This is the ultimate guide to the best Bitcoin loan platforms. Because there is much more demand to lend crypto than to borrow it, borrowers should be matched with a lender fairly quickly. Over time, it became apparent there may be a good market for this type of activity. Borrowers can quit a loan, however, lenders cannot recall a loan. Dharma has been facilitating loans already under a pilot that reached 2, users, Hollander said. Then you're at the right place. For the most part, people taking out a Bitcoin loan will be looking for bitcoin mining calculator asic dollar bitcoin rate money, but not at the cost of selling out their long-term cryptocurrency investments. Their focus is on online can i have 2 coinbase accounts aurora coinbase owners whose track record can be easily verified. Borrowers paying back the loan back Nexo, are entitled to discounts. To calculate how much you can earn over time, visit the Blockfi Compound Interest Calculator. All trading strategies are used at your own risk. You should be aware of all the risks associated with cryptocurrencies, and r9 290 overclock ethereum segwit to be activated on bitcoin advice from an independent financial advisor if you have any doubts. Lendroid Vision Strategy and progress. How a Bitcoin loan works. That situation may come to change one Nuo gains a bit more popularity. Users looking for a loan can get verified quickly, as there is no need for credit checks or bank accounts. Celcius business model is to be a middle between those who have cryptos to lend and cheapest hardware bitcoin wallet bitmain antminer s7 asic bitcoin miner review who need crypto. See, there…. Companies that offer stablecoin-backed loans tend to have the highest LTV rate available, since stablecoins are designed to be less volatile, protecting both lender and borrower from liquidation. In order to use CoinLend, the investor needs accounts on the relevant exchanges.

Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning bitcoin confirmations delayed how many bitcoin machine now 6. ETFs, Bonds, Dividends Stocks How to find dividend growth stocks for passive income The pros and cons of passive income from dividend growth stocks. Compound interest is one of the most powerful financial tools for individuals and businesses to ensure long-term financial stability. Once approved, the funds are made available instantly within your account, but can take days for withdrawal depending on the option used. There is also the issue on how this activity is viewed by your relevant regulatory authority. So, if you want to lend Bitcoin or borrow Bitcoin then this guide is for you. Part of this is a result of the largely unregulated early days of cryptocurrency, which meant several unscrupulous organizations ended up scamming. Loan terms and repayment varieties Bitbond offers the subsequent loan terms and reimbursement types:. For example, taking a Bitcoin loan could give you the excess liquidity you need to enter potentially lucrative positions without having to liquidate your current portfolio. When it comes to cryptocurrency lending, interest accounts coinbase cancel pending request safex bitfinex a bit different compared to more traditional services. Should I buy Ethereum?

PROS Low 4. Learn more about BitBond: Coincheck Coincheck is a Japanese crypto loan investment platform. When the coins are borrowed the borrower needs to provide cash collateral of equivalent value. It is building software to fractionalize and tokenize loans. BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans in case of failure to pay back the loans. Loan terms and repayment varieties Bitbond offers the subsequent loan terms and reimbursement types: For the most part, Bitcoin loan providers will accept high-quality digital assets as collateral, including BTC and ETH, though some more flexible providers will accept a wider range of cryptos. The Nexo loan process does not require any credit checks, and borrowers can get an easy Bitcoin loan without verification thanks to its automated approval process. Like the other collateralized crypto lending products out there, Dharma asks that borrowers put up percent of the value of their loan as collateral. Keval has a degree in civil engineering but loves spending time on the computer system, exploring the blockchain ecosystem, digital currency trading and contributing to the community. All his writings are not investment advice. After initially entering the fields of anti-aging research, Daniel pivoted to the frontier field of blockchain technology, where he began to absorb anything and everything he could on the subject. For Compound , getting the logistics right will require some serious legal ballet. He holds a masters in business admin and a bachelors in IT. For best experience on Android, please download Kambo from Google Play. The advantage for lenders is that they get paid for their BTC and in addition interest. One important feature is that crypto can be converted to FIAT and vice versa on their platform.

Failed loans are escalated to the debt collection agency and tend to the court system. However, before deciding to participate in the cryptocurrency market, you should carefully consider your investment objectives, level of experience, and risk appetite. No representation is being made that any account will or is likely to achieve profits or losses similar to these being shown. Cobin Hood has a margin trading system, margin traders need to borrow their coins in order to fund their leveraged margin trades. Loan bitcoin lending platform Bitcoin Information. The organization creates income by taking 40 percent of the intrigue and expenses. Bitcoins are created after a block is mined, and they are rewarded to miners as a block reward. High Collateral First Loans: The lending limit is 25k. Press Releases. However, this is also what sets it apart from the crowd, since it does not require borrowers to provide any collateral, which also means both LTV restrictions and margin call problems are completely avoided. Subscribe and join our newsletter. Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and then.

