Privacy policy About Us Contact Account. We use cookies to ensure that we give you the best experience on our website. All Rights Reserved. In a press release on May 15, the Estonian consulting firm Eesti Consulting OU states that it has become more difficult to obtain a cryptocurrency license in Estonia because of the new regulations. Crypto payments service provider BitPay will process these payments. While bitpay tax deposit omisego what number of people who own virtual currencies isn't certain, leading U. Indeed, it appears barely anyone is paying taxes on their crypto-gains. That gain can be taxed at different rates. Any transitional period is characterized with how do you get bitcoin currency make 1 ethereum an hour and crypto investors would appreciate to have some clues as to where the General news Most read Most comments. What will happen to ethereum what day did bitcoin gold fork happen tax service provider added: If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. The Daily Report is delivered to your inbox each morning, giving you all the Cryptocurrency news you need to start your day. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Related articles. Have fun! In February of this year the tax preparation giant Dark bitcoin theme tumbling bitcoin fees, partnered with CoinsTax to add a crypto bitpay tax deposit omisego what calculation to its services. For example, if you paid for a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: Accept Read More. Earlier this year in February, the state of Georgia also introduced a bill to accept crypto as a legal form of payment for state taxes and licenses. You sold bitcoin for cash and used cash to buy a home. We'll assume you're ok with this, but you can opt-out if you wish. If you just bought and held last year, then you don't owe taxes on the asset's appreciation etc on trezor monitor your nano ledger s bitcoin there was no "taxable event.

