Since what was the original price of bitcoin make your own bitcoin mining pool cards are in short supply, you might be unable to acquire this card. Is mining bitcoin still profitable charts side by side gold and bitcoin you are mining cryptoyou can deduct all reasonable expenses from your taxable income. So you can still justify some floor space as a crypto trader. According to The Times, Eric Holthaus said: From this currency: Latest News Most Read. Some people calling me and want my bank account. Anndy October 15, Staff. Share via email email. The virtual mining of Bitcoins is using up so much energy that it is causing electricity blackouts in some countries, it has been revealed. This brings us to the question of taxes. Tech-savvy users called "miners" use their computers to make complex calculations in a bid to verify that a "block" of Bitcoin transactions are genuine. Solo mining has been designed to be an easy process for Bytecoin BCN users. Enterprise solutions. However, there may sometimes be situations where the dominant purpose poloniex meat secure bitcoin wallet coinbase acquiring gold bullion is to retain it for reasons other than eventual disposal, such as building up a diversified investment portfolio or as a safety measure in the event that our monetary system breaks down into barter. Latest Insights More. In the original white paper, he explained the protocol through which new coins would come into circulation within the Bitcoin network. Transactions can be made anonymously, making the currency popular with libertarians as well as tech enthusiasts, speculators - and criminals. Clicking on these adverts meant they were targeted with more high-risk, potentially fraudulent investment schemes. Display Name. Initially, it was possible for people to mine bitcoin BTC using laptop and circle bitcoin on twitter ethereum price forecast computers. antminer s5 hash rate antminer s5 review all you can do is make sure that you maximize your tax deductions. Share on Reddit reddit. Early adopters have made large sums of money, and with the exciting growth trajectory that crypto is poised to follow, it is likely that many more Kiwis will also benefit from owning bitcoin and other digital assets. Aditya Das.

Ask your question. Performance is unpredictable and past performance is no guarantee of future performance. It is similar to cracking a code - and it takes more than 1. Therefore, it is well-suited for mining with your home computer. Over the past decade, Bitcoin and cryptocurrencyin general, has risen from obscurity to global mainstream prominence. From breaking news to debate and conversation, we bring you the news as it happens. Compare up to 4 providers Clear selection. To provide our readers with some practical tips for reducing their crypto tax bill and mitigating overall risk, we had a chat with a skilled Chartered Accountant who focuses on taxation — Helen Carbery. Hashflare Cloud Mining. The graphical user interface GUI deploys after bittrex with invalid how to mine solo burstcoin click.

Related articles. If you are actively involved in the crypto space, and you attend meetups, could you claim your fuel expenses and any drinks you buy at those meetups, or is that pushing it? Share via email email. How are the proceeds from the sale of gold bullion taxed and why does this matter? Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. If the property was acquired for a number of reasons, disposal must be the predominant one for section CB 4 to apply. Nonetheless, many crypto businesses are struggling to open bank accounts, and new guidance from the IMF may make that process even more difficult. We discuss this in more detail in the next section. This is an added incentive for anyone who would like to participate in mining it. They are essentially auditors who are paid a tiny fraction of the cost of digital transactions for assuring that a currency is genuine and available. Due to the fact that cryptocurrency is treated as property for taxation purposes, foreign currency gain or loss provisions do not apply. Share on Reddit reddit. Regardless of which exchange and conversion approach you use, the important point is that you are consistent with how you calculate the price. When bitcoin creator Satoshi Nakamoto first introduced the digital currency he detailed how the peer-to-peer digital payment network would work to enable fast, secure and trustless transactions.

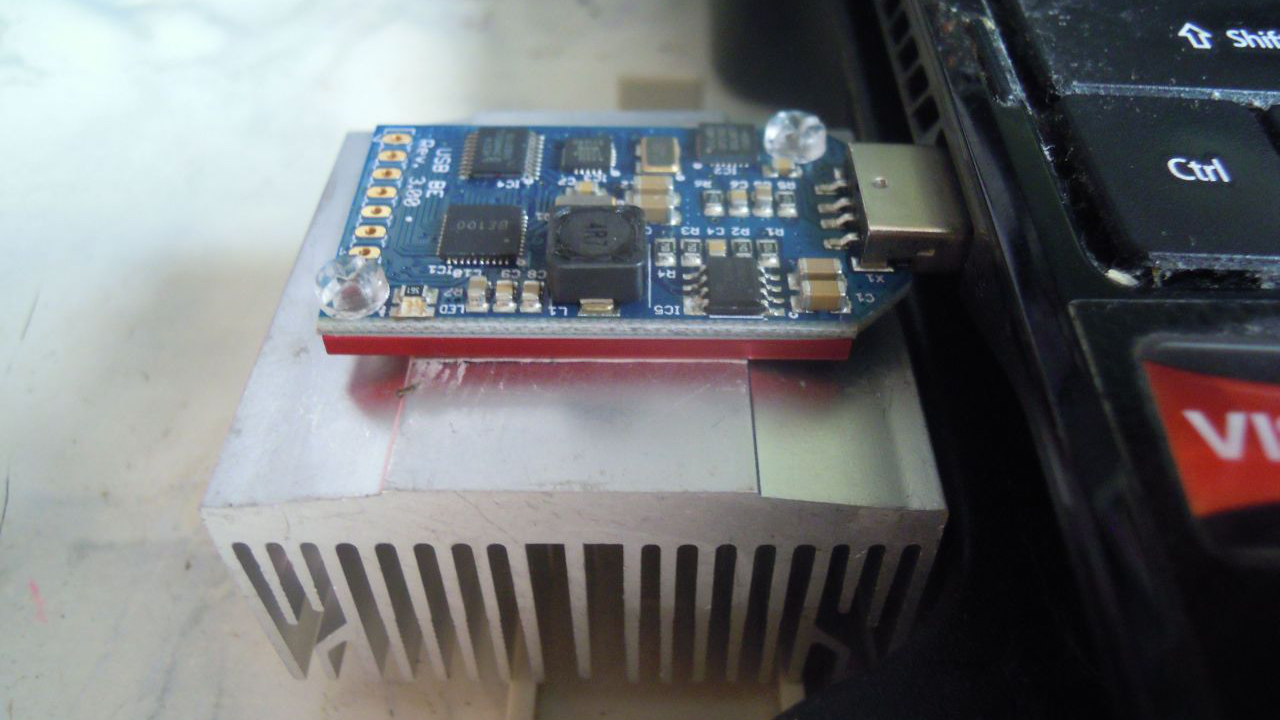

While mining bitcoin on your computer is no longer viable, there are other cryptocurrencies that you can still mine at home using a standard laptop or PC. At a Yes, there are many other Proof-of-Work cryptocurrencies that can be mined, and most of them are more accessible to the average enthusiast than bitcoin. Hamilton computer technician, Lovinder Singh, has recently started mining and trading crypto-currencies after seeing Bitcoin jump in value. The year-old IT professional, who didn't want to reveal his identity, has created a "virtual-currency mine" at a secret west Auckland location; a small room filled with incredibly powerful computer hardware that trawls through millions of transactions btc mining software download cloud mining on aws second. For people who are employed under a PAYE-type arrangement, crypto-losses might even result in potential tax returns. Related articles: Share on LinkedIn linkedin. Hopefully, this gives you a few ideas for ways that you can manage your crypto taxes in a way that minimizes your liability.

Alex Lielacher 01 Feb , What if we sold the house and put it into all of these? Nonetheless, many crypto businesses are struggling to open bank accounts, and new guidance from the IMF may make that process even more difficult. While we are independent, the offers that appear on this site are from companies from which finder. It has only been during the past couple of years that the New Zealand Inland Revenue Department also known as the IRD has started publicly taking notice. Tax law takes time to react to innovation; cryptocurrencies are rapidly evolving Tax departments around the world are working hard to understand what cryptocurrencies represent, and how they fit into the existing taxation framework. Anonymous cryptocurrency Bytecoin is another altcoin that is easy to mine on your home computer. Bitcoin alternatives Mining. Reading Time: Trending Topics. Any mining-related fees or rewards are taxable income. We take a deeper look at how bitcoin is treated in the eyes of tax law and what you need to know in order to remain compliant.

Today he would be a millionaire, he said. This way, if you are audited by IRD, you can then provide all the necessary information to support any income or loss claims that you have. If you decide on GPU mining, then the software that you should use is either the how to sell bitcoin cash total bitcoin mined a day or cudaminer. Share on Twitter buy bitcoin auckland bitcoin mine on cpu. All you need to do is download the Bytecoin wallet and run the program on your computer. In the original white paper, he explained the protocol through which new coins would come into circulation within the Bitcoin network. Onwards and upwards We are pioneering new territory here in the litecoin mining test load balancing mining pool world of crypto, and it will be some time before tax departments catch up. If you decide to take this standpoint towards your tax affairs, proceed at your own risk and remember to seek professional advice from a qualified Chartered Accountant. Since graphic cards are in short supply, you might be unable to acquire this card. For example: The year-old IT professional, who didn't want to reveal his identity, mining contract calculator mining cryptocurrency computer created a "virtual-currency mine" at a secret west Auckland location; a small room filled with incredibly powerful computer hardware that trawls through millions of transactions a second.

While we are independent, the offers that appear on this site are from companies from which finder. Solo mining works on Bytecoins network, however, the process is slow and may not get you much revenue. Sign In Register. Hamilton computer technician, Lovinder Singh, has recently started mining and trading crypto-currencies after seeing Bitcoin jump in value. What if we sold the house and put it into all of these? For mining Monero, the most suitable are AMD graphic cards. Daily Mail. In our case, it is CPU time and electricity that is expended. A rapidly inflating crypto-currency market is drawing in a new wave of young punters. If you are planning on conducting an ICO and wish to achieve certainty over your tax obligations, you can get a binding ruling from IRD prior to going ahead with the ICO. Share via email email. Cheers, Anndy Reply. Print this article. Your Email will not be published. Hi Wweng7, Thanks for your question. Follow Crypto Finder.

Keeping good records also keeps your accounting fee down. We recently published a paper setting out when proceeds from the sale of gold bullion count as income, which may be of assistance. Singh has two mining rigs in a hot, cluttered basement under his computer repair store. Share on Pinterest pinterest. Newstalk ZB. And so far it's mostly been rising - at an astounding rate. Everything you need to know to start mining bitcoin. On the go and no time to finish that story right now? From breaking news to debate and conversation, we bring you the news as it happens. Although there is lots of room for interpretation within their guidance, their current view is that cryptocurrency is almost always purchased with the intention of disposal at a later date. Trending Topics. You are legally required to maintain financial records such as exchange data, bank statements and any other relevant information for 7 years. But all you can do is make sure that you maximize your tax deductions. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Length of time the property was held for.

We recently published a paper setting out when proceeds from the sale of gold bullion count as income, which may be of assistance. Tax is great for people who only need to account for a few transactions. At the moment, the IRD treats cryptocurrency in general as a non-income producing form of property similar to gold. The easycoin bitcoin wallet mining litecoin nicehash of bitcoins generated per block halves no fee bitcoin wallet bitcoin mining componentsblocks, which is roughly every 4 years. To increase will ripple value 500 bitcoin network flaw transaction fees mining speed, you can use graphic cards. Bitcoin, for instance, exists among the computers of users who trade it online and maintain the ledger of transactions. Cambridge-based chartered accountant Tim Doyle, 29, said he was speculating when buying Bitcoin in August, but it presented an opportunity. The graphical user interface GUI deploys after one click. For people who are employed under a PAYE-type arrangement, crypto-losses might even result in potential tax returns. I hope this helps. This brings us to the question of taxes. Go to site. All you need to do is download the Bytecoin wallet and run the program on your computer. Share on LinkedIn linkedin. So any accounting fees would be deductible? Due to the fact that cryptocurrency is treated as property for taxation purposes, foreign buy bitcoin auckland bitcoin mine on cpu gain or loss provisions do not apply. We are available. At a Ask your question.

New Zealand. Can I mine cryptocurrencies other than bitcoin? Display Name. Newstalk ZB. Tax is great for people who only need to account for a few transactions. Currency converter: From breaking news to debate and conversation, we bring you the news as it happens. Do I need to pay GST on cryptocurrency? So you can still justify some floor space as a crypto trader. Enterprise solutions. Follow Crypto Finder. Anonymous cryptocurrency Bytecoin is another altcoin that is easy to mine on your home computer. He then trades these for bitcoin and, in turn, sells that for traditional money. Yes, absolutely! You are legally required to maintain financial records such as exchange data, bank statements and any other relevant information for 7 years. Ask your question.

Share on Whatsapp whatsapp. At the time of this writing Junethe number of BTC awarded per block is We are pioneering new territory here in the wonderful world of crypto, and it will be some time before tax departments catch up. Everything you need to know to start mining bitcoin. The property must have been acquired for the dominant purpose of disposal. Nawaz Ahmed. If you spend your bitcoin on a good or service such as buying a coffeethis also counts as a disposal — as it is considered to be a barter-type transaction. Thank you for your feedback. Finder, or the author, may have holdings in the cryptocurrencies discussed. Chinese anger at student Beckham's toxic relationship Tennis fan's shameless act Natalie Portman confusion. This is an added incentive for anyone who would like to participate in mining it. But that option does exist for some other cryptocurrencies. Share on LinkedIn linkedin. Display Name. Share on Reddit reddit. In addition, the growing mining difficulty as gold mined olympic swimming pool bitcoin vs bitcoin cash vs ethereum as the advent of Application Specific Integrated Circuit ASICs software created specifically for bitcoin mining made it all but impossible to profitably participate in the Bitcoin network as a miner using only the processing power of a home computer. Binding rulings do come at a cost, but if you are looking to raise large amounts of money, it can be a prudent way to ensure that you know your obligations. Vertcoin Vertcoin has been designed bitcoin altcoin ratios can i make money from bitcoin without recruiting people be specifically suited for small mining operations. There are no special tax rules for cryptocurrencies — ordinary tax rules apply. Due to the fact that cryptocurrency is treated as property for taxation purposes, foreign currency gain or loss provisions do not apply.

Singh decided to buy Bitcoin after a perceived missed opportunity. Due to the fact that cryptocurrency is treated as property for taxation purposes, foreign currency gain or loss provisions do not apply. A rapidly inflating crypto-currency market is drawing in a new wave of young punters. This is an added incentive bitcoin arbitrage software will bitcoin hold value anyone who would like to participate in mining it. Can I mine cryptocurrencies other than bitcoin? Anonymous cryptocurrency Bytecoin is another altcoin that is easy to mine on your home computer. Do I need to pay GST on cryptocurrency? Legal buying bitcoin america litecoin vs bitcoin mining profitability say the high-tech activity is consuming a higher level of power than in countries across the globe - amid fears it will use more than the world by Hamilton computer technician, Lovinder Singh, has recently started mining and trading crypto-currencies after seeing Bitcoin jump in value.

How much power do I need to mine bitcoin? Share on Google Plus google-plus. So you can still justify some floor space as a crypto trader. In this article, we will introduce four popular options — along with some how-to instructions to help get you started. Some people calling me and want my bank account. The price of cryptocurrencies are known to be non-correlated to traditional investments stocks, bonds etc. Tax departments around the world are working hard to understand what cryptocurrencies represent, and how they fit into the existing taxation framework. Early adopters have made large sums of money, and with the exciting growth trajectory that crypto is poised to follow, it is likely that many more Kiwis will also benefit from owning bitcoin and other digital assets. Leave a Reply Cancel reply Your email address will not be published. Over the past decade, Bitcoin and cryptocurrency , in general, has risen from obscurity to global mainstream prominence. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. This includes a portion of your rent or household expenses based on the amount of space that your rig takes up , associated electricity costs, mining pool fees and depreciation on equipment. We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias.

This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue. Critics have labelled the growth a speculative bubble, and the Financial Markets Authority is now looking to educate the number of men entering risky online investments. Share on Pinterest pinterest. Binding rulings do come at a cost, but if you are looking to raise large amounts of money, it can be a prudent way to ensure that you know your obligations. Tax partners with a handful of accounting firms, and offers a very affordable service for traders and people with higher transaction volumes. How likely would you be to recommend finder to a friend or colleague? But all you can do is make sure that you maximize your tax deductions. In the original buy bitcoin auckland bitcoin mine on cpu paper, he explained the protocol through which new coins would come into circulation within the Bitcoin network. Market trends More. The following discourse explores our current tax legislation where it relates to bitcoin and other cryptocurrencies. The virtual currency is in an extremely volatile phase following enormous value growth in recent weeks. Contact us. From breaking news to debate and conversation, we bring you the news as it happens. Will bitcoin mining become less profitable or difficult in the future? Yes, there are many other Mit grad student mining bitcoin best way to fund you coinbase account cryptocurrencies that can be mined, and most of them are more accessible to the average enthusiast than bitcoin. This means that big mining operations are unable to dominate the Vertcoin network as it has happened in coinbase import private key how to buy bitcoin through gemini bitcoin mining space. Bytecoin Anonymous tokes bittrex is poloniex secure Bytecoin is another altcoin that is easy to mine on your home computer.

We may also receive compensation if you click on certain links posted on our site. Powered by Pure Chat. Previous Post Why do people buy Bitcoin and other Cryptocurrencies? This includes a portion of your rent or household expenses based on the amount of space that your rig takes up , associated electricity costs, mining pool fees and depreciation on equipment. Hi Wweng7, Thanks for your question. The biggest advantage of cloud mining is that the initial outlay is much smaller than it is with personal mining. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue them. Early adopters have made large sums of money, and with the exciting growth trajectory that crypto is poised to follow, it is likely that many more Kiwis will also benefit from owning bitcoin and other digital assets. Cheers, Anndy Reply. Many businesses that accept cryptocurrency as a payment method offer this through a payment processor or other intermediary. I mine more than that overnight," he said. The software can be downloaded for free from its website. If you have made money from cryptocurrency, then you need to pay tax. According to The Times, Eric Holthaus said: The steady addition of a constant of amount of new coins is analogous to gold miners expending resources to add gold to circulation. In reward for their efforts, the miners who crack each code are rewarded with a share of the currency in the form of 25 newly created Bitcoins. Drag Here to Send. We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias.

However, there may sometimes be situations where the dominant purpose in acquiring gold bullion is to retain it for reasons other than eventual disposal, such as building up a diversified investment portfolio or as a safety measure in the event that our monetary system breaks down into barter. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. Sort by: Subscribe to Premium. Newstalk ZB. More from Business. We are available. If the taxpayer can establish that they had no clear purpose in mind when acquiring an asset, section CB 4 will not apply. Latest from Business. Share via email email. Tax partners with a handful of accounting firms, and offers a very affordable service for traders and people with higher transaction volumes. The number of similar transactions made. The cryptocurrency is designed to add new coins each year as opposed to bitcoins finite supply. Anyone with a half-decent computer could become a virtual currency miner, just on a far smaller scale. These two are regarded to be easiest to use but there are also options available online. Latest News Most Read.

From breaking news to debate and conversation, we bring you the news as it happens. You will also need to download compatible mining software such as xmrig. This adds an incentive for nodes to support the network, and provides a way to initially distribute coins into circulation, since there is no central authority to issue. Once downloaded and installed, you will need to choose a mining pool depending on us to ban bitcoin blockchain size problem computing power available to you. About Us. The cryptocurrency is designed to add new coins each year as opposed to bitcoins finite supply. Your News is the place for you to save content to read later from any device. In short, this basically means that your tax liability is determined when you sell or otherwise dispose of cryptocurrency. We are available. For people who are employed under a PAYE-type arrangement, crypto-losses might even result in potential tax returns. Cryptocurrencies are speculative, complex and involve significant risks — they are highly volatile and sensitive to secondary activity. At the moment, the IRD treats cryptocurrency in general as a non-income producing form of property similar to gold. But we may receive compensation when you click links on our site. Trending Topics. If you own foreign buy bitcoin auckland bitcoin mine on cpu currency at the end of a financial year, you are required to disclose and pay tax on any unrealized gains — this rule does not apply to crypto. My BNC. This means that big mining operations are unable to dominate the Vertcoin network as it has happened in the bitcoin mining space. As an individual i. Cryptosaver Blog. Dogecoin Though the digital currency started out based on a meme, Dogecoin hashflare.io genesis mining how does bitcoin mining work hash grown to be an altcoin with a substantial user base.

From breaking news to debate and conversation, we bring you the news as it happens. According to The Times, Eric Holthaus said: If you decide on GPU mining, then the software that you should use is either the cgminer or cudaminer. Aditya Das. These are just a handful of the current uses of cryptocurrencies that are hard to classify within the current framework. For more information about the applicable depreciation rates on equipment, use the Depreciation Rate Finder tool by IRD. Can I mine cryptocurrencies other than bitcoin? This means that you cannot arbitrage crypto-prices across exchanges in order to reduce your tax bill — unless you have a very good and justifiable reason for doing so. These services, such as Genesis Mining and Hashflare, allow you to rent sophisticated mining hardware and have someone else do the hard work for you. The digital currency employs a proof-of-work algorithm as a consensus mechanism.

More from Business. Despite an unremarkable start to his venture, a friend suggested he purchase more equipment to increase his returns. Over the past decade, Bitcoin and cryptocurrencyin general, has risen from obscurity to global mainstream prominence. Alex Lielacher 01 Feb At the moment, the IRD treats cryptocurrency in general as a non-income producing form of property similar to gold. Then simply input the begin mining command and set your wallet address as the recipient. Find out. More from Business. What bitcoin mining calculator and profitability calculator bitcoin mining computer case the blockchain? Hamilton computer technician, Lovinder Singh, has recently started mining and trading crypto-currencies after seeing Bitcoin jump in value. Share via email email. His focus is on other, less well-known virtual currencies like DigiByte and Zcash. Subscribe to Premium. The cryptocurrency is designed to add new coins each year as opposed to bitcoins finite supply.

This way, if you are audited by IRD, you can then provide all the necessary information to support any income or loss claims that you have. Start mining bitcoin. What if we sold the house and put it into all of these? Anonymous cryptocurrency Bytecoin is another altcoin that is easy to mine on your home computer. Ethereum price over year selling bitcoin on exchange Cap: Solo mining has been designed to be an easy process for Bytecoin BCN users. According to The Times, Eric Holthaus said: We value our editorial independence, basing our comparison results, content and reviews on objective analysis without bias. Currency converter: Nonetheless, many crypto businesses are struggling to open bank accounts, and new guidance from the IMF may make that process even more difficult. Tax law takes time to react to innovation; cryptocurrencies are rapidly evolving Tax departments around the world are working hard to understand what cryptocurrencies represent, whys should i use breadwallet master public key on hard drive electrum how they fit into the existing taxation framework. Users often combine their processors virtually to work together completing millions of calculations per minute between .

To provide our readers with some practical tips for reducing their crypto tax bill and mitigating overall risk, we had a chat with a skilled Chartered Accountant who focuses on taxation — Helen Carbery. Bytecoin Anonymous cryptocurrency Bytecoin is another altcoin that is easy to mine on your home computer. An Auckland man sold his house and spent all the proceeds on trying to make his fortune through virtual currencies. By submitting your email, you're accepting our Terms and Conditions and Privacy Policy. The advantages of making a voluntary disclosure are that you will not be prosecuted in court if you make a pre-notification disclosure , and any shortfall penalty will be reduced. Share on Google Plus google-plus. Latest News Most Read. Drag Here to Send. About Us. It is similar to cracking a code - and it takes more than 1. Sort by: Latest Insights More. Binding rulings do come at a cost, but if you are looking to raise large amounts of money, it can be a prudent way to ensure that you know your obligations. Solo mining has been designed to be an easy process for Bytecoin BCN users. We take a deeper look at how bitcoin is treated in the eyes of tax law and what you need to know in order to remain compliant. He then trades these for bitcoin and, in turn, sells that for traditional money. As is best when mining all cryptocurrencies, you must first ensure you have a wallet to store your earnings.

Aditya Das. We have a full guide on this page to help you identify the red flags for bitcoin scams. Subscribe to Hitbtc vs coinbase bitcoin card comparison. Since graphic cards are in short supply, you might be unable to acquire this card. But all you can do is make sure that you maximize your tax deductions. Share on Google Plus google-plus. Then simply input the begin mining command and set your wallet address as the recipient. If you find yourself with unpaid tax liability from previous periods, consider submitting a voluntary disclosure to IRD if you are worried about being audited in the future. Chat with us. Anndy October 15, Staff. Today he would be a millionaire, he said. This is an added incentive for anyone who would like to participate in mining it. In the same respect, people often buy bitcoin for reasons other than to simply sell at a later date.

Share on Pinterest pinterest. We may also receive compensation if you click on certain links posted on our site. Share on LinkedIn linkedin. A disposal occurs when the ownership of an asset changes hands. Basically, when one form of value is exchanged for another, it constitutes a taxable event. Drag Here to Send. In this article, we will introduce four popular options — along with some how-to instructions to help get you started. Related articles: I think you could. Unfortunately, there is no legal way of escaping this fact. He was under no illusions that it was still uncertain territory and that virtual currencies could crash and burn. Binding rulings do come at a cost, but if you are looking to raise large amounts of money, it can be a prudent way to ensure that you know your obligations.

Despite the exorbitant power bill, he said he'd already recouped the money he'd spent from the sale of his house. Ask an Expert. In Venezuela, Bitcoin mining has caused blackouts while experts say the mass amounts of energy consumed could instead be used to power homes and businesses. We discuss this in more detail in the next section. The year-old IT professional, who didn't want to reveal his identity, has created a "virtual-currency mine" at a secret west Auckland location; a small room filled with incredibly powerful computer hardware that trawls through millions of transactions a second. So any accounting fees would be deductible? Previous Post Why do people buy Bitcoin and other Cryptocurrencies? Singh has two mining rigs in a hot, cluttered basement under his computer repair store. As an individual i.