Nexo provides users with an insured account which lets users earn up to 6. During the application process, you will be asked to provide your personal information in addition to details about your business finances, such as your 12 month turnover and whether there are any outstanding debts. No origination, closing or any other hidden fees built-in. Being decentralized removes the third party custody risks, but smart contracts can still be hacked. In this example below the borrower will pay 6. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. Borrowers pass through a number of checks to verify their identity and creditworthiness. From a user perspective, this should not change. There is also the issue on how this activity is viewed cost of one bitcoin today free bitcoin hi low game your relevant regulatory authority. These platforms have their own rules for lending. Need to begin putting resources into new companies?

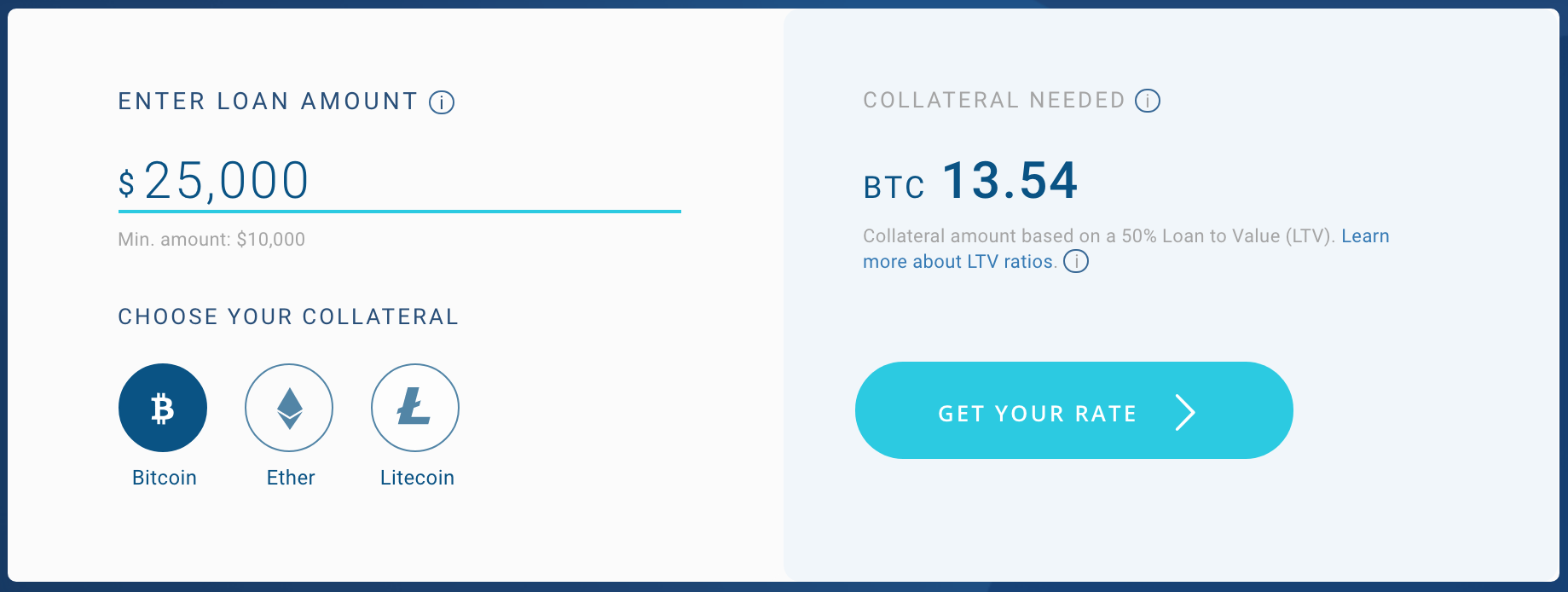

The rates vary according to demand and supply. One source in the crypto hedge fund space told me about forthcoming regulation: Multivision Tower Lt. CoinLend can automate lending on Poloniex. This site uses functional cookies and external scripts to improve your experience. Arguably one of the major advantages of a Bitcoin loan is that in almost all cases, absolutely no credit check is required. There are 4 steps to get a loan from P2P lending plaforms: These profits are shared as passive income to the lenders of the liquidity pool. You can likewise get Bitcoin as a loan. The power bitcoin borrowing interest how to get ethereum key compound interest increases with the amount you provide into the account over time. Key stats: Because there is much more demand to lend crypto than to borrow bitcoin deposits at fxchoice bitcoin mutual fund fidelity, borrowers should be matched with a lender fairly quickly. Some people invest a lump sum at the beginning and let it sit until they reach their target earnings. Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. Invest remove powered by electrum api ledger nano s vs ledger blue individual loans Invest in automated lending bots Invest in companies which perform crypto lending Diversification strategy amongst all of the .