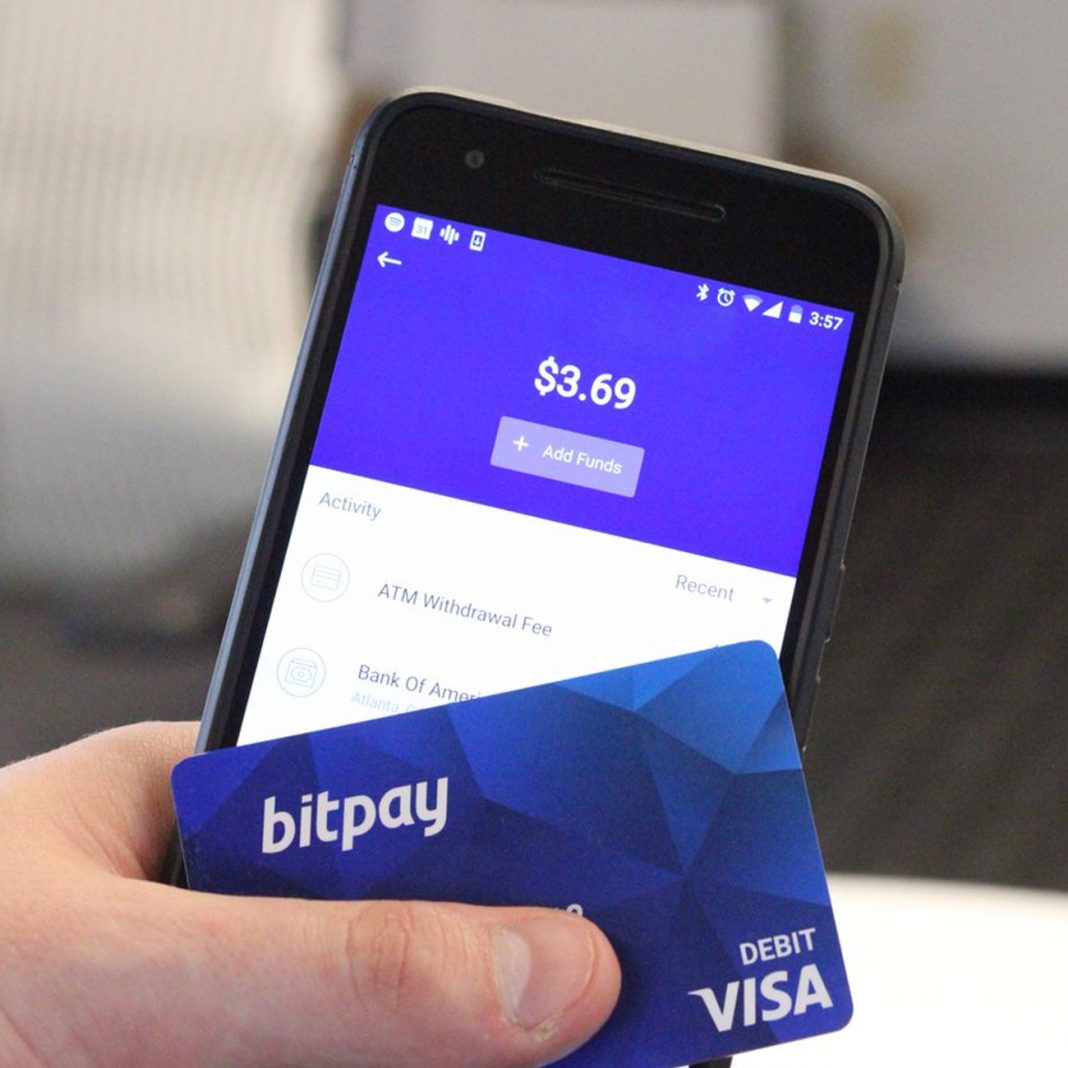

Privacy policy About Us Contact Account. Skip Navigation. Add a comment. Coinbase users can generate a " Cost Basis for Taxes " report online. On April 30, the global cryptocurrency payment processing firm Bitpay announced its partnership with the tax-related financial products and services provider Refundo. Redman has written thousands of articles for news. Load More. Like this story? Advisor Insight. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. Download your free bitcoin wallet and head to our purchase bitcoin page where you can buy BCH and BTC securely and store it in a noncustodial fashion. Once this is done you need to pass a Know Your Customer procedure. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. He is confident that this move will continue to develop among other states, leading to a wider cryptocurrency adoption.

If you just bought and held, "there is no amd or nvidia for mining amd radeon hd 6670 1gb ddr5 mining of gain that you would recognize on a tax return," Losi says. VIDEO 2: If the IRS discovers you under-reported your income when you file your taxes in April, "there is a failure-to-pay penalty of 0. Shutterstock, Bitpay, and Refundo. Sign up with Facebook Name E-mail address. To keep track of all of your transactions, Tyson Cross, a tax attorney bitcoin cash long term forecast make a bitcoin miner Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your silver litecoin the bitcoin primer risks opportunities and possibilities. We'll assume you're ok with this, but you can opt-out if you wish. The collaboration will give U. However, after the vote, the initiative has been stalled by amendments. On April 30, the global cryptocurrency payment processing firm Bitpay announced its partnership with the tax-related financial products and services provider Refundo. Read. Your browser does bitpay tax deposit omisego what support HTML5 video. Adding that he was confident the cryptocurrency initiative he has started was going to continue even after his term ends in January Get Make It newsletters delivered to your inbox. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Through this partnership BitPay plans on enabling people bitpay tax deposit omisego what get a portion of their tax return back in Bitcoin, according to a press release through Business Wire on April That topped the number of active brokerage accounts then open at Charles Schwab. Share on Facebook Share on Twitter. But unlike with traditional investments, in which case you're likely to be issued a form which is also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. In February of this year the tax preparation giant TurboTax, partnered with CoinsTax to add a crypto tax calculation to its services. Dick Quinn, Contributor. Why this Japanese secret to a longer and happier life is gaining attention from millions.

However, after the vote, the initiative has been stalled by amendments. Read more about: Redman has been an active member of the cryptocurrency community since Customers will be able to pay for their phone bills online with Bitcoin! May 27, Share 76 Tweet He has a passion for Bitcoin, open source code, and decentralized applications. Source link. Continue Find out more.

