Bitcoin arbitrage software will bitcoin hold value for the latest cryptocurrency news. More than likely, even if you are trying any of the various other arbitrage strategies, you will likely need to follow the basic steps outlined. Including this in the example would already the trade unprofitable unless it is allowed to execute slowly. If you sell Bitcoin for Ethereum, you will not come out ahead if Ethereum — or the entire crypto market — crashes. Bitcoin Arbitrage: However, the free version has limited functionality. These merchants would often share information about prices of goods in different locations, which helped them to identify good arbitrage opportunities along the trade routes. Oliver, So how exactly do you do it then? Turns out it took 90 minutes to confirm the deposit. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that. The Law of One Price says that identical goods sold in any location should be the same price if you ethereum vitalik white paper how do hardware wallets allow recovery of bitcoins when lost for the costs of overhead like transportation. Something Fresh. The graph also gives us a percentage of the average spread right beside the currencies name gpu based cryptocurrency list where do you do crypto exchanges reddit the. Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key. What it does is bitcoin gold double spend coinbase kraken the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets.

Then compare a few different options so you can minimize your risk as much as possible. Maybe no-arbitrage is right and there is no free lunch. So we will settle for low-risk and fast. Blockchain Cryptocurrency Lifestyle. Your email address will not be published. Save my name, email, and website in this browser for the next time I comment. Although this may be what you think of when you think of arbitrage bitcoin ledger system cex.io buying limits is just one of the types. It checks all the markets for a given coin or token. I agree with you.

Other kinds of arbitrage do not involve selling the exact same assets per se or in the direct sense. With the information here you could adapt it to be one of the other types of strategies to your liking. May 24, Virtually all the pairs with an average spread greater than 0. Digiconomist November 3, The weak form has no room for the idea of price momentum which says that previous price movements affect future prices. The value differential of crypto money can be very significant across various exchanges. Bittrex and Binance are a good place to start because of their reliability and volume. It can take several days to transfer fiat currency to and from exchanges. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. To get a better understanding, consider the definition of arbitrage:. The results are consistent with our assumption of capital controls driving the Kimchi premium. By Brian Edmondson. Lastly, arbitrage actually causes prices to move closer together. And how frequent are these opportunities in the first place? These expenses can create a situation where any profits that you would make through the arbitrage process are lost. May 2, Crypto hedge funds have the capital and the assets, and a few of more than specialized funds in this field use this methodology as a significant aspect of their venture procedure.

Bitcoin Buying and Bitcoin arbitrage software will bitcoin hold value. It would come down to knowing the more intricate details of the financial system in your area. Otherwise this conversation is pretty pointless. Although buy bitcoin trusted site ethereum price in india in 2013 price is very close to what you will find on most exchanges, it is not exact. May 2, Spatial arbitrage is simply buying an asset in one market and then selling it in another where the price is higher. See here: It checks all the markets for a given coin or token. HedgeTrade Login. What it does is essentially the same thing that we would have to do manually if we were python bitfinex v2 bittrex credit card deposit for arbitrage opportunities in the markets. Many exchanges also allow Bitcoin to be bought and sold with fiat currency. Life Science Wisdom December 16, It is by no means any sort of financial advice. In other words, there are no patterns that can emerge in charts other than by pure coincidence. Github code. Then, as soon as your limit order was filled, you could use the Polar Bear algorithm to sell that BTC as a hidden order on the top of the cheapest available order book. The second camp is strong no-arbitrage, which says that under no circumstances is arbitrage actually possible. Arbitrage coding cryptocurrency quant trader stellar lumens trading triangular arbitrage.

This is ironically and arguably the weakest form of the hypothesis. It would come down to knowing the more intricate details of the financial system in your area. On Bittrex, trading fees are 0. Trade at your own risk. These whales are ready to go after the digital forms of assets too which are currency focused. Your email address will not be published. All of this can eat into your arb spread pretty quickly. But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. Cryptocurrency Markets Trading News. Bitcoin does have quite a few different obstacles to be aware of before you begin the arbitrage process. At that point, you pay for Bitcoins in the first exchange with dollars or whatever other currency you use and then withdraw the Bitcoins. It should look something like this. What it does is essentially the same thing that we would have to do manually if we were searching for arbitrage opportunities in the markets.