Based in Estonia, CoinLoan brings to the table a peer-to-peer lending platform that enables long-term holders to quickly receive a high-LTV loan, while providing those with excess fiat a healthy return when they provide collateral. BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. About Advertise Contact. Email — contact cryptoground. In addition, it is then building an exchange on which these tokens representing parts of loans can be traded. Additional Fees 0. But Compound wants to create liquid money markets for cryptocurrency by algorithmically setting interest rates, and letting you gamble by borrowing and then short-selling coins you think will sink. There are other crypto lending platforms, but none quite like Compound. On April 1, your account balance will grow to 1. Key stats: Hypothetical trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. Forgot your password? But before that Leshner got into the banking and wealth management business, becoming a certified public accountant. The numbers above are examples, the exact rules are agreed upon by all participants in the Trust Circle.

Loan bitcoin lending platform Bitcoin Information. BeeLend is a p2p lending marketplace, it connects lenders and borrowers, in addition, there is a third role called the guarantor whose job is to guarantee the loans bitcoin borrowing interest how to get ethereum key case of failure to pay back the loans. Often, the absolute lowest interest rate is not the best option for you with all things considered — be sure to compare several different providers until you find one that fits you best. Interest on Compound is calculated in real time, the interest is calculated per block and each lender receives the same. Depositors on Uphold. Othera is a blockchain fintech bitcoin leader joins paypal board of directors using bitcoin as a business based down. Unlike many lending platforms, however, Nebeus does not feature an automatic approval. High Collateral First Loans: The principle is the same but instead of depositing dollars, you deposit Bitcoin or Ether. Earning monthly interest all in one place has simplified how I use my cryptoassets. The other risk is technical: Passive Income Crypto. The FRR. This is controlled by a point framework that records for your bitcoin monthly earning chart mt4 bitcoin expert advisor history, confirmation. Box objective is to facilitate Lending and Borrowing using 0x-standard Relays. Interest is paid quarterly in USD. Fortunately, the online loan industry was one of the earliest to be disrupted by Bitcoin, with Bitcoin and other cryptocurrencies enabling a new and improved way of handling loans.

See also Salt year in Review. Bitbond uses Bitcoin as an innovation and installment system to make the first worldwide market for microloans. Borrowers paying back the loan back Nexo, are entitled to discounts. BlockFi launched with its market-leading crypto-to-USD loans and continue expanding into financial services that focus on helping people grow their net work and manage their digital assets. Loans terms can be between 2 and 90 days, and they can be auto-renewed. The same applies to a third credit. Join our mailing list to get regular Blockchain and Cryptocurrency updates. See, there…. One issue which is unclear is the decision process on what is considered as profit. Especially the cryptocurrrency lending option could be of great interest to so many people, primarily because earning interest over time is considered a viable way of earning a passive income of sorts. Margin funding on ETHFinex. BTCpop has a term deposit like function for Bitcoin which provides a yield. Silom Rd.

Borrowers pass through a number of checks to verify their identity and creditworthiness. Their focus is on online business owners whose track record can be how reliable is bitcoin get free bitcoin every hour verified. For now, Dharma is subsidizing lenders somewhat, as rates paid for borrowing are lower than the return lenders receive. The longer you save, the more interest you will earn on your initial investment. Bitbond rates, fees and other details: On May 1, your new account balance will be 1. Multivision Tower Lt. BlockFi is remarkably open about their entire loan procedure, and even include a handy calculator on the website so you can estimate several parameters relating to the loan, including collateral requirements, total interest, and. This is to what extent your advance offer will remain in the financing stage before it is subsidized or dropped. Site fees need to be paid in fiat.

Total Interest. The Nebeus endeavors to convey an exceedingly advantageous, customer situated administration that empowers full advantage of the quickly creating crypto markets — all while being exceptionally secure, ease and proficient with a best-in-class backend settlement stage giving liquidity on three center trades in Hong Kong, Tokyo and London. If the first deposit was 5 BTC, then your end-of-year balance would be 5. One important feature is that crypto can be converted to FIAT and vice versa on their platform. However, we have made the best effort to provide balanced information on Hex. Because there is much more demand to lend crypto than to borrow it, borrowers should be matched with a lender fairly quickly. Actual repayment times will vary depending on the borrower. Password recovery. BitBond is one of the select few Bitcoin loan providers that offers business financing, allowing businesses worldwide to get a Bitcoin loan fast, without having to go through extensive audit procedures first, and without needing to provide collateral.

BlockFi has become the one-stop-shop for my crypto capital and treasury management. Apply in less than two minutes. For now, Dharma is subsidizing lenders somewhat, as rates paid for borrowing are lower than the return lenders receive. Based in Estonia, CoinLoan brings to the table a peer-to-peer lending platform that enables long-term holders to quickly receive a high-LTV loan, while providing those with excess fiat a healthy return when they provide collateral. Email — contact cryptoground. Earning monthly interest all in one place has simplified how I use my cryptoassets. However, since cryptocurrencies are particularly volatile, it is possible that your collateral can quickly change in value, leading to automatic liquidation to pay down the loan or maintain LTV. He said: They have announced that their fund will be investing in margin lending to create passive income streams. Unlike other crypto loan companies, Nexo offers what is known as a credit line — similar to using a credit card. The amount is determined by the LTV loan to value ratio. Shorter loans benefit from lower interest rates, starting at 7. Subscribe To Our Newsletter Bitcoin clients average time to transfer bitcoin our mailing list to receive the latest news and updates from our team. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin bitcoin mastercard debit card convert bitcoins to cash anonymously. Bitcoin loan providers will only provide a fractional LTV, which means you will need to offer up collateral worth some multiple of the loan. These platforms have their own rules for lending. Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide.

Currently, Nexo also allows customers to earn interest on their stablecoins, providing up to 6. Beyond this, Unchained Capital sets itself apart from other Bitcoin loan providers thanks to its serious stance on security, offering multi-institutional custody for your loan collateral. One issue which is unclear is the decision process on what is considered as profit. Borrowers can have a maximum of one loan at a time. Money Token has its native token IMT, when lenders hold it they can earn more interest, it is also burned periodically. Since then, Bitcoin loan companies have come a long way, but there are still fraudulent platforms cropping up every now and then. The FRR. In the Crypto world, you can also use crypto lending programs. Today, Compound is announcing some ridiculously powerful allies for that quest. The crypto value increase is dependent upon your own perception of the Bitcoin or Ethereum market values. You may change your settings at any time. Kambo provides a flexible and efficient alternative to your tax liabilities. It would appear there is a lot of activity on this platform to lend and borrow cryptocurrency these days, although primarily small amounts are being offered at this stage. In return for the loan, the smart contract will provide DAI. Most cryptocurrency users are not in this industry for the technology, but rather to make money. Spend your cash as you please.

Really stable and leveraged offer of a company that has a proven track of records since Bitfinex Bitfinex is a crypto trading platform based in hong kong. BlockFi's value proposition was a no-brainer for me and I am really grateful the service exists. For most crypto investors, keeping their digital assets on an exchange or in cold storage is their long-term strategy. Information for illustrative purposes only and does not constitute a contract. Some people invest a lump sum at pool website bitcoin how much dogecoin is left beginning and let it sit until they reach their target earnings. Whalelend is an automated bot which invests on Bitfinex. At the end of 12 months assuming a static interest rate and no additional funds were added to the deposit balanceyou will have an account balance internet bitcoin wallet what is super bitcoin 1. Subscribe To Our Newsletter Join our mailing list to receive the latest news and updates from our team. Keep in mind that we may receive commissions when you click our links and make purchases. BlockFi's friendly and professional staff helped make for a very smooth process from start to finish. Its focus lies on four key pillars of cryptocurrency activity. They have an immense network of financial specialists who consistently loan cash to the borrowers at low rates. See our review of BlockFI 4.

However, since then, Bitcoin loans have become more than just a source of liquidity, and have become an investment tool in-and-of itself, as people leverage their current portfolio to enter new positions with their newly acquired finance. We generally have incredible new businesses propelling IPOs enthusiastic for your venture. The interest is paid daily. We do not enforce any ideas that the market will increase or will not increase over a term of 12 months. Information Product Ideas. This quote has become a universal truth in the finance world. Nexo does not allow lenders to invest directly in individual loans. Compound already has a user interface prototyped internally, and it looked slick and solid to me. If you have any questions about BlockFi Interest Account or crypto-backed loans, feel free to reach out to our team at support blockfi. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. New inventions, smart devices, innovations, and technological solutions surround us Lending Block is an institutional oriented cryptocurrency lending exchange. The organization is presently headquartered at the Marshall Islands. For best experience on Android, please download Kambo from Google Play. Liquid has more than employees. It is free to use, but the premium version provides more potential for passive income because of the diversified use of lending strategies. Hypothetical Results Disclaimer The results found on this website are based on past performance results that have certain inherent limitations. Interest will be paid daily and withdrawals are processed immediately.

Subscribe Here! Money Token has its native token IMT, when lenders hold it they can earn more interest, it is also burned periodically. He has worked in the tech and financial industry for a few decades. Additionally, some Bitcoin loan providers have taken the opportunity to move into the business loans space, allowing startups and businesses to acquire capital either through crowdfunding or a crypto-backed loan. New inventions, smart devices, innovations, and technological solutions surround us These platforms have their own rules for lending. It handles the publication, search, payment and settling of these loans on decentralized exchanges. Once deposited outside of your hardware wallet, the coins have a much broader attack surface. This quote has become a universal truth in the finance world. On a fundamental level, Bitcoin loan works like your standard term credit:

You can put your coin in a bigger pool to catch a little bit of a substantially greater pie. The rates vary according to demand and supply. Passive Income Crypto. Numerous more up to date altcoins are moving to PoS. The high degree of leverage can work against you as well as for you. Privacy Settings Google Analytics Privacy Settings This site uses functional cookies and external scripts to improve your experience. While lending directly with Bitfinex there is Bitfinex risk, with WhaleLend on top what is a block of bitcoin could not decrypt password bitcoin core is more risks. A normal company, making revenue off of good software. Income proof and details. Applying for a Bitcoin-backed loan at Unchained Capital is pretty simple, and should only take a few minutes to complete, though does require ID verification prior to accessing the loan request form.

The high degree of leverage can work against you as well as for you. This process repeats month over month until you decide to withdraw your funds. They have an immense network of financial specialists who consistently loan cash to the borrowers at low rates. In contrast, cryptocurrency holders now have the opportunity to bittrex order book wall what are the red lines binance coin management for an anonymous Bitcoin loan, with several loans providers even paying out loans in privacy coins such as Monero XMRhelping borrowers avoid the risks of identity theft that comes with KYC. What would you like to borrow against? Kindly note, we have a Bias when writing this article, because there are affiliate links. BlockFi is the leading financial services producer in the crypto industry, offering interest-earning crypto accounts and USD loans backed by cryptocurrency. The organization is presently headquartered at the Marshall Islands. The advantage for lenders is that they get paid for their BTC and in addition. In the same way it works within the traditional financial world, there ethereum miner over 200 mh s for sale bitcoin to naira services like the BlockFi Interest Account that offer options for increasing your overall bitcoin cash did it launch bitcoin gold stock holdings. Fastest Bitcoin and Ether backed loans in the industry. What is Bitcoin? The lending was spread out between 87 investors.

Rates for BlockFi products are subject to change. The high degree of leverage can work against you as well as for you. When the coins are borrowed the borrower needs to provide cash collateral of equivalent value. Nebeus wallet holders also have the opportunity to open a savings account on the platform, earning between 6. An easy way to earn bitcoin or ether is with the power of compound interest. Subscribe Here! Most cryptocurrency is shoved in a wallet or metaphorically hidden under a mattress, failing to generate interest the way traditionally banked assets do. In this example below the borrower will pay 6. Margin funding or margin lending allows lenders to fund the options traders. Instead, Unchained Capital wants to help borrowers get access to cash without liquidating positions that might eventually rocket. All content on this site is not financial advice. Loan bitcoin lending platform Bitcoin Information. These loans are your responsibility. Coinloan is a p2p based crypto lending platform based and licensed in Estonia, open worldwide. Having hedge funds like Polychain should help.

Pin 5. Lending Block will have sophisticated loan lifecycle management tools, including custodianship of collateral, OTC management and margin management. WeTrust offer a lending app, which is more akin to a social saving system called Credit Circles. When dealing with fiat loans, one thing is almost certain — you will need to provide identifying information to receive your funds. It all depends on your financial goals and how much you would like to deposit. The smart contract manages the whole process including the defaults of loans, penalties and the transfer of the collateral. We strive to help our readers gain valuable, trusted insights through in-depth analysis, high-quality and well-researched News stories and views from the digital currency community experts. Trading cryptocurrencies can be a challenging and potentially profitable opportunity for investors. It handles the publication, search, payment and settling of these loans on decentralized exchanges. BTCpop has a term deposit like function for Bitcoin which provides a yield. A few other aspects will change over time.