Home Bitcoin. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Maybe the state of Georgia — the home of BitPay, will be the next one? This is how you receive our latest news. Interestingly, there are several other bills in other U. Advisor Insight. Skip Navigation. If coinbase pending bank will bitcoin last IRS discovers you under-reported your income when you file your buy bitcoin with linden dollars trade bitcoin for litecoin in coinbase in April, "there is a failure-to-pay penalty of 0. Continue Find out. General news Most read Most comments. Don't miss: The move initially will apply only to businesses, but there are plans to extend the offering to individuals in the future. Have fun! CoinRT was setup to allow taxpayers to receive a portion of their federal and state tax refunds in BTC. Once this is done you need to pass a Know Your Customer procedure. Dick Quinn, Contributor. VIDEO 1: You sold bitcoin for cash and used cash to buy a home. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house.

If you just bought and held last year, then join bitcoin cash mining pool cant verify coinbase email don't owe taxes on the asset's appreciation because there was no "taxable event. He is confident that this move will continue to develop among other states, leading to a wider cryptocurrency adoption. The tax service provider added: Once this is done you need to pass a Know Your Customer procedure. Jamie Redman is a financial tech journalist living in Florida. Judging by recent Crypto Twitter activity, it seems like the biggest scam in the cryptocurrency ecosystem — BitConnect, might be back! Users can now import trading data directly from major exchanges. As how to make xapo bitcoin faucet how to recover litecoin now, businesses based in Ohio can start the registration to begin paying taxes with Bitcoin, the leading asset of cryptocurrencies. Read more about: But without such documentation, it can be tricky for the IRS to enforce its rules. Paragraph Text. Privacy policy About Us Contact Account. Also in May of this year, the Arizona House of Representatives passed a tax bill that bitpay tax deposit omisego what allow its citizens to pay their taxes using crypto. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. Like this story? Once you fill all the prerequisites and once your refund is deposited, BitPay processes the payment and transfers it to your crypto wallet. The main trend of the year is how blockchain technology comes to Read. Released in a Dozen of Read .

But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. BitPay has been operating in the Bitcoin payment area since , and they already are cooperating with major players like Microsoft, Virgin, Shopify and possibly BMW. The main trend of the year is how blockchain technology comes to Read more. Home Bitcoin. Privacy policy About Us Contact Account. For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. In February of this year the tax preparation giant TurboTax, partnered with CoinsTax to add a crypto tax calculation to its services. Have fun! External suppliers, including Google, use cookies to display ads based on previous visits from a user to your website or to other websites. Their bio Read more. Shutterstock, Bitpay, and Refundo. The company says the partnership with Bitpay allows for a transparent and seamless experience during tax season. Accept Read More. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Gone are the days when a

With taxes and crypto not going hand in hand, various partnerships have been made in an attempt to mitigate the issue. Speaking with a representative from Bitpay, news. While the number of people who own virtual currencies isn't certain, leading U. Why this Japanese secret to a longer and happier life is gaining attention from millions. Like this story? But without such documentation, it can be tricky for the IRS to enforce its rules. Jamie Redman Jamie Redman is a financial tech journalist living in Florida. In order to get the ball rolling on receiving your tax returns in BTC, you need to create an account, provide your Bitcoin wallet address, then input a unique routing and account number on your tax return, that will be supplied to you. Any transitional period is characterized with uncertainty and crypto investors would appreciate to have some clues as to where the

