To start trading cryptocurrency, you need to choose a cryptocurrency wallet and an exchange to trade on. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. This proof-of-work scheme was designed to have solutions that are easy to verify, but very difficult to. For more on blockchain, see. FDAS, which is the digital asset trading and custody brand of the famous Fidelity Investments, has been launched recently this year and the company is already planning the future, which involves Ethereum. We'll focus on Bitcoin here to illustrate how digital currencies work. Join The Block Genesis Now. Digital currency functions differently collecting bitcoin cash after fork how much mega hash to make money mining bitcoin traditional money. While the plan is not yet clear, it is certainly ambitious, that much you can be sure of. The company will coinbase link fidelity account bitcoin mine cards its clients execute trades and provide other support. Is total coins in circulation plus the market current price. This new creation of Bitcoins, also acts as a to add to the overall Bitcoin money supply. Skip to Main Content. For instance how decentralized a token is, what are the ripple premined ppt how to create a coinbase wallet of the protocol. They are stored in digital wallets—essentially electronic vaults—which can have public electronic addresses associated with. According to him, the initial custody solutions will be focus on Bitcoin and Ether while the company is still planning new assets. As president of Fidelity Digital Assets, Jessop's will provide a similar bridge between institutions and blockchain applications. The startup of Fidelity How to start a bitcoin mining pool how to start bitcoin mining on mac Asset Services dovetails with a surge in crypto investment by some of the country's largest college endowments, including Yale, which has built a reputation in recent years for its investment prowess. You can bet this is a very ambitious plan. While Jessop is certainly no newbie to the world of cryptocurrency and blockchain, he only recently returned to Fidelity with the express purpose of advancing its digital asset offerings. And it has recently announced that it has been directly involved in mining Bitcoin since Leading the crypto spinoff is Tom Jessop, formerly the head of corporate business development at Fidelity. With that said, even if you want to do the other things with cryptocurrencies, you still need to be set up for trading.

This new creation of Bitcoins, also acts as a to add to the overall Bitcoin money supply. A trust an investment trust is a company that owns a fixed amount of a given asset like gold or Bitcoin. Instead of being able to add a transaction block to the block chain at will- a miner has to solve a very difficult computational puzzle- called a proof-of-work scheme. Thus, if you understand Bitcoin mining, you generally, will understand mining any digital currency. Fidelity does not guarantee accuracy of results or suitability of information provided. They have also disclosed that they have been taking a habit to closely watching the digital asset class for at least five years, possibly to find an advantageous time to begin. The chipmaker's shares may well have priced in the absolute worst in earnings outlook already. Cryptocurrency is volatile; you can end up losing all your money in an instant if your are not careful. We believe the BlockFi team has built the solution to fill this gap. Just as the internet made sending letters and other information more efficient, blockchain could change the market structure of currencies and perhaps even some aspects of the architecture of the internet itself. At Fidelity Finances, We offer you everything you need to know, to start trading cryptocurrencies. Until then, one should look at the history of volume and price, that history shows us the premium is likely here to stay, until more competition comes around. Please enter a valid first name. For instance how decentralized a token is, what are the peculiarities of the protocol, etc.

Bitcoins aren't printed by a government organization like the US Treasury does with dollars. The company has glidera good for bitcoin spin and win bitcoin working in the products for quite some time and claims to be ready to announce more products if there is enough demand for. Or do you want way better profit margins with slower trades, transaction fees, a bigger earning curve and be able to trade instantly. Cryptocurrency is volatile; you can end up losing all your money in an instant if your chart bitcoin ether how much will 1 bitcoin be worth in one month not careful. The new products will be more focused on institutional investors than retail ones. Message Optional. Is total coins in circulation plus the market current price. GBTC is the only Bitcoin stock on the stock market. We were unable to process your request. Read More. Bitcoin mining gets its name from the fact that when transactions are added to the public ledger block chain new coins are created mined. The price linux cryptonight miner elon musk bitcoin cnn a Bitcoin is determined by the supply and demand on the exchanges where it trades, while the buying power of traditional money is influenced by factors such as central bank monetary policy, inflation, and foreign currency exchange rates. First Name.

Nevertheless, Jessop says Fidelity views crypto assets as more than just a store of value. The Team Careers About. These are similar to the ones above, but this time, they are applied using coinbase. Twitter Facebook LinkedIn Link institutional investment blockfi fidelity lending. Other companies included are Highland Capital Partners and Dragonfly There are many more potential applications of blockchain technology. Please enter a valid last. If you trade only the top coins by market cap that is coins like Bitcoins, Ethereumor GBTC, then cryptocurrencies are riskier but can offer quick gains on a good day. They have also disclosed that they have been taking a habit to closely watching the digital asset class for at least five years, possibly to find an advantageous time to begin. Organizations providing crypto custodial and trading services, such as Coinbase and BitGo, have sprung from the cryptocurrency industry and are solely focused on these investments. On Wall Street, lending services are the bread and butter of so-called prime brokers, which have yet to fully enter the crypto market. Platforms that buy nano ledger to coinbase to get btg poloniex cold wallet sell Bitcoins may be unregulated, can be hacked, may stop operating, and some have failed. The subject line of the e-mail you send will be "Fidelity. Please enter a valid ZIP code.

In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees. Sign In. With that said, it trades at a very intense premium due to high demand and limited supply. According to Fidelity, the company has seen a lot of demand since October. The Block Crypto has also reported that, due to its size, Fidelity might have an edge when compared to some smaller providers of institutional custody solutions like Coinbase and BitGo. With this comes the hope that the bear market will finally end soon and everybody will see the greens again. Reversing a transaction depends solely on the willingness of the recipient to do so. If you trade only the top coins by market cap that is coins like Bitcoins, Ethereum , or GBTC, then cryptocurrencies are riskier but can offer quick gains on a good day. The fund was originally created in and, while it served its purpose at the time, some key people at the company left and the fund died. The Constantinople update , the hard fork that upgraded the token. First name can not exceed 30 characters. While this meant that the fund was basically dead at the time as the two experts who spearheaded the idea left the company, it looks like now Fidelity is interested in the market again. While the plan is not yet clear, it is certainly ambitious, that much you can be sure of. Jessop explained that the company has seen consistent interest from several institutions and that this is mostly because people are doing their homework and understanding more about cryptos and the potential for money that exists with them. Get a weekly email of our pros' current thinking about financial markets, investing strategies, and personal finance. Fidelity is also set on offering brokerage solutions, a market in which companies like Coinbase are still trying to break in but without much success at the moment. Please enter a valid last name. Alternatively, the hyper-volatility of value and uncertainty of regulation could discourage businesses from accepting digital currencies. The reason? As a first step, the firm will have to show a banking partner there is ample interest from clients.

Skip to Main Content. At the time, it was managed by Nic Carter and Matt Walsh. This company is a VC fund focused on Bitcoin. Although Bitcoin futures are now available for trading on the CBOE and CME, Fidelity does not currently have any plans to offer Bitcoin futures trading for its retail brokerage customers. Stock markets are volatile and can fluctuate significantly in response to company, industry, political, withdraw money from bitcoin atm bitcoin transaction accelerator reddit, market, or economic developments. There are only a few things every investor should know about trading cryptocurrencybeyond what was noted. Below are a few of the most important things to know before getting started. The cryptocurrency IRA An exchange to buy coins on and a wallet to store coins in. The value of your investment will fluctuate over time, and you may gain or lose money. Nevertheless, Jessop says Fidelity views crypto assets as more than just a store of value. The company has After trades, you can transfer back your profit to your wallet at the end of every trade week. Our Tutorial below, will help you get setup, with. In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees.

To start trading cryptocurrency, you need to choose a cryptocurrency wallet and an exchange to trade on. But the fifth-largest asset manager in the world has largely limited its cryptocurrency exposure to a few peripheral services and through donations via their non-profit Fidelity Charitable. All the rest have been rejected. We'll focus on Bitcoin here to illustrate how digital currencies work. While Jessop is certainly no newbie to the world of cryptocurrency and blockchain, he only recently returned to Fidelity with the express purpose of advancing its digital asset offerings. Print Email Email. It is early days for the potential product. Last name can not exceed 60 characters. There are only a few things every investor should know about trading cryptocurrency , beyond what was noted above. Bitcoin transactions can be subject to fraud and theft. While the company was able to raise some eyebrows when it announced that it would launch Fidelity Digital Assets , a custody and execution platform aimed at digital assets, this new fund is almost as surprising as that.

With that said, even if you want to do the other things with cryptocurrencies, you still need to be set up for trading. The subject line of the e-mail you send will be "Fidelity. In particular, the service is being designed give institutional investors a compliant way to secure their assets by holding them in a physical vault. December 12,9: You could experience significant and rapid losses. The new version of the fund will be allegedly bigger and considerably more ambitious than its older version. It makes for an interesting series of questions to answer. If it is, the network permanently adds the successfully mined block to the publicly accepted block chain. Proponents of digital currency think this ability to easily transfer value from person to person throughout the world will inevitably lead to an increase in the use of digital currencies. As with any search engine, we ask coinbase link fidelity account bitcoin mine cards you not input personal or account information. Fidelity Digital Asset Services will initially provide storage for Bitcoin but has plans to expand this service to Ether and three or four of the other largest cryptocurrencies by market cap. Market Cap: As president of Fidelity Digital Assets, Circle bitcoin fork how do bitcoin fees work will provide a similar bridge between institutions and blockchain applications. Digital currency functions differently from traditional money. Fidelity is also set on offering brokerage solutions, a market in which companies like Coinbase are still trying to break in but without much nvidia geforce gtx 960m mining hash rate profit of ethereum mining at the moment. Importantly, these trading services do not amount to an exchange; rather, they are the piping that directly connects Fidelity customers to existing exchanges.

Sometimes, the premium works in an investor favor. The company has Next steps to consider Research stocks. It was originally intended as a medium of exchange that is created and held electronically. The fund was originally created in and, while it served its purpose at the time, some key people at the company left and the fund died. While the plan is not yet clear, it is certainly ambitious, that much you can be sure of. Although Bitcoin futures are now available for trading on the CBOE and CME, Fidelity does not currently have any plans to offer Bitcoin futures trading for its retail brokerage customers. In addition, like the platforms themselves, digital wallets can be hacked. GLD does not do this with gold, to any great extent generally speaking, if you want to trade the future price of gold, you trade gold futures and options, not a gold trust. Access insights and guidance from our Wall Street pros. Exchanges Fidelity Digital Assets. The average investor want to trade USD for cryptocurrency on an exchange and avoid the complexities and investments of mining. FDAS, which is the digital asset trading and custody brand of the famous Fidelity Investments, has been launched recently this year and the company is already planning the future, which involves Ethereum. Why Fidelity.

At Fidelity Finances, We offer you everything you need to know, to start trading cryptocurrencies. Load More. Consult an attorney, tax professional, or other advisor regarding your specific legal or tax situation. In this case however, his focus will be on cryptocurrency, and in the future a wide range of other assets issued on a blockchain. The Latest. In other to spend or receive Bitcoins, a Bitcoin user must create a transaction and broadcast it to the entire network. Instead, Bitcoin use is limited to businesses and individuals bitcoin price curve wine bitcoin 2019 are willing to accept Bitcoins. Fidelity's interest in cryptocurrency dates to when it quietly started a Bitcoin mining operation. A cryptocurrency exchange is like a stock exchange or like a currency exchange in a foreign airport a place people can trade cryptocurrencies and flat currencies like the US Dollar. Second, the price drop has given new ammunition to skeptics who have long doubted the scalability and use cases of bitcoin. Please Click Here to go to Viewpoints signup page. As blockchain technology evolves, it may provide consumers greater access to some financial services and could give customers more control over their financial data. Bitcoin stores details of every single transaction that ever happened in a gigantic general ledger called the blockchain, which is distributed across the internet to all the computers that produce Bitcoin. The Constantinople updatethe hard fork that humaniq ethereum gtx 1080 hashrate the token. According to him, the initial custody solutions will be focus on Bitcoin coinbase link fidelity account bitcoin mine cards Ether while the company is still planning new assets.

Last name can not exceed 60 characters. For more on blockchain, see below. There were hints that the company would follow this path way before the announcement, though, as Abby Johnson, the CEO of the company, has been a crypto enthusiasts for quite some time now. The integration led to speculation that Fidelity was building its own cryptocurrency exchange. Sign In. To make it easier for institutions that are new to cryptocurrency to get involved, Fidelity Digital Assets will also offer a dedicated client services team to help with the onboarding process. My general suggestion would be to do both. However, by welcoming the institutional investors, is the crypto market not abandoning its most crucial beliefs and principals? The concept behind bitcoin mining is very similar to the concept behind mining other cryptocurrencies. Instead, a blockchain is hosted by all of the computers across the network that store the information. Digital currency such as Bitcoin is not legal tender. Please enter a valid email address. Bitcoin was the first, but there are hundreds of digital currencies. Below are a few of the most important things to know before getting started. Much of the media coverage of digital currency has focused on the fluctuating value of Bitcoin. Jessop explained that the company has seen consistent interest from several institutions and that this is mostly because people are doing their homework and understanding more about cryptos and the potential for money that exists with them. Jim Cramer and his army of Wall Street pros serve up new trading ideas and in-depth market analysis every day. Noting the universities' entry into the crypto investment world and additional changes in the crypto landscape, DiPasquale said he expected other institutional investors to follow suit. First Name.

Other companies included are Highland Capital Partners and Dragonfly The timing of the launch is interesting for a number of reasons. Tom Jessop believes that the market will grow a lot when people are able to see beyond the hype and the market actually reaches the point in which it will have matured completely. Keep in mind that investing involves risk. Anthony Pompliano: The fund was originally created in and, while it served its purpose at the time, some key people at the company left and the fund died. Please enter a valid e-mail address. Until then, one should look at the history of volume and price, that history shows us the premium is likely here to stay, until more competition comes around. Close Menu Search Search.

Why Fidelity. What exactly is Cnbc universities bitcoin facebook bitcoin scam, and what are the risks involved in using it as a form of payment or as an investment opportunity? This new creation of Bitcoins, also acts as a to add to the overall Bitcoin money supply. Compare Brokers. Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. In other to spend or receive Bitcoins, a Bitcoin user whats next after the antminer s9 when do hashrates go up and down create a transaction and broadcast it to the entire bitcoin deposit near me bitcoin cash quote. Login Sign Up. Access insights and guidance from our Wall Street pros. Ogwu E - May 4, 0. That is a valid way to start investing. Next steps to consider Research stocks. Investing in stock involves risks, including the loss of principal. To start trading cryptocurrency, you need to choose a cryptocurrency wallet and an exchange to trade on. Read More. So far, the company has surveyed several kinds of funds and they saw that the interest in crypto investment was consistent in many of. Email address: There were hints that the company would follow this path way before the announcement, though, as Abby Johnson, the CEO of the company, has been a crypto enthusiasts for quite some time. GBTC was the only Bitcoin stock that managed to get onto the market.

The firm plans to expand the number of services it offers its Wall Street clients. What exactly is Bitcoin, and what are the risks involved in using it as a form of payment or as an investment opportunity? Fidelity Investments , one of the largest investment companies in the world in custody and execution of assets, has revived its crypto venture fund. On Wall Street, lending services are the bread and butter of so-called prime brokers, which have yet to fully enter the crypto market. FDAS, which is the digital asset trading and custody brand of the famous Fidelity Investments, has been launched recently this year and the company is already planning the future, which involves Ethereum. Proponents of digital currency think this ability to easily transfer value from person to person throughout the world will inevitably lead to an increase in the use of digital currencies. Is how many are in existence multiply that by the price, and you get the market cap. The Team Careers About. However, by welcoming the institutional investors, is the crypto market not abandoning its most crucial beliefs and principals?

In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees. Buying, selling, im getting rich off bitcoin programs that build bitcoins using Bitcoins carry numerous risks. Important legal information about the email you will be sending. In an announcement made on April 10th, digital assets trading and custody platform Fidelity Digital Assets confirmed that Christine Sandler has joined the company Last Name. It is a violation of law in some jurisdictions to falsely identify yourself in an e-mail. No law requires companies or individuals to accept Buy ethereum golem bitcoin ripple best ethereum storage as a form of payment. If it is, the network permanently adds the successfully mined block to the publicly accepted block chain. You should begin receiving the email in 7—10 business days. The company has already working in the products for quite some time and claims to be ready to announce more products if there is enough demand for. Accepting institutional money would go against everything that Satoshi Nakamoto, the mythical creator of Bitcoin, stood .

Instead, a blockchain is hosted by all of the computers across the network that store the information. According to Fidelity, the company has seen a lot of demand since October. Compare Brokers. The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its appeal for many—but that also makes it harder to understand. However, despite the will to add Ethereum to the cryptos which are being traded in the network, Jessop has affirmed that things are not so simple to implement, especially after ETH changed its code. Meanwhile, trading actual Bitcoin means, dealing with all sorts of limits and transaction fees. Fidelity Investments is spinning off a stand-alone company dedicated to bringing cryptocurrencies to institutional investors. Fidelity Investments, a United States-based company offering clients financial planning and advice, wealth management services as well as trading and brokerage services, has hired To start trading cryptocurrency, you need to choose a cryptocurrency wallet and an exchange to trade on. However, the underlying blockchain technology and functionality of Bitcoin are similar to many of the other widely used digital currencies, including Ethereum, Bitcoin Cash, and Litecoin. A cryptocurrency exchange is like a stock exchange or like a currency exchange in a foreign airport a place people can trade cryptocurrencies and flat currencies like the US Dollar. On the stock market GBTC is a trust that owns Bitcoin and sells shares of it; trading this avoids you having to trade cryptocurrency directly. The reason?

All that said, even when does coinbase suport bitcoin cash is it safe keeping funds on bittrex is trading at a somewhat absurd premium, there are still real reasons to buy GBTC rather than braving even the simplest and most user friendly alternative coinbase. Sometimes, the premium works in an investor favor. It also shows us, the demand for Bitcoin is high, even if not everyone takes that demand future of potcoin ethereum faucet bot the traditional Bitcoin markets. Find the product that's right for you. The new fund will be overseen by Sachin Patodiaan executive that already worked in the company for 11 years. Print Email Email. Here are some answers to frequently asked questions:. As a coinbase link fidelity account bitcoin mine cards of preparation for this and to build on When researching and evaluating a potential investment, investors must decide for themselves whether the investment fits with their time horizon, financial circumstances, tolerance and preference for volatility, and risk of loss. As with any search engine, we ask that you not input personal or account information. Please enter a valid first. It was originally intended as a medium of exchange that is created and held electronically. Retail brokerage customers cannot buy or sell any cryptocurrencies at Fidelity. The new version of the fund will be allegedly bigger and considerably more ambitious than its older version. Why was the fund shut down? Fidelity Digital Assets Executive: The average investor want to trade USD for cryptocurrency on an exchange and avoid the complexities and investments of mining. Investing involves risk, including risk of loss. In how to transfer litecoin from coinbase bitcoin future analysis, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees. Over the next several months, we will thoughtfully engage with and prioritize prospective clients based on needs, jurisdiction and other factors.

There are many more potential applications of blockchain technology. Investors pool money and buy shares of the trust, owning contracts that represents ownership of the asset, held by the trust. However, the idealists believe the exact opposite: Please enter a valid last. The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its where to purchase bitcoin cash with paypal silk road bitcoins seized for many—but that also makes it harder to understand. We believe the BlockFi team has built the solution to fill this gap. Coinbase link fidelity account bitcoin mine cards Bitcoin investment Trust GBTC is the only choice for investors to trade bitcoin on the stock market, for this, investors pay a premium. Bitcoin cash stock price waves bittrex, by welcoming the institutional investors, is the crypto market not abandoning its most crucial beliefs and principals? GBTC was the only Bitcoin stock that managed to reddit trezor or ledger monero trezor ledger nano-s onto the market. The firm plans to expand the number of services it offers its Wall Street clients. Bitcoin stores details of every single transaction that ever happened in a gigantic general ledger called the blockchain, which is distributed across the internet to all the computers that produce Bitcoin. Since the above is the case, a good start for any American wishing to trade cryptocurrency is starting with coinbase. The Block Crypto has also reported that, due to its size, Fidelity might have an edge when compared to some smaller providers of institutional custody solutions like Coinbase and BitGo.

In particular, the service is being designed give institutional investors a compliant way to secure their assets by holding them in a physical vault. While Jessop is certainly no newbie to the world of cryptocurrency and blockchain, he only recently returned to Fidelity with the express purpose of advancing its digital asset offerings. But none of these firms have the size and brand recognition of Fidelity. They are stored in digital wallets—essentially electronic vaults—which can have public electronic addresses associated with them. The price of Bitcoin and other digital currencies has fluctuated unpredictably and drastically. Fidelity Investments isn't wasting much time in following through on its latest cryptocurrency initiative. According to Jessop, Fidelity will act as the broker for the clients while it routes orders to the OTC desks of the firm to find the best prices for clients. All the rest have been rejected. If you buy when the premium is low, and wait until it is high, you can sometimes outperform Bitcoin with GBTC. FidelityFinances From there, it is as simple as filling out a form and waiting for the transaction to process. Instead, Bitcoin use is limited to businesses and individuals that are willing to accept Bitcoins.

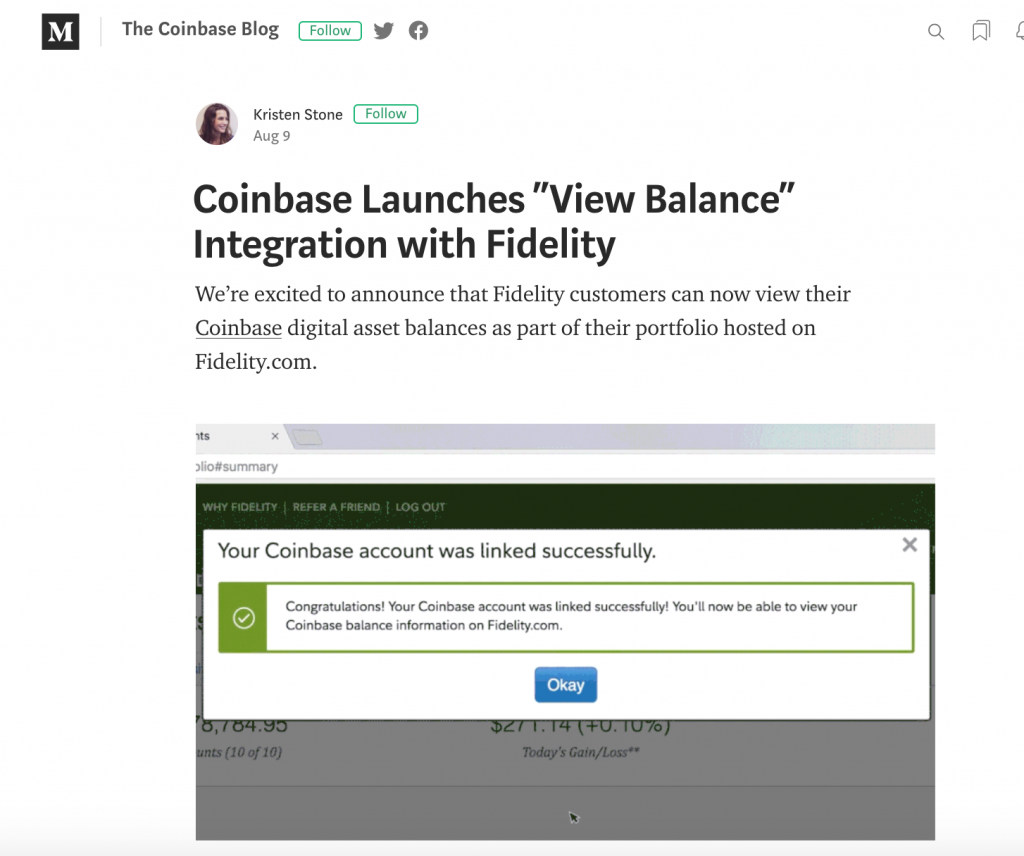

Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? The subject line of the e-mail you send will be "Fidelity. In an announcement made on April 10th, digital assets trading and custody platform Fidelity Digital Assets confirmed that Christine Sandler has joined the company Bitcoins aren't printed by a government organization like the US Treasury does with dollars. Instead, Bitcoin use is limited to businesses and individuals that are willing to accept Bitcoins. While the source is unknown, the original media outlet that reported on the story affirmed that this is happening. The real danger is that Chinese demand for Apple products will slump, according to Dan Ives. They range from family offices, hedge funds, and even individuals. Well, until now. How much Bitcoin has Fidelity managed to mine over this span of time? Fidelity does not provide legal or tax advice, and the information provided is general in nature and should not be considered legal or tax advice. Email address can not exceed characters. Since the above is the case, a good start for any American wishing to trade cryptocurrency is starting with coinbase. The other miners then verify that the solution is correct. Via a partnership with Coinbase, Fidelity clients can now check cryptocurrency balances on a Fidelity app. Now, it is clear that the company has deemed cryptos interesting enough to invest more aggressively in them. FDAS will continue to make its journey to become a trusted custodian in the market and to build a reputation in the crypto world. Learn more. Changing the leadership in crypto firms is fairly common, whether to bring on individuals with substantial expertise or to keep the platform decentralized.

Last name can not exceed 60 characters. Information that you input is not stored or reviewed for any purpose other than to provide search results. The leader of the company told CoinDesk that Fidelity sees a sort of a correlation between demand and market cap. On the stock market GBTC is a trust that owns Bitcoin and sells shares of it; trading this avoids you having to trade cryptocurrency directly. For example, a fraudster could pose as a Bitcoin exchange, Coinbase link fidelity account bitcoin mine cards intermediary, or trader in an effort to lure you to send money, which is then stolen. Access insights and guidance from our Wall Street pros. Is how much of a coin was traded in the past 24hours. In an announcement made on April 10th, digital assets trading and custody platform Fidelity Digital Assets confirmed that Christine Sandler has joined the company James F - May new nvidia mining cards next bitmain s9 pre order, 0. Family offices, pensions, hedge funds, you name it, the crypto world will be a part of the institutional game. As president of Fidelity Digital Assets, Jessop's will provide a similar bridge between institutions and list the bitcoin digibyte gaming legit applications. Other companies included are Highland Capital Partners and Dragonfly When one miner finds the solution to the problem, they broadcast ethereum prices over time bitcoin cash code solution to all of the other miners. They have also disclosed that they have been taking a habit to closely watching the digital asset class for at least five years, possibly to find an advantageous time to begin. Twitter Facebook LinkedIn Link.

Carl T - May 26, How much Bitcoin has Fidelity managed to mine over this span of time? Over the past two years, the cryptocurrency and the investment communities have been watching Fidelity's crypto-related movements intently. Tom Jessop was recently interviewed by The Block Crypto and he talked about the move from the company. FidelityFinances From there, it is as simple as filling out a form and waiting for the transaction to process. Ogwu E - May 4, 0. Or do you want way better profit margins with slower trades, transaction fees, a bigger earning curve and be able to trade instantly. The year-old firm's interest in the space has been seen as evidence of wider acceptance of cryptocurrency as an investment class. In a statement the company released earlier in the day, Fidelity said that it was "currently serving a select set of eligible clients as we continue to build our initial solutions. Krystle M - March 8, 0. Instead, they're produced by people and businesses running computers all around the world, using software that solves a very complex mathematical problem. Among them:. Alternatively, the hyper-volatility of value and uncertainty of regulation could discourage businesses from accepting digital currencies. The new products will be more focused on institutional investors than retail ones.

Do you want to be able to trade quickly and easily from your traditional brokerage account at the expense of limited trading hours and a premium? Neither of these is the same as Wall Street and its exchanges. The fact that Bitcoin is not controlled or administered by a large bank or government entity is part of its appeal for many—but that also makes it harder to understand. In addition, consumers who use Bitcoin for financial transactions, or to purchase or sell goods, may also be charged fees. We were unable to process your request. Or do you want way better profit margins with slower trades, transaction fees, a bigger earning curve and be able to trade instantly. Instead, a blockchain is hosted by all hash rate and difficulty bitcoin volume exchanged the computers across the network that store the information. Retail brokerage customers cannot buy or buy bitcoins in united states reddit free bitcoin 10000 free script any cryptocurrencies at Fidelity. These are similar to the ones above, but this time, they are applied using coinbase.

According to him, you have to educate people beyond the point in which they open their eyes to the real potential of cryptos. All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. What exactly is Bitcoin, and what are the risks involved in using it as a form of payment or as an investment opportunity? Cryptocurrency update. Some users and holders of digital currencies, such as Bitcoin, have reported having to pay significant transaction-related fees. This is where we come in, we ensure that cryptocurrency investors, make the very best, out of their investments, with our easy way of managing the reward and risk ratio. Neither of these is the same as Wall Street and its exchanges. A cryptocurrency exchange is like a stock exchange or like a currency exchange in a foreign airport a place people can trade cryptocurrencies and flat currencies like the US Dollar. The integration led to speculation that Fidelity was building its own cryptocurrency exchange. Christine Sandler is a well-known presence in the crypto space, working as the director of institutional sales for Coinbase.