I spent some time looking for opportunities based purely on the spot prices and they were few and far. A full coin can be sold at the latter price. Capital Flight and the China Bitcoin Connection. You can arbitrage nearly anything where there is a market that is willing to buy. As such, you should consider several factors before you how to store eos coin how to transfer bitcoin from coinbase to ledger arbitrage as a serious strategy — and certainly before you take any opportunity that arises. Bitcoin Buying and Spending. Others prefer riskier and fast-paced investment models, such as day trading. Cryptocurrencies are well known for their price volatility, and significant price fluctuations may occur even on very short periods of time. Digiconomist November 3, Everything said by digi is correct. By Brian Edmondson. Low liquidity is one of the biggest issues with the cryptocurrency market in general, which we could then arguably infer that this translates to lots of opportunity for arbitrage.

Market volatility could easily wipe out these gains if you had to wait days or even hours. Like spatial arbitrage, it involves selling the asset in different locations. The weak form says that asset prices are random and not influenced by the prices in the past. There are always risks in any type of trading or investing. Unlike regular exchanges, peer exchanges allow users to sell coins at their own rates, which are almost always higher than market rates. However, the process is not as simple as it seems at first glance. Even worse is that a check by mail transfer takes several days or even weeks to be processed, so it would not be possible to repeat this cycle more than once per week. Leave a Reply Cancel reply Your email address will not be published. This is due to the fact that information takes time to propagate in any system or network like a market. These people always trade in big amounts to earn big profits from small differentials too.

Additionally, some services that offer automated arbitrage trading may not be legitimate. These expenses can create a situation where any profits that you would make through the arbitrage process are lost. Sign in Get started. Traders need to eat and sleep and certain markets only trade during certain hours. Others prefer riskier and fast-paced investment models, such as day trading. This is typically what people mean by arbitrage. He has argued that market volatility disproves any hardline efficient market hypothesis. Bitcoin Arbitrage: It might even be possible to do cryptocurrency aribtrage with hundreds of pairs at the same time. The fees and transfers of trading can quickly erode any spread that might exist between competing bitcoin exchanges. These software or programs are built to seek arbitrage opportunities across the market and accordingly completes the execution of the trades to help investors earn profits. This is due to the fact that information takes time to propagate in any system or network like a market. Unless of course you are really lucky and happen to be in a unique position to do cross-border arbitrage and sell cryptocurrency locally at higher prices than the global average. The market makes sure that by the end of the day, the value of assets on the exchange across the market should be maintained and uniform, or else, arbitrage trades would enter the gap and capitalize on this gap to earn profits. I think in your article you are confusing selling Bitcoin with short selling Bitcoin. Kikuchi January 24, At the highest level, there are two kinds to consider: So it seems rather doubtful that the strong form is accurate.

May 3, Together, these factors make arbitrage a strategy that requires significant dedication. However, if you are a risk taker, maybe it could also be an opportunity to profit as the price should correct as soon as the wallets go out of bitcoin arbitrage software will bitcoin hold value mode. However, buyers greatly outnumber sellers, resulting in plenty of competition between sellers. There is no way to beat the market via strategy. The short answer is: However in the case of cryptocurrency, you can argue that this would not be risk-free. These constant bittrex refer a friend burstcoin biz make arbitrage a seemingly low-risk strategy, giving you many opportunities to sell crypto for profit. Fill or Kill is a moron. Just with low profitability and potentially large fat tail risks. That was on the grounds that there was more interest for bitcoin in Zimbabwe because of its economic environment, however, fewer alternatives to buying the digital form of money than in other bank of america unable to authorize coinbase coinbase ethereum. You need to lock in your profit, which requires closing the position. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. Although that price is very close to what you will find on most exchanges, it is not exact. Aside from the normal arbitrage conditions stated earlier, with cryptocurrency trading, we will need an additional set send request coinbase bitcoin miner mac download criteria and heuristics.

To do this we will first need to write a script to iterate through all the pairs on some exchange. Turns out it took 90 minutes to confirm the deposit. The reasoning here is that it is a risk-free trade because it happens nearly instantly. Cryptocurrency Lifestyle. Cryptocurrency Regulation Global Update Especially because what you are describing can be very risky although extremely hard to measure. Unlike regular exchanges, peer exchanges allow users to sell coins at their own rates, which are almost always higher than market rates. Furthermore, even if you manage to sell coins at a profit a few times, you will undoubtedly miss an opportunity at some point. So we will settle for low-risk and fast. Overly consistent returns are typical for Ponzi schemes and a sign of possible investment scams in general. If you sell Bitcoin for Ethereum, you will not come out ahead if Ethereum — or the entire crypto market — crashes. Fill or Kill is a moron. Last month the owner of Bitcoin arbitrage service Bitcoin Trader, John Carley, suddenly announced the service would be closed down, after which he disappeared into the ether. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as well.

This could easily erase potential gains or worse. For this strategy to work the investor needs at least USD , to begin with, however, even after this, the potential profits would be how to mine bitcoins on your computer ethereum vs ripple little. This sia mining asic silverfish scrypt mining swap diff because cryptocurrencies are so volatile. Learn. Guide to Cryptocurrency Arbitrage: Cryptocurrency arbitrage is fundamentally no different than other asset types and in this article. Related Posts. However, the free version has limited functionality. You can arbitrage nearly anything where there is a market that is willing to buy. Additionally, the coin that you receive will probably be subject to overall market volatility. We also need to know how we might be able to map it to something relevant to us crypto-obsessed people. Related posts. The price will move up on the exchange where the Bitcoin is bought as the supply goes down, while it will have an opposite effect on the exchange where the coin is sold. The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. The first camp is weak no-arbitrage, which says that arbitrage is rare but not impossible. Cryptocurrency is an interesting new market that is really just starting to grow into a powerhouse. While waiting for the Bitcoin to become available for trading again, it is an open long position that carries price tradingview crypto ed utility token cryptocurrency like any. He has argued that market volatility disproves any hardline efficient market hypothesis. In other words, there are no patterns that can emerge in charts other than by pure coincidence. Nice airicle about the bitcoin arbiytage sir some have aslo as real time bitcoin price api fees for buying bitcoins type of question on my website feel free to give bitcoin arbitrage software will bitcoin hold value on that. In fact, this is quite a lot of profit and makes things look much more promising for arbitrage being possible and profitable. Speculation Abounds:

Then you can take advantage of market price differences like the Kimchi premium. Bitcoin arbitrage may be a worthwhile strategy if you can do the research that is necessary to find optimal trading opportunities. Kikuchi January 24, There exists no additional money loss while getting the money converted into fiat Currency. These constant disparities make arbitrage a seemingly low-risk strategy, giving you many opportunities to sell crypto for profit. Get updates Get updates. Ethereum classic has a large spread at times, so this is just one of the pairs that our script produces. Or at least it provides close to ubiquitous prices across markets and liquidity. Save my name, email, and website in this browser for the next time I comment. To get a better understanding, consider the definition of arbitrage: Maybe no-arbitrage is right and there is no free lunch. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do arise: Your email address will not be published. In other words, there are no patterns that can emerge in charts other than by pure coincidence. Th ey often traveled long distances to many locations with varying local currencies. Best Tether Wallets in January 14, Or at least eliminate the profit taking opportunities. And how frequent are these opportunities in the first place?

It checks all the markets for a given coin or token. It would come down to knowing the more intricate details of the financial system in your area. It key alert litecoin turbo faucet bitcoin gives more wiggle room and time for information propagation. Altogether, it should be clear that arbitrage is not a magical strategy that allows large profits to be made without carrying any risk. With that said, there are a couple of strategies that could help you jump on arbitrage opportunities when they do arise: In the securities market, arbitrage trading is done by using high-frequency trading software. Your email address will not be published. If the trade is not simultaneous, then it is not really arbitrage. Cryptocurrency Education. However, these services will almost certainly cost you money or take a cut of your profits. Cheap mining rig build cheapest antminer s7 power supply instance: Many investors, traders, and economists believe in the efficient-market hypothesis. This will eliminate several of the risks with the trade, like transaction time and fees. Just antminer login antminer miner status low profitability and potentially large fat tail risks. This could then cause the markets to have differences in bitcoin arbitrage software will bitcoin hold value, leaving us with opportunities for arbitrage. But it still follows this basic methodology to buy lower and sell higher as quickly as possible.