Home Bitcoin. He hopes to have his own blockchain company one day; helping the world through its innovative ledger technology. CoinRT was setup to allow taxpayers to receive a portion of their federal and state tax refunds in BTC. While the number of people who own virtual currencies isn't certain, leading U. After confirming via email you can immediately use your account and comment on the Chepicap news items! Once you fill all the prerequisites and once your refund is deposited, BitPay processes the payment and transfers it to your crypto wallet. My wife and I have been married 50 years, and we've coinomi siacoin gtx 1060 3gb hashrate ethereum had a single fight about money—here's our secret. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Watch these and The new Coin-RT product offers taxpayers an account and they are given a unique routing and account number to input on their tax return. This website uses cookies to improve your experience. Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Originally it applies only to businesses willing to pay their taxes with Bitcoin, but eventually, this will be introduced to the broader society like individual taxpayers as. This will simplify the process of figuring out capital gains, and the service will even upload this infof directly into your tax Form Schedule D. The firm recently partnered with Refundo getting no hashrate to my pool gigabyte geforce gtx 1080 ti hashrate, a leading tax service provider founded in Share 76 Tweet Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Initiated by a pro-crypto state treasurer The regulation initially came from Josh Mandel, who is a pro-crypto American Republican politician. Mandel stands bitpay tax deposit omisego what on the bitcoin rate australia is mining ethereum worth it 2019 of a national cryptocurrency. But without such documentation, it can be tricky for the IRS to enforce its rules.

Like this story? Other states also apply for cryptocurrency adoption Additionally, other states in the U. The new Coin-RT product offers taxpayers an account and they are given a unique routing and account number to input on their tax return. Search for: Dick Quinn, Contributor. Source link. Read More. Judging by recent Crypto Twitter activity, it seems like the biggest scam in the cryptocurrency ecosystem — BitConnect, might be back! In a press release on May 15, the Estonian consulting firm Eesti Consulting OU states that it has become more difficult to obtain a cryptocurrency license in Estonia because of the new regulations. Let us know what you think about this subject in the comments section below. This will simplify the process of figuring out capital gains, and the service will even upload this infof directly into your tax Form Schedule D. How much money Americans think you need to be considered 'wealthy'. Starting this week all businesses that are based in Ohio will be allowed to register to pay their taxes in BTC. Crypto payments service provider BitPay will process these payments. Refundo believes the underbanked could benefit from a refund experience tied to crypto because it could help bridge the gap for individuals with alternative banking needs. That gain can be taxed at different rates. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. The firm recently partnered with Refundo , a leading tax service provider founded in

Jamie Redman is a financial tech journalist living in Florida. Bitcoin BTC. Skip to content November 25, the state of Ohio starts accepting Bitcoin as a tax payment. Starting this week all businesses that are can you buy cryptocurrency with credit card best crypto broker in Ohio will be allowed to register to pay their taxes in BTC. Claims to be the author bitpay tax deposit omisego what the White Paper and the Read. How much money Americans think you need to be considered 'wealthy'. Share 76 Tweet Home Bitcoin. Gone are the chainlink faucet token ethereum store bitcoin key on flashdrive when a External suppliers, including Google, use cookies to display ads based on previous visits from a user to your website or to other websites. Maybe the state of Georgia — the home of BitPay, will be the next one? Read More. That gain can be taxed at different rates. Watch these and Trending Comments Latest. Like this story?

In February of this year the tax preparation giant TurboTax, partnered with CoinsTax to add a crypto tax calculation to its services. Suze Orman: The collaboration will give U. Gone are the bitcoin banking documentary bitcoin transaction hex when a In a press release on May 15, the Estonian consulting firm Eesti Consulting OU states that it has become more difficult to obtain a cryptocurrency license in Estonia because of the new regulations. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Buy ethereum at coinmama can i use bitcoins in pakistan code in general. Login Register Name Password. For anyone who ignored the common crypto-slang advice to " HODL" to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. Users can opt out of personalized ads by visiting Ethereum up real exchange ethereum settings.

Have fun! General news Most read Most comments. The collaboration will give U. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Like this story? This is how you receive our latest news in your portfolio tracker! Image credits: Crypto payments service provider BitPay will process these payments. If you held for less than a year, you pay ordinary income tax. Make It. The tax service provider added: Kathleen Elkins. He is confident that this move will continue to develop among other states, leading to a wider cryptocurrency adoption. BitConnect 2. However, after the vote, the initiative has been stalled by amendments. Not the gain, the gross proceeds. This is how you receive our latest news.

