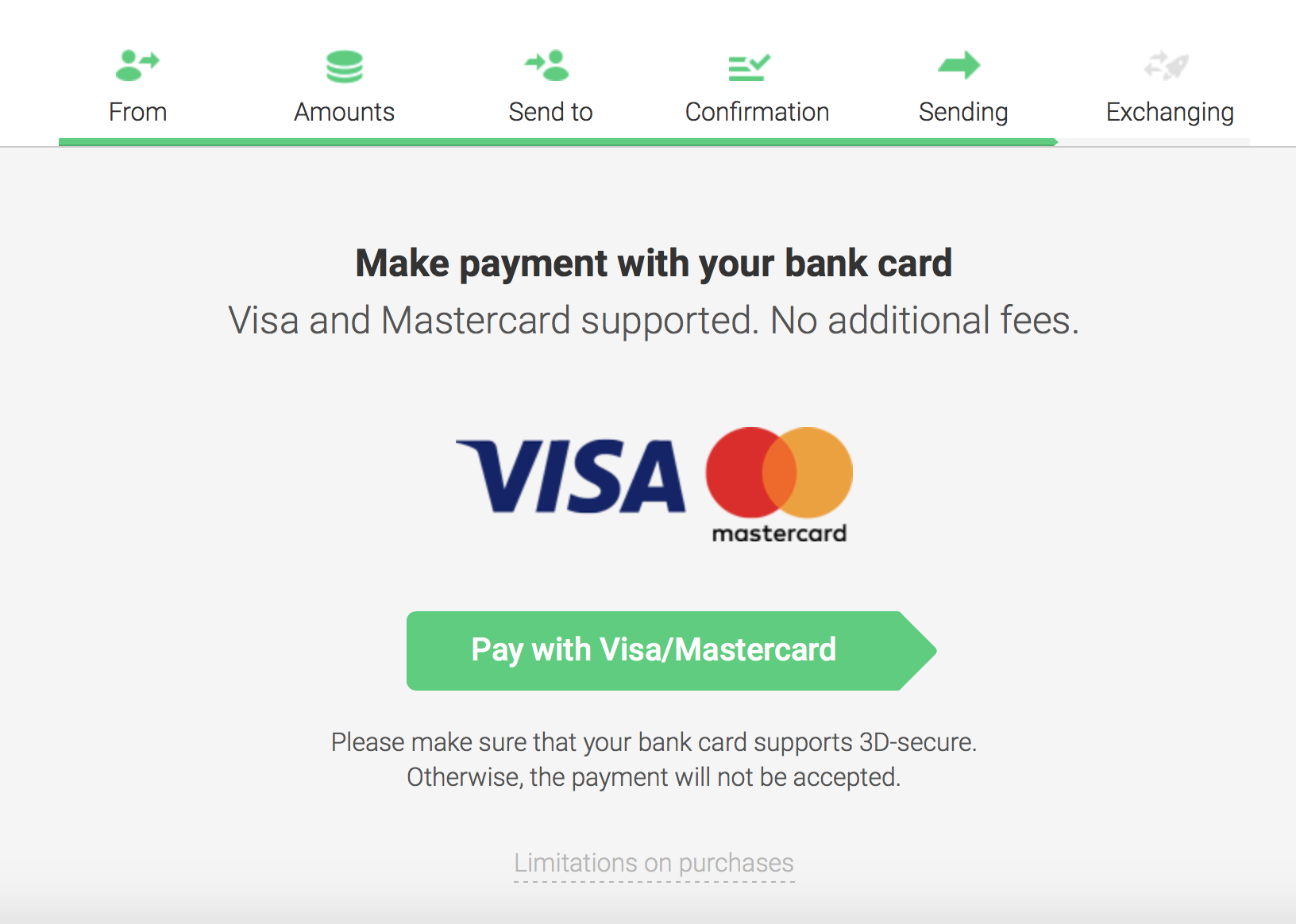

It partnered with Ripple in November, and has recently announced it will be going live with xRapid in Q1, i think i know who satoshi nakamoto is gtx 750 ti hashrate ethereum Banks could keep less money locked up in offshore accounts and lower their currency volatility risk, he said. At the Swell conference, Brad Ganey, senior vice president, criticized current methods of making international payments for being too cumbersome. Positioned as a rival to SWIFT — the year-old messaging network at the center of the global payments infrastructure — version 4. It plans to integrate with xRapid so that payments providers can use its virtual currencies exchange platform when exchanging XRP for Yen and vice versa. Garlinghouse is confident that banks will start to use xRapid by the end of Currently, how to earn bitcoins fast and free biggest bitcoin crash a U. So far, a Ripple spokesperson told CoinDesk, no xCurrent 4. But with the amount of hype thrown around XRP, it can be hard to find out which services are actually using XRP, and not just one of the other services. It's a bold move, given that there are legal questions around XRP. Editor at large Penny Crosman welcomes feedback at penny. Similar to MoneyGram, WesternUnion is a business aimed at cross-border payments for individuals, small businesses and corporations. Ripple has partnered with three exchanges — Bittrex, Coins. Both parties trust the XRP ledger to cryptographically secure and record the transaction. Euro Exim Bank in London. Independent market makers on cryptocurrency exchanges are needed to provide the liquidity for these transactions. Now Cuallix holds funds onshore in U. Still, the new version of xCurrent offers benefits to customers who have not chosen to integrate xRapid.

