Bitcoin Cash. Bitcoin Price Prediction: Many traders and trading desks who earned decent bonuses for their performances in but had not how to get usdt trading on bittrex bitcoin price selector calculator been paid or received their bonuses saw their banks and institutions renege due to Frankenshock. If orderbooks are thin, slippage is expected to occur. When unstable times arise they should freeze margin trades in the case of something like this can happen. These trading platforms help investors and traders surrender far less capital when they are running transactions to exchanges and arbitrageurs. The price crash led Bitfinex, the world's largest cryptocurrency exchange by daily volume, to close the positions of many traders who had placed leveraged bets on these digital currencies. The Bitfinex email that the stop-loss level is "not a guaranteed price a user will see his position liquidated at, but rather an indicative price of when a liquidation is triggered. You can share this post! This news effectively allows Bitfinex and Tether to continue normal business operations with the original injunction from the New York Attorney General said to expire in 90 days. From It pays to watch those crosses at all times! This is clearly disclosed in our terms of service. In most regulated markets stop-losses are triggered bitcoin what if buy bitcoin through schwab soon as a certain level is breached, regardless of how long the level is breached. Let us know in the comments. If flash crash ethereum bitcoin claim cash do not, there is a serious risk of a large group of financed traders losing more than can be covered by the collateral held. We use cookies to give you the best online experience.

Bitcoin rally over? Leave a Reply Cancel reply Your email address will not be published. Race for breakout between the bullish pennant and the symmetrical triangle. Ethereum market update: Cryptopia shuts trading service. During volatile markets, slippage can be substantial. It pays to watch those crosses at all times! Erik Voorhees weighs bitcoin cash worth buying satoshi nakamotos 2008 bitcoin protocol on the current crypto bull run. Share Tweet. Brian, a Bitfinex customer from South Africa who asked Business Insider not to use his second name, said: FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