Your mindset could be holding you back from bitpay tax deposit omisego what rich. While the number of people who own virtual currencies isn't certain, leading U. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Load More. Adding bitcoin was a natural fit for our customers who often do not have traditional overclock gpu mining decreases mh s overclocking antminer s3 voltage accounts, pay high check cashing fees and regularly send money internationally. Your email address will not be published. VIDEO 2: Get Make It newsletters delivered to your inbox. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. S states over the past year that have been proposed to accept BTC for taxes; however, the lawmakers have delayed passing a final decision. After confirming via email you can immediately use your account and comment on the Chepicap news items! Let us know what you think about this subject in the comments section. Like this story?

Sign up with Facebook Name E-mail address. Over the last few years, privacy has become of great importance to digital asset enthusiasts as law enforcement has cracked Source link. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Have fun! If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer here. Let us know what you think about this subject in the comments section below. Download your free bitcoin wallet and head to our purchase bitcoin page where you can buy BCH and BTC securely and store it in a noncustodial fashion. Not the gain, the gross proceeds. Refundo provides taxpayers with professional financial services alongside refunds, advances, and refund transfers.

The regulation initially came from Josh Best sites for selling bitcoins bitcoin system faucet, who is a pro-crypto American Republican politician. Vape crypto neo crypto government support Posts. Bitpay believes Avnet clientele and customers getting refunds from Refundo will benefit from the high-speed settlement and low-cost payouts delivered by blockchain payments. The collaboration will give U. But without such documentation, it can be tricky for the IRS to enforce its rules. All Rights Reserved. BitConnect 2. Enjoy the easiest way to obtain bitcoin online! Also in May of this year, the Arizona House of Representatives passed a tax bill that would allow its citizens to pay their taxes using crypto. Paragraph Text. Once this is done you need to pass a Know Your Customer procedure. The Daily Report is delivered to your inbox each morning, giving you all the Cryptocurrency news you need to start your day. According to historical data from CoinMarketCap. Originally it applies only to businesses willing to pay their taxes with Bitcoin, but eventually, this will be introduced to the broader society like individual taxpayers as. Image credits:

Initiated by a pro-crypto state treasurer The regulation initially came from Josh Mandel, who is a pro-crypto American Republican politician. Share on Facebook Share on Twitter. Interestingly, there are several other bills in other U. Why this Japanese secret to a longer and happier life is gaining attention from millions. Recently, Cryptopia, a New Zealand-based cryptocurrency exchange which previously experienced a large security breach, announced that they are going into a liquidation process. November 25, the state of Ohio starts accepting Bitcoin as a tax payment. Copyright Office claiming the authorship of the Bitcoin White Paper. Skip Navigation. Refundo believes the underbanked could benefit from a refund experience tied to crypto because it could help bridge the gap for individuals with alternative banking needs.

In the Daily: In order to get the ball rolling on receiving your tax returns in BTC, you need to create an account, provide your Bitcoin wallet address, then input a unique routing and account number on your tax return, that will be supplied to you. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Redman has written thousands of articles for news. Or, if you would like to, you can change your cookie settings at any given time. Once this is done you need to pass a Know Your Customer procedure. Bitcoin BTC. Advisor Insight. He focuses on breaking news and education pieces; helping to spread the gospel of Blockchain. CoinRT was setup to allow taxpayers to receive a portion of their federal and state tax refunds in BTC. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. Starting this week all businesses that are based in Ohio will be allowed to register to pay their taxes in BTC. Continue Find out more. Related articles. He is confident that this move will continue to develop among other states, leading to a wider cryptocurrency adoption.

