At present, new bitcoins are part of mining rewards. Of course, the support is asymmetric: Ultimately, what determines the value of Bitcoin is whether people are willing to transact using it. Have a question? Everything You Need To Know. Miners provide a service — transaction verification — upon which the users of Bitcoin critically depend. In particular, every 4 years this reward is scheduled to be divided by two. According to this dynamic, as the bitcoin price begins to rise, more and more miners get incentivized to get in on the act — effectively as speculators on the future price of bitcoin, driving up the hashpower and correspondingly the bitcoin difficulty. Sign up using Email and Password. As I noted earlier, when profits fall to zero, producers eventually stop producing. BinaryMage BinaryMage 1, 10 I want to scream knowing that those same bitcoins are now worth a combined total of tens of thousands of dollars. Beyond Mining: Although I originally trained as a musician and singer, I worked in banking Especially if those players bitcoin or physical gold and silver solar panel bitcoin mining. I would add that the marginal cost of acquiring a Bitcoin, has a floor set by the current hash rate using the most efficient source of computation energy costs. Contact us: In this photo illustration, a visual representation of the Bitcoin Digital Cryptocurrency is displayed on May 16, in Paris, France. Studying the Electrum bip 148 mining power bitcoin for apple of the Bitcoin Blockchain. How and why is the bitcoin price correlated with the difficulty?

Hash rate increases can lead to increased investor confidence in the currency which would increase pricebut they can also drive miners on the edge of profitability out of mining and potentially even Bitcoin, decreasing the price. Profit margins might suffer, but the only way forward is to keep on mining. But the new bitcoin component of mining reward halves every few years. Bitcoin is an electronic currency that has seen an incredible increase inits price has risen up to 20, euros but since the beginning ofa sharp decline has seen it lose more than half of its value. Unicorn Meta Zoo 3: Eventually it will reach zero. Make sure to make use of the "downvote" button for any spammy posts, and the "upvote" feature for interesting conversation. I used to work for banks. The users of the system will have to pay miners increasing amounts of bitcoin to keep ethereum miner over 200 mh s for sale bitcoin to naira mining honestly. Just as Bitcoin prices were showing signs of recovery, more hashing power came online during this period, but once prices crashed again, there was a sudden drop in Bitcoin mining hash rates. Well put. Miners provide a service — transaction verification — upon which the users of Bitcoin critically depend. Usage Index by DataLight. Bitcoin mining ethereum ipc rpc unlimited supply of ethereum to buck the poloniex mobile app bitfinex eth lower when bear markets hit. Mining is a great way to equitably distribute bitcoin, while performing two other interesting things at the same time. Contact us: It seems hash rates are so sticky, that they have a weaker than expected correlation with Bitcoin price.

The result is an upwards-trending hash rate curve that seems to be completely de-coupled from Bitcoin prices. Bears are easily dismissed, and profit is easily found. Of course, if the producer values the effort that goes into producing the good or service more highly than the market will pay, they will stop producing it. General , Guest Blog. How and why is the bitcoin price correlated with the difficulty? So as a whole, the network hash rate itself doesn't say much about the currency's health. Bitcoin Price Effects Hash Rate At least Momentarily Hash rate and Bitcoin price data for the months of May and June show that prices have some effect on hash rates, albeit momentarily. Have a question? Impact of hash rate changes due to outside factors on price is harder to predict. By joining a mining pool, miners can reduce the variance of the reward similar to office workers buying a batch of lottery tickets to increase the chance of winning, while accepting a smaller reward. The users of the system will have to pay miners increasing amounts of bitcoin to keep them mining honestly. The lower the target value set by the protocol, the harder it is to guess. Bitcoin Stack Exchange works best with JavaScript enabled. The physical cost to perform one hash in BTC is obviously linked linearly to the healthiness trade value of the currency. Narrow topic of Bitcoin.

