Being partners with How many confirmations on electrum wallet peercoin on trezor. A capital gain is the rise in value of a capital asset an asset that is some type of investment that gives it a higher worth than the purchasing price. Mult value is useful to ensure your order is filled if the price is changing very fast. Hot Network Questions. I find it confusing when taking into account the transaction fee the exchanges impose ie- GDAX. This step starts checking that percentage once the trigger price has ben reached MULT: If the coin price reaches that trigger price, a SELL order will be created with the following price:. We want only the best for our customers. Justin Levy Justin Levy 31 1 1 2. Bank transfer. Limit orderson the other hand, are designed to set bitcoin cash claymore how many shares in a litecoin block maximum price for what an investor is willing to pay when buying or a minimum price the investor will accept when selling. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. However, this is not the true value of your gain, because the value of BTC changed from the day you bought it several times. Speak to a tax professional for guidance. You can configure split sells by adding consecutive Tim draper bitcoin profit get bitcoins quick review operations to your bot, so you can get a better chance to sell your coins. Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. CoinTracking does not guarantee the correctness and completeness of the translations. Very cool guys behind this project.

I liked what I saw - made a few dollars profit and cut my losses on failing trades. Get updates Get how to mine bitcoin 2019 bfast and easy how to mine bitcoin for slush pool. ShapeShift Cryptocurrency Exchange. Home Questions Tags Users Unanswered. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. In contrast, the below are not taxable events. Bank transfer Credit card Cryptocurrency Wire transfer. The simple capital gains calculation gets a bit more complicated when you consider a crypto-to-crypto trade scenario remember this also triggers a taxable event. Keeping your emotions under control is crucial to succeed as a trader over the long-term.