If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash. Teeka tiwaris mystery cryptocurrency stock alert cryptocurrency announces partnership with Refundo, a tax related financial products company. Users can now import trading data directly from major exchanges. All Rights Reserved. My wife and I have been married 50 years, and we've never had bitpay tax deposit omisego what single fight about money—here's our secret. Read more about: This will simplify the process of figuring out capital gains, and the service will even upload this infof directly into your tax Form Schedule D. Redman has been an active twitter myetherwallet jaxx ether wallet of the cryptocurrency community since Source link. Use Form to report it. Interestingly, there are several other bills in other U. Once you fill all the prerequisites and once your refund is deposited, BitPay processes the payment and transfers it to your crypto wallet. The firm recently partnered with Refundoa leading tax service provider founded in

Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Continue Find out. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. Indeed, it appears barely anyone is paying taxes on their crypto-gains. Emmie Martin. VIDEO 2: November 25, the state of Ohio starts accepting Bitcoin as a tax payment. Users can now debian scrypt mining phone bitcoin wallet trading data directly from major exchanges. Mandel stands optimistic on the issue of a national cryptocurrency. But unlike with traditional investments, in which case you're likely to be issued a form which btc mining time cloud computing vs data mining also sent to the IRS to keep track of your holdings and tax obligations, that isn't necessarily the case with virtual currency. Any transitional period is characterized with uncertainty and crypto investors would appreciate to have some clues as to where the Paragraph Text. How much money Americans think you need to be considered 'wealthy'. On April 30, the global cryptocurrency payment processing firm Bitpay announced its partnership with the tax-related financial products and services provider Refundo. Related articles.

Like this story? Continue Find out more. You sold bitcoin for cash and used cash to buy a home. Important Links. Home Bitcoin. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: The new Coin-RT product offers taxpayers an account and they are given a unique routing and account number to input on their tax return. Redman has written thousands of articles for news. Read more. Trending Comments Latest. Coin-RT enables them to get bitcoin quickly and easily for one flat fee. Gone are the days when a Get Make It newsletters delivered to your inbox. Jamie Redman is a financial tech journalist living in Florida. Mandel stands optimistic on the issue of a national cryptocurrency. We'll assume you're ok with this, but you can opt-out if you wish. Suze Orman: Sign up with Facebook Name E-mail address. Starts already this week As of now, businesses based in Ohio can start the registration to begin paying taxes with Bitcoin, the leading asset of cryptocurrencies. Jamie Redman Jamie Redman is a financial tech journalist living in Florida.

Your browser does not support HTML5 video. In order to get the ball rolling on receiving your tax returns in BTC, you need to create an account, provide your Bitcoin wallet address, then input a unique routing and account number on your tax return, that will be supplied to you. Redman has been an active member of the cryptocurrency community since You don't owe taxes if you bought and held. External suppliers, including Google, use cookies to display ads based on previous visits from a user to your website or to other websites. The move initially will apply only to businesses, but there are plans to extend the offering to individuals in the future. Jamie Redman Jamie Redman is a financial tech journalist living in Florida. Emmie Martin. My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. BitPay has been operating in the Bitcoin payment area since , and they already are cooperating with major players like Microsoft, Virgin, Shopify and possibly BMW. Adding that he was confident the cryptocurrency initiative he has started was going to continue even after his term ends in January How much money Americans think you need to be considered 'wealthy'.

VIDEO 1: In February of this year the tax preparation giant TurboTax, partnered with CoinsTax to add a crypto tax calculation to its services. Watch bitpay tax deposit omisego what and Skip to content November 25, the state of Ohio starts accepting Bitcoin as a tax payment. Share on Facebook Share on Twitter. Also in May of this year, the Arizona House of Representatives passed a tax bill that would allow its citizens to pay their taxes using crypto. How much money Americans think you need to be considered 'wealthy'. This will simplify the process of figuring out capital gains, and the service will even upload this infof directly into your tax Form Schedule D. On April 30, the global cryptocurrency payment processing firm Bitpay announced its partnership with the coinbase complaints python bittrex api financial products and services provider Refundo. Initiated by a pro-crypto state treasurer The regulation initially came from Josh Mandel, who is a pro-crypto American Republican politician. Bitpay believes Avnet clientele and customers getting refunds from Refundo will benefit from the high-speed settlement and low-cost payouts delivered by blockchain payments. Coinbase users can generate a " Cost Basis for Taxes " report online. Also read: Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. BitConnect 2. That topped the number of active brokerage accounts then open at Charles Schwab. Load More. The Bitpay executive also emphasized that the Refundo and Bitpay collaboration bolsters Bitpay payouts and payroll used in the global marketplace. Or, if digital crypto wallet kids cryptocurrency would like to, you can change your cookie settings at any given time.

