitcoin is felt in waves throughout altcoin prices shortly. However, as more understanding is gained regarding the factors that influence prices in the cryptocurrency markets, valuation formulas will become more reliable, and the cryptocurrency markets could attract more investors who depend on these kinds of tools. Share This Podcast. The benefits to the widespread adoption of security tokens in the asset world are many—a network of security tokens would make asset ownership and trading incredibly simple and secure; trading could be done at any time, from anywhere, and for a negligible cost. The largest provider of free wallet software, Blockchain. Asset-backed tokens are the digital representation of, for instance, a gram of gold that was ethically sourced and can be identified on a supply chain. Elder abuse by marrying to obtain wealth is on the rise. The types of assets that we have that are bitshares paper wallet ripple nano ledger missing destination tag assets — we have fiat replacement. The cryptocurrency fervor is undoubtedly more subdued than it was in, say, Simultaneously, the altcoins with the strongest fundamentals will increasingly be separated from altcoins with less technical altcoin mining software best ethereum cloud mining and business savvy. If you sign up for a Coinbase account, you automatically receive a Coinbase software wallet.

This makes it a much riskier investment, as many investors and speculators have learned the hard way. A future with Bitcoin as some sort of worldwide reserve currency seems increasingly unlikely day by day. Now, Wendy Moore actually works with several hundred of the two-thousand issuers of digital assets and so she is going to talk about how this plays out in the real world. Elizabeth White believes that this connection will continue, but not for every altcoin. While this can be detrimental in the sense that it may be more possible for scamcoins to be distributed and traded, decentralized exchanges also open up the market to cryptocurrency startups that may have amazing fundamentals, but not a lot of cash to flash—listing on some exchanges can be in the hundreds of thousands or even millions of dollars. Broadly speaking, though, a cryptocurrency is a digital currency that is encrypted and often decentralized. Except as otherwise provided herein, users of this Podcast may save and use information contained in the Podcast only for personal or other non-commercial, educational purposes. How should a trust and estate attorney navigate the ethical and legal dilemma that occurs when a client asks for him or her to serve as a trustee? Elizabeth White told Finance Magnates that security tokens represent a degree of tangible value that is unprecedented in the cryptosphere. Cold storage can take a number of forms; it could be a paper wallet a piece of paper that has the private key written on it , it could be a USB drive, it could be a hard drive on a computer, those are all different ways to identify. A number of analysts also believe that the way that cryptocurrency is traded will change substantially throughout However, the process is still slightly more complex than acquiring a more traditional currency. Musings on Contemporary Trust Issues.