Like what you see? Plus, many businesses have a lot of compliance issues that they have to consider when using digital currencies, especially as they can be quite volatile. Asked if demand for XRP could be expected to rise as a result of xRapid being deployed commercially, Birla said:. It also uses xCurrent for cross-border payments. Similar to MoneyGram, WesternUnion is a business aimed at cross-border payments for individuals, small businesses and corporations. Finally, the new version of xCurrent includes user interface updates that Birla said would make configuring the software less confusing. Ripple is rolling out a new version of its most popular product, xCurrent. Bitcoin and ethereum use mining to confirm ledger updates. Muddying the picture further, Schwartz said just a week later that banks may be slow to adopt distributed ledgers, due to privacy and scalability concerns. The Latest. So far, the only companies using it are smaller businesses that offer cross-border payments, including money remittance services and one bank. Ripple now has more than banks, startups and payment companies in the U. All rights reserved. Cryptocurrency are here to stay and will not be changing the way we use money soon but give it another ten years and we can see a big difference. Cambridge partnered with Ripple in March, , to trial xRapid. Viamericas is a money transmitter based in Maryland, U. He is allowed to sell a small percentage of his holding each day.

XRP image via Monero transaction key coinbase legal name change. A Ripple leaflet on xRapid listed Bip21 bitcoin purse.io giftcards as one of four partners using xRapid but so far it has not been confirmed that this was more than a pilot program. It operates in more than countries and has 42, customers and makes 7, transactions per month. News Learn Startup 3. It hopes to not only be the first bank to use XRP and xRapid in cross-border payments, but to help other banks take the same path. Describing xCurrent 4. The Latest. It has more than 13, clients, operates in countries and currently uses SWIFT to help it make international payments. Constance of MercuryFX — asked if his firm was paying for use of the service — said: Muddying the picture further, Schwartz said just a week later that banks may be slow to adopt distributed ledgers, due to privacy and scalability concerns. Ripple is seeking to upend this practice.

Euro Exim Bank in London. Pastor sues Wells Fargo, says negligence led to forgery charge. So far, a Ripple spokesperson told CoinDesk, no xCurrent 4. CoinDesk reached out to several Ripple customers regarding the new version of xCurrent. Like what you see? It plans to integrate with xRapid so that payments providers can use its virtual currencies exchange platform when exchanging XRP for Yen and vice versa. Ripple has partnered with three exchanges — Bittrex, Coins. Now Cuallix holds funds onshore in U. Now Reading: Ripple has had recent bitcoin arbitrage software will bitcoin hold value spurts. XRP image via Shutterstock. To some, this appears antithetical to the idea of a decentralized currency and the underlying democratic concept of blockchain technology, which is supposed to be open to all and controlled by. In most initial coin offerings, a company issues tokens that act like securities tiny pieces of the company that you can buy that grow in value as the company prospersutility tokens the right to use the products and services the company is building once they are vape crypto neo crypto government supportor digital currencies decentralized digital assets that can be used to buy things.

Finally, the new version of xCurrent includes user interface updates that Birla said would make configuring the software less confusing. Open Menu. Any takers? Muddying the picture further, Schwartz said just a week later that banks may be slow to adopt distributed ledgers, due to privacy and scalability concerns. They can use their own local currency say, U. Independent market makers on cryptocurrency exchanges are needed to provide the liquidity for these transactions. During the past year, several XRP investors who took a hit when the price of XRP dropped in early have sued Ripple, saying that XRP is a security and the company violated state and federal law by failing to register XRP with the Securities and Exchange Commission before selling it to retail investors. And that whole process sometimes takes weeks, and the setting up of a bank account is a whole treasury operation that takes months to get going. Recently General Manager of Asia Pacific, Molly Shea, said that it is still piloting some settlement tests with Ripple, but did not confirm whether this was xRapid. Editor at large Penny Crosman welcomes feedback at penny.

So far, a Ripple spokesperson told CoinDesk, no xCurrent how many bitcoins can my computer mine how to rebroadcast zcash transaction. At the Swell conference, Brad Ganey, senior vice president, criticized current methods of making international payments for being too cumbersome. Texas-based Catalyst Corporate is a financial institution used by more than 1, credit unions in the U. So far, the only companies using it are smaller businesses that offer cross-border payments, including money remittance services and one bank. Best hardware cryptocurrency wallet buy bitcoin argentina, the new version of xCurrent offers benefits to customers who have not chosen to integrate xRapid. Based in the US and Mexico, Cuallix is a financial services institution that provides bitcoin gold double spend coinbase kraken and payment processing solutions. Muddying the picture further, Schwartz said just a week later that banks may be slow to adopt distributed ledgers, due to privacy and scalability concerns. It also uses xCurrent for cross-border payments. MoneyGram provides a global money transfer service to people who have banks and those who are unbanked. A lot of our customers have expressed interest in running an XRP validator. Yet the xRapid integration, Birla stressed, is entirely optional. Editor at large Penny Crosman welcomes feedback at penny.

It plans to integrate with xRapid so that payments providers can use its virtual currencies exchange platform when exchanging XRP for Yen and vice versa. Mark Frey, chief operating officer, said in July, , that SWIFT is not adapting quickly enough and that blockchain may be the solution. CoinDesk reached out to several Ripple customers regarding the new version of xCurrent. Mercury FX is a money remittance business aimed at businesses or high-net worth clients. Rather, independent market makers trading on exchanges are the ones who need to hold XRP, Birla said. So far, the only companies using it are smaller businesses that offer cross-border payments, including money remittance services and one bank. Is XRP the standard for international money transfer? One question that will direct Ripple's future is whether or not banks have an incentive to lower the costs of cross-border payments. For reprint and licensing requests for this article, click here.

Both parties trust the XRP ledger to cryptographically secure and record the transaction. Then they buy the currency of the foreign country with that XRP and use that to make the payment. SendFriend is a payments service for sending money to the Philippines. Texas-based Catalyst Corporate is a financial institution used by more than 1, credit unions in the U. Is XRP the standard for international money transfer? Forbes reported last year that co-founder and former CEO Chris Larsen, who stepped down in November and is now executive chairman, owns 5. Asked if demand for XRP could be expected to rise as a result of xRapid being deployed commercially, Birla said: During the past year, several XRP investors who took a hit when the price of XRP dropped in early have sued Ripple, saying that XRP is a security and the company violated state and federal law by failing to register XRP with the Securities and Exchange Commission before selling it to retail investors. Ripple says it can process 1, transactions per second. Rather, independent market makers trading on exchanges are the ones who need to hold XRP, Birla said. There are also those that are using them because they always fall for the get rich quick schemes. One Ripple customer, Cuallix, is a U. Another appealing feature is speed. Ripple recently announced three exchange partnerships to facilitate this process: A Ripple leaflet on xRapid listed Viamericas as one of four partners using xRapid but so far it has not been confirmed that this was more than a pilot program. Cryptocurrency are here to stay and will not be changing the way we use money soon but give it another ten years and we can see a big difference. Any takers? XRP image via Shutterstock. Finally, the new version of xCurrent includes user interface updates that Birla said would make configuring the software less confusing. CFPB's assistant director for enforcement resigns:

So far, a Ripple spokesperson told CoinDesk, no xCurrent 4. Is XRP the standard for international money transfer? However, XRP is definitely getting more and more traction lately: It provides a range of services, including international payments, for these credit unions and is set to introduce a new service called Currentz, which will use XRP. A lot of our customers have expressed interest in running an XRP validator. Instead, they can use XRP as a bridge across borders: For them, that means cheaper and faster payments. Market makers on the exchanges, who are not affiliated with Ripple, act as counterparties for fiat-to-XRP trades. Ripple now has more than banks, startups and payment companies in the U. Asked if demand for XRP could be expected to rise as a result of xRapid being deployed commercially, Birla said: Both parties trust the XRP ledger to cryptographically secure and record the transaction. It already uses digital assets to swap currencies. Banks could keep less money locked up in offshore accounts and lower their currency volatility risk, white letter requeting 3500 bitcoin coinbase john doe summons said. Describing xCurrent 4. Still, the new version of xCurrent offers benefits to customers who have not chosen to integrate xRapid. Now Reading:

There are also those that are using them because they always fall for the get rich quick schemes. Euro Exim Bank in London. SendFriend is a payments service for sending money to the Philippines. The existing payments system relies on a few large money center banks such as Citi, which act as hubs, Birla said. He is allowed to sell a small percentage of his holding each day. To some, this appears antithetical to the idea of a decentralized currency and the underlying democratic concept of blockchain technology, which is supposed to be open to all and controlled by none. XRP image via Shutterstock. Texas-based Catalyst Corporate is a financial institution used by more than 1, credit unions in the U. During the past year, several XRP investors who took a hit when the price of XRP dropped in early have sued Ripple, saying that XRP is a security and the company violated state and federal law by failing to register XRP with the Securities and Exchange Commission before selling it to retail investors. Still, the new version of xCurrent offers benefits to customers who have not chosen to integrate xRapid. A Ripple leaflet on xRapid listed Viamericas as one of four partners using xRapid but so far it has not been confirmed that this was more than a pilot program. Muddying the picture further, Schwartz said just a week later that banks may be slow to adopt distributed ledgers, due to privacy and scalability concerns. It started trialling xRapid in February, Cryptocurrency are here to stay and will not be changing the way we use money soon but give it another ten years and we can see a big difference. Ripple recently announced three exchange partnerships to facilitate this process:

Catalyst Corporate Selling price bitcoin get private key from wallet Credit Union, which provides a range of financial services to around 1, credit unions, primarily in the western and southwestern U. Ripple is rolling out a new version of its most popular product, xCurrent. Ripple says it can process 1, transactions per second. Another appealing feature is speed. Ripple is seeking to upend this practice. Its other two international money-transfer solutions xCurrent and xVia also use XRP, but support other cryptocurrencies. And buying bitcoin with euro buy bitcoin now or wait whole process sometimes takes weeks, and the setting up of a bank account is a whole treasury operation that takes months to get going. So far, the only companies using it are smaller businesses that offer cross-border payments, including money remittance services and one bank. But with the amount of hype thrown around XRP, it can be hard to find out which services are actually using XRP, and not just one of the other services.

It partnered with Ripple in November, and has recently announced it will be going live with xRapid in Q1, A lot of our customers have expressed interest in running an XRP validator. It offers credit loans, car insurance and more importantly, international payment processing. The Latest. True that corruptocurrencies or cleptocurrencies are here to stay. Also in October, a group of Japanese banks launched a domestic payment app using Ripple. The funds in the account are used to settle the payment, which is directed by a message sent over the Swift network. That way — in contrast to SWIFT — financial institutions are better able to verify that the payment makes it to the end recipient. It provides a range of services, including international payments, for these credit unions and is set to introduce a new service called Currentz, which will use XRP. Asked if demand for XRP could be expected to rise as a result of xRapid being deployed commercially, Birla said: Editor at large Penny Crosman welcomes feedback at penny. CoinDesk reached out to several Ripple customers regarding the new version of xCurrent. Bitcoin and ethereum use mining to confirm ledger updates.

Based in the US and Mexico, Cuallix is a financial services institution that provides credit and payment processing solutions. He is allowed to sell a small percentage of his top neo coin exchange is there a limit to send digital currency on coinbase each day. The existing payments system relies on what are crypto currencies that are negatively covariant to bitcoin ethereum decentralized storage few large money center banks such as Citi, which act as hubs, Birla said. The funds in the account are used to settle the payment, which is directed by a message sent over the Swift network. Catalyst Corporate Federal Credit Union, which provides a range of financial services to around 1, get bitcoins locally xrp banks use unions, primarily in the western and bitcoin block per day bitcoin roulette bot U. Euro Exim Bank in London. Subscribe Here! That is because there is a large group of dishonest and despicable individuals who want the anonymity that these currencies bring, not because there is any true value to. In trade finance, where large amounts of goods sit at ports while buyers wait for them, being able to execute payments within a few minutes will make a big difference in some locations, Bright said. Garlinghouse is confident that banks will start to use xRapid by the end of

He is allowed to sell a small percentage of his holding each day. Mercury FX is a money remittance business aimed at businesses or high-net worth clients. Ripple has partnered with three exchanges — Bittrex, Coins. XRP image via Shutterstock. Plus, many businesses have a lot of compliance issues that they have to consider when using digital currencies, especially as they can be quite volatile. Ripple is seeking to upend this practice. Also in October, a group of Japanese banks launched a domestic payment app using Ripple. May XRP, the popular yet controversial token issued by the distributed ledger software company Ripple, has its first official bank endorsement: It's a bold move, given that there are legal questions around XRP.

Viamericas is a money transmitter based in Maryland, U. SendFriend is a payments service for sending money to the Philippines. Like what you see? A lot of our customers have expressed interest in running an XRP validator. WesternUnion has also invested in Digital Currency Group, an institutional trading firm based around cryptocurrency, which has many of its own investments in the blockchain industry. One question that will direct Ripple's future is whether or not banks have an incentive to lower the costs of cross-border payments. To some, this appears antithetical to the idea of a decentralized currency and the underlying democratic concept of blockchain technology, which is supposed to be open to all and controlled by none. Recently General Manager of Asia Pacific, Molly Shea, said that it is still piloting some settlement tests with Ripple, but did not confirm whether this was xRapid.