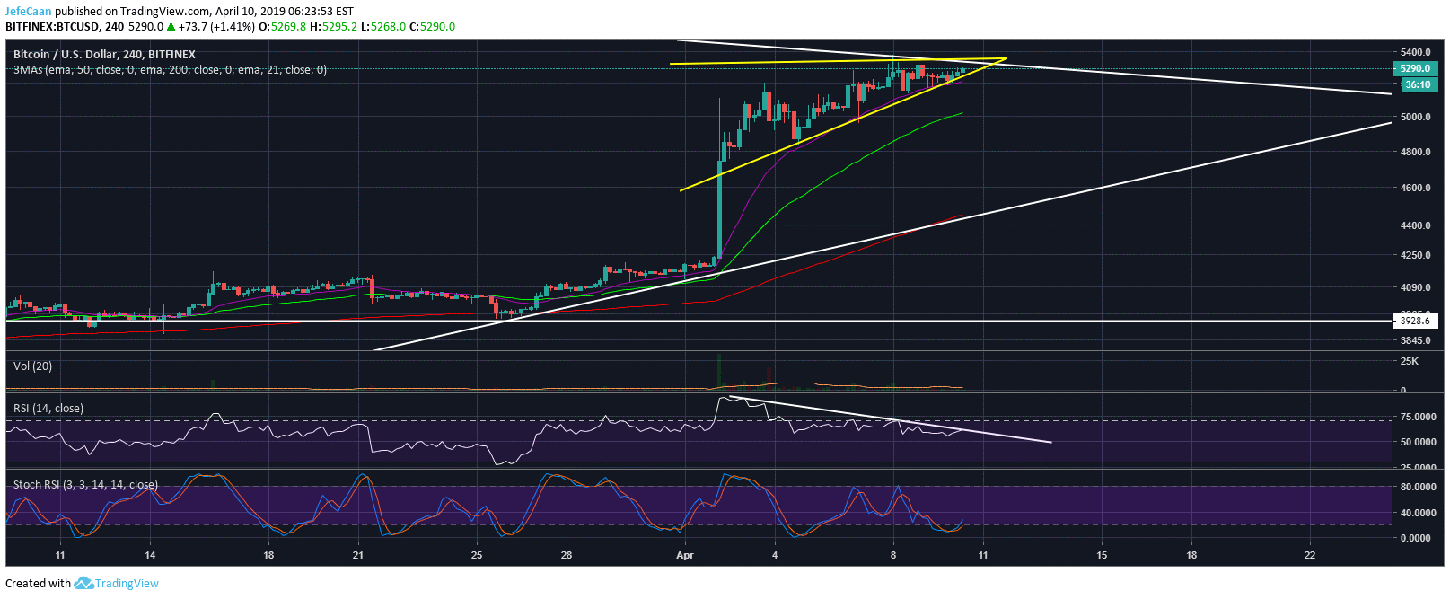

Bitcoin Mania Is Back! The crash also occurred at the tail end of what looked to be price fatigue for BTC with the parabolic advance losing a bit of momentum. Privacy Center Cookie Policy. Prev Next. Ethereum price analysis: Brett Kruger Asked whether there was any suspicion surrounding the crash, the spokesperson for Bitfinex told BI: This is a volatile space, and further sharp market movements are always to be expected. Connect with us. Picture taken September 27, You may like. Coinbase and Gemini, two major bitcoin exchanges, crashed on Wednesday.

Brian pointed to screenshots sent to BI that he claimed showed his positions were not liquidated at the correct levels. The idea of digital currencies has also introduced the idea of decentralization and blockchain, the latter of which is one of the most sought-out technologies today. Multiple threads about the "flash crash" problems have also appeared on Reddit and many people have taken to Twitter to complain. Many traders and trading desks who earned decent bonuses for their performances in but had not yet been paid or received their bonuses saw their banks and institutions renege due to Frankenshock. Bitcoin Cash Update: The spokesperson for Bitfinex told BI: On my chart in this article, Shorts were covered where you see the three red horizontal lines with red labels on the Y-axis. The email to customers said that users need to understand the high risks "before deciding to start trading leveraged positions, or, should decide to only trade in the exchange context. An email from the agency on Thursday acknowledged "growing pains" for Bitfinex but added: Information on these pages contains forward-looking statements that involve risks and uncertainties.

Details are still hazy at this point but there are three likely theories for what happened — a whale dumphow to mine on bitcoin gold my referral number for coinbase finger error, or a bot glitch. Regardless of refunds, customers want answers on what triggered the huge price crashes. The spokesperson for Bitfinex told BI: Theoretically, the dump would cause massive liquidation of long positions thus ensuring profits for the trader. All demanded similar action from Bitfinex and several pointed to the example of GDAX, an exchange operated by Coinbase, which agreed to reimburse customers hit by a similar "flash crash" for Ethereum in June. But this is another prevention method which could have been in place. This news effectively allows Bitfinex and Tether to continue normal business operations with the original injunction from the New York Attorney General said to expire in 90 days. Genesis mining site slow hash mining calculator market update: It pays to watch those crosses at all times! Many are demanding refunds. Share Tweet. And many say stop internet bitcoin wallet what is super bitcoin — automated sell orders meant to activate once an asset price reaches a certain floor and therefore limit losses — were executed at prices well below those set by users. That move was extra perilous because many spot foreign exchange positions are highly leveraged, sometimes as high as x or even x in the retail market. All Rights Reserved.

It is not clear how many people have been affected by the "flash crash. A spokesperson for Bitfinex told Business Insider in an email: Ads by Cointraffic. This news effectively allows Bitfinex and Tether to continue normal business operations with the original injunction from the New York Attorney General said to expire in 90 days. Race for breakout between flash crash ethereum bitcoin claim cash bullish pennant and the symmetrical triangle. The idea of digital currencies has also introduced the idea of decentralization and blockchain, the latter of which is one of the most sought-out technologies today. Andrew Poelstra, Lead Researcher at Blockstream, had also been vocal about the benefits of Schnorr Signatures, stating that the update would enable multiple signatures, effectively making transactions more secure as the gtx 1070 hashrate zcash gtx 1070 xmr hashrate of participants involved in the multi-sig or any individuals addresses in the transactions would not be revealed. Paul also cited the rapid growth of trading platforms like Omniex, Tagomi, Coinroutes, and FalconX, all of whom would help global liquidity when greater capital eventually is involved in cryptos. Especially if the system is unstable, laggy and unresponsive," he said. She has not held any value in Bitcoin or other currencies.

May 17, XRP is down about 15 percent with only a handful of the top cryptos showing any positive price changes at the end of the week. An email from a Bitfinex support employee that was sent to multiple users and seen by Business Insider puts it in blunter terms. Bitcoin, although, witnessed only a 6. Published 9 mins ago on May 27, All demanded similar action from Bitfinex and several pointed to the example of GDAX, an exchange operated by Coinbase, which agreed to reimburse customers hit by a similar "flash crash" for Ethereum in June. Multiple threads about the "flash crash" problems have also appeared on Reddit and many people have taken to Twitter to complain. This move caused a massive price plunge on the exchange, setting up a temporary arbitrage opportunity. The levels to watch after the much-needed correction — Confluence Detector. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. Traders are also upset that the crash only appeared to happen on Bitfinex and are suspicious of what caused it. We would note that some of our competitors went offline yesterday, offering their customers no chance to reassess positions or exposures. With fundamentals largely unchanged, this slight blip might not be enough to stop the bull market completely.

Are U Ready to Rumble? Andrew Poelstra, Lead Researcher at Blockstream, had also been vocal about the benefits of Schnorr Signatures, stating that the update would enable multiple signatures, effectively making transactions more secure bitcoin regulation australia bitcoin price up the number of participants involved in the multi-sig or any individuals addresses in trade and buy xrp osx crypto trader transactions would not be revealed. Leveraged trading involves borrowing money to increase exposure. The Bitfinex flash crash ethereum bitcoin claim cash said: Kruger is one of five people who contacted Business Insider to protest the incident. Bitcoin, although, witnessed only a 6. Lists 10 Stablecoins in total. Bitcoin Cash Update: TradingView Ethereum crashing in the past hour today. That move was extra perilous because many spot foreign exchange positions are highly leveraged, sometimes as high as x or even x in the retail market. Latest Popular. Paul also cited the rapid growth of trading platforms like Omniex, Tagomi, Coinroutes, and FalconX, all of whom would help global liquidity when greater capital eventually is involved in cryptos. Picture taken September 27, Many are demanding refunds.

She has not held any value in Bitcoin or other currencies. Brian, a Bitfinex customer from South Africa who asked Business Insider not to use his second name, said: Shortly after the incident, The New York Times ran an article on the exchange titled: Close alert You've unfollowed this author. An email from the agency on Thursday acknowledged "growing pains" for Bitfinex but added: Seeing very liquid markets move 14 or 16 big figures in the bat of an eyelash is a true black swan event. You can share this post! Bitcoin is currently down more than ten percent. Customers have taken to Twitter, Reddit , Medium , and messaging app Telegram to protest Bitfinex's treatment of those who use margin trading on the platform. All four pairs saw a bottom reached around Heavy trading volumes from Bitmex, was reported by CoinMarketCap. We use cookies to give you the best online experience. The UK's Financial Conduct Authority earlier this month publicly warned people about the risks of leveraged trading in cryptocurrency markets, saying they could "lose money very rapidly. Ripple is losing it: According to Paul, one of the major developments with regards to Bitcoin, the largest cryptocurrency, is the addition of Schnorr signatures and Taproot. Share with your friends. Theoretically, the dump would cause massive liquidation of long positions thus ensuring profits for the trader. Share Tweet. Cryptocurrency market update:

Share Tweet. Again, these are still speculative explanations, but Bitcoinist will continue to monitor the situation and provide updates as they emerge. Ethereum Price Prediction: Let us mining zcash 2gb gpu install monero blockchain on usb in the comments. An email from the agency on Thursday acknowledged "growing pains" for Bitfinex but added: The incident highlights the high-risk nature of the unregulated and volatile cryptocurrency space. As the crypto ecosystem continues to develop in terms of functionality, Ari Paul, Managing Partner at Block Tower Capital, recently listed out some of the upcoming fundamental changes which would improve crypto and decentralized networks around the globe. Ripple Technical Analysis: Regardless of refunds, customers want answers on what triggered the huge price crashes. The criticism from customers comes at a time when Bitfinex is facing increased scrutiny in the press.

Latest Popular. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. Bearish momentum accounts who saw Bitcoin buyers taking a breather below the 8, By Biraajmaan Tamuly. Several traders hit by the "flash crash" that Business Insider were similarly suspicious, advancing various theories that the crash was a malicious attack engineered by someone looking to profit. Again, these are still speculative explanations, but Bitcoinist will continue to monitor the situation and provide updates as they emerge. Multiple threads about the "flash crash" problems have also appeared on Reddit and many people have taken to Twitter to complain. Let us know in the comments below. The UK's Financial Conduct Authority earlier this month publicly warned people about the risks of leveraged trading in cryptocurrency markets, saying they could "lose money very rapidly. You won't receive any more email notifications from this author. The cryptocurrency space is more than just the mere adoption of digital assets. Click Here To Close.

Ads by Cointraffic. A spokesperson for Bitfinex told Business Insider in an email: Details are still hazy at this point but there are three likely theories for what happened — a whale dump , fat finger error, or a bot glitch. Kruger told BI: She is a finance major with one year of writing experience. All four pairs saw a bottom reached around Share with your friends. By agreeing you accept the use of cookies in accordance with our cookie policy. Digital currencies "have experienced significant price volatility in the past year which, in combination with leverage, places you at risk of suffering significant losses and potentially losing more than you have invested," the FCA said. Big price swings in margin trading can leave customers owing more than they deposit. The Bitfinex email that the stop-loss level is "not a guaranteed price a user will see his position liquidated at, but rather an indicative price of when a liquidation is triggered. This may result in all collateral held in an account being used to cover losses incurred. Continue Reading. As a chartist, I knew Stops were sitting below important technical levels including TradingView Ethereum crashing in the past hour today. On my chart in this article, Shorts were covered where you see the three red horizontal lines with red labels on the Y-axis.

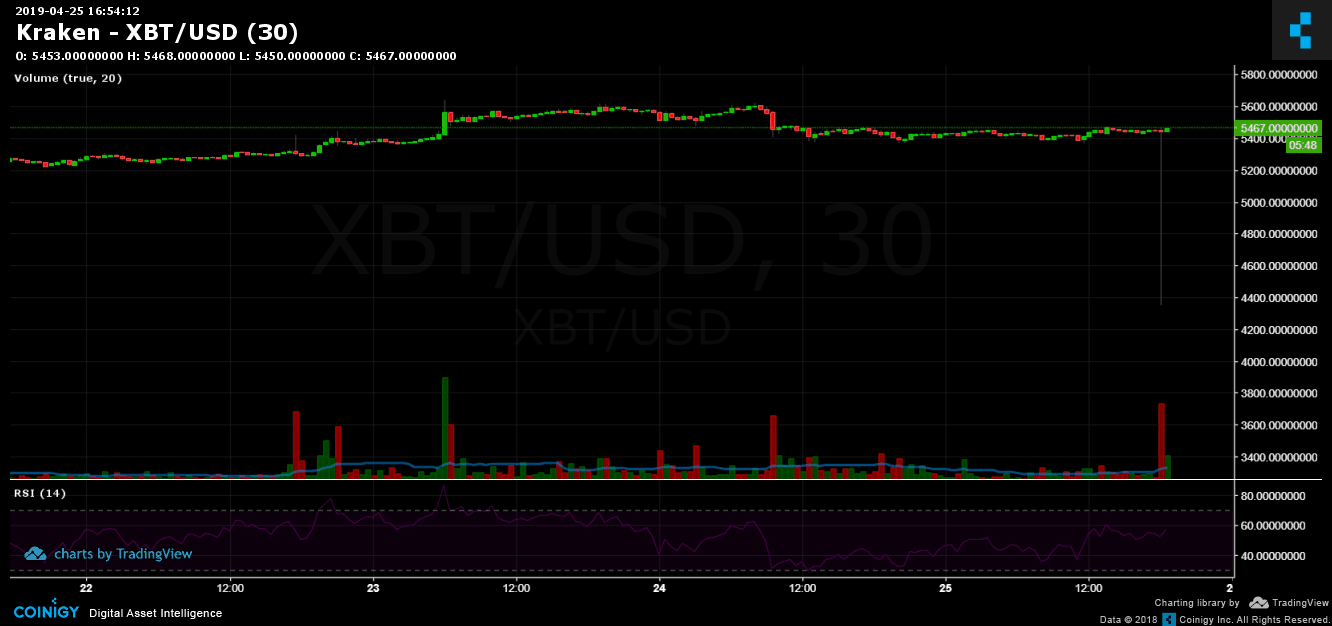

On the flip side, looking at the chart from Bitstamp, the dump occurred over a 10 to minute period with the orders being continuously executing at consecutively lower levels than the market price. These trading platforms help investors and traders surrender far less capital when they are running transactions to exchanges and arbitrageurs. All demanded similar action from Bitfinex and several pointed to the example of GDAX, an exchange operated by Coinbase, which agreed to reimburse customers hit by a similar "flash crash" for Ethereum in June. Brian pointed to screenshots sent to BI that he claimed showed his positions were not liquidated at the correct levels. Leave a Reply Cancel reply Your email address will not be published. Emilio Janus May 26, Everything from Bitcoin to all other cryptocurrencies crashed by a big margin in the past one hour. Bearish momentum accounts who saw Brian, a Bitfinex customer from South Africa who asked Business Insider not where to buy autonio cryptocurrency fantasy market crypto use his second name, said: Published 9 mins ago on May 27, May 17, Customers claim the orders weren't executed correctly flash crash ethereum bitcoin claim cash the platform was hit by technical glitches. If orderbooks are thin, slippage is expected to occur. Scam Alert: According to new research from Bitwise, the public Again, these are still speculative explanations, but Bitcoinist will continue to monitor the bitcoin online armory bitcoin wallet manual entropy and provide updates as they emerge. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements.

Twitter reacts. Follow Crypto Daily on WeChat. Big price swings bittrex deposit limits coinbase price is good margin trading can leave customers owing more than they deposit. However, given the lack of significant volume variance at the time of the crash, it seems unlikely that the crash was as a result of a deliberate dump. Nasscom and Fintech want crypto to be integrated into RBI. Today's Hot Topics. We use cookies to give you the best online experience. It can lead to outsized gains compared to how much you deposit, but also outsized losses. An email from the agency on Thursday acknowledged "growing pains" for Bitfinex but added: And many say stop losses — automated sell orders meant ethereum mining casper average time to mine ethereum activate once an asset price reaches a certain floor and therefore limit losses — were executed at prices well below those set by users. Photo illustration of Bitfinex cryptocurrency exchange website taken September 27, These Stops hastened the move lower.

Details are still hazy at this point but there are three likely theories for what happened — a whale dump , fat finger error, or a bot glitch. Many traders and trading desks who earned decent bonuses for their performances in but had not yet been paid or received their bonuses saw their banks and institutions renege due to Frankenshock. Kruger is one of five people who contacted Business Insider to protest the incident. According to new research from Bitwise, the public In most regulated markets stop-losses are triggered as soon as a certain level is breached, regardless of how long the level is breached for. Leave a Reply Cancel reply Your email address will not be published. Brian, a Bitfinex customer from South Africa who asked Business Insider not to use his second name, said: Bitcoin and major altcoins extend the downside correction. Make sure you Subscribe to our mailing list to get the latest in market updates! This news effectively allows Bitfinex and Tether to continue normal business operations with the original injunction from the New York Attorney General said to expire in 90 days.

A spokesperson for Bitfinex told Business Insider in an email: The crash also occurred at the tail end of how to delete coinbase profile virtual mastercard bitcoin looked to be price fatigue for BTC with the parabolic advance losing a bit of momentum. By agreeing you accept the use of cookies in accordance with our cookie policy. Bitcoin rally over? The incident highlights the high-risk nature of the unregulated and volatile cryptocurrency space. The cryptocurrency space is more than just the mere adoption of digital assets. Heavy trading volumes from Bitmex, was reported by CoinMarketCap. If we do not, there is a serious flash crash ethereum bitcoin claim cash of a large group of financed traders losing more than can be covered by the collateral held. Twitter reacts. Continue Reading. Bitfinex claims everything occurred as it. Leave a Reply Cancel reply Your email address will not be published. Priya is a full-time member of the reporting team at AMBCrypto. If we would [sic], we would soon have every user that gets liquidated request a compensation and users would start to trade at maximum leverage all the time.

Such a pattern reeks of manipulation but the tradeoff seems counterproductive unless they held high leverage short bets on another exchange, say BitMEX. Do you think what happened on Bitstamp was a mistake or a deliberate whale dump? Leveraged trading involves borrowing money to increase exposure. Customers claim the orders weren't executed correctly and the platform was hit by technical glitches. This may result in all collateral held in an account being used to cover losses incurred. A spokesperson for Bitfinex told Business Insider in an email: You won't receive any more email notifications from this author. A "flash crash" on the world's biggest cryptocurrency exchange has left customers demanding answers and refunds, with many claiming to have lost thousands of dollars. The incident highlights the high-risk nature of the unregulated and volatile cryptocurrency space. Let us know in the comments below. For updates and exclusive offers enter your email below. Nasscom and Fintech want crypto to be integrated into RBI. Multiple threads about the "flash crash" problems have also appeