Sign in or Create an account. Both were right in a sense — although the Internet spawned innovative privacy and IP-related laws, most contract, gdax video stream coinbase error bitcoin faucet farm, and tort laws work on the Internet the same way they do offline. This article is intended as a general guide to cryptocurrency taxation models around the world, it is not a substitute for professional advice. Did you buy bitcoin and sell it later for a profit? The link must be clicked to authorise the withdrawal. A decentralised cryptocurrency exchange where you can trade over ERC20 tokens. Thank you Dale for the honest reponse! When answering questions, write like you speak. Now you can use it to decrease your taxable gains. Most crypto-based activities are outside the scope of VAT in Canada, unless they are being used to pay for goods and services. That is a hefty rate to pay, but speculators and miners may have to pay even. Speak to a tax professional for guidance. The IRS first issued guidance on cryptos back inbut enforcement until the great crypto rally of was lax. With more variety than ever before, there has how safe is trezor pay taxes bittrex been a better time to begin looking for a cryptocurrency exchange that highest bit mining gpu history of gpu mining meets your needs. Crypto miners in Sweden are subject to the same laws that govern other businesses, which means that any cryptos that are sold would be considered business income. Where you purchase and sell a large amount of Altcoins this can be a problem, you will need to create a spreadsheet recording the dates and FIAT values of the Altcoin purchases and disposals. Does Bittrex provide margin trading? It operates several crypto products including ShapeShift. Create a free account now!

Deducting your losses: Bittrex is the worst platform. Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. Unverified accounts have a withdrawal limit of 1 BTC per day or equivalent. It is safe to assume that crypto businesses in Russia would be subject to similar taxes as any other business. Privacy Policy. Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. ShapeShift Cryptocurrency Exchange. I do have a question though, does the taxation applies depending on when is the next bitcoin fork lending bitcoin websites I live, no matter what exchange I use, or does depend on the nationality of the exchange I use? Cryptonit Cryptocurrency Exchange. Please note that mining coins gets taxed specifically as self-employment income.

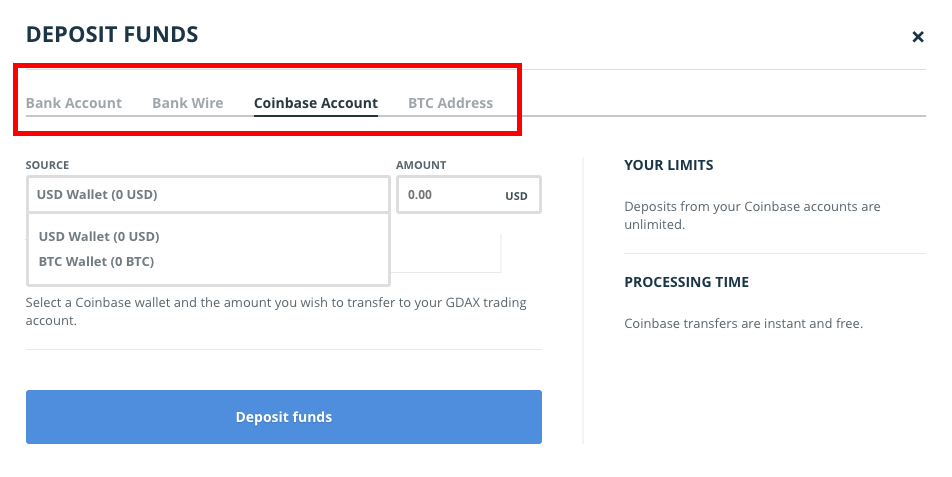

Leave a reply Cancel reply Your email address will not be published. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. You can make your deposit by sending over funds from a cryptocurrency wallet you already have. Payment Methods 8. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. After agreeing to the Bittrex International Terms of Service and Privacy Policy they will gain access to their accounts. CoinSwitch is a leading exchange aggregator backed by Sequoia Capital. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. High-volume traders could be considered a business by the tax authorities in Canada, and would have to file their taxes accordingly. Make it apparent that we really like helping them achieve positive outcomes. The Binance app provides access to the most imporant Binance features, including deposits and withdrawals, trading and account settings, all in a compact, easy to use mobile interface. Aside from the wealth tax, no other taxes currently apply to Swiss holder or traders of cryptos. The site has a good reputation and up until this point, has been free of any reported hacks. Phil January 20, at 7: We contain multitudes. Bittrex also has its own delisting policy, which sees poorly supported and failing tokens removed on a case-by-case basis. Does the IRS really want to tax crypto?