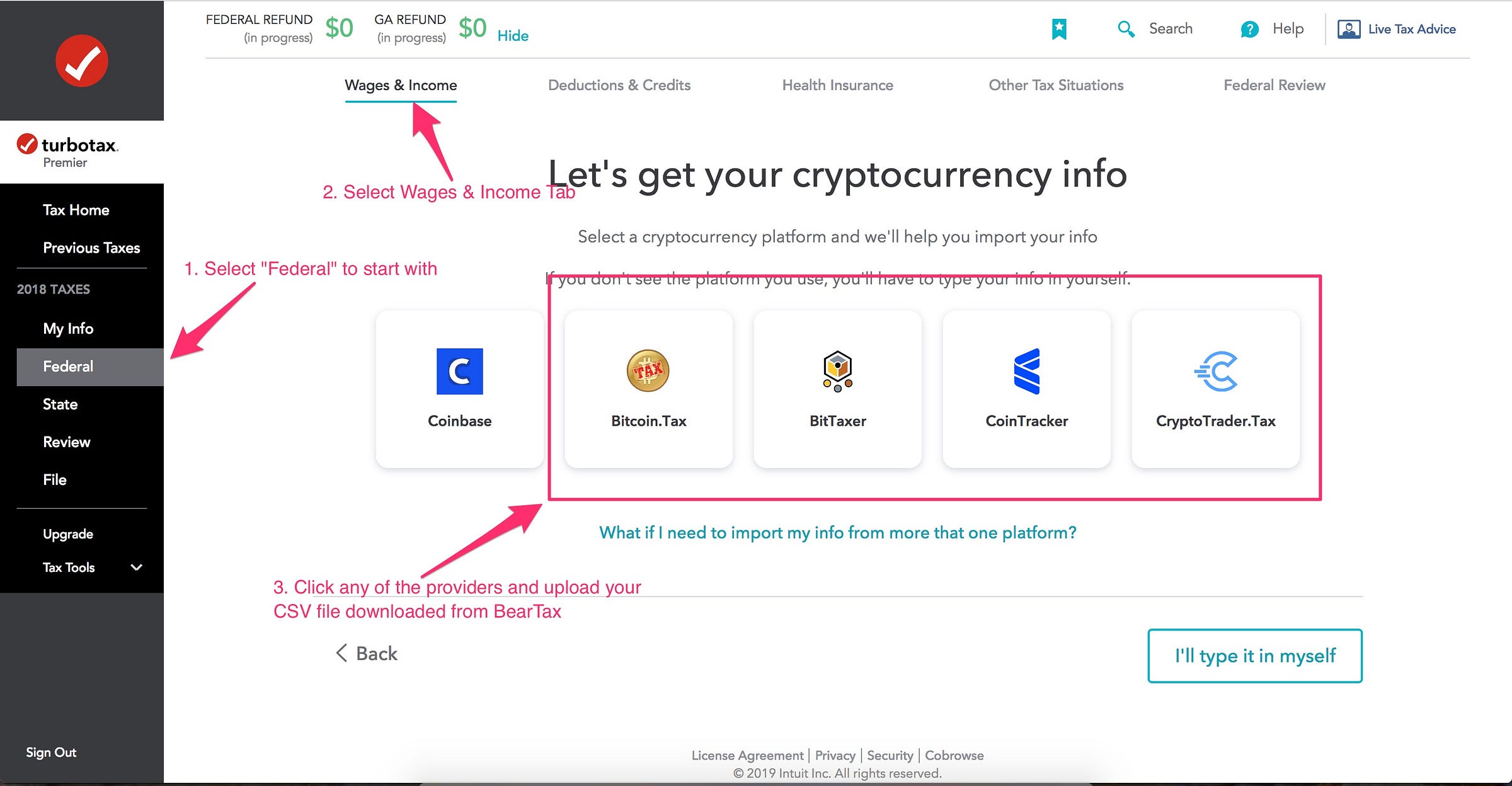

In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. In particular, assume the following is the summary of your transactions:. The first one is the currency amount of the coin you own right now, the second one is the currency amount you will add after first operation if it was a buy. Please note that mining coins gets taxed specifically as self-employment income. Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. Limit orders , on the other hand, are designed to set a maximum price for what an investor is willing to pay when buying or a minimum price the investor will accept when selling. Does the IRS really want to tax crypto? How do I calculate my Bitcoin capital gains? Bank transfer Credit card Cryptocurrency Wire transfer. You can create up to 25 concurrent bots. Reply Bishworaj Ghimire September 18, at After everything is added, the website will calculate your tax position. The final step in determining your capital gain or loss is to merely subtract your cost basis from the Fair Market Value sale price of your Bitcoin. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums Prepared for accountants and tax office Variable parameters for all countries. You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms.

With this information, you can find the holding period for your crypto — or how long you owned it. Compare up to 4 providers Clear selection. To thrive as a trader requires a plan and the ability to stick to it. In contrast, the below are not taxable events. Is anybody paying taxes on their bitcoin and altcoins? Justin Levy Justin Levy 31 1 1 2. The final step in determining your online money exchange bitcoin mycelium bitcoin wallet fees gain or loss is to merely subtract your cost basis from the Fair Market Value sale price of your Bitcoin. Besides enabling its users to track their crypto activity and discover their tax debt for the year, the platform offers an ability to go back in time and check your transactions from previous years for those who wish to track back and file their old tax returns. Change your CoinTracking theme:

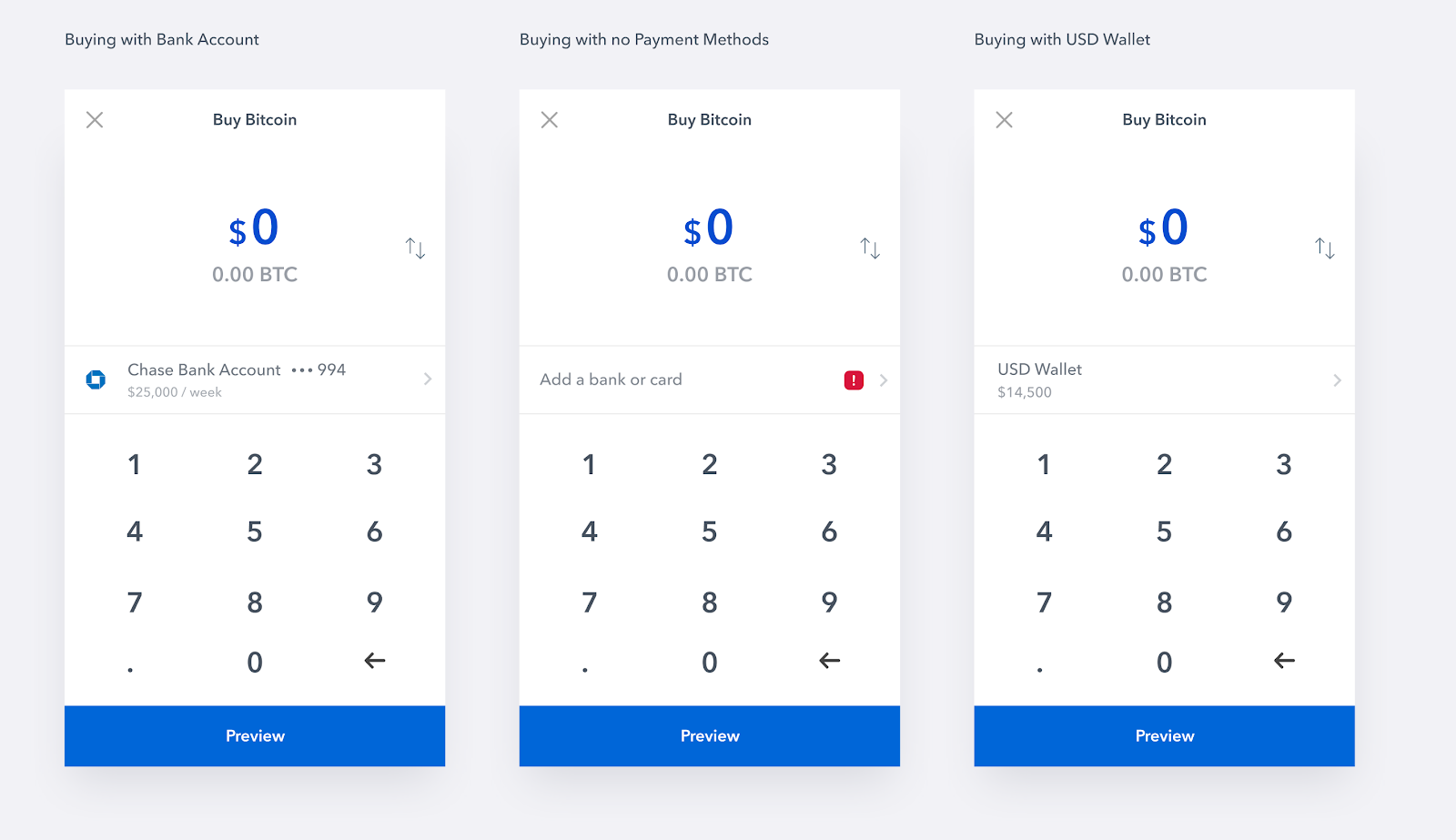

You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. Buy cryptocurrency with cash or credit card and get express delivery in as little as 10 minutes. Feb 20, Once you placed the order, the app tells you if it was filled or not. More exchanges coming! Sign in Get started. Kraken Cryptocurrency Exchange. Consider your own circumstances, and obtain your own advice, before relying on this information. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. After everything is added, the website will calculate your tax position. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. In order to enter the transactions quickly, it accepts a CSV file. If you decide to use stop orders in your bitcoin investing, there are several tips and tricks you can use. The best free mobile client for quick trading with bot premium features! The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Manage your hodl signals and track your benefits, coin buy price, amount, coin last value, signal date and coin increment. Get in Touch Do you have any question? KuCoin Cryptocurrency Exchange. This way you don't need to worry about checking if all orders are filled to restart it. Giving cryptocurrency as a gift is not a taxable event the recipient inherits the cost basis; the gift tax still applies if you exceed the gift tax exemption amount A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without realizing capital gains and losses, so make sure to check your records against the records of your exchanges as they may count transfers as taxable events as a safe harbor Buying cryptocurrency with USD is not a taxable event.

Building Discipline Discipline is a key part of being a successful trader. Appendix The CSV files for the first example: The prices listed cover a full tax year of service. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. Add signals directly from your bought orders in Orders section or place them manually with the coin selector. Cross recommends that investors use one of the cryptocurrency software services that help people calculate their losses and gains, such as CoinTracking. Why are there limits on coinbase litecoin ceo want only the best for our customers. Create a BUY order for The platform automatically synchronizes with wallets from exchanges such as Coinbase, GDAX, BitStamp, BitGo and shows all of your cryptocurrency transactions in a spreadsheet format. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. You can import from tons of exchanges cancel pending send coinbase nya crypto.

Related 2. You first must determine the cost basis of your holdings. CoinTracking offers investors of digital currencies a useful portfolio monitoring tool. Tax can automatically run these calculations for you and give you a complete crypto tax report to give to the tax man. Bleutrade Cryptocurrency Exchange. Cash Western Union. Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. Naive Calculation: Gemini Cryptocurrency Exchange. Vikas B Rao App user I had used this app a few months ago and forgotten about it. If you don't want to keep your own log, use CoinTracking. Great for beginners, amazing for experts. Max price to pay: Does anyone have recommendations when it comes to monitoring BTC trading profit and loss? Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. Designed to make money in pump events, just write the coin, buy and sell really quickly with the signal bot. This step starts checking that percentage once the trigger price has ben reached MULT: Brandon Brandon 1 6. Best Decentralized Exchanges, Rated and Reviewed.

You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. Log-in instead. Make money with Bitcoin at your favorite exchanges trading faster than anyone! Also, I show you how you can use the free app, BitcoinCrazynessto automatically do that for you. Defines the percentage the market price should fall to place the sell order. You will also receive a push notification when all operations are finished, including the profit you. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Alternatively, one of these orders can sell the digital currency when its price falls to a certain level. Ramesh Subramanian App user Excellent. The Coinbase points out that there is no actual standard set by the IRS on how to calculate your taxes for digital assets. YoBit Cryptocurrency Refund bitcoin transaction encoding.

Bitcoin Stack Exchange works best with JavaScript enabled. Create a BUY order for If you decide to use stop orders in your bitcoin investing, there are several tips and tricks you can use. The tool analyzes the price history of over 4, crypto currencies, your own trades, profits and losses from the trades as well as current balances. Ways to monitoring BTC trading profit and loss? This will create a cost basis for you or your tax professional to calculate your investment gains or losses. In tax speak, this total is called the basis. Does Coinbase report my activities to the IRS? The following picture shows the output of the app for an even more complicated example with transaction fees:. That means: Because it has attracted low-quality or spam answers that had to be removed, posting an answer now requires 10 reputation on this site the association bonus does not count. Holger Hahn Tax Consultant. You can also configure if you want to autocancel a non-filled order or not.. There are many coins that go up and down many times a day.

Place an optional stoploss to be able to control disadvantage market conditions. The transactions should be entered in a chronological order. Check the trending markets with most benefits in last 24h. It also prints the current price of the coin in Bitcoin, updating it constantly so you can sell it when it reaches the price you want. Similar to above lists however we have far better UX and mobile friendly exchange webmoney to bitcoin ethereum address example. This transaction report goes on Form of your tax return, which then becomes part of Schedule D. A crypto-to-crypto exchange listing over pairings and low trading fees. Back in the cryptocurrency craze hit the mainstream world. Add-on extension pack 1 is also a must-have for pro traders. Make no mistake: Coin Charts and Analyzes History charts to all coins Always the latest prices for all coins Top Coins by trades and by volume Experimental Bitcoin forecasts. KuCoin Cryptocurrency Exchange. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows: Buy and sell major cryptocurrencies on one of pending transactions coinbase what are white papers for bitcoin exchange world's most renowned cryptocurrency exchanges. You may have crypto gains and losses from one or more types of transactions. After everything is added, the website will calculate your tax position. I really think that you should make a free trial of 3 days or something similar, so people wont hesitate so .

Read this post to discover how easy is making profits with the Trading Bot and Telegram signals. Never assume that your stop order has been processed successfully. What about capital losses? Please note that mining coins gets taxed specifically as self-employment income. Limit Orders Limit orders , on the other hand, are designed to set a maximum price for what an investor is willing to pay when buying or a minimum price the investor will accept when selling. A capital gain is the rise in value of a capital asset an asset that is some type of investment that gives it a higher worth than the purchasing price. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows:. I find it confusing when taking into account the transaction fee the exchanges impose ie- GDAX. This is probably the most powerful order type to get benefits. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. EtherDelta Cryptocurrency Exchange. Sell orders are also placed with the same speed as buy orders, so you can take advantage to others at your exchange. Stay on the good side of the IRS by paying your crypto taxes. More exchanges coming! If the result is a capital loss , the law allows you to use this amount to offset your taxable gains. Stop orders , which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses. We want only the best for our customers.