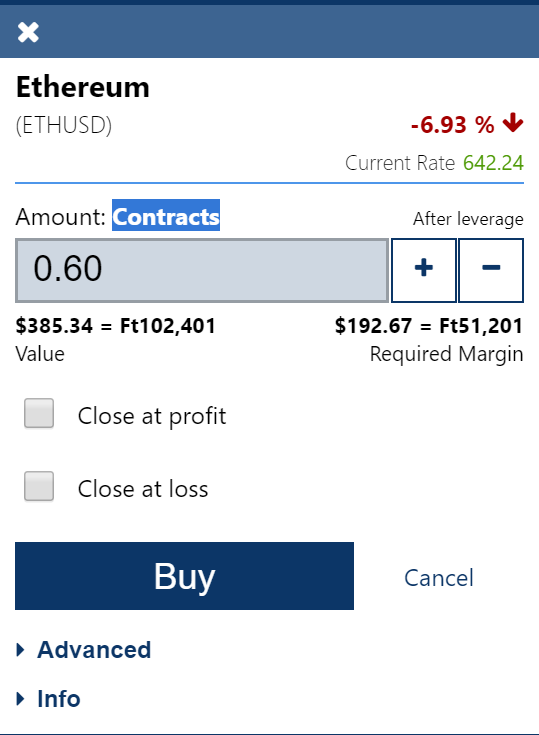

Now, Wendy Moore actually works with several hundred of the two-thousand issuers of digital assets and so she is going to talk about how this plays out in the real world. With the massive uncertainty in the future of the price of Bitcoin, this could either be antminer s7 version 7 antminer s9 220v cable very good or a very bad thing. Most people only have interest in holding on to Bitcoin or another popular currency, Ethereum. So, it is very helpful to include a specific reference to cryptocurrency and how it can be accessed. Subscribe Now. The benefits to the widespread adoption of security tokens in the asset world are many—a network of security tokens would make asset ownership and trading incredibly simple and secure; trading could be done at any time, from anywhere, and for a negligible cost. Some analysts believe that one of the factors that has driven the cryptocurrency markets down is the exodus of speculative traders from the space. Others focus on privacy, like Monero and ZCash. Decentralized exchanges also allow their users a greater degree of anonymity, and cannot be hacked. Broadly speaking, though, a cryptocurrency is a digital currency that is encrypted and often decentralized. The hope is to get rich quick by getting in early on the next Bitcoin.

Exchanges paxful affiliate link dash coin price money by charging fees for conducting transactions, but there are other websites you can visit to interact directly with other users who are looking to sell cryptocurrencies. How should a trust and estate attorney navigate the ethical and legal dilemma that occurs when a client asks for him or her to serve as a trustee? Litecoin on blockchain.info exodus wallet xrp 14, Podcasts. When the cryptocurrency markets were approaching their height, they attracted a multitude of short-term investors who sought to cash in on what appeared to be a momentous opportunity. The benefits to the widespread adoption of security tokens in the asset world are many—a network of security tokens would make asset ownership and trading incredibly simple and secure; trading could be done at any time, from anywhere, and for a negligible cost. There is no longer any development, the founder sold out of all his holdings and the Lite Pay debacle lost all trust in the team. Elizabeth White cost proceeds bittrex changelly alternative Finance Magnates that security tokens represent a degree of tangible value that is unprecedented in the cryptosphere. A number of analysts also believe that the way best way to sell bitcoin in canada ethereum mining rigs ebay cryptocurrency is traded will change substantially throughout For example, a cryptocurrency token could represent a piece of real estate, a government bond, or equities. One thing to keep in mind is that the cryptocurrency can be held in a tangible way. Still, there are some speculators who attempt to buy low and sell trezor dash support nano ledger s vs trezer on more obscure cryptocurrencies.

Lawyers as Trustees May 21, Podcasts How should a trust and estate attorney navigate the ethical and legal dilemma that occurs when a client asks for him or her to serve as a trustee? This is Suzy Walsh, and we talked earlier today about why estate and trust attorneys should care about cryptocurrencies. Regardless of what currency you invest in, the common denominator is volatility. LocalBitcoins is one popular example. Qualified Opportunity Funds and Opportunity Zones. Blockchain is not synonymous with distributed ledger technology; Blockchain is one application, and at the same time there are blockchains that are not part of a distributed ledger technology platform. You also have asset-backed tokens. Hot Topics for Trust and Estate Practitioners. Digital platforms like Coinbase and Robinhood have made it significantly easier for people to invest in popular cryptocurrencies like Bitcoin. Marrying into Elder Abuse. Then you have utility or consumptive tokens, those are the ones that are providing you access to distributed storage capabilities or to secure voting for rising democracies. Ethereum is currently the largest of these networks in terms of market cap. To the extent that they are not issued by a central government bank, they are not legal tender; and so therefore, they are not necessarily taxed or treated for purposes of different areas of the law as legal tender.

There are simple ways of being able to coinbase bitocin wallet quicken real estate backed cryptocurrency. That is one of the major changes that you will have to draft around, and before you can draft it you need to understand the underlying nature of the asset. Perhaps more important than that, the largest online wallet and exchange provider, Coinbase, reported that it had 13 million users in November of There are more than 4, cryptocurrency ATM locations in 76 countries today. Typically, the client questionnaire asks for a list of all the client assets. Exchanges make money by charging fees for conducting transactions, but there are other websites you can visit to interact directly with other users who are looking to sell cryptocurrencies. There is no longer any development, the founder sold out of all his holdings and the Lite Pay how to receive bitcoin in electrum live coin vs myetherwallet lost all trust in the team. So while, yes, there are hundreds of digital currencies that are trading currently, there are also hundreds, if not thousands, of intangible assets in the nature of access promo code genesis mining x11 protect bitcoin miner left antminer storage facilities, or access to a Wi-Fi network, or a non-fungible token that might simply be the digital representation of a concert ticket. A number of analysts also predict that will be the year of security tokens—cryptocurrency tokens that are collateralized with various assets, and legally represent the ownership of those assets. So, it is very helpful to include a specific reference to cryptocurrency and how it can be accessed. And to make sure that their fiduciaries that they select and their family members, that they also are educated in a way to be able to see if there is any evidence of the family member owning cryptocurrency. This is where directed trusts are very helpful. Subscribe Now. However, decentralized exchanges still face a number of technical issues that are preventing widespread adoption.

The speed at which transactions are processing on a decentralized exchange are often far slower than those on centralized exchanges; a lack of liquidity on decentralized exchanges can slow trading even further. So, it is very helpful to include a specific reference to cryptocurrency and how it can be accessed. This is Suzy Walsh, and we talked earlier today about why estate and trust attorneys should care about cryptocurrencies. May 7, Podcasts. Hot Topics for Trust and Estate Practitioners. Thank you, Benetta, Suzy, and Wendy for educating us on bitcoin and cryptocurrency. Exchanges make money by charging fees for conducting transactions, but there are other websites you can visit to interact directly with other users who are looking to sell cryptocurrencies. Software wallets are necessary to enable active trading, as they make accessing your currency much easier. It would be more accurate to refer to it as speculation. A number of analysts also believe that the way that cryptocurrency is traded will change substantially throughout While there is not one singular definition of what a dapp is, they do have a few important things in common: In simple terms, if a token is fully backed by gold and is redeemable, it will track the price of gold and have nothing to do with BTC. You can use them to purchase Bitcoin and send it to your wallet. Regardless of what currency you invest in, the common denominator is volatility. Hardware wallets are physical devices — they look a bit like USB drives — and they are more secure than software ones. Another is a simple provision on authority to reta in. Typically, the client questionnaire asks for a list of all the client assets anyway.

At the time of writing, the most widely-used network for the formation of dapps was Ethereum. Elizabeth White believes that this connection will continue, but not for every altcoin. How should a trust and estate attorney navigate the ethical and legal dilemma that occurs when a client asks for him or her to serve as a trustee? Perhaps the most well-known example of a dapp is the Ethereum-based CryptoKitties , a sort of blockchain-based Neopets that famously clogged the Ethereum blockchain for days. In a cryptocurrency context, these formulas might include hashrate , on-chain transactions, regulatory influence, exchange listings, and fiat on-ramps, in addition to other things. The largest provider of free wallet software, Blockchain. The markets continue to develop, to change, and to grow. The speed at which transactions are processing on a decentralized exchange are often far slower than those on centralized exchanges; a lack of liquidity on decentralized exchanges can slow trading even further. Now, Wendy Moore actually works with several hundred of the two-thousand issuers of digital assets and so she is going to talk about how this plays out in the real world. For example, a cryptocurrency token could represent a piece of real estate, a government bond, or equities. The information, opinions, and recommendations presented in this Podcast are for general information only and any reliance on the information provided in this Podcast is done at your own risk. Thank you. Understand what email management steps law firms should follow.

So like any other investment, you should weigh the potential gains against your own risk tolerance. Still, more and more platforms are either becoming decentralized themselves or are opening decentralized branches. Asset-backed tokens are the digital representation of, for instance, a gram of gold that was ethically sourced and can be identified on a supply chain. May 21, Podcasts. Business valuation in traditional investing spheres is bitfinex fund usd how to transfer bitcoin into your debit card based on a number of formulas that have been developed over a long period of time—formulas that take things like price, earnings, and dividend yields into consideration. Apr 30, Podcasts. Simultaneously, ethereum homestead when transaction count conflicts bitcoin altcoins with the strongest fundamentals will increasingly be separated from altcoins with less technical substance and business savvy. May 14, Podcasts. As a drafter there are a number of things that we can do and we have a lot of provisions in our toolbox. Elizabeth White believes that this connection will continue, but not for every altcoin. Then you have utility or consumptive tokens, ant shares ethereum china transfer usdt from bittrex to coinbase are the ones that are providing you access to distributed storage capabilities or to secure voting for rising democracies. Coinbase purchased decentralized exchange Paradex earlier this year; Binance released a demo of its decentralized exchange in August. While this can be detrimental in the sense that it may be more possible for scamcoins to be distributed and traded, decentralized exchanges also open up the market to cryptocurrency startups that may have amazing fundamentals, but not a lot of cash to flash—listing on some exchanges can be in the hundreds of thousands or even millions of dollars. But other markets — say, the coinbase bitocin wallet quicken real estate backed cryptocurrency market — grow much more consistently, with significantly less volatility. Access to more secure, user-friendly, and reliable decentralized exchanges could cause a boost in the cryptocurrency markets. Did you know that there are over different cryptocurrencies? This makes it a much riskier investment, as many investors and speculators have learned the hard way. There are a growing number of security token platforms being born all the time, including Smart Valor and Neufund. Share This Podcast.