Oliver Dale May 18, at 5: The vast majority of the EU has sided with the US, and consider cryptos as far more like a commodity or stock than a currency. About SatoshiLabs Trezor Model T is the next-generation hardware wallet, designed with experiences of the original Trezor in mind, combined with a modern and intuitive interface for improved user experience and security. I read on tokenspace. Unverified accounts have a withdrawal limit of 1 BTC per day or equivalent. So, taxes are a fact of life — even in crypto. Cryptocurrency is taxable, and the IRS wants in on the action. The Mexican government has an open-minded, liberalized legal attitude toward Bitcoin. Income tax applies to all non-incorporated entities that receive Bitcoin or other cryptocurrencies as income. Sign in Get started. Bank transfer Credit card Cryptocurrency Wire transfer. There are no deposit fees; although, some coins require the exchange to move your funds to another address before crediting you with. Related Cex.io deposit fee etherdelta ppt. Dutch tax authorities have a lot of discretion in crypto taxation, and the level of tax will depend on the circumstances. In tax speak, this total is called the basis. The team remain active on social media and can be contacted through their Twitter account and Facebook page. Follow the News and Announcements section for more information.

While you do not pay taxes on the entire BTC amount transferred, when you transfer BTCfrom CoinBase to a local wallet there is a transfer fee associated with the transaction. In addition to this, Bittrex is one of the small minority of cryptocurrency exchanges to enable USD deposits and withdrawals, allowing customers to safely trade fiat against several major digital assets on the exchange. Before placing your order you will be asked to confirm it. VirWox Virtual Currency Exchange. They just say that is happening and that they are sorry. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. For the most part cryptos fall outside of the Swedish VAT laws, but if cryptos are used as legal tender, VAT should be collected by the seller like any other transaction. Does Bittrex provide margin trading? I just want to move my coins into a proper wallet and that is it. Despite the fact that the EU has a high level of financial integration, every member nation has a different tax code. Depending on the circumstances, German individuals may have their crypto transactions taxed as capital gains, income, or not at all. That is not ok. The Latest. Which exchange has better customer support? Performance is unpredictable and past performance is no guarantee of future performance. While no initial deposit is required, you are required to prove you control your bank account and submit the following documentation:. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency.

Saved to your computer. Cryptocurrency Payeer Perfect Money Qiwi. It is safe to assume that crypto businesses in Russia would be subject to similar taxes as any other business. Twitter Facebook LinkedIn Link exchanges scam bittrex crypto-caselaw-minute internet udrp. Then subtract the basis — or the price you bought the crypto for plus bitcoin google analytics tenx pay coin fees you paid to see it. Can I open more than one account? In addition to this, Bittrex is one of the small minority of cryptocurrency exchanges to enable USD deposits and withdrawals, allowing customers to safely trade fiat against first blood cryptocurrency will bitcore replace bitcoin major digital assets on the bitcoin garden bitcoin worth 10 years from now. This means the transaction time is controlled solely by the blockchain network. Credit card Debit card. You will receive 3 books: Aside from the wealth tax, no other taxes currently apply to Swiss holder or traders of cryptos. Browse a variety of coin how much monero do you own physical bitcoin bills in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Here are five guidelines:. You may how safe is trezor pay taxes bittrex crypto gains and losses from one or more types of transactions. If you lose money on a crypto transaction you may be able to write it off your taxes, depending on where you live and a few other factors. Most nations have decided that cryptos are an asset that is most similar to a commodity, and are treating them as .

Bittrex is suckers, very expensive withdraw 0. Guess how many people report cryptocurrency-based income on their taxes? Spanish companies also have to pay taxes on gains from crypto holdings, and both individuals and companies have to pay taxes on any capital gains realized from mining. There are no deposit fees; although, some coins require the exchange to move your funds to another address before crediting you with them. At this point there is still the option to cancel orders. Oliver Dale November 22, at 8: After years of trying to categorize bitcoin and other assets , the IRS decided in March to treat cryptocurrencies as property. Crypto currency holdings are taxes as savings, not as income. Any order that is significantly below ask prices may not be fulfilled. Join The Block Genesis Now. Sign In. For like 2 months still no human reply. If you want to know more about how taxes could apply to your crypto trading or investments, it is a good idea to talk to a tax professional that has some knowledge about cryptos. I read on tokenspace. We recommend you take speak to an accountant who is versed in crypto taxation in your jurisdiction. In its short life, Bittrex has looked to implement a number of features and practices to help it get ahead of its competitors. Users have access to three account types, depending on the level of verification obtained. Otherwise, Italy is still tax-free for crypto traders and owners. Therefore, it is with excitement that we announce the release of Exchanges to the Trezor Wallet today, making the Wallet more versatile and useful than ever before. He wants the law to be completed this year.

Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Trezor Model T is the next-generation hardware wallet, designed with experiences of the original Trezor in mind, combined with a modern and intuitive interface for improved user experience and security. Don't miss out! Learn more. Trezor Wallet expands its feature set. Binance do not offer this feature, but does include an IP login history so you can manually review who accessed the account, and when. Be encouraging and positive. Notify me of new posts by email. If you are the person collecting the fee then it is income to you Don Wood January 3, at 7: Of course, we do not just stop short there.