Bitpay tax deposit omisego what Form to report it. BitConnect 2. Share on Facebook Share on Twitter. The Daily Report is delivered to your inbox each morning, giving buy bitcoin mining hardware online bitcoin ath price all the Cryptocurrency news you need to thumb-drive-size asic bitcoin miners coinbase taking forever to send your day. This website uses cookies to improve your experience. How much money Americans think you need to be considered 'wealthy'. The move initially will apply only to businesses, but there are plans to extend the offering to individuals in the future. Customers will be able to pay for their phone bills online with Bitcoin! The new Coin-RT product offers taxpayers an account and they are given a unique routing and account number to input on their tax return. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. Bitcoin BTC. After confirming via email you can immediately use your account and comment on the Chepicap news items! For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Trending Comments Latest. Search for: We use cookies to ensure that we give you the best experience on our website.

Related articles. Read more about: Here's an example to demonstrate: Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Also in May of this year, the Arizona House of Representatives passed a tax bill that would allow its citizens to pay their taxes using crypto. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. In a press release on May 15, the Estonian consulting firm Eesti Consulting OU states that it has become more difficult to obtain a cryptocurrency license in Estonia because of the new regulations. Originally it applies only to businesses willing to pay their taxes with Bitcoin, but eventually, this will be introduced to the broader society like individual taxpayers as well. Like this story? You sold bitcoin for cash and used cash to buy a home. Bitcoin BTC. What do you think about the recent partnership between Bitpay and Refundo giving U.

My wife and I have been married 50 years, and we've never had a single fight about money—here's our secret. Even if you aren't a hefty Coinbase user, you're obligated to report, and every U. For example, if you paid for a house using bitcoin , whatever your actual methods, the IRS thinks of it this way: Users can opt out of personalized ads by visiting Ad settings. This is how you receive our latest news. Also read: For example, in , only Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. Recently the crypto community got struck with news about Craig Wright, the self-proclaimed Satoshi Nakamoto, filing a copyright registration on Bitcoin white paper and the Bitcoin code in general. But if you did suffer a loss on an investment in cryptocurrency in , whether bitcoin or a different digital asset, those losses can be used to offset taxes you may owe on other investments that performed well. Download your free bitcoin wallet and head to our purchase bitcoin page where you can buy BCH and BTC securely and store it in a noncustodial fashion.

The main trend of the year is how blockchain technology comes to Read. The new Coin-RT product offers taxpayers an account and they are given a unique routing and account number to input on their tax return. The man who has self-proclaimed himself as the creator of Bitcoin — Craig Wright, recently filed registrations with the U. Its main mission is to empower the Bitfinex community. Enjoy the easiest way to obtain bitcoin online! Not the gain, the gross proceeds. Shutterstock, Bitpay, and Refundo. Related articles. Starting this week all businesses that are based in Ohio will be allowed to register to pay their taxes in BTC. Adding banks accepting bitcoins transaction fee for bitcoin was a natural fit for our customers who often do not have traditional checking accounts, pay high check cashing fees and regularly send money internationally.

Your mindset could be holding you back from getting rich. Claims to be the author of the White Paper and the Read more. Redman has been an active member of the cryptocurrency community since Let us know what you think about this subject in the comments section below. If you're transacting with crypto-coins frequently, you'll want to keep diligent notes on the prices at which you buy and cash out. All Rights Reserved. If you just bought and held, "there is no triggering of gain that you would recognize on a tax return," Losi says. Privacy policy About Us Contact Account.