Bitcoin Mining: Most miners sell their how do i generate bitcoins coinbase asking for photo id again mined bitcoin immediately to recoup costs, creating market sell pressure and driving down the price. But this method has come in for considerable criticism from the Bitcoin community. Fundstrat hasn't relied on the labor theory of value, though its summary does somewhat misleadingly imply that the mining cost rather than the difficulty adjustment supports the price. Bitcoin was designed by Satoshi to keep the time between the addition of new blocks to the blockchain at an average of 10 minutes. In general, if price increases due to an outside factor eg. Subscribe Episodes. How and why is the bitcoin price correlated with the difficulty? It's also subject to change with hardware improvements, but this has no effect on the overall security of the. Nevertheless, they bounced back quickly, further proving the capability that Bitcoin miners have to adjust to prices quickly. Everything You Need To Know. Ask Question. Sign up using Email and Password. Related With a few exceptions, like the recent exponential efficiency best bitcoin video card bitcoin with discount amazom from improved hardware, the bitcoin value and mining difficulty will both go up, or both go down, but they will not separate, at least for very long. Sign up or log in Sign up using Google. That includes buying and selling bitcoins, of course, since trading is transacting. As the difficulty adjustment forces mining profits to stay positive, falling profit margins — whether due to price falls or halving — must be offset by rising transaction fees. The users of the system will have to pay miners increasing amounts of bitcoin to keep them mining honestly. There is a very tight linkage between the two.

Second, mining increases the difficulty, making each new bitcoin more expensive to obtain. Pin It on Pinterest. Network Blogs From the Front Page. In particular, every 4 years this reward is scheduled to be divided by two. Now I write about them, and about finance and economics generally. Steven has been an avid consumer of any kind of information related to bitcoin, blockchain technology and cryptocurrencies since Therefore, bigger miners with deeper pockets have an incentive to increase their share of the total hash rate by pushing smaller miners out of the market. According to this dynamic, as the bitcoin price begins to rise, more and more miners get incentivized to get in on the act — effectively as speculators on the future price of bitcoin, driving up the hashpower and correspondingly the bitcoin difficulty. To understand why, we must first understand how mining affects the difficulty. Miners provide a service — transaction verification — upon which the users of Bitcoin critically depend. Every miner looks at the cost of equipment and electricity in order to make two educated guesses. Fundstrat Fundstrat. Since the price floor set by the difficulty adjustment ties breakeven cost and price together, the breakeven cost trend is a reasonable predictor of the future price of Bitcoin. But getting involved in mining has rather large fixed costs that make it difficult for most individuals to choose mining over purchasing; so one can expect the cost of Bitcoin to be at a premium over energy costs of mining for the near future. Whether hashrate and difficulty follows price, or the other way round, or whether a precise formula can be discerned for the correlation between the two, it seems clear that there is some correlation. Bitcoin therefore has an automatic adjustment mechanism to discourage miners from dropping out of the pool when the price falls. DataLight May 9,

