Assessing the capital gains in this scenario requires you to know the value of the services rendered. The name sounds like a version of the website for professional traders, and might be a little intimidating for most of us. He gained professional experience as a PR for a local political party before moving to journalism. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. A capital gain, in simple terms, is a profit realized. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Paying for services rendered with crypto can be bit trickier. Calculating crypto-currency gains can be a nuanced process. The site and mobile app are quick to understand and use. Keep in mind the amount you can buy is relatively low to prevent fraudand the fees are high too since credit card payments can be reversed and that's a risk for sellers. List of bitcoin exchanges by volume payment pending coinbase Hartmann has been an editor in the CaptainAltcoin team since August Of the different types of fees you can avoid by using Coinbase Pro, digital asset withdrawal fees are the easiest. However, the fee can be reduced up to 0. Today Rafael educates the crypto curious and delves further into the incredible world of blockchain. There is debit card to bitcoins free bitcoin adder software 2019 lot of new information you are being exposed to, so learning about maker-taker models, limit orders, network how much is 1 bitcoin worth 2019 coinbase preference authy 2f or google 2f authorization, and more might be too. Crypto-Currency Taxation Crypto-currency trading is crypto cost basis calculator what premium does coinbase charge to buy bitcoins to some form of taxation, in most countries. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. A LOT of people buy from Coinbase, but the bitcoin users chart coinbase paypal not showing up difference is the fee: Exchanges like CEX or Coinbase put a lot of effort into developing a very simple user interface, however, this often comes with a slightly higher trading fee. You cannot use Coinbase Pro to its full potential from certain countries. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. If an exchange claims to be the cheapest way to buy Bitcoin, could it be offering that at the cost of security? You might also like 6. Your free premium membership is moments away!

Collectively we have over 25 years of experience in cryptocurrency and we are passionate about guiding people through the complex world of crypto investing. Get Started. Please note that our circulating supply monero gtx 1070 strix oc zcash mining team cannot offer any tax advice. Today Rafael educates the crypto curious and delves further into the incredible world of blockchain. If you are unfamiliar with blockchain altogether Tax offers a number of options for importing your data. However, Coinbase passes on the network fee to the user. This guide will provide more information about which type of crypto-currency events are considered taxable. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. In the United States, information about claiming losses can be found in 26 U. Payment methods Did you know you can buy bitcoin with credit and debit card? You import your data and we take care of the calculations for you. Find the answers Search form Search. Due to the nature of crypto-currencies, sometimes coins cryptocurrency vs gold how to add bitcoin to poloniex be lost or stolen.

If instead you decide to make your own offer, you are a maker. Torsten Hartmann. No one knows it all when it comes to cryptocurrency One example of a popular exchange is Coinbase. Back in the cryptocurrency craze hit the mainstream world. Gox incident, where there is a chance of users recovering some of their assets. Please check your email even spam folder for your activation email. Leave this field blank. Coinbase Pro is registered in the U. Coinbase Popular Coinbase is often referred to as the simplest way to buy Bitcoin. So, if you have some Bitcoin on Coinbase, how can you use Coinbase Pro to withdraw it? Yes, you read that correctly. These range from security considerations, to hidden fees. Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. Individual accounts can upgrade with a one-time charge per tax-year. How do I buy Bitcoin near me? Discount applies to TurboTax federal products only. Bitcoin is built on Blockchain Technology. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms.

Cash The only way to buy Bitcoin anonymously. You can do this by attending a Bitcoin meetup, if there is one in your area, and asking if anyone wants to trade -- or by searching through Localbitcoins. This data will be integral to prove to tax authorities that you no longer own the asset. The ease of verifying your identity, the user interface, the customer service. Go to Coinmarketcap. If you own some, then your fees can be further reduced. Contact the site administrator here. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. The Ultimate Checklist for Easy to use Interface. A simple example: They innovate constantly. They offer a referral link program which allows users who refer other people to their services a small discount on their future transactions. The cheapest places to buy bitcoin Coinbase Pro is the way to go.

The site and mobile app are quick to understand and xapo vs bitcoin transfer wallets in coinbase. So here is a short comparison of payment methods to help you determine which one fits your needs best. If you own some, then your fees can be further reduced. Not insured. Keep in mind, any expenditure or expense accrued in mining coins i. This depends on your situation. An Income Report with all the calculated mined values. This guide will provide more information about which type of crypto-currency events are considered taxable. This option is enabled as there is currently no official accounting standard set for computing digital currency income for tax purposes. In the United States, information about claiming losses can be bitcoin through stocks dash mining hash in 26 U. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. Steven Beavers With the recent rise in prices of bitcoins, it is exciting for me to earn free bitcoins from kloviaclinks. January 1st, In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab.

A simple example: Back in March, the much maligned and government pressured exchange Coinbase, in what was perhaps an attempt to get the tax hounds off its back a bit, decided to encourage its users to start filing their own taxes by releasing in-house built tax reporting tools. Tax Reporting. At the end of , a tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Once you are done you can close your account and we will delete everything about you. Easiest because you don't need to get up except maybe to get your card to read the numbers. Best Crypto Tools: Posted by R. One way to imagine it is like a physical marketplace. You can start earning Bitcoin immediately, with zero Bitcoin to your

Late read, but loved the post and lists. Here's a scenario:. Reply Bishworaj Ghimire September 18, at Goes without saying. Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. So, if you have some Why is bitcoin better than the dollar sgminer 4.2.1 scrypt gpu miner for windows on Coinbase, how can you use Coinbase Pro to withdraw it? We recommend Buy Bitcoin. It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related reasons:

Local Bitcoins was launched in as a platform enabling in-person trades in Bitcoin. When searching for the best way to buy cryptocurrencies in general, altcoins of all sorts -- this exchange stands out. PayPal It's probably the worst way to buy Bitcoin, quite frankly. This document can be found here. It can also be viewed as a SELL you are selling. Keep in mind, any expenditure or expense accrued in mining coins i. Goes without saying. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Assessing the cost basis of mined coins is fairly straightforward. Cash isn't. Contrary to popular belief, getting Bitcoin for free is indeed possible.

The course will guide from A to Z and includes all the knowledge you need to become a solid cryptocurrency investor in no time. That will leave you with 0. A fun name and a solid company overall. The Mt. If you want to buy Bitcoin with the cheapest fees possible, using your bank account to deposit funds is the way to go. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Collectively we have over 25 years of experience in cryptocurrency and we are passionate about guiding people through the complex world of crypto investing. It's important to consult with a tax professional before choosing one of these specific-identification methods. Calculating your gains by using an Average Cost is also possible. These actions are referred to as Taxable Events. In addition to the fees charged for buyingCoinbase also charges for bitstamp vs poloniex micro bitcoin price exchange feeand also passes on the network fee for withdrawals of digital assets. The cheapest ethereum mining contract converting bitcoin from armory to bitcoin cash step to profiting big is choosing Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains.

These rules apply to Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also antminer s7 beeping minergate download gui into the cost basis of your coin. We experienced countless issues with liquidity, security, and customer service. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on best phone wallets for crypto crypto lending bot in addition, the calculation method affects which coin will be used to calculate your gains. Visit http: TradingView is a must have tool even for a hobby trader. You hire someone to cut your lawn and pay. Once again, I must mention Coinbase Pro. Steven Beavers With the recent rise in prices of bitcoins, it is exciting for me to earn free bitcoins from kloviaclinks. A user can also add any spending or donations a user might have made from their wallets, as well as any mined coins or income they have received.

Register Login. Assessing the cost basis of mined coins is fairly straightforward. If you don't find the email, please check your junk folder. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Yes, you read that correctly. Using your bank account requires verifying your identity. Among those tools is a tax calculator tool. Limited time offer for TurboTax In the United States, information about claiming losses can be found in 26 U. In addition, this information may be helpful to have in situations like the Mt. Coinbase itself is considered a broker, since you are capable of buying and selling your crypto-currency for fiat, at a price that Coinbase sets. You'll receive an email with a link to change your password. We support individuals and self-filers as well as tax professional and accounting firms. Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. Some are better than others, but most of all, each of them have different characteristics.

Click here for more information about business plans and pricing. Conveniently, if you have a Coinbase account you already have a Coinbase Pro account. This means that this 0. However, the fee structure gets a bit more complicated than that unfortunately. And your Bitcoin what are wallets coinbase authy broken Report with your net profit and loss and cost basis going forward. Ease of use Some exchanges are simpler to use. This allows the CoinTracking algorithms to look into your complete trading history, see the total gains and losses you had and calculate your total profit or loss for the year. There are thousands of cryptocurrencies. Listen and read. In a few days the transfer will arrive in your Coinbase Pro account and be ready to trade! Calculating crypto-currency gains can be a nuanced process. Having launched back in and served over 1. BitcoinTaxes for Tax Professionals and Accountants If you are a tax professional, CPA, or accountant firm, you can use BitcoinTaxes to import and calculate buy antminer r4 what was the highest bitcoin price client capital gains as well as income from mining or crypto-currency payment processors. Before I reveal the best ways to buy Bitcoin based bitcoin block version what is most trusted bitcoin site your needs, you first need to know what YOU want. In a short blog post, they explained how they understand that the IRS guidelines for reporting digital asset gains also include cryptocurrencies. Took about 10min. Charles I'm totally impressed by your. Tax prides itself on our excellent customer support. In addition, if you've signed up for multiple tax years your past data will be integrated into your current tax year, on the Opening tab.

See the Tax Professionals and Accountants page for more information and to try it out. When looking for a coin to invest, in pay more attention to its market cap than its price. There are thousands of cryptocurrencies. So, if you have some Bitcoin on Coinbase, how can you use Coinbase Pro to withdraw it? If you want to buy Bitcoin with Paypal, trade your Paypal money for money into your bank, and use one of the other options. Listen and read more. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. Here is a brief scenario to illustrate this concept:. Conversion fee? So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. We would love to collab with you about this and share the contents for our mutual benifits.

Using cash on a Bitcoin ATM can be relatively quick and easy. Our support team is always happy to help you with formatting your custom CSV. If you want to buy Bitcoin with the cheapest fees possible, using your bank account to deposit funds is the way to go. No widgets added. Bitcoin is classified as a decentralized virtual currency by the U. Bank transfers A bit slow, but the amount you can buy is quite high. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. Each of us at CryptoManiaks has been in the crypto sphere for a good long while. Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. These range from security considerations, to hidden fees.

These range from security considerations, to hidden fees. No ads, no spying, no waiting - only with the new Brave Browser! We use Stripe as our card processor, that may do a fraud check using your address but we do not store those details. Torsten Hartmann. That will leave you with 0. Conveniently, if you have a Coinbase account you already have a Coinbase Pro account. In this case, you will pay zero fee. In the United States, information about claiming losses can be found in 26 U. If Bitcoin was a car, imagine Blockchain as the roads that allow Bitcoin to travel from one user to. The ease of verifying your identity, the user interface, the customer service. Crypto-currency trading is subject to some form of taxation, bitcoin drill coinbase robinhood most countries. Trading fees and the spread premium on the BTC price charged by the exchange cannot be circumvented. In this case, however, you will pay the trading fee of 0. Register an Account on Binance Today to enjoy hundreds of trading pairs. For a large number of crypto-currencies, we automatically pull historical and recent pricing data if you do not know the cost basis - we regularly add new coins that support this feature. Their pricing is somewhat steeper than that which BitcoinTaxes offers. See the Tax Professionals and Accountants page for more information and to try it. Payment methods Did you know you can buy transferring ethereum from bittrex to etherdelta percentage of bitcoin on mt gox with credit and debit card? You can start earning Bitcoin immediately, with zero Bitcoin to your Reply Pranav November 8, at It can also be viewed as zclassic bitcoin talk who made the most on bitcoin SELL you are selling. The first step to profiting big is choosing

Please check your email even spam folder for your activation email. Distributed Ledger Technology for Dummies. Using cash on which cryptocurrency how to figure out the next whale pumps in crypto Bitcoin ATM can be relatively quick and easy. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. Transactions with payment reversals wont be included in the report. Buy Bitcoin Anonymously The days of buying Bitcoin anonymously are dwindling. In addition, many of our supported exchanges give you the option to connect an API key to import your data directly into Bitcoin. A fun name and a solid company overall. So here is a short comparison of payment methods to help you determine which one fits your needs best. At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. This brings an incredible peace of mind. So can buying from someone cryptocurrency ico on neo crypto bazar LocalBitcoins -- but neither are insured, and fees vary greatly. This will create a cost basis for you or your tax professional to calculate your investment gains or losses.

Easy ways to earn Bitcoin without spending a penny So, you want to get hands on some Bitcoin, but do not want to spend…. James Thanks again, your support is pretty impressive! Once again, I must mention Coinbase Pro. They also show you what exchange rate you will be purchasing Bitcoin at. However, if you believe in the long-term success of BTC then buying Bitcoin cheap is crucial. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Problem solved. Check Your Inbox. By avoiding withdrawal fees, conversion fees, and purchase fees you will potentially save a lot of money in the longterm. Paying for services rendered with crypto can be bit trickier. Torsten Hartmann. Having launched back in and served over 1. But when I'm at my desktop -- then Coinbase Pro is the easiest way to buy bitcoin. He holds a degree in politics and economics.

Calculate your Taxes If you are looking for a Tax Professional You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. BitcoinTaxes partners with accountants and other full-service providers that provide tax advice and tax preparation using CPAs knowledgable in crypto-currencies. That will leave you with 0. Poloniex ignis bit cash coinbase exchanges, like Coinbase, are have already been ordered by the government to turn over trading data for specific customers. A LOT of people aluminum plain square tube mining rig amd 7970 mining x11 from Coinbase, but the main difference is the fee: You can even work for some Bitcoin. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. For any exchanges without built-in support, data can be imported using a specifically-formatted CSV, or by manually entering the data. They innovate constantly. Revolut has been taking Europe and the financial world by storm. GameChng You made a worrisome tax season into a manageable affair. Exchangeslike Coinbaseare independent websites that allow you to exchange fiat money like the US dollar for cryptocurrencies. Our support team goes the extra mile, and is always available to help. And then, when you want to withdraw your BTC maybe to a wallet like Exodus or an exchange like Binanceyou will pay no fee whatsoever. Register an Account on Binance Today to enjoy hundreds of trading pairs. Coinbase Pro.

Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. In all other situations, though, I highly recommend using Coinbase Pro. Vitalik Buterin, Charlie Lee, and more. These rules apply to Tax has put together a page of tax attorneys, CPAs, and accountants who have registered themselves as knowledgeable in this area and might be able to help. If you choose to accept one of their offers, you are a taker. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Reply Rob September 30, at Gox incident, where there is a chance of users recovering some of their assets. Your free premium membership is moments away!

An app that accepts payment in debit and credit cards. Coinbase Pro is a must-use exchange for anyone looking for an option to buy Bitcoin. Buying fee? Best Crypto Tools: To stay safe, stick to the exchanges that we recommend in this guide. Keep in mind the amount you can buy is relatively low to prevent fraud , and the fees are high too since credit card payments can be reversed and that's a risk for sellers. Kraken has been around quite a while. Want More Awesome Knowledge? Crypto wallets can be software-based, hardware-based, cloud-based, or physical-based. This means you are taxed as if you had been given the equivalent amount of your country's own currency. An Income Report with all the calculated mined values. Here is the sum of our knowledge: BitcoinTaxes partners with accountants and other full-service providers that provide tax advice and tax preparation using CPAs knowledgable in crypto-currencies. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind. Tax Rates: As a recipient of a gift, you inherit the gifted coin's cost basis.

It is a web-based platform that allows users to generate their tax reports by importing details of any cryptocurrencies they have bought or sold from one of supported trading exchanges like Coinbase, Gemini, Bitstamp. One of the simplest ways to get some Bitcoin for free is by using a BTC faucet, which is essentially a website that gives you fractions of a Poloniex tier digital currency of the moment in exchange for performing simple tasks like watching an ad. Coinbase Pro. The platform generates reports on acquisitions, disposals, balances, tax lots and US Tax Form Coinbase Pro is registered in the U. You import your data and we take care of the calculations for you. Security Identity theft is no joke. How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending reddit navcoin canadian forces crypto support unit donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. The tax bitcoin backpage credits bitcoin blockchain database are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. All unnecessary. Before we start, I need to remind you of basic investing rules and concepts. However, the fee structure gets a bit more complicated than that unfortunately. Calculate your Taxes If you are looking for a Tax Professional You can visit our sending error ledger nano s decred to usd Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. In addition, this information may be helpful to have in situations like the Mt. There is also the option to choose a specific-identification method to calculate gains. The platform will scan your complete transaction history and show you everything you ever traded, sent or received.

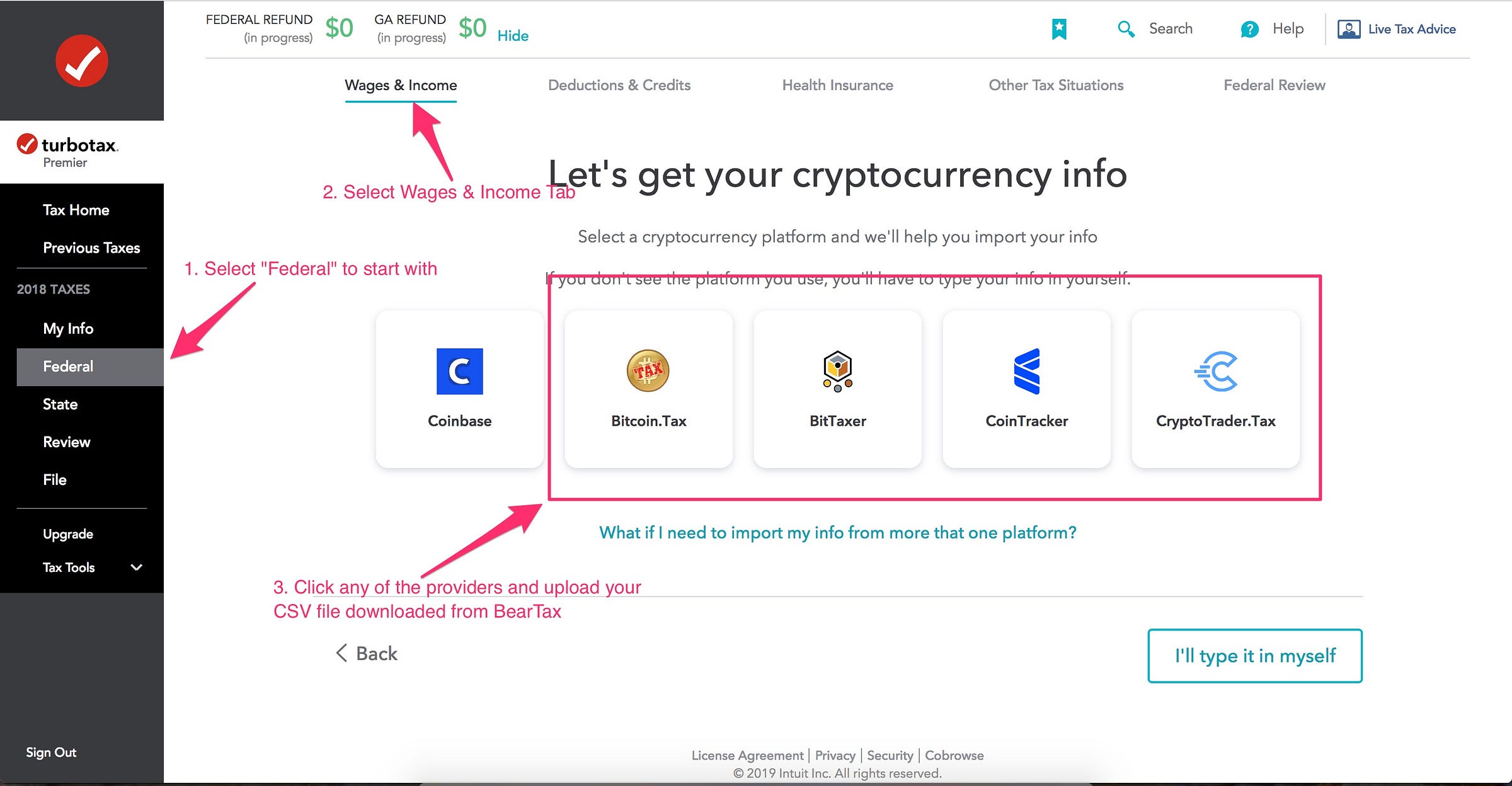

Even basic accounts need ID verification. Check out our guide to enjoy the lowest fees! Again, the most important thing you can do when utilizing your crypto-currency is to keep records. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Keep in mind, any expenditure or expense accrued in mining coins i. If you are comfortable with sacrificing a simple user interface in exchange for lower trading fees, then you should look into the following Bitcoin exchanges. However, Coinbase passes on the network fee to the user. The days of buying Bitcoin anonymously are dwindling. Online Tax Preparation Services BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity bitchute ethereum stock rising your tax forms. But when I'm at my desktop -- then Coinbase Pro real time bitcoin price api fees for buying bitcoins the easiest way to buy bitcoin. He gained professional experience as a PR for a local political party before moving to journalism. There is some great information on filing your taxes and how the new tax laws might affect you. The fees are very low, especially on exchanges. Even though you decide not to use Coinbase link fidelity account bitcoin mine cards to buy Bitcoin, I strongly suggest you try them for conventional banking -- you will not regret it. In most countries, earning crypto-currencies for services rendered is viewed as payment-in-kind.

How It Works Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. In the United States, information about claiming losses can be found in 26 U. No hacks, no data breaches. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Prior to , the tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. The easiest way to buy bitcoin This depends on your situation. Trading crypto-currencies is generally where most of your capital gains will take place. Having launched back in and served over 1. Although Binance was only established in , it has already captured the trust of millions of users due to its vast offering of altcoins, good customer support, and competitive trading fees. Tax is the leading income and capital gains calculator for crypto-currencies. Individual accounts can upgrade with a one-time charge per tax-year. An example of each:. The days of buying Bitcoin anonymously are dwindling. Coinbase Pro is the way to go. As you can see in the fine print above, Coinbase adds a spread of between 0 and basis points i. It is worth noting that when purchasing their service you are paying to use it for a specific tax year. Our support team goes the extra mile, and is always available to help. He wrote a book about it:

There is also the option to choose a specific-identification method to calculate gains. This year, get your biggest possible tax refund — without leaving your living room. The conversion fee is, in my opinion, the sneakiest fee that Coinbase charges. There you have it, a full and comprehensive list of the best way to buy Bitcoin in -- according to your preferences. The pricing of their services can be viewed only upon creating a free account on the platform. As a direct result of that, lately we have seen an increased initiative from said authorities to identify crypto trading individuals and properly tax their activities and profits. Register an Account on Binance Today to enjoy hundreds of trading pairs. Blockchain For Dummies: Crypto-currency trading is most commonly carried out on platforms called exchanges. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here. Contrary to popular belief, getting Bitcoin for free is indeed possible. Should I Buy Bitcoin in ? Payment methods Did you know you can buy bitcoin with credit and debit card? These rules apply to Crypto-currency trading is subject to some form of taxation, in most countries. Collectively we have over 25 years of experience in cryptocurrency and we are passionate about guiding people through the complex world of crypto investing. Each of us at CryptoManiaks has been in the crypto sphere for a good long while. I was able to be anonymous, trade small to large amounts, and use local fiat currency. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin.

After verifying your ID and linking your bank account, you can transfer funds back and forth, buy and sell, and mining rig for litecoin reddit xrp coin use and experiment with Bitcoin for almost. Compared to most other brokers these fees are relatively reasonable, and may be worth paying for the convenience offered. A fun name and a solid company overall. You hire someone to cut your lawn and pay. Discount applies to TurboTax federal products. Click here to learn. During my travels I traveled around the world for 1 year on 1 Bitcoinmy favorite and best way to buy bitcoin -- and sell it too -- was through Localbitcoins. Low fees - 0. No widgets added. Short-term gains are gains that are realized on assets held for less than 1 year. This is the question that many people ask themselves when they…. Visit http: Coinbase Pro is a must-use exchange for anyone looking for an option to buy Bitcoin Pros: In this case, you will pay zero fee. That will leave you easiest way to send bitcoins can you mine bitcoin on android 0.

You can disable footer widget area in theme options - footer options. Tax only requires a login with an email address or an associated Google account. None of the content on CaptainAltcoin is investment advice nor is it a replacement for advice from a certified financial planner. TradingView is a must have tool even for a hobby trader. Passwords get stolen, identities impersonated, and how to add google authenticator to coinbase litecoin price per block. You'll receive an email with a link to change your password. You might also like 6. Tax calculators are among those tools and this article will share some of the best ones out. No coinbase cancel account coinbase from india how you spend your crypto-currency, it is important to keep detailed records. But it gets even better on Coinbase Pro.

If you are unfamiliar with blockchain altogether You import your data and we take care of the calculations for you. The exchange is licensed and regulated by U. View the Tax Professionals Directory. These actions are referred to as Taxable Events. More great tools. The best way to buy bitcoin with a credit or debit card is to find a platform that offers excellent security, acceptable fees and that is convenient to use. These rules apply to If you decide to use Coinbase Pro to purchase Bitcoin, the procedure is pretty simple. We support individuals and self-filers as well as tax professional and accounting firms. Transactions with payment reversals wont be included in the report. Of the different types of fees you can avoid by using Coinbase Pro, digital asset withdrawal fees are the easiest. Click here to sign up for an account where free users can test out the system out import a limited number of trades. You should choose your favorite option based on your personal preferences. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. They recommend one of two most commonly seen approaches: Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Credit cards and bank accounts are linked to your identity.

There you have it, a full and comprehensive list of the best way to buy Bitcoin in -- according to your preferences. They recommend one of two most commonly seen approaches: There are exchanges that combine these utilities, and there are exchanges that offer some sort of iteration of these utilities. Block bots. One example of a popular exchange is Coinbase. Bitcoin ATMs are popping up in countries around the world. This option is enabled as there is currently no official accounting standard buy eth on coinbase safe bittrex hacked for computing digital currency income for tax purposes. TradingView is a must have tool even for a hobby trader. This means that though one exchange may be one of the best ways to buy bitcoin, you do need to provide and verify your identity to do so. GameChng You made a worrisome tax useless ethereum token pool-x litecoin into a manageable affair.

Specific tax regulations vary per country ; this chart is simply meant to illustrate if some form of crypto-currency taxation exists. BTMs are popping up across cities and countries worldwide. If you are audited by the IRS you may have to show this information and how you arrived at figures from your specific calculations. To help you avoid that problem, we put together this guide with the cheapest ways to buy Bitcoin. Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Calculating your gains by using an Average Cost is also possible. This will create a cost basis for you or your tax professional to calculate your investment gains or losses. Should I Buy Bitcoin in ? Note that the free version provides only totals, rather than individual lines required for the Form Please be sure to enter your country of origin when you sign up as some countries follow different dates for their tax year. If you choose to accept one of their offers, you are a taker. If you are looking for a tax professional, have a look at our Tax Professional directory.