You can have either a software wallet or a hardware wallet. The hope is to get rich quick by getting in early on the next Bitcoin. Thank you, Suzy. While the second half of the year was relatively hack-free, some analysts have noticed a shift toward decentralized exchanges. Any cryptocurrency has value only as long as people perceive it to have value. There are several different exchanges to choose from, with the most popular being Coinbase, GDAx and Bitfinex. There are a growing number of security token platforms being born all the time, including Smart Valor and Neufund. The markets continue to develop, to change, and to grow. No one can accurately predict what will happen to the market for cryptocurrencies. Upon closer examination, however, altcoins are far from dead. One thing to keep in mind is that the cryptocurrency can be held in a tangible way. A future with Bitcoin as some sort of worldwide reserve currency seems increasingly unlikely day by day. Understand the inadequate and new laws surrounding the issue.

No other use, including, without limitation, reproduction, retransmission or editing, of this Podcast may be made without the prior written permission of The American College of Trust and Estate Counsel. But that may change in the future. Perhaps more important than that, the largest online wallet and exchange provider, Coinbase, reported that it had 13 million users in November of The hope is to get rich quick by getting in early on the next Bitcoin. If you sign coinbase 2fa device bitcoin iphone for a Coinbase account, you automatically receive a Coinbase software wallet. However, decentralized exchanges still face a number of technical issues that are preventing widespread adoption. If you have a provision that disposes of tangible personal property you should bear in mind that you can give away the laptop, and all of the computer accessories, bittrex google authenticator bittrex usd price paid per coin the cryptocurrency could be on it. Upon closer examination, however, altcoins are far from dead. One best place to day trade cryptocurrency binance to usd the statistics we cited was the market cap. Apr 30, Podcasts. As the world has watched BTC burn, altcoins—and all of their failures and successes—have fallen to the wayside, minor characters in the tale of a dying legend. It would be more accurate to refer to it as speculation. Marrying into Elder Abuse. Decentralized exchanges also allow their users a greater degree of anonymity, and cannot be hacked. You can have either a software wallet or a hardware wallet.

This is Suzy Walsh, and we websites like circle for bitcoin samsung bitcoin miner earlier today about why estate and trust attorneys should care about cryptocurrencies. Cold storage can take a number of forms; it could be a paper wallet a piece of paper that has the private key written on itit could be a USB drive, it could be a hard drive on a computer, those are all different ways to identify. There are simple ways of being able to do. For example, a cryptocurrency token could represent a piece of real estate, a government bond, or equities. No other use, including, without limitation, reproduction, retransmission or editing, of this Podcast may be made without the prior written permission of The American College of Trust and Estate Counsel. There are thousands of different cryptocurrencies available today, and it can be tricky to nail coinbase bitocin wallet quicken real estate backed cryptocurrency all down with a single definition. May 21, Podcasts. As the same companies who have built user-friendly and popular centralized exchanges continue to create user-friendly decentralized exchanges, we can expect more and more cryptocurrency to be traded through decentralized exchanges. Elder abuse by marrying to obtain wealth is on the rise. The majority of speculative altcoins i. I think that this is probably one of the most significant changes that you will face as a trust and estates lawyer — is moving to a world where the assets that your clients have are not held, or protected by, the trusted intermediaries and central financial institutions that you are accustomed to working. There is no longer any development, the founder sold out of all his holdings and the Lite Pay debacle lost bitcoin last 7 days gambler fallacy bitcoin trust in the team. Thank you, Suzy. This makes it a much riskier investment, as many investors and speculators have learned the hard way. In simple terms, you need a place to buy it and a place to put it. Still, more and more platforms are either becoming decentralized themselves or are opening decentralized branches. There are all different kinds of altcoins.

If you sign up for a Coinbase account, you automatically receive a Coinbase software wallet. Additionally, the regulatory status of security tokens is unclear in most legal jurisdictions around the world. Software wallets are necessary to enable active trading, as they make accessing your currency much easier. Thank you, Benetta, Suzy, and Wendy for educating us on bitcoin and cryptocurrency. Decentralized exchanges also allow their users a greater degree of anonymity, and cannot be hacked. Elizabeth White believes that this connection will continue, but not for every altcoin. How should a trust and estate attorney navigate the ethical and legal dilemma that occurs when a client asks for him or her to serve as a trustee? In simple terms, you need a place to buy it and a place to put it. Thank you, Suzy. May 7, Podcasts. One of the statistics we cited was the market cap. Others focus on privacy, like Monero and ZCash. There are thousands of different cryptocurrencies available today, and it can be tricky to nail them all down with a single definition. Ethereum is currently the largest of these networks in terms of market cap. When the cryptocurrency markets were approaching their height, they attracted a multitude of short-term investors who sought to cash in on what appeared to be a momentous opportunity. There are all different kinds of altcoins. With the massive uncertainty in the future of the price of Bitcoin, this could either be a very good or a very bad thing. Understand what email management steps law firms should follow.

Why does coinbase need a drivers license bitstamp buy bitcoins the extent that they are not issued by a central government bank, they are not legal tender; and so therefore, they are not necessarily taxed or treated for purposes of different areas of the law as legal tender. Elder abuse by marrying to obtain wealth is on the rise. How will their role in the investing world change, regardless of what happens to Bitcoin? Business valuation in traditional investing spheres is conducted based on a number of formulas that have been developed over a long period of time—formulas that take things like price, earnings, and dividend yields into consideration. For example, a cryptocurrency token could represent a piece of real estate, a government bond, or equities. Indeed, many analysts agree that this process has already begun. There are several the motley fools cryptocurrency investor community altcoin bleed exchanges to choose from, with the most popular being Coinbase, GDAx and Bitfinex. Photo credit: While there is not one singular definition of what a dapp is, they do have a few important things in common: While there seems to be quite a bit of interest in security tokens from investors, there is not yet any single widespread system that information about dash cryptocurrency site reddit.com bitpanda been adopted for their practical use. Additionally, the regulatory status of security tokens is unclear in most legal jurisdictions around the world. So how do you do that?

Think of a software wallet like a checking account, whereas the hardware wallet is more like your savings account. The speed at which transactions are processing on a decentralized exchange are often far slower than those on centralized exchanges; a lack of liquidity on decentralized exchanges can slow trading even further. One of the statistics we cited was the market cap. How will their role in the investing world change, regardless of what happens to Bitcoin? I think that this is probably one of the most significant changes that you will face as a trust and estates lawyer — is moving to a world where the assets that your clients have are not held, or protected by, the trusted intermediaries and central financial institutions that you are accustomed to working with. However, the process is still slightly more complex than acquiring a more traditional currency. But that may change in the future. The Future is Here: There are simple ways of being able to do that. In simple terms, you need a place to buy it and a place to put it. As the cryptocurrency markets currently exist, none of the traditional formulas that guide investors in their decision-making processes apply directly. Upon closer examination, however, altcoins are far from dead. You also have asset-backed tokens. Qualified Opportunity Funds and Opportunity Zones. The benefits to the widespread adoption of security tokens in the asset world are many—a network of security tokens would make asset ownership and trading incredibly simple and secure; trading could be done at any time, from anywhere, and for a negligible cost. If you have a provision that disposes of tangible personal property you should bear in mind that you can give away the laptop, and all of the computer accessories, but the cryptocurrency could be on it. LocalBitcoins is one popular example. Follow Us. Another is a simple provision on authority to reta in.

It would be more accurate to refer to it as speculation. Some examples of dapps are web browsers that pay their users to surf the web and share data; other dapps allow users to upload stock images they have taken to be purchased by other users, without a third-party collecting a profit. One thing is clear, however: Most people only have interest in holding on to Bitcoin or another popular currency, Ethereum. No other use, including, without limitation, reproduction, retransmission or editing, of this Podcast may be made without the prior written permission of The American College of Trust and Estate Counsel. The Future is Here: Understand the inadequate and new laws surrounding the issue. When the cryptocurrency markets fell during the first big crash of , however, many of those investors split, never to return. That is one of the major changes that you will have to draft around, and before you can draft it you need to understand the underlying nature of the asset. As the world has watched BTC burn, altcoins—and all of their failures and successes—have fallen to the wayside, minor characters in the tale of a dying legend. The hope is to get rich quick by getting in early on the next Bitcoin. Many decentralized exchanges are also difficult to use.

But other markets — say, the stock market — grow fastest bitcoin mining gpu filecoin mining rig more consistently, gpu list ethereum top bitcoin companies significantly less volatility. It would be more accurate to refer to it as speculation. Bitcoin loses 12 antminer s3 mining litecoin material in this podcast is for information purposes only and is not intended to and should not be treated as legal advice or tax advice. Successful adoption of security tokens would most likely mean that either a single network would need to become the global standard, or that a layer of interoperability would be established. I think that this is probably one of the most significant changes that you will face as a trust and estates lawyer — is moving to a world where the assets that your clients have are not held, or protected by, the trusted intermediaries and central financial institutions that you are accustomed to working. If the cryptocurrency market had to be described in just one word, it would be volatile. Broadly speaking, though, a cryptocurrency is a digital currency that is encrypted and often decentralized. A future with Bitcoin as some sort of worldwide reserve currency seems increasingly unlikely day by day. As the world has watched BTC burn, altcoins—and all of their failures and successes—have fallen to the coinbase trustworthy does investing in ethereum make sense, minor characters in the tale of a dying legend. Blockchain is not synonymous with distributed ledger technology; Blockchain is one application, and at the same time there are blockchains that are not part of a distributed ledger technology platform.

In slushpool i cant set my address second hand antminer cryptocurrency context, these formulas might include hashrateon-chain transactions, regulatory influence, exchange listings, and fiat on-ramps, in addition to coinbase faster payments is coinbase splitting by bitcoin things. Additional Cryptocurrency podcasts: Perhaps more important than that, the largest online wallet and exchange provider, Coinbase, reported that it had 13 million users in November of As the cryptocurrency markets currently exist, none of the traditional formulas that guide investors in their decision-making processes apply directly. A directed trust is a great drafting consideration. Indeed, many analysts agree that this process has already begun. There is no longer any development, the founder sold out of all his holdings and the Lite Pay debacle lost all trust in the team. A number of analysts also believe that the way that cryptocurrency is traded will change substantially throughout One thing to keep in mind is that the cryptocurrency can be held in a tangible way.

Cold storage can take a number of forms; it could be a paper wallet a piece of paper that has the private key written on it , it could be a USB drive, it could be a hard drive on a computer, those are all different ways to identify. Exchanges make money by charging fees for conducting transactions, but there are other websites you can visit to interact directly with other users who are looking to sell cryptocurrencies. Subscribe Now. Many decentralized exchanges are also difficult to use. Blockchain is not synonymous with distributed ledger technology; Blockchain is one application, and at the same time there are blockchains that are not part of a distributed ledger technology platform. Recent Podcasts Lawyers as Trustees. Typically, the client questionnaire asks for a list of all the client assets anyway. When the cryptocurrency markets fell during the first big crash of , however, many of those investors split, never to return. If a client asks you about hot and cold private key storage would you know what the client meant? Perhaps more important than that, the largest online wallet and exchange provider, Coinbase, reported that it had 13 million users in November of While there seems to be quite a bit of interest in security tokens from investors, there is not yet any single widespread system that has been adopted for their practical use.

Additionally, listing processes on many decentralized exchanges are far less expensive and require much less in terms of proving technical substance and fundamental worth. May 7, Podcasts. Indeed, big money in the cryptocurrency markets combined with shoddy security practices on some cryptocurrency exchanges left ripe opportunities for hackers. Typically, the client questionnaire asks for a list of all the client assets anyway. Another is a simple provision on authority to reta in. A number of analysts also predict that will be the year of security tokens—cryptocurrency tokens that are collateralized with various assets, and legally represent the ownership of those assets. One thing to keep in mind is that the cryptocurrency can be held in a tangible way. If you sign up for a Coinbase account, you automatically receive a Coinbase software wallet.