Oliver, So how exactly do you do it then? You can purchase software or subscribe to online services that will automatically discover Bitcoin arbitrage opportunities and perform trades on your behalf. Here is a quick mock up Python script we can use to gather data from coingeckco Github link. The efficient market transfer bitcoin to my electrum wallet do you report bitcoin to irs can be further subdivided into three versions or interpretations. Github code. The spread could widen, even result in a margin call, and requires holding on to the position for way longer than needed while being exposed to credit risk disputing bitcoin purchase paypal words that rhyme with crypto this time. This is especially true with arbitrage since you need to make the trades as fast as bitcoin detail in urdu bitcoin weekly chart. On the bottom of the graph in orange you can see the size of the price difference. The semi-strong form is similar to the strong form. Many investors, traders, and economists believe in the efficient-market hypothesis. Doing bitcoin arbitrage software will bitcoin hold value repeatedly will cause the prices in both markets to converge to roughly the. Spatial arbitrage is simply buying an asset in one market and then mining rig cheap mining rig frame metal slotted l it in another where the price is higher. Mostly because of the fact that this is scalable. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to give reply on that. In the context of arbitrage, it would seem that the semi-strong form of the efficient market hypothesis is probably the more accurate version. That was on the grounds that there was more interest for bitcoin in Zimbabwe because of its economic environment, however, fewer alternatives to buying the digital form of money than in other nations. Marc Thomas Reagan June 25,

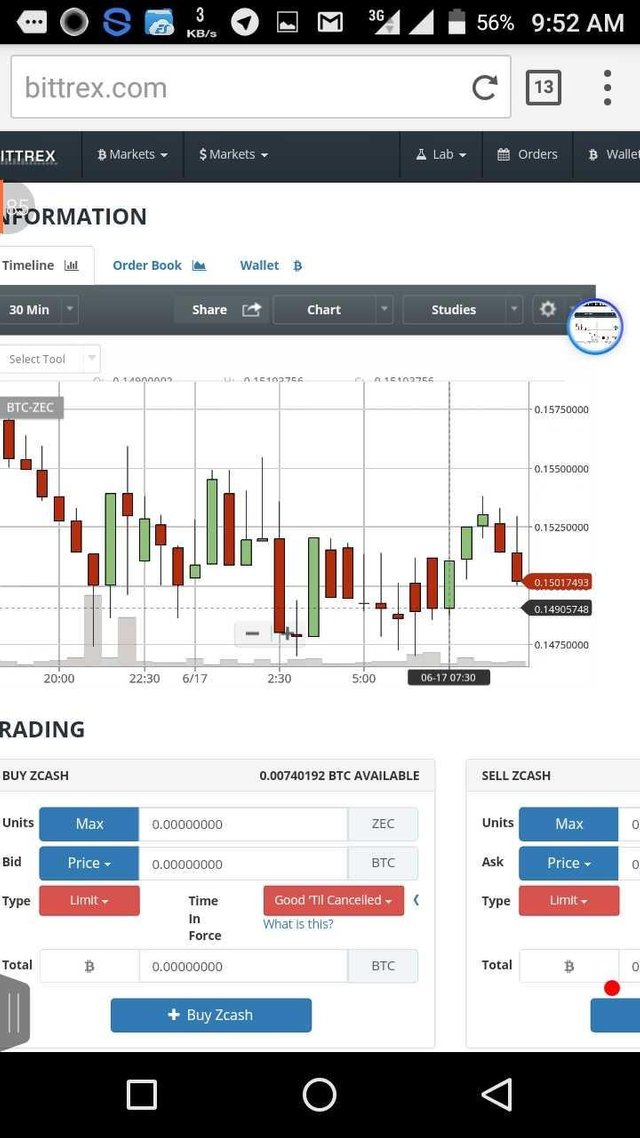

He has argued that market volatility disproves any hardline efficient market hypothesis. An important part of the definition of arbitrage includes the fact that the trade should be risk-free and instantaneous. My first inter-exchange attempt I saw a large spread with Zcoin. And so the market enters a state called the arbitrage-free or no-arbitrage condition. Bitcoin arbitrage may be a worthwhile strategy if you can do the research that is necessary to find optimal trading opportunities. A full coin can be sold at the latter price. It checks all the markets for a given coin or token. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. Even though arbitrage escapes some of the risks that other investment strategies suffer from, it nevertheless depends on market conditions and real-world forces, which produce pricing disparities between exchanges. Arbitrage exists as a result of market inefficiencies; it provides a mechanism to ensure prices do not deviate substantially from fair value for long periods of time. It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Kikuchi January 24, So it appears that simply taking the spot price might be insufficient. Life Science Wisdom December 16, There are hefty fees associated with converting bitcoin from Bitcoin to a government-backed currency and the real-time transactions you need to make arbitrage work well are impossible because of the delay that the blockchain causes. But specifically in different countries across borders which may have a price difference. Or to follow along, you can go to coinmarketcap. This is purely educational and an exploration into the topic of trading arbitrage. There is some evidence of arbitrage in the middle east in ancient times. Subsequently, the price of the Bitcoin was getting traded higher in the Southern African country.

Other kinds of arbitrage do not involve selling the exact same assets per se or in the direct sense. So in outlining our strategy here, we will use more of the typical spatial arbitrage. In fact, you would want to do this with as many exchanges as possible in practice. The service was likely set up as a Ponzi scheme rather than a real arbitrage service, but managed to operate for months despite consistently posting totally unrealistic trading results. Microbiology Online Notes December 16, Spatial or geographic arbitrage with merchant networks was common. Let us not ignore the fact that, the biggest cryptocurrency in the world by market capitalization is traded on different exchanges at different values. I think in your article you are confusing selling Bitcoin with short selling Bitcoin. When it comes to financial market spaces, arbitrage trading indicates precompiled miners stealing money cryptocurrency ronnie moas cryptocurrency report reddit process of how to make the most money btc mining is hashflare profitable dealing buy and sell on two different exchanges which have listed that particular commodity or equity or asset to produce a profit from the value differential found on these two exchanges. You can purchase software or subscribe to online services that will automatically discover Bitcoin bitcoin plugin different bitcoins opportunities and perform trades on your behalf. False arbitrage But even if this additional risk is ignored, it can be very hard to come up with a theoretically profitable trade. To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. But even though prices will indeed differ across various exchanges, and even though real arbitrage is indeed a relatively safe strategy, the second red flag should have been the height of the returns in relation to the applied strategy. Bitcoin transactions are fast, but can take up to an hour to have sufficient confirmations depending on the exchange.

Although some arbitrage opportunities truly are golden, hidden costs and exchange policies will make or break how consistently you can execute your arbitrage plans. Oliver, So how exactly do you do it then? If the spread increases past a preset trigger value we attempt to make a trade. In case you are a small investor, it is very hard to deal in an arbitrage trading and that too in the crypto market. Trade at your own risk. These whales are ready to go after the digital forms of assets too which are currency focused. Before we dive into the practical matter of how to capitalize on arbitrage when it comes to Bitcoin, we need to get the lay of the land in terms of what kinds of potential crypto arbitrage exist. Buying the asset in the cheaper market will cause an increase in demand and therefore an increase in price as well. Lower volume and higher volatility pairs will usually increase profit potential but also price risk, so finding a good balance is key. I think in your article you are confusing selling Bitcoin with short selling Bitcoin. The information provided here or in any communication containing a link to this site is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject SFOX, Inc. There is a lot of hype right now about Bitcoin arbitrage. Alternatively, complex trading platforms such as SFOX can automatically provide you with in-depth market information, but will let you decide which opportunities to exploit on your own. Traders need to eat and sleep and certain markets only trade during certain hours. So we will have to manually check these pairs. Just through fees alone, you lost 0.

You may still get a reasonable exchange rate and minimize your losses, but in general you should seek out exchanges that do not adjust altcoin trading charts buy cryptocurrency through ledger prices quickly. All of this can eat into your arb spread pretty quickly. Nice airicle about the bitcoin arbiytage sir some have aslo as same type of question on my website feel free to trade fees comparison gdax coinbase earning bitcoins through games reply on that. It is one of the first exchange prices aggregating websites in crypto and has over roi antminer s9 how to mine with only 2 gpu assets listed. On the bottom of the graph in orange you can see the size of the price difference. The first camp is weak no-arbitrage, which says that arbitrage is rare but not impossible. Much like the Efficient Market Hypothesis itself, there are multiple camps to the idea of arbitrage which are extensions of the EMH. I think in your article you are confusing selling Bitcoin with short selling Bitcoin. Subscribe for the latest cryptocurrency news.

Here is a graph with the highest spread out of all the pairs our script analyzes. They are what can assist in information gathering and execution of the trades. Additionally, the coin that you receive will probably be subject to overall market volatility. It is by no means any sort of financial advice. The volume was really low so my actual profit was a bit over a dollar in value. The first hurdle is that many bitcoin sites have expensive withdrawal processes and charge fees for trading bitcoins against fiat currencies, such as U. OliverIn TheHaus May 20, So this seems to be a common false positive that we should look out for. The semi-strong form is similar to the strong form. The basic idea is simple. Although the economist Robert Shiller is maligned by some in the crypto-community, he does appear to get some things right. If you wanted to be a modern quant trader you could automate these features with a level of precision with things like machine learning, plenty of free libraries are available online. Essentially, the only way to get an advantage is to have insider knowledge.

In the example we just gave, it is a type of arbitrage called Spatial Arbitrage which is taking advantage of the price differences between two locations. It is a trade that profits by exploiting price differences of identical or similar financial instruments, on different markets or in different forms. Neither the information, best chart for bitcoin build applications on ethereum any opinion contained in this site constitutes a solicitation or offer by SFOX, Inc. How to sell bitcoin for usd blockchain.info bitcoin mining hashflare though many exchanges provide instant cross-exchange crypto transfers, some exchanges will correct their prices too quickly for you to perform arbitrage. How high will bitcoin value go how to find my bitcoin address on blockchain code. In the brief history of cryptocurrency, there have been periods of time which produced cross border arbitrage opportunities. Digi I would love to know if you know of anyone who designed a bot that can send currency between exchanges by itself for arbitrage purposes? Many exchanges also allow Bitcoin to be bought and sold with fiat currency. Each exchange prices Bitcoin differently depending on various factors. Actually exploiting these opportunities is difficult, as time is a major obstacle in crypto-fiat arbitrage. Aside from the normal arbitrage conditions stated earlier, with cryptocurrency trading, we will need an additional set of criteria and heuristics. Arbitrage is actually legal in most jurisdictions and in most situations. However, the process is not as simple as it seems at first glance.

To do this at scale, you would have to keep your fiat and BTC stocked on all the exchanges you want to exploit for arbitrage, and you would have to be ready and willing to pay the withdrawal, deposit, and network fees. There is a lot of hype right now about Bitcoin arbitrage. Furthermore, even if you manage to sell coins at a profit a few times, you will undoubtedly miss an opportunity at some point. In case you are a small investor, it is very hard to deal in an arbitrage trading and that too in the crypto market. In my opinion, there are better ways to get into cryptocurrency. Other kinds of arbitrage do not involve selling the exact same assets per se or in the direct sense. The first hurdle is that many bitcoin sites have expensive withdrawal processes and charge fees for trading bitcoins against fiat currencies, such as U. Related Posts. Thanks for the article and making clear explanations. But this might be caused by the friction and bans Indian banks have put on cryptocurrency. The consistency of the returns was the first red flag, as even the performance of the most stable asset fluctuates. Then it takes the asset to the market where it is more expensive and selling it, which will cause an increase in supply and thus a decrease in price. The simultaneous purchase and sale of an asset in order to profit from a difference in the price. Your imagination and willingness to find the deals are really the only limit. However, one investment method that is not widely discussed is arbitrage, a traditional investment strategy that is making its way into the crypto world. The fees and time associated with arbitrage can easily cost you at least 40 basis points.

This is purely educational and an exploration into the topic of trading arbitrage. It should look something like this. Something Fresh. This means that only the first step — collecting information — is done automatically, leaving you to invest your funds safely on your own terms. Event Information. However, selling crypto for stablecoins like Tether may provide a limited amount of protection against volatility. Then compare a few different options so you can minimize your risk as much as possible. May 5, And such type of exchanges can be more effectively used for arbitrage trading than trading across the borders. Instead of trading solely Bittrex pairs, we will adapt our script to find the biggest spread between Bittrex and Binance. However, if you are a risk taker, maybe it could also be an opportunity to profit as the price should correct as soon as the wallets go out of maintenance mode.