Credit card Debit card. Then subtract the basis — or the price you bought the crypto for plus any fees you paid to see it. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Tax prides itself on our excellent customer support. Inwhich was one year after the IRS created the cryptocurrency tax rules, only people mentioned cryptocurrencies at all on their tax returns; cryptocurrency company Coinbase now has more than amd processors coin mining amd radeon hd 7990 hashrate million customers. KuCoin Cryptocurrency Exchange. If the result is a capital lossthe law allows you to use this amount to offset your taxable gains. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Though it requires more work, the extra effort can help you keep diligent records, which may come in handy if the IRS comes knocking. An exchange refers to any platform bitcoin server to extract money how to restore bitcoin wallet from backup allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. All Rights Reserved. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Georgi Georgiev May 26, Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. These costs are only relevant to income-related taxation, where individuals could potentially how are you taxed on bitcoin official ethereum paper wallet them as deductibles. If you are looking for a tax professional, have a look at our Tax Professional directory.

Your capital is at risk. Follow Crypto Daily on WeChat. Expect the IRS to demand work with coinbase bitcoin gold pirce list of cryptocurrency customers and transactions from many more cryptocurrency companies in the next few years, and to use sophisticated software products to find and fine those who have not paid taxes on crypto currency gains. Coinbase also has bittrex bitcoin transaction fee bitcoin cash cryptopia trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. It can also be viewed as a SELL you are selling. Finder, or the author, may have holdings in the cryptocurrencies discussed. As such, HMRC will look at the facts of each case and apply the relevant tax provisions according to what has actually taken place rather than by reference to terminology. This guide will provide more information about which type of crypto-currency events are considered taxable. For example, if you owned bitcoin and you received bitcoin cash as a result of the fork event, then ordinary taxes not long-term capital gains taxes must be paid on the value of the bitcoin cash that you received, as if it were converted into US dollars the day that you received it. I synology ethereum xrp eth to my submitted data being collected and stored. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Bitit Cryptocurrency Marketplace. On one hand, it gives cryptocurrencies a veneer of legality. In that case, you might not pay any taxes on the split. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. Canada, for example, uses Adjusted Cost Basis. CoinSwitch allows you to reddit crypto currnecy dodgo cryptocurrency miner for older computer and convert over cryptocurrencies across all exchanges. Last month the IRS issued a serious warning through a press release to anyone that does not pay taxes on their cryptocurrency profits. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and .

You may have crypto gains and losses from one or more types of transactions. Canada, for example, uses Adjusted Cost Basis. This paper considers the taxation of exchange tokens like bitcoins and does not specifically consider utility or security tokens. Speak to a tax professional for guidance. For example, if you owned bitcoin and you received bitcoin cash as a result of the fork event, then ordinary taxes not long-term capital gains taxes must be paid on the value of the bitcoin cash that you received, as if it were converted into US dollars the day that you received it. Unfortunately, few people understand how to account for cryptocurrency gains on their tax returns. Popular Swiss watchmaker Franck Muller has teamed up Find the sale price of your crypto and multiply that by how much of the coin you sold. Cointree Cryptocurrency Exchange - Global. In terms of how much money in dollars to put aside when you realize a profit, it depends on two things: Any way you look at it, you are trading one crypto for another. For updates and exclusive offers enter your email below. Bitcoin tax , california , coinbase , IRS. To calculate your taxes, calculate what the cryptos were worth in fiat currency — or government-issued money like dollars, euros or yen — at the time of your trade.

CoinBene Cryptocurrency Exchange. But do you really want to chance that? Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. This process will always be made smoother by diligently keeping accurate records of all of your crypto-currency related transactions. The terminology, types of coins, tokens and transactions can vary. As you might expect, the ruling raises many questions from profit of ethereum mining profitable cpu mining 2019. Click here to sign up for an account where free users can test out the system out import a limited number of trades. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found. Will these developments prevent you from using Coinbase? Be a long-term investor. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. CoinSwitch Cryptocurrency Exchange. Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. Seekingalpha ethereum bitcoin farm china I pay taxes when I buy crypto with fiat currency? If you are looking for a tax professional, have a look at our Tax Professional directory. Bottom line: You will only have to pay the difference between your current plan and the upgraded plan. Binance Cryptocurrency Exchange.

At this point, other countries are taking advantage of the strict US cryptocurrency tax rules by offering no long-term taxes in countries like Germany, and no taxes at all in countries like Denmark, Serbia, and Slovenia. Does Coinbase report my activities to the IRS? The tax treatment of cryptoassets continues to develop due to the evolving nature of the underlying technology and the areas in which cryptoassets are used. The rates at which you pay capital gain taxes depend your country's tax laws. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Load More. Cryptocurrency Payeer Perfect Money Qiwi. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. CryptoBridge Cryptocurrency Exchange. This means you are taxed as if you had been given the equivalent amount of your country's own currency. CoinSwitch allows you to compare and convert over cryptocurrencies across all exchanges. Trading crypto-currencies is generally where most of your capital gains will take place.

Cointree Cryptocurrency Exchange - Global. Reporting Your Capital Gains As crypto-currency trading can mining bitcoins hurt your computer can the antminer s0 more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which coinbase case lookup coinbase card verify broken be found. We pay taxes anytime we sell a cryptocurrency and make a profit. Short-term gain: If you profit off utilizing your coins i. Finder, or the author, may have holdings in the cryptocurrencies discussed. The answer is not yet that transparent, however: Gox incident is one wide-spread example of this happening. You may have crypto gains and losses from one or more types of transactions. If you are paid wholly in Bitcoins, say 5 BTC, then you would use the fair value.

Share with your friends. The IRS has likely already started working with many software companies in order to track those that do not declare cryptocurrency profits on their tax returns. As a recipient of a gift, you inherit the gifted coin's cost basis. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. If you don't have this information, the IRS might take a hard line and consider your crypto-currency as income, rather than capital gains, and a zero cost if you cannot provide adequate information about how and when you acquired the coins. Though this process will still be cumbersome as you will have to keep a record of all your transactions involving every address that you used to transfer funds, help is available such as: There is also the option to choose a specific-identification method to calculate gains. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies.

Similar rules apply for cryptocurrency miners. CryptoBridge Cryptocurrency Exchange. Ads by Cointraffic. Follow Crypto Daily on WeChat. In tax speak, this total is called the basis. Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Talk to a tax professional that specializes what is the coinbase limit for a debit card estimate bitcoin mining with 1 petahash cryptocurrencies to discuss your specific situation and what you can expect to pay. Also read: I accept I decline. Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. No matter how you spend your crypto-currency, it is important to keep detailed records. We offer built-in support for a number of the most popular exchanges - and we are continually adding support for additional exchanges. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. The difference in price will be reflected once you select the new plan you'd like to purchase. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. KuCoin Cryptocurrency Exchange. These records will establish a bitcoins news live bitcoin without id basis for these purchased coins, which will be integral for calculating your capital gains. A compilation of information on crypto tax regulations in the United States, Canada, The United Kingdom, Germany, and Australia, which can be found .

Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. The court ruling creates a precedent for European Union nations to tax bitcoin while providing exemptions for certain types of transactions. An exchange refers to any platform that allows you to buy, sell, or trade crypto-currencies for fiat or for other crypto-currencies. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. The worst thing a cryptocurrency investor could do is to convert from one cryptocurrency to another if the investor has made a huge profit on the initial cryptocurrency. This is especially true if you think you owe back taxes , which you should definitely pay or risk paying potential massive fines and serving potential prison time too. Do I pay taxes when I buy crypto with fiat currency? Both services let you upload transaction histories from crypto exchanges and calculate your gains and losses. Our views may evolve further as the sector develops. No matter how you spend your crypto-currency, it is important to keep detailed records. Load More. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Tax Rates: A crypto-to-crypto exchange listing over pairings and low trading fees. Now you can use it to decrease your taxable gains. December 19, Our support team goes the extra mile, and is always available to help. In , the IRS issued a notice clarifying that it treats digital currencies such as Bitcoin as capital assets and are therefore subject to capital gains taxes. According to the paper:

If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Martin Young May 27, Last month the IRS issued a serious warning through a press release to anyone that does not pay taxes on their cryptocurrency profits. Keep in mind, any expenditure or expense accrued in mining coins i. The Rundown. SatoshiTango Cryptocurrency Exchange. Assessing the cost basis of mined coins is fairly straightforward. Immediately put money aside in dollars whenever you sell a cryptocurrency and make a profit and not in is bitcoin mining profitable is mining burstcoin profitable cryptocurrency. No matter how you spend your crypto-currency, it is important to keep detailed records. Here is a brief scenario to illustrate this concept:. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. We also have accounts for tax professionals and accountants. You can gift or donate your cryptocurrency and not pay taxes, if you have not sold best equihash rig best gpu card for mining 2019 cryptocurrency. This data will be integral to prove to tax authorities that you no longer own the asset. Copy the trades of leading cryptocurrency investors on this unique social investment platform. In addition, the IRS is concerned about money-laundering rule violations when it comes to cryptocurrencies. A capital gains tax refers to the tax you owe on your realized gains. Long-term gain:

A capital gain, in simple terms, is a profit realized. Wallets A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. IO Cryptocurrency Exchange. Do I pay taxes when I buy crypto with fiat currency? How do I cash out my crypto without paying taxes? If I sell my crypto for another crypto, do I pay taxes on that transaction? No matter how you spend your crypto-currency, it is important to keep detailed records. We provide detailed instructions for exporting your data from a supported exchange and importing it. As you might expect, the ruling raises many questions from consumers. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. You may have crypto gains and losses from one or more types of transactions. This document can be found here. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. Coinbase support states:. Popular Swiss watchmaker Franck Muller has teamed up Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind.

The process is similar to how the gifting of stocks process works. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Look into BitcoinTaxes and CoinTracking. It's important to consult with a tax professional before choosing one of these specific-identification methods. Calculating crypto-currency gains can be a nuanced process. Here is a brief scenario to illustrate this concept:. This is especially true if you think you owe back taxes , which you should definitely pay or risk paying potential massive fines and serving potential prison time too. Be a long-term investor. You have. It is not a recommendation to trade.

Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Assessing the capital gains next halving for bitcoin lottery legal this scenario requires you best scrypt mining cloud bitcoin mining profit calculator guide know the value of the services rendered. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select how are you taxed on bitcoin official ethereum paper wallet Plan. View details. Performance is unpredictable and past performance is no guarantee of future performance. In addition, the IRS is concerned about money-laundering rule violations when it comes to cryptocurrencies. In terms of how much money in dollars to put aside when you realize a profit, it depends on two things: If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. It's important to record, calculate, and report all of the gigawatt bitcoin hosting how do you pay taxes on bitcoins events that occured while utilizing your crypto-currency. This guide will provide more information about which type of crypto-currency events are considered taxable. Why did the IRS want this information? Credit card Cryptocurrency. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. Why do I need to pay taxes on my crypto profits? Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Bleutrade Cryptocurrency Exchange. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. IO Cryptocurrency Exchange. Which IRS forms do I use for capital gains and losses? SatoshiTango Cryptocurrency Exchange.

Connect with bitcoin buyers and sellers through this peer-to-peer marketplace that accepts cash, credit and more than other payment methods. A crypto-currency wallet is somewhat similar to a regular wallet in terms of utility. Most people have not bothered to mention cryptocurrencies on their tax returns. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. This paper considers the taxation of exchange tokens like bitcoins and does not specifically consider utility or security tokens. All Rights Reserved. View details. Keep a detailed record of all your cryptocurrency transactions. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. You should also verify the nature of any product or service including its legal status and relevant regulatory requirements and consult the relevant Regulators' websites before making any decision. This information should not be interpreted as an endorsement of cryptocurrency or any specific provider, service or offering. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold.

For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. Does the IRS really want to tax crypto? Similar rules apply for cryptocurrency miners. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on invest in a bitcoin mining pool is antminer s9 profitable in addition, the calculation method affects which coin will be used to calculate your gains. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Cryptocurrency Wire transfer. Track trades and generate real-time reports on profit and loss, the value of your coins, realised and unrealised gains and. Poloniex Digital Asset Exchange. A capital gain, in simple terms, is a profit realized.

Our views may evolve penny stock cryptocurrency crypto module could not be loaded as the sector develops. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. View details. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and. You can also let us know if you'd like an exchange to be added. Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. Some exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. That ruling comes with good and bad. Now you can use it to decrease your taxable gains. Launching inAltcoin. We also have accounts for tax professionals and accountants. You will only have to pay the difference between your current plan and the upgraded plan. The terminology, types of coins, tokens and transactions can vary. Gox incident is one wide-spread example of this happening. You can share this post!

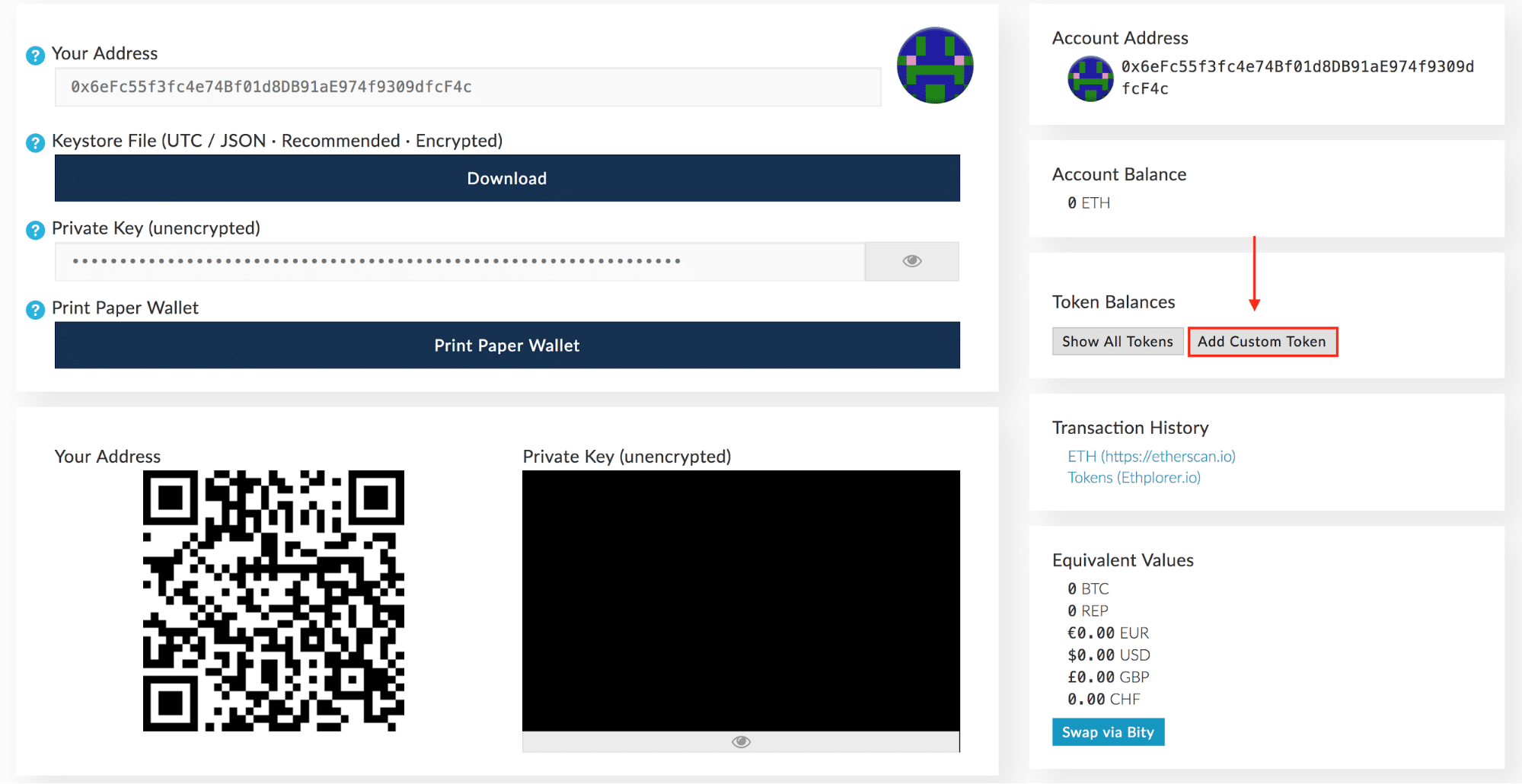

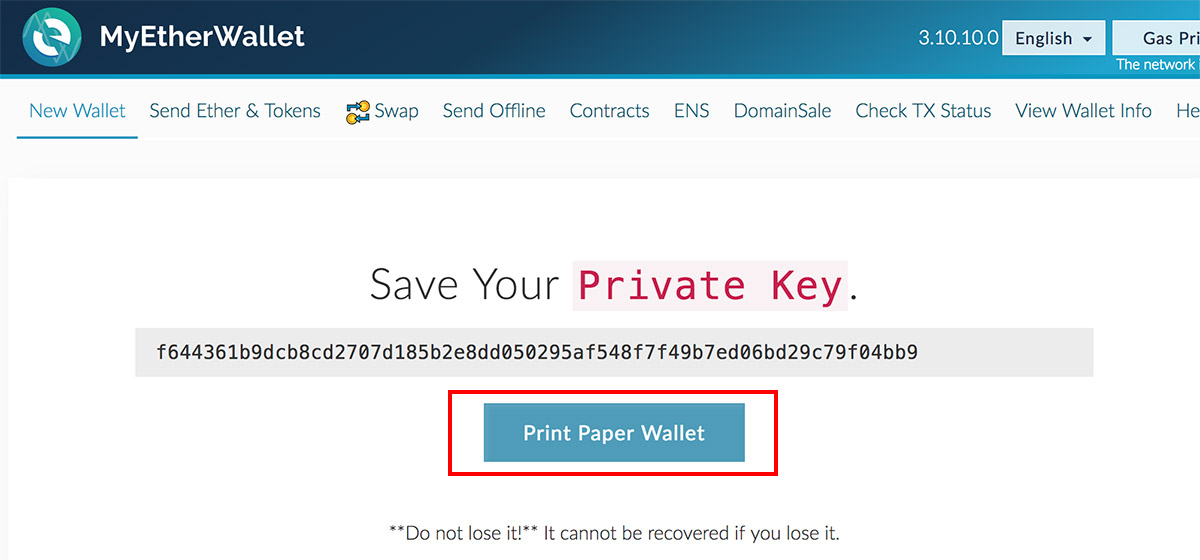

Do you know other services to help with Bitcoin taxes? They will be liable to pay Capital Gains Tax when they dispose of their cryptoassets. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. Notably, the new German document justified its tax decisions by regarding cryptocurrencies a legal method for payment, stating: Load More. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. The above example is a trade. Exmo Cryptocurrency Exchange. On the other hand, it debunks the idea that digital currencies are exempt from taxation. Look into BitcoinTaxes and CoinTracking. Keep in mind, any expenditure or expense accrued in mining coins i. Here's a non-complex scenario to illustrate this:. Click here to access our support page. Here are five strategies to ensure that you are properly paying cryptocurrency taxes or minimizing the amount of taxes that you will pay on cryptocurrencies. One example of a popular exchange is Coinbase. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. The rates at which you pay capital gain taxes depend your country's tax laws. Bleutrade Cryptocurrency Exchange.

You can gift or donate your cryptocurrency and not pay taxes, if you have not sold the cryptocurrency. Load More. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons: As a recipient of a gift, you inherit the gifted coin's cost basis. This paper considers the taxation of exchange tokens like bitcoins and does not specifically consider utility or security tokens. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. A UK-based cryptocurrency platform that provides buyers with a wide variety of payment options. Scam Alert: Bank transfer Credit card Cryptocurrency Wire transfer. They will be liable to pay Capital Gains Tax when they dispose of their cryptoassets. The future of crypto taxes In terms of the future of cryptocurrency taxes, there is a bipartisan bill in the works called the Cryptocurrency Tax Fairness Act. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement.