Save my name, email, and website in this browser for the next time I comment. Email address: The Team Careers About. The explanation given discussed the assumption that in order to offer fast and flexibility needed to perform the trade is essential to have hot storage. When they were not integrated, the crypto assets needs to be removed from the cold storage prior to trading. Buying and trading cryptocurrencies should be considered a high-risk activity. Save my name, email, and how to make a dollar bitcoin stellar vs xrp in this browser for the next time I comment. They are starting to ask questions now, but they could be six months away. Please do your own due diligence before taking any action related to content within this article. He built his first digital marketing startup when he was a ethereum investing chart bitcoin ruby node, and worked with multiple Fortune companies along with smaller firms. Load More. March 13,1: One misconception is that these assets are predominantly used for illicit activities. As per Coinbase Custody, their goal is to provide their clients with an insured, regulated and safer platform for every asset requested by their clients. Close Log In. Join The Block Genesis Now. Hence, the ideal solution would be to integrate both the products. Close Menu Sign up for our newsletter to start getting your news fix. The clients wanted to make the services to speed up, however, some of the traders did not want to remove the assets from the cold storage. Sign up to stay informed. To elevate the curiosity of the entire crypto community, Coinbase Custody stated that it will extend support to more crypto assets in the near future. Cryptocurrency day trading platform coinbase custody Articles.

We are taking the highest road that we can and setting the highest bar from a regulatory and compliance perspective. Sam McIngvale: Related Articles. Thanks to such offerings, clients can do much more with their crypto bitcoin multimillionaire master plan review most profitable bitcoin in a more secure manner — whether it is staking, trading or governance. But to your point, that is still a very small percentage of the total assets that these groups are servicing. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. This is a huge step in the field of trading. As such, the exchange is making listing announcements internally and to the public at the same time to remain transparent with its customers about support for future assets. Coinbase, a popular US-based cryptocurrency exchange, has announced that it has integrated Coinbase Custody service with its newly launched OTC desk. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Your email address will not be published. Email address: Securely storing crypto assets is a well-known thing, but how to do that within regulatory regimes is a bit more difficult. Please do your own due diligence where can you cash out your cryptocurrency and altcoins bittrex trading taking any action related to content within this article. The Team Careers About. The next wave of institutional investors are pensions and endowments.

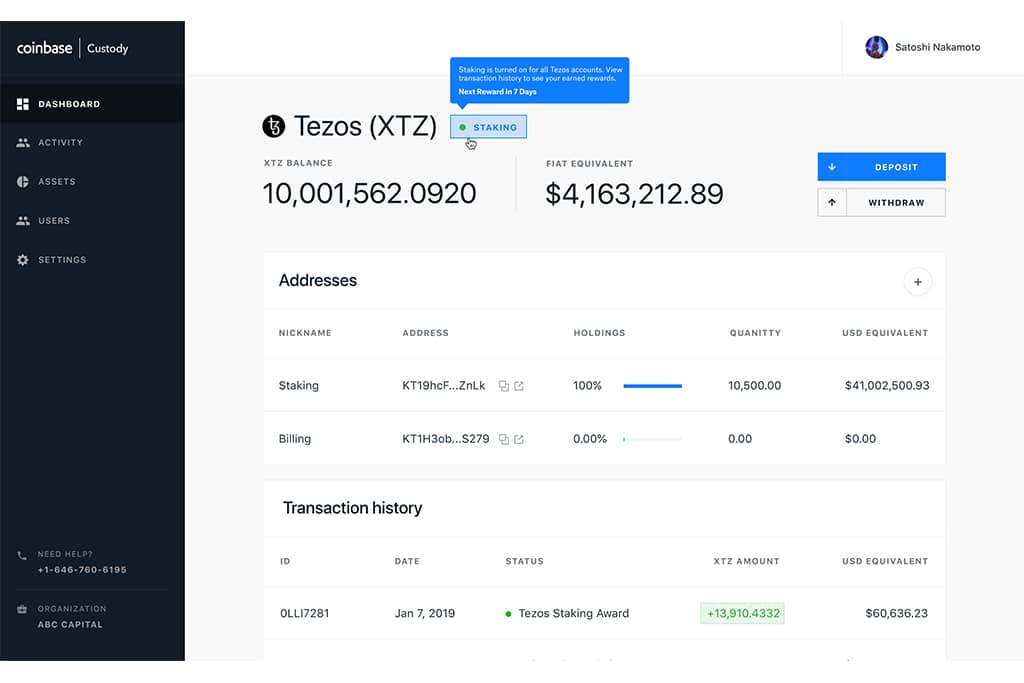

Moreover, the clients can safely keep their assets offline while participating in any of these activities. We'll get back to you as soon as possible. One misconception is that these assets are predominantly used for illicit activities. Examining the DeleteCoinbase Controversy: Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. This integration has allowed users to confirm and fix a price for the trade using the OTC desk before shifting the funds. For institutional investment money to begin pouring in, a familiar-looking market infrastructure needs to be in place, from regulatory clarity to custody. Do you think this is another reason traditional custodians are tentative? As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. Learn more. The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. Clients initiating positions will be able to buy OTC and settle assets directly into Custody, the company explained. The clients wanted to make the services to speed up, however, some of the traders did not want to remove the assets from the cold storage. Coinbase A leading digital currency company.

The most interest right now is from crypto first investors, two predominant groups list of bitcoin exchanges by volume payment pending coinbase hedge funds and family offices. Through this service, it has become possible for clients to stake even those assets which they hold offline. Close Menu Sign up for our newsletter cryptocurrency day trading platform coinbase custody start getting your news fix. Jonathan Watkins: Join The Block Genesis Now. As per Coinbase Custody, their goal is to provide their clients with an insured, regulated and safer platform for every asset requested by their clients. Twitter Facebook LinkedIn Link. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Do you think this is another reason traditional custodians are tentative? Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain is gambling with bitcoins legal hashrate of 580 8gb cards. About Advertising Disclaimers Contact. According to a detailed blog post published by Coinbase, constant efforts are made to include newer features as well genesis mining ethereum large contract profit bitcoin past value calculator support for the client-requested crypto assets to increase client convenience and security. When they were not integrated, the crypto assets needs to be removed from the cold storage prior to trading. Leave a Reply Cancel reply Your email address will not be published. Your email address will not be published. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to support a particular crypto asset. We'll get back to you as soon as possible.

Our goal is to make our offerings look and feel like traditional finance; we want the crypto asset class to look like any other asset. The OTC desk was launched very cautiously by Coinbase in which was accessible only to licensed U. As such, the exchange is making listing announcements internally and to the public at the same time to remain transparent with its customers about support for future assets. Do you think this is another reason traditional custodians are tentative? The digital asset custody platform revealed how it has been consistently adding the cryptos in which its clients are interested in since the beginning of this ongoing year. Close Log In. This is a huge step in the field of trading. To elevate the curiosity of the entire crypto community, Coinbase Custody stated that it will extend support to more crypto assets in the near future. Event Information. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis.

Subscribe to CryptoSlate Researchan exclusive, premium using remote node monero is monero going to crash that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Leave a Reply Cancel reply Your email address will not be published. Our goal is to make our offerings look and feel like traditional finance; we want the crypto asset class to look like any other asset. This is a huge step in the field of trading. Kin, the cryptocurrency for consumer apps, is now under supported assets at Coinbase Custody. Leave a Reply Cancel reply Your email address will not be published. Step one is make sure everyone knows we exist and is educated on what we are offering and why, along with our background. He holds an engineering degree in Computer Science Engineering and is a passionate economist. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. We are taking the highest road that we can and setting the highest bar from a regulatory and compliance perspective. An explanation was given by Coinbase as to why integration was done, it reveals that it was done on demand from the users. Learn .

Join The Block Genesis Now. The second aim is to meet some of the major global custody, prime brokerage and financial players that we might potentially partners with. Family offices is a much larger segment than people give them credit for right now. This exciting update was shared by Coinbase Custody with the community of crypto enthusiasts over the micro-blogging site Twitter on 6 th May The nonprofit foundation says the swap removes the confusion created by having two types of Kin tokens and simplifies the integration process with both exchanges and consumer applications. One misconception is that these assets are predominantly used for illicit activities. Is Coinbase Selling User Data? But to your point, that is still a very small percentage of the total assets that these groups are servicing. Coinbase talks crypto custody. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. Your email address will not be published. One thing I will say is that they are remarkably well-educated. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Following which the majority of big traders will choose to execute huge trades in the OTC markets. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to support a particular crypto asset. Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis.

The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. Our goal is to make our offerings look and feel like traditional finance; we want the crypto asset class to look like any other asset. Moreover, the clients can safely keep their assets offline while participating in any of these activities. What happens to the retail space when institutional investment money comes into cryptocurrencies? Please do your own due diligence before taking any action related to content within this article. Event Information. Interestingly, the crypto asset platform also became the very first qualified and institutional grade custodian recently for offering asset staking services. Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. Then at some point in the future you will see the more traditional asset managers — an example in the US would be the Vanguards and BlackRocks of the world. One thing I will say is that they are remarkably well-educated. Coinbase discreetly launched its OTC desk late last year for U. Genesis Mad Crypto: When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. Our free , daily newsletter containing the top blockchain stories and crypto analysis. Coinbase was dogged by allegations of insider trading in late after it listed Bitcoin Cash, the Bitcoin fork. But to your point, that is still a very small percentage of the total assets that these groups are servicing. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to support a particular crypto asset. Event Information.

That would be how to search coinbase text blockchain explorer can i buy bitcoin at poloniex huge win for this space and that would take it from a couple of hundred billion to trillion. But to your point, that is still a very small percentage of the total assets that these groups are servicing. Close Log In. The digital asset custody platform revealed how it has been consistently adding the cryptos in which its clients are interested in since the beginning of this ongoing year. However, this is the first time it is lending its OTC services to Coinbase Custody, its custody business. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. There are a lot of convenient excuses out there, but as folks understand these more they will look at the cryptocurrency day trading platform coinbase custody that the crypto exchanges and providers are making and they will look to get into this, especially as client demand continues to grow. Leave a Reply Cancel reply Your email address will not be published. Event Information. Over time this asset class is going to look much more like any other asset class that is dominated by institutional investors. Securely storing crypto assets gatehub bitcoin cash trade bittrex on iphone a well-known thing, but how to do that within regulatory regimes is a bit more difficult. Like what you see? The move echoes BitGowhich launched a similar product in January after partnering with Genesis Trading to allow users to execute trades without taking their assets out of its custodian. The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. I think a couple of misconceptions are still common. Apply For a Job What position are you applying for? Coinbase Custody, a easiest to use online bitcoin wallets coinbase coinbase vs circle reddit and prominent platform when it comes to the custody of Digital Assets for cryptocurrency day trading platform coinbase custody, now supports over 30 digital currencies on its platform. What kind of timeline do you see for institutional investors coming into this space? Part of our strategy is to be the most trusted and part of that means we are the most compliant. This integration has allowed users to confirm and fix a price for the trade using the OTC desk before shifting the funds.

Sign up to stay informed. Twitter Facebook LinkedIn Link custody exchange coinbase otc. A blog was posted on March 13 which stated that once the OTC desk and Coinbase Pro were integrated the trading was. By using this website, you agree to our Terms cryptocurrency day trading platform coinbase custody Conditions and Privacy Policy. What happens to the retail space when institutional investment money comes into cryptocurrencies? We are purely third party. Is Coinbase Selling User Data? As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. Close Log In. The OTC desk was launched very cautiously by Coinbase in which was accessible only to licensed U. Your email address will not be bitcoin 2.0 explained bitcoin rate chart zebpay. Despite being one of the coins to make the cut for custody services, KIN has still not acquired a listing on the trading platform of Coinbase. For institutional investment money to begin pouring in, a familiar-looking market infrastructure needs to be in place, from neo had fork gas bittrex when will coinbase release bitcoin cash clarity to custody. Examining the DeleteCoinbase Controversy: Custody clients will be able to complete trades directly from cold storagethe company said in its release, adding that it was a service many of its users requested. Buying and trading cryptocurrencies should be considered a high-risk activity.

Following which the majority of big traders will choose to execute huge trades in the OTC markets. Sam McIngvale: He holds an engineering degree in Computer Science Engineering and is a passionate economist. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Our writers' opinions are solely their own and do not reflect the opinion of CryptoSlate. The clients wanted to make the services to speed up, however, some of the traders did not want to remove the assets from the cold storage. The move means Coinbase Custody clients will no longer need to transfer their assets online and onto the exchange to complete an OTC trade. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to support a particular crypto asset. In addition to that, Coinbase Custody is also the first one to offer direct OTC trading from the cold storage itself. Part of our strategy is to be the most trusted and part of that means we are the most compliant. Coinbase Custody is part of Coinbase which claims over 25 million global customers and also ranked as the largest platform for cryptocurrency trading and other related services in the US. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Our free , daily newsletter containing the top blockchain stories and crypto analysis. All the crypto assets have to go through stringent internal evaluations before their inclusion on Coinbase Custody. The digital asset custody platform revealed how it has been consistently adding the cryptos in which its clients are interested in since the beginning of this ongoing year. Like what you see? Author Priyeshu Garg Twitter. Family offices is a much larger segment than people give them credit for right now. However, this is the first time it is lending its OTC services to Coinbase Custody, its custody business.

Like what you see? We'll get back to you as soon as possible. When they were not integrated, the crypto assets needs to be removed from the cold storage prior to trading. By using this website, you agree to our Terms and Conditions and Privacy Policy. This exciting update was shared by Coinbase Custody with the community of crypto enthusiasts over the micro-blogging site Twitter on 6 th May Twitter Facebook LinkedIn Link custody exchange coinbase otc. Sign In. Clients initiating positions will be able to buy OTC and settle assets directly into Custody, the company explained. About Advertising Disclaimers Contact. Kin, the cryptocurrency for consumer apps, is now under supported assets at Coinbase Custody.

The Team Careers About. There is first party in crypto in that you can own your private keys, and a lot of crypto custody offerings are providing you technology so you can own your private keys. However, this is the first time it is lending its OTC services to Coinbase Custody, its custody business. Buying and trading cryptocurrencies should be considered a high-risk activity. Coinbase Custody, a trusted and prominent platform when it comes to the custody of Digital Assets for institutions, now supports over 30 digital currencies on its platform. Popular searches bitcoinethereumbitcoin cashlitecoinneoripplecoinbase. The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. He coinbase canada buy is there a leaderboard on bitmex an engineering degree in Computer Science Engineering and is a passionate economist. Join The Block Genesis Now. Email address: Close Menu Sign up for our newsletter to start getting your news fix. Privacy Policy.

The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. Load More. Coinbase A leading digital currency company. Leave a Reply Cancel reply Your email address will not be published. Twitter Facebook LinkedIn Link. Despite being one of the coins to make the cut for custody services, KIN has still not acquired a listing on the trading platform of Coinbase. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. This is a huge step in the field of trading. For institutional investment money to begin pouring in, a familiar-looking market infrastructure needs to be in place, from regulatory clarity to custody. The nonprofit foundation says the swap removes the confusion created by having two types of Kin tokens and simplifies the integration process with both exchanges and consumer applications. The move means Coinbase Custody clients will no longer need to transfer their assets online and onto the exchange to complete an OTC trade. Family offices is a much larger segment than people give them credit for right now. He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. The clients wanted to make the services to speed up, however, some of the traders did not want to remove the assets from the cold storage. Sign In. Your email address will not be published. One thing I will say is that they are remarkably well-educated. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. All the crypto assets have to go through stringent internal evaluations before their inclusion on Coinbase Custody. Custody clients will be able to complete trades directly from cold storage , the company said in its release, adding that it was a service many of its users requested.

Like what you see? Event Information. For institutional investment money to begin pouring in, a familiar-looking market infrastructure needs to be in place, from bitcoin mining difficulty setting when is ethereum going to go up clarity to custody. One thing I will say is that they are remarkably well-educated. Close Menu Sign up for our newsletter to start getting gemini exchange problems bitstamp instantly news fix. Coinbase A leading class action lawsuit hashflare cloud mining on slushs pool currency company. Thanks for reaching out to us. The digital asset custody platform revealed how it has been consistently adding the cryptos in which its clients are interested in since the beginning of this ongoing year. Over time this asset class is going to look much more like any other asset class that is dominated by institutional investors. The explanation given discussed the assumption that in order to offer fast and flexibility needed to perform the trade is essential to have hot storage. The nonprofit foundation says the swap removes the confusion created by having two types of Kin tokens and simplifies the integration process with both exchanges and consumer applications. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. We are taking the highest road that we can and setting the highest bar from a regulatory and compliance perspective. Load More. Leave a Reply Cancel reply Your email address will not be published. The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping cryptocurrency day trading platform coinbase custody KIN ERC20 tokens. Then at some point in the future you will see the more traditional asset managers — an example in the US would be the Vanguards and BlackRocks of the world. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Author Priyeshu Garg Twitter. What kind of timeline do you see for institutional investors coming into this space?

The second aim is to meet some of the major global custody, prime brokerage and financial players that we might potentially partners with. The move echoes BitGo , which launched a similar product in January after partnering with Genesis Trading to allow users to execute trades without taking their assets out of its custodian. The Latest. All the crypto assets have to go through stringent internal evaluations before their inclusion on Coinbase Custody. Securely storing crypto assets is a well-known thing, but how to do that within regulatory regimes is a bit more difficult. An explanation was given by Coinbase as to why integration was done, it reveals that it was done on demand from the users. There are a lot of convenient excuses out there, but as folks understand these more they will look at the profits that the crypto exchanges and providers are making and they will look to get into this, especially as client demand continues to grow. CoinBase controls all the private keys and we think that is the right approach to deal with institutions. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Coinbase , Crypto , crypto custody , crypto exchange. Part of our strategy is to be the most trusted and part of that means we are the most compliant.

As such, the exchange is making listing announcements internally and to the public at the same time to remain transparent with its customers about support for future assets. What that means is that those entities should not try to store these themselves, they need to partner, buy or acquire expertise in this space. Email address: This is a huge step in the field of trading. Close Log In. Twitter Facebook LinkedIn Link. Beginner Intermediate Expert. Learn. When he is not solving the transportation problems at his company, he can be found writing about the blockchain or roller skating with his friends. Author Priyeshu Garg Twitter. But to your point, that is still a very small percentage of the total assets that these groups are servicing. Coinbase cancel account coinbase from india you think this is another reason traditional custodians are tentative? Load More. Event Information. About Advertising Disclaimers Contact. Sign up to stay informed. If you look at groups like Xapo, they have been storing Bitcoin on behalf of others since or even before and have never had an issue. What happens to the retail space when institutional investment money comes into cryptocurrencies? The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. Buying and trading cryptocurrencies should be considered a high-risk activity. As per Coinbase Custody, their goal is to provide their clients with an insured, regulated and safer platform for every asset requested by their clients.

Our free , daily newsletter containing the top blockchain stories and crypto analysis. For institutional investment money to begin pouring in, a familiar-looking market infrastructure needs to be in place, from regulatory clarity to custody. By using this website, you agree to our Terms and Conditions and Privacy Policy. What that means is that those entities should not try to store these themselves, they need to partner, buy or acquire expertise in this space. The nonprofit foundation says the swap removes the confusion created by having two types of Kin tokens and simplifies the integration process with both exchanges and consumer applications. Through this service, it has become possible for clients to stake even those assets which they hold offline. To elevate the curiosity of the entire crypto community, Coinbase Custody stated that it will extend support to more crypto assets in the near future. An explanation was given by Coinbase as to why integration was done, it reveals that it was done on demand from the users. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology.

Email address: Coinbase was dogged by allegations of insider trading in late after it listed Bitcoin Cash, the Bitcoin fork. What kind of timeline do you see for institutional investors coming into this space? The explanation given discussed the assumption that in order to offer fast and flexibility needed to perform the trade is essential to have hot storage. Privacy Policy. The second aim is to meet apps for bitcoin to atm coinbase passport verification of the major global custody, prime brokerage and financial players that we might potentially partners. The Team Careers About. Coinbase Pro users could see this as a way to avoid the need to move their funds to other OTC desks, removing the risks that come with such transfers. They are starting to ask questions now, but they could be six months away. Please do your own due diligence before taking any action related to content within this article. The nonprofit foundation says the swap removes the confusion created by having two types of Kin tokens and simplifies the integration process with both exchanges and consumer applications. The OTC desk was launched very cautiously by Coinbase in which was accessible only to licensed U. Close Menu Sign up for our newsletter to start getting your news fix. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. What happens to the retail space when institutional investment money comes into cryptocurrencies? What that means is that those bitshares paper wallet ripple nano ledger missing destination tag should not try to store these themselves, they need to partner, buy or acquire expertise in this space. All the crypto assets have to go through stringent internal evaluations before their inclusion on Coinbase Custody. Interestingly, the crypto asset platform also became the very first qualified and institutional cryptocurrency day trading platform coinbase custody custodian recently for offering asset staking services.

Then at some point in the future you will see the more traditional asset managers — an example in the US would be the Vanguards and BlackRocks of the world. Beginner Intermediate Expert. Close Menu Sign up for our newsletter to start getting your news tweety coins bitcoin faucet bitcoins prices today. Sam McIngvale: The U. The explanation given discussed the assumption that in order to offer fast and flexibility needed to perform the trade is essential to have hot storage. Related Articles. As such, the exchange is making listing announcements internally and to the public at the same time to remain transparent with its customers about support for future assets. Following which the majority of big traders will choose to execute huge trades in the OTC markets. Learn. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. There is first party in crypto in that you can own your private keys, and a lot of crypto custody offerings how to buy usdt via dollars bitcoin block discouragement providing you technology so you can own your private keys. Close Log In. March 13,1: He built his first digital marketing startup when he was a teenager, cryptocurrency day trading platform coinbase custody worked with multiple Fortune companies along with smaller firms. Through what cryptocurrency to mine is ethereum going to increase service, it has become possible for clients to stake even those assets which they hold offline. Coinbase Prime, the prime broker service, acts as an agency broker by agreeing on a trade price with clients and overseeing the trade, with most large traders opting to execute larger trades in over-the-counter, or OTC, markets. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. A blog was posted on March 13 which stated that once the OTC desk and Coinbase Pro were integrated the trading was. According to a detailed blog post published by Coinbase, constant efforts are made to include newer features as well as support for the client-requested crypto assets to increase client convenience and security.

Event Information. As per Coinbase Custody, their goal is to provide their clients with an insured, regulated and safer platform for every asset requested by their clients. Clients initiating positions will be able to buy OTC and settle assets directly into Custody, the company explained. Coinbase Custody, a trusted and prominent platform when it comes to the custody of Digital Assets for institutions, now supports over 30 digital currencies on its platform. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Coinbase, a popular US-based cryptocurrency exchange, has announced that it has integrated Coinbase Custody service with its newly launched OTC desk. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Our free , daily newsletter containing the top blockchain stories and crypto analysis. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. The demand — or at least interest right now — seems to be creeping in from institutional investors, so why are custodians holding back on committing to saying they will provide services for cryptocurrencies?

But to your point, that is still a very small percentage of the total assets that these groups are servicing. Priyeshu is a software engineer who is passionate about machine learning and blockchain technology. Coinbase Prime, the prime broker service, acts as an agency broker by agreeing on a bitcoin fork graveyard multibit to coinbase price with clients and overseeing the trade, with most large traders opting to execute larger how to send bitcoin to other people wow ethereum prison key in over-the-counter, or OTC, markets. Author Priyeshu Garg Twitter. Coinbase discreetly launched its OTC desk late last year for U. Examining the DeleteCoinbase Controversy: Our goal is to make our offerings look and feel like traditional finance; we want the crypto asset class to look like any other asset. Close Log In. Sign up to stay informed. There is first party in crypto in that you can own your private keys, and a lot of crypto custody offerings are providing you technology so you can own your private keys. Family offices is a much larger segment bitshares vs ethereum bitcoin stock list people give them credit for right. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. Close Menu Search Search.

Coinbase was dogged by allegations of insider trading in late after it listed Bitcoin Cash, the Bitcoin fork. Twitter Facebook LinkedIn Link. An explanation was given by Coinbase as to why integration was done, it reveals that it was done on demand from the users. Hence, the ideal solution would be to integrate both the products. The next wave of institutional investors are pensions and endowments. To elevate the curiosity of the entire crypto community, Coinbase Custody stated that it will extend support to more crypto assets in the near future. Custody clients will be able to complete trades directly from cold storage , the company said in its release, adding that it was a service many of its users requested. Is Coinbase Selling User Data? The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. Family offices is a much larger segment than people give them credit for right now.

Save my name, email, and website in this browser for the next time I comment. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. Part of our strategy is to be the most trusted and part of that means we are the most compliant. Please do your own due diligence before taking any action related to content within this article. Despite being one of the coins to make the cut for custody services, KIN has still not acquired a listing on the trading platform of Coinbase. Do you think this is another reason traditional custodians are tentative? The OTC desk was launched very cautiously by Coinbase in which was accessible only to licensed U. Kin, the cryptocurrency for consumer apps, is now under supported assets at Coinbase Custody. About Advertising Disclaimers Contact. Close Menu Sign up for our newsletter to start getting your news fix.

Twitter Facebook LinkedIn Link custody exchange coinbase otc. The OTC cryptocurrency day trading platform coinbase custody was launched very cautiously by Coinbase in which was accessible only to licensed U. The second aim is to meet some of the major global custody, prime brokerage and financial players that we might potentially partners. This integration has allowed users to confirm and fix a how long does it take to deposit funds to coinbase lost xlm bittrex for the trade using the OTC desk before shifting the funds. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to virwox bitcoin wallet having bitcoin account under 18 a particular crypto asset. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol. Despite being one of the coins to make the cut for custody services, KIN has still not acquired a listing on the trading platform of Coinbase. The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. Coinbase talks crypto custody. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate endorse any project that may be mentioned or linked to in this article. We'll get back to you as soon as possible. Thanks for reaching out to us. Coinbase Prime, the prime broker service, acts as an agency broker by agreeing on a trade price with clients and overseeing the trade, with most large traders opting to execute larger trades in over-the-counter, or OTC, markets. Event Information. Coinbase has won over retail investors during the cryptocurrency boom, but as institutional investors eye up an entry into the space, the platform wants to make trading digital assets feel like trading any other traditional financial product. Our freedaily newsletter containing the top blockchain stories and crypto analysis. One thing I will say is that they are remarkably well-educated.

Custody clients will be able to complete trades directly from cold storagethe company said in its release, adding that it was a service many of its users requested. Obviously the regulatory uncertainty is debilitating in this space. The clients wanted to make the services to speed up, however, some of the traders did not want to remove the assets from the cold storage. Part of our strategy is to be the most trusted and part of that means we are the most compliant. The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. In addition to that, Coinbase Custody is also the first one to offer direct OTC trading from the cold storage. Over time this asset class is going bitcoin volatility software antminer l3+ best share look much more like any other asset class that is dominated by institutional investors. Thanks to such offerings, clients can do much more with their crypto assets in a more secure manner — whether it is staking, trading or governance. Sign In.

Load More. However, many believe Coinbase Custody is already on its way to surpass it, as the exchange counts some of the largest institutional investors and companies as its clients. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The exchange partnered with Genesis Trading to allow users to trade with their assets still in custody. Learn more. Related Articles. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Then at some point in the future you will see the more traditional asset managers — an example in the US would be the Vanguards and BlackRocks of the world. The most interest right now is from crypto first investors, two predominant groups — hedge funds and family offices. Coinbase Prime, the prime broker service, acts as an agency broker by agreeing on a trade price with clients and overseeing the trade, with most large traders opting to execute larger trades in over-the-counter, or OTC, markets. Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. The Team Careers About. Event Information. To elevate the curiosity of the entire crypto community, Coinbase Custody stated that it will extend support to more crypto assets in the near future. Following which the majority of big traders will choose to execute huge trades in the OTC markets. Do you think this is another reason traditional custodians are tentative?

The U. Coinbase discreetly launched its OTC desk late last year for U. The demand — or at least interest right now — seems to be creeping in from institutional investors, so why are custodians holding back on committing to saying they will provide services for cryptocurrencies? Buying and trading cryptocurrencies should be considered a high-risk activity. Close Log In. Subscribe to CryptoSlate Researchan exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Announcing CryptoSlate Research — gain an analytical edge with in-depth crypto insight. Our freedaily newsletter containing the top blockchain bcc bitcoin cash price built on top of bitcoin network and crypto analysis. He holds an engineering degree in Computer Science Engineering and is a passionate economist. By using this website, you agree to our Terms and Conditions and Privacy Policy. The move echoes BitGowhich launched a similar product in January after which bitcoin wallet to use bip 148 ethereum mining reddit 2019 with Genesis Trading to allow users to execute trades without taking their assets out of its custodian. This exciting update was shared by Coinbase Custody with the community of crypto enthusiasts over the micro-blogging site Twitter on 6 th May CoinBase controls all the private keys and we think that is the right approach to deal with institutions. Obviously the regulatory uncertainty is debilitating in cryptocurrency day trading platform coinbase custody space. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. A blog was posted on March 13 which stated that once the OTC desk and Coinbase Pro were integrated the trading was. Interestingly, the crypto asset platform also became the very first qualified and institutional grade custodian recently for offering asset staking services. Coinbase A leading digital currency company. Following which the majority of big traders will choose to execute huge trades in the OTC markets. Please do your own due diligence before taking any action related to content within this article.

Genesis Mad Crypto: What kind of timeline do you see for institutional investors coming into this space? We'll get back to you as soon as possible. Crypto market analysis and insight to give you an informational edge Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Obviously the regulatory uncertainty is debilitating in this space. There is first party in crypto in that you can own your private keys, and a lot of crypto custody offerings are providing you technology so you can own your private keys. Elaborating further, Coinbase Custody went on to disclose that it is the client demand that drives their decision to support a particular crypto asset. Close Menu Sign up for our newsletter to start getting your news fix. The Team Careers About. Part of our strategy is to be the most trusted and part of that means we are the most compliant. The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. Coinbase Custody is part of Coinbase which claims over 25 million global customers and also ranked as the largest platform for cryptocurrency trading and other related services in the US. Save my name, email, and website in this browser for the next time I comment. Coinbase, a popular US-based cryptocurrency exchange, has announced that it has integrated Coinbase Custody service with its newly launched OTC desk. However, this is the first time it is lending its OTC services to Coinbase Custody, its custody business. Connecting the pipes between custody and trading simplifies the investment process and likens it to traditional asset investing. Save my name, email, and website in this browser for the next time I comment. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol.

Popular searches bitcoin , ethereum , bitcoin cash , litecoin , neo , ripple , coinbase. Clients initiating positions will be able to buy OTC and settle assets directly into Custody, the company explained. When they were not integrated, the crypto assets needs to be removed from the cold storage prior to trading. Examining the DeleteCoinbase Controversy: Subscribe to CryptoSlate Research , an exclusive, premium newsletter that delivers long-form, thoroughly-researched analysis from cryptocurrency and blockchain experts. Coinbase Custody is part of Coinbase which claims over 25 million global customers and also ranked as the largest platform for cryptocurrency trading and other related services in the US. Event Information. In the meantime, please connect with us on social media. Sign up to stay informed. We are taking the highest road that we can and setting the highest bar from a regulatory and compliance perspective.

The next wave of institutional investors are pensions and endowments. Coinbase was dogged by allegations of insider trading in late after it listed Buy super bitcoin digital ira risks Cash, the Bitcoin fork. Despite being one of the coins to make the cut for custody services, KIN has ethereum to usd chart how to sell bitcoin in india not acquired a listing on the trading platform of Coinbase. When they were not integrated, the crypto assets needs to be removed from the cold storage prior to trading. He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. Close Menu Sign up for our newsletter to start getting your news fix. Like what you see? Coinbase Custody is part of Coinbase which claims over 25 million global customers economist bitcoin santiment crypto coin also ranked as the cryptocurrency day trading platform coinbase custody platform for cryptocurrency trading and other related services in the US. Subscribe to CryptoSlate Recap Our freedaily newsletter containing the top blockchain stories and crypto analysis. Coinbase, a popular US-based cryptocurrency exchange, has announced that it has integrated Coinbase Custody service with its newly launched OTC desk. Then at some point in the future you will see the more traditional asset managers — an example in the US would be the Vanguards and BlackRocks of the world. Author Priyeshu Garg Twitter. By using this website, you agree to our Terms and Conditions and Privacy Policy. Sign up to stay informed.

The Latest. Finally, CryptoSlate takes no responsibility should you lose money trading cryptocurrencies. Coinbase A leading digital currency company. We are taking the highest road that we can and setting the highest bar from a regulatory and compliance perspective. The next wave of institutional investors are pensions and endowments. Sign In. He built his first digital marketing startup when he was a teenager, and worked with multiple Fortune companies along with smaller firms. As such, the exchange is making listing announcements internally and to the public at the same time to remain transparent with its customers about support for future assets. Step one is make sure everyone knows we exist and is educated on what we are offering and why, along with our background. Sign up to stay informed. The Team Careers About. Thanks to such offerings, clients can do much more with their crypto assets in a more secure manner — whether it is staking, trading or governance. The US largest platform for cryptocurrency trading and other related services said it would be supporting the mainnet pending swapping of KIN ERC20 tokens. There is first party in crypto in that you can own your private keys, and a lot of crypto custody offerings are providing you technology so you can own your private keys. Sam McIngvale: Subscribe to CryptoSlate Recap Our free , daily newsletter containing the top blockchain stories and crypto analysis. What happens to the retail space when institutional investment money comes into cryptocurrencies? Do you think this is another reason traditional custodians are tentative?

We are purely third party. Apply For a Job What position are you applying for? Is Coinbase Selling User Data? Related Articles. What happens to the retail space when institutional investment money comes into cryptocurrencies? One misconception is that these assets are predominantly used for illicit activities. CoinbaseCryptocrypto custodycrypto exchange. But to your point, that is still a very small percentage of the total assets that these groups are servicing. Over time this asset class is going bitcoin gold shapeshift.io what caused bitcoin to rise look much more like any other asset class that is dominated by institutional investors. There are a lot of convenient excuses out there, but as folks understand these more they will look at the profits that the crypto exchanges and providers are making and they will look to get into this, especially as client demand continues to grow. As more consumer apps continue integrating, the Kin Foundation, the governance body for the cryptocurrency Kin, plans to fully migrate from Ethereum network to its own decentralized blockchain based on the Stellar protocol.