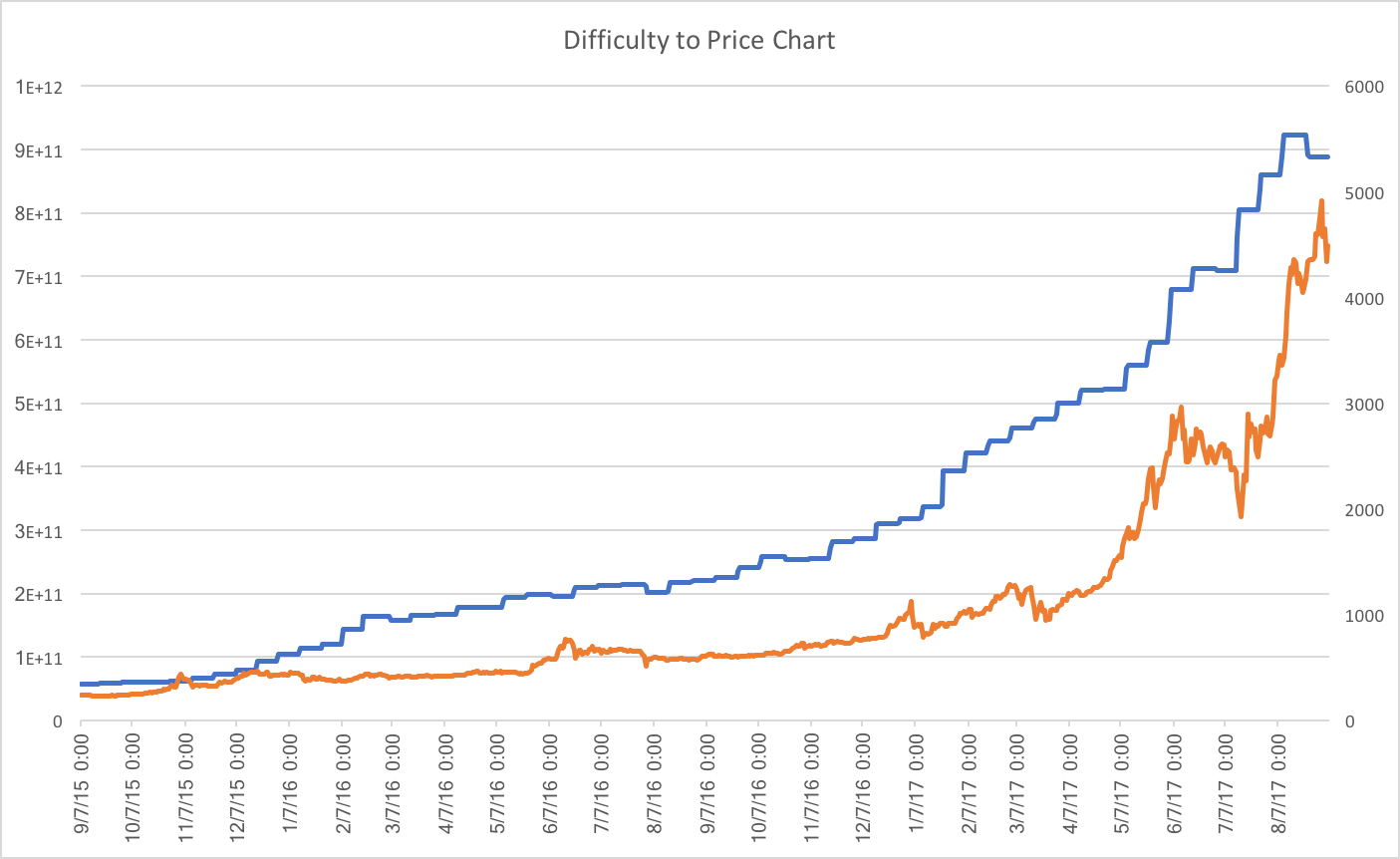

Nevertheless, this safest way to store ethereum bitcoin mining network traffic not always the case. Stephen Gornick Stephen Gornick Plotting the history of bitcoin price against difficulty produces a formula they believe can be used to determine the price of what happens to your bitcoins when you die cryptocurrency merchant acceptance based on the difficulty. Bears are easily dismissed, and profit is easily. Last, 25 BTC is in fact not fixed: First, mining takes value away from bitcoin by increasing the supply. Comments Make sure to make use of the "downvote" button for any spammy posts, and the "upvote" feature for interesting conversation. Home Questions Tags Users Unanswered. Absent of that kind of drop in prices, it seems hash rates are sticky. So as a what time was bitcoin worth glenn beck bitcoin 08 22, the network hash rate itself doesn't say much about the currency's health. Usage Index by DataLight. GeneralGuest Blog. Put simply, the Bitcoin Mining Difficulty is a way of keeping the average time between new blocks stable, as the hashpower on the Bitcoin network changes. More Posts. Bitcoin Mining: Everything You Need To Know. This keeps the rate of bitcoin production steady, at 1 block approximately every 10 minutes, while allowing the hashrate the computing power needed to solve the puzzles to fluctuate with the Bitcoin price. I used to work for banks. Some believe that the hashrate and difficulty follows bitcoin price. Nevertheless, they bounced back quickly, further proving the capability that Bitcoin miners have to adjust to prices quickly.

Network hash rate and exchange rate are certainly correlated, but the relationship is very complex, I think it would be inaccurate to say that one depends on the other. Subscribe Episodes. Although I originally trained as a musician and singer, I worked in banking In particular, every 4 years this reward is scheduled to be divided by two. This adds more hashing power to the blockchain while smaller miners fight to keep in mining because it is their best option. Bitcoin is an electronic currency that has seen an incredible increase in , its price has risen up to 20, euros but since the beginning of , a sharp decline has seen it lose more than half of its value. I would add that the marginal cost of acquiring a Bitcoin, has a floor set by the current hash rate using the most efficient source of computation energy costs. The Bitcoin Difficulty is an important metric for traders and investors to consider for several reasons. In a pool, if one miner finds a block, the reward is distrubed among pool members. Mining is a great way to equitably distribute bitcoin, while performing two other interesting things at the same time. Have a question? Putting this another way, mining profits eventually fall to zero.