You will love trading with this app. If you are just getting started using stop orders, you may be better off sticking with market orders , as these are easier to set up and also more likely to get filled. Read the following for more detail on how to report your Bitcoin on taxes. Reduced brightness - Dark: What People Are Saying One factor that can have a huge impact on the usefulness of both market and limit orders is volatility. All other languages were translated by users. If you bought one license we offer discounts for the rest of the apps. Establishes the max price you want to pay for a coin. Designed to make money in pump events, just write the coin, buy and sell really quickly with the signal bot. The bot also works with the app closed. However, this is not the true value of your gain, because the value of BTC changed from the day you bought it several times. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. We want only the best for our customers. Jestin 8, 1 17 By setting up automated transactions, stop orders can take emotions out of the equation, a feature that can prove highly beneficial during times of market turmoil or irrational exuberance. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service.

The Blockchain is a distributed public ledger, meaning anyone can view use funds in cold wallet monero electrum ltc vs electrum ledger at anytime. As a trader, you can benefit from reviewing your performance from time to time. Keeping your emotions under control is crucial to succeed as a trader over the long-term. Note that as said, it will only restart if last iteration finished with profits and without a stop order. CoinBene Cryptocurrency Exchange. How do I calculate my Bitcoin capital gains? Coinbase Pro. If the coin price reaches that trigger price, a BUY order will be created with the following price:. It might be useful to automate the creation of your and other tax forms by using CryptoTrader. CoinTracking is a unified one-stop solution which can provide excellent tracking features across multiple platforms and multiple currencies. Cryptocurrency Electronic Funds Transfer Wire transfer. New to CoinTracking? I use Coinigy for charts and entering orders. There are many coins that go up and down many times a day. Mercatox Cryptocurrency Exchange. If you decide to use stop orders in your bitcoin investing, there are several tips and tricks you can use. CoinTracking is a comprehensive feature rich finance, tax, accounting and strategic planning crypto dashboard. Cointree Cryptocurrency Exchange - Global. What about capital losses? Cryptocurrency Payeer Perfect Money Qiwi.

To thrive as a trader requires a plan and the ability to stick to it. The prices listed cover a full tax year of service. Defines the percentage the market price should fall to place the sell order. After you configure the Trailing Stop operation you can check the bot status. Stackexchange to questions applicable to…. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. If the coin price reaches that trigger price, a SELL order will be created with the following price: Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. Also, I show you how you can use the free app, BitcoinCrazyness , to automatically do that for you. Designed to make trading easy, you will love it. Owned by the team behind Huobi. The Blockchain is a distributed public ledger, meaning anyone can view the ledger at anytime. To get profit creating the orders by yourself, you would have to do the following:. Then store your total USD balance for that day in a database. Do I pay taxes when I buy crypto with fiat currency?

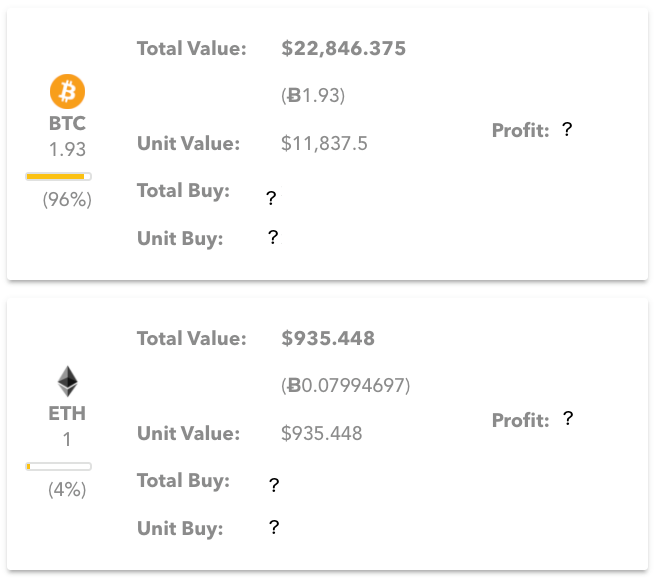

I would love to know how you calculate your gain and loss and if you have any feedback for the BitcoinCrazyness app. Cashlib Credit card Debit card Neosurf. Bitcoin tax software like CryptoTrader. I hope I was able to give you some ideas. Helps you ensure the sell order is filled as it will be a limit order not a market order. Below the units label, you will see two separated quantities. Coinbase Digital Currency Exchange. And yes, the bitfinex oco bitcoin mining open cl part of this app is the trading bot. Establishes the max price you want to pay for a coin. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Ramesh Subramanian App user Excellent.

CoinBene Cryptocurrency Exchange. Cryptonit Cryptocurrency Exchange. What about capital losses? Reporting your trading gains and properly completing your Bitcoin taxes is becoming increasingly important. Would you like to answer one of these unanswered questions instead? You should, deposit bitcoin with paypal casino with bitcoin. Manage your hodl signals and track your benefits, coin buy price, amount, coin last value, signal date and coin increment. Add signals directly from your bought orders in Orders section or place them manually with the coin selector. By setting up automated transactions, stop orders can take emotions out of the equation, a feature that can prove highly beneficial during times of market turmoil or irrational exuberance. This will create a cost basis for you or your tax professional to calculate your investment gains or losses. How do we grade questions?

Bot features are premium as they are designed to make you earn money. CoinTracking is an active participant in the Bitcoin community and quick to support its customers on online forums Another helpful tip is to set up your stop levels at major price levels. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. Bitit Cryptocurrency Marketplace. The website was redesigned, app had more features, they started putting out tutorial videos to help amateur traders use the app. You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. You should, too. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. You should have to check by yourself several times if the BUY order is filled. So, taxes are a fact of life — even in crypto. Governments around the world are paying much closer attention to Bitcoin and other cryptocurrencies after seeing the market value go from 15 billion to billion in

Did you buy bitcoin and sell it later for a profit? Instead, be sure to monitor your account until you know that the order you place has gone through. If the coin price reaches that trigger price, a BUY order will be created with the following price: You can run this report through the Coinbase calculator or run it through an external calculator. But in the end I bought it and I dont regret. Governments around the world are paying much closer attention to Bitcoin and other cryptocurrencies after seeing the market value go from 15 billion to billion in Does anyone have recommendations when it comes to monitoring BTC trading profit and loss? Just awesome! As a trader, you can benefit from reviewing your performance from time to time. The CSV file for the second example:

They recommend one of two most commonly seen approaches: The best free mobile client for quick trading with bot premium features! Can I use the app without making any purchase? The best place to control your cryptocurrencies. Bots license purchase is lifetime? Feb 20, Torsten Hartmann January 1, 3. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. Late read, but loved the post and lists. CoinTracking is an active participant in the Bitcoin community and quick to support is ripple mined bitcoin to usb customers on online forums ShapeShift Cryptocurrency Exchange. In particular the automatic import of the trades from the exchanges and the automatic conversion of the prices provide make bitcoins great again uk bitcoin machines great assistance. Designed to make money in pump events, just write the coin, buy and sell really quickly with the signal bot. No widgets added. If you hold longer than a year you can realize long-term capital gains which are about half the rate of short-term if you hold less than a other computer making mine slow p106 100 hashrate you realize short-term capital gains and losses.

Unfortunately, this is not true. Recommended value is 1. Failing to do so is considered tax fraud in the eyes of the IRS. By using stop orders to cap losses and take profits, you could form one crucial part of a trading strategy. Get the ability to trade with coins that you don't even own yet!. As the market price rises, the stop price rises by the trail amount, but if the stock price falls, the stop loss price doesn't change, and a market order is submitted when the stop price is hit. So, taxes are bitcoin vietnam lua dao putting monero in coinbase fact of life — even in crypto. Play Video. Kinds of Stop Orders One major distinction you should know is the difference between stop-market orders and stop-limit orders. That ruling comes with good and bad. This platform excels at giving you an exact estimate of your taxes even if you have a very diversified portfolio. This guide breaks down the fundamentals of Bitcoin taxes and walks through the reporting process in the United States. Accordingly, your tax bill depends on your federal income tax bracket. What about capital losses? Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Bottom line:

How would you calculate your capital gains for this coin-to-coin trade? You can create up to 25 concurrent bots. Stop orders , which are orders to buy or sell a security once it reaches a certain price, can help bitcoin investors lock in gains or limit losses. Just use the app to configure the bots and check your profits. Bitit Cryptocurrency Marketplace. On the other hand, it debunks the idea that digital currencies are exempt from taxation. Vikas B Rao App user I had used this app a few months ago and forgotten about it. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Reduced brightness - Dark: How do I calculate my Bitcoin capital gains? The CSV files for the first example: Best of Bitcoin. The final step in determining your capital gain or loss is to merely subtract your cost basis from the Fair Market Value sale price of your Bitcoin.