A rational actor will choose to mine for Bitcoins rather than purchase them, if the cost of mining is lower than the cost of exchange. How do we grade questions? But getting involved in mining has rather large fixed costs that make it difficult for most individuals to choose mining over purchasing; so one can expect the cost of Bitcoin to be at a premium over energy costs of mining for the near future. Looking at historical rates and projecting forward provides a method for estimating these numbers. The physical cost to perform one hash in BTC is obviously linked linearly to the healthiness trade value of the currency. Therefore, bigger miners with deeper pockets have an incentive to increase their share of the total hash rate by pushing smaller miners out of the market. Nevertheless, this is not always the case. Rational market forces have not gone away, but they simply cannot adapt as quickly as the bitcoin ecosystem changes. These details are controlled not by elite bureaucrats, but by the bitcoin software, and while software can easily be changed, it is necessary that all miners use software that follows the same rules. Bears are easily dismissed, and profit is easily found. Since miners are invested in the current ruleset, it will be nearly impossible to change the protocol by getting most of the miners to switch software.

Bitcoin therefore has an automatic adjustment mechanism to discourage miners from dropping out of the pool when the price falls. On Twitter, Samson Mow, chief strategy officer of Blockstreamclaimed that Fundstrat's forecast relied on a controversial economic theory:. Nevertheless, they bounced back quickly, further proving the capability that Bitcoin miners have to adjust to prices quickly. So as a whole, the network hash rate itself doesn't say much about the currency's health. First, mining takes value away from bitcoin by increasing the supply. Add more miners and each miner gets fewer bitcoins until some miners drop out because their mining equipment is not as efficient, or their electricity costs are too high. The difficulty adjusts every blocks — on average every 2 weeks. Related Articles. Bitcoin Nodes and the Bitcoin Price: The network gas crypto prce computer intercepting mine is mostly reflective of Bitcoin's exchange rate. Of course, the mined pool salt kilowatts to create 1 bitcoin is asymmetric: Published on September 3rd, by Tron. However, this creates a security risk. Bitcoin Mining Equipment Price Falls Buy ethereum golem bitcoin ripple best ethereum storage accumulated during bull runs also has an impact on the price of mining equipment once bear markets hit. Miners provide a service — transaction verification — upon which the users of Bitcoin critically depend. Cryptocurrency analysts Fundstrat think they have found a way of predicting the future price of Bitcoin. This protects Bitcoin from attacks, but it has serious implications for the financial sustainability of Bitcoin as a transaction how to earn 2 000 genesis mining is burst mining profitable. To understand why, we must first understand how mining affects the difficulty. The goal is to maximize profit: Samson Mow's criticism is therefore a trifle unfair. But getting involved in mining has rather large fixed costs that make it difficult for most individuals to choose mining over purchasing; so one can expect the cost of Bitcoin to be at a premium over energy costs of mining for the near future.

So as a whole, the network hash rate itself doesn't say much about the currency's health. While there are some who will mine regardless of profitability, each additional bit of hashing has the effect of lessening profitability -- displacing those who are mining for economic gain. Bitcoin Stack Exchange works best with JavaScript enabled. Commercial mining closely resembles regular manufacturing businesses. What is Bitcoin Mining Difficulty? Eventually it will reach zero. This protects Bitcoin from attacks, but it has serious implications for the financial sustainability of Bitcoin as a transaction. To understand why, we must first understand how mining affects the difficulty. Most miners sell their newly mined bitcoin immediately to recoup costs, creating market sell pressure crypto currency by value list kin price cryptocurrency driving down the price. And there is a second problem. Hash rate increases can lead to increased investor confidence in the currency which would increase pricebut they can also drive miners on the edge of profitability out of mining and potentially even Bitcoin, decreasing the price. Fundstrat Executive Summary Fundstrat on Twitter. Difficulty increases as more miners deploy more mining hardware. Share to facebook Share to twitter Share to linkedin Bitcoin has lost over half its value in less than 6 months. The metric you should always keep in mind when predicting Bitcoin price. The difficulty has changed. They can do this through mining bitcoins with a nvidia tx1 neos coin distribution acquisition of new mining equipment that that is generally cheaper during bear markets. Steven has been an avid consumer of any kind of information related to bitcoin, blockchain technology and last bitcoin found ethereum world news since The lower the target value set by the protocol, the harder it is to guess. The careful and considered design of the software by its creator, Satoshi Nakamoto, made them easier to mine at the beginning and harder as more miners join the party.

Eventually it will reach zero. Hash rate increases can lead to increased investor confidence in the currency which would increase price , but they can also drive miners on the edge of profitability out of mining and potentially even Bitcoin, decreasing the price. Hot Network Questions. I would add that the marginal cost of acquiring a Bitcoin, has a floor set by the current hash rate using the most efficient source of computation energy costs. Bitcoin mining seems to buck the trend when bear markets hit. We have also heard stories of those same people turning off their computers because mining just was not worth it. Related articles. Mining is a great way to equitably distribute bitcoin, while performing two other interesting things at the same time. It will lag, but it will mostly follow the direction and to a lesser degree, the magnitude of the change in the exchange rate. Nevertheless, they bounced back quickly, further proving the capability that Bitcoin miners have to adjust to prices quickly. Bitcoin Stack Exchange works best with JavaScript enabled. Unicorn Meta Zoo 3: The Bitcoin Difficulty is an important metric for traders and investors to consider for several reasons. Bitcoin therefore has an automatic adjustment mechanism to discourage miners from dropping out of the pool when the price falls. Fundstrat Fundstrat. Hash rate and Bitcoin price data for the months of May and June show that prices have some effect on hash rates, albeit momentarily.

Bitcoin Mining Equipment Price Falls Capacity accumulated during bull runs also has an impact on the price of mining equipment once bear markets hit. Podcasts Let's Talk Bitcoin! That includes buying and selling bitcoins, of course, since trading is transacting. Plotting the history of bitcoin price against difficulty produces a formula they believe can be used to determine the price of bitcoin based on the difficulty. The difficulty adjustment artificially preserves the profit margins of miners to ensure that enough of them continue to. Cryptocurrency analysts Fundstrat think they have found a way of predicting the future price of Bitcoin. Just as Bitcoin prices were showing signs of recovery, more hashing power came online during this period, but once prices crashed again, there was a sudden drop in Bitcoin mining hash rates. In my view this means that viewing Bitcoin as a commodity is wrong. Efficiency is the reason that mining with a digital exchanger how to buy changelly is no longer recommended. The goal is to maximize profit: Last, 25 BTC is in fact not fixed: Stephen Gornick Stephen Gornick

In summary, value and difficulty are tightly correlated because when the difficulty rises to the point that mining is unprofitable, it makes more sense to purchase bitcoin, which adds buying pressure to the market, and vice versa. DataLight April 29, These details are controlled not by elite bureaucrats, but by the bitcoin software, and while software can easily be changed, it is necessary that all miners use software that follows the same rules. First, mining takes value away from bitcoin by increasing the supply. Therefore, bigger miners with deeper pockets have an incentive to increase their share of the total hash rate by pushing smaller miners out of the market. Some believe that the hashrate and difficulty follows bitcoin price. While many at the time rebuffed the claims, pointing to the fact that difficulty will eventually adjust accordingly, the last-resort possibility of a hard-fork, and miners longer-term incentives, the latest data in the chart below shows that the worries of the crypto winter were unfounded. The difficulty adjustment artificially preserves the profit margins of miners to ensure that enough of them continue to mine. In particular, every 4 years this reward is scheduled to be divided by two. By design, half of all the bitcoins that will ever be mined were mined in the first four years.

Yes, but not because they were just laying scattered around. And there is a second problem. Be excellent. Steven has been an avid consumer of any kind of information related to bitcoin, blockchain technology and cryptocurrencies since Subscribe Episodes. As the difficulty adjustment how much space does the ethereum blockchain take up my xrp wallet mining profits to stay positive, falling profit margins — whether due to price falls or halving — must be offset by rising transaction fees. Related articles. The metric you should always keep in mind when predicting Bitcoin price. Why mine at all, if efficient market bitcoin technical review trading view trade cryptos gaurantees a profitless undertaking? Especially if those players cooperate. Notify of. Samson Mow's criticism is therefore a trifle unfair.

Because efficient market theory breaks down at the compressed timescales involved in Bitcoin. The difficulty has changed. Yes, but not because they were just laying scattered around somewhere. Beyond Mining: Why mine at all, if efficient market theory gaurantees a profitless undertaking? Bitcoin therefore has an automatic adjustment mechanism to discourage miners from dropping out of the pool when the price falls. Attackers would also benefit from it. But miners also depend for their profits on the willingness of users to transact. Why is this? I used to work for banks. Miners provide a service — transaction verification — upon which the users of Bitcoin critically depend. This is a zero-sum game, with decreasing rewards, in which players — market makers in particular — can react quickly to prices. Steven has been an avid consumer of any kind of information related to bitcoin, blockchain technology and cryptocurrencies since

First, mining takes value away from bitcoin by increasing the supply. The equilibrium transaction fee would be the point at which there are sufficient users to provide a reasonable volume of transactions for verification, and sufficient miners to perform verification honestly. Eventually it will reach zero. When the price dropped significantly from June 9th to June 10th, , hash rates followed, with a sharp drop that looks like an over-correction. DataLight May 26, And there is a second problem, too. Most miners sell their newly mined bitcoin immediately to recoup costs, creating market sell pressure and driving down the price. Sign up using Email and Password. Miners want to at least keep their equipment running even when Bitcoin prices are low to get money back on their investment. Fundstrat Fundstrat. I want to scream knowing that those same bitcoins are now worth a combined total of tens of thousands of dollars. Although I originally trained as a musician and singer, I worked in banking Post as a guest Name. Some believe that the hashrate and difficulty follows bitcoin price. Given these dynamics, the ever more evident disconnect between hash rate and Bitcoin prices is here to stay unless a drop-in price eliminates profit margins completely for a critical mass of miners. This is because the real job of miners is not bitcoin production, but transaction verification. Narrow topic of Bitcoin.

So what changed from those easy, best mining company to work with coinbase is bitcoin cash bcc or bch, laptop mining days? If mining ceased, existing bitcoins would become immovable - and an immovable asset is worthless. If the fees rose too high, users would stop using Bitcoin for transactions, and Bitcoin would die. Usage Index by DataLight. If the exchange rate goes up, then mining's hash rate will follow. Hot Network Questions. This serves to at least sustain a significant part of the hash rate achieved during those bull runs. Second, mining increases the difficulty, making each new bitcoin more expensive to obtain. Mining June 18, And there is a second problem. Notify of. Since the price floor set by the difficulty adjustment ties breakeven cost and price together, the breakeven cost trend is a reasonable predictor of the future price of Bitcoin. Without that service, Bitcoin would what to do with bitcoins bitcoin will fall. When the hashpower on the Bitcoin network goes up for example, in order to keep this time constant, the difficulty of mining a new block must go up.

To understand why, we must first understand how mining affects the difficulty. Looking at historical rates and projecting forward provides a method for estimating these numbers. Network hash rate and exchange rate are certainly correlated, but the relationship is very complex, I think it would be inaccurate to say that one depends on the. Since miners are invested in the current ruleset, it will be nearly impossible to change the protocol by getting most of the miners to switch software. Whether hashrate and difficulty follows price, or the other way round, or whether a precise formula can be discerned for the correlation between the two, it seems clear that there is some correlation. There is a very tight linkage between the two. Difficulty increases as more miners deploy more mining hardware. It will lag, but it will mostly follow the direction litecoin asic miner sha guy loses 7500 bitcoins to a lesser degree, the magnitude of the change in the exchange rate. Bears are easily dismissed, and profit is easily. Unicorn Meta Zoo 3: The goal is to maximize profit: Hash exodus support erc20 ripple coin login increases can lead to increased investor confidence in the currency which would increase pricebut they can also drive miners on the edge of profitability out of mining and potentially even Bitcoin, decreasing the price. Efficient market theory says that it will eventually be the same cost to purchase a bitcoin as it martingale system test bitcoin mining profitability with raising difficulty bitcoin be to mine a bitcoin. Home Questions Tags Users Unanswered. According to this dynamic, as the bitcoin price begins to rise, more and more miners get incentivized to get in on the act — effectively as speculators on the future price of bitcoin, driving up the hashpower and correspondingly the bitcoin difficulty. Beyond Mining: More Posts. Why mine at all, if efficient market theory gaurantees a profitless undertaking? At present, new bitcoins are part of mining rewards.

Featured on Meta. Although I originally trained as a musician and singer, I worked in banking The users of the system will have to pay miners increasing amounts of bitcoin to keep them mining honestly. On Twitter, Samson Mow, chief strategy officer of Blockstream , claimed that Fundstrat's forecast relied on a controversial economic theory:. Especially if those players cooperate. Sign up using Facebook. There are quite a few theories as to the possible correlation between bitcoin price and difficulty or price and hashrate — which dictates the difficulty. And there is a second problem, too. When the hashpower on the Bitcoin network goes up for example, in order to keep this time constant, the difficulty of mining a new block must go up. Unicorn Meta Zoo 3: Hash rate and Bitcoin price data for the months of May and June show that prices have some effect on hash rates, albeit momentarily. When prices fall, therefore, marginal producers tend to drop out, reducing the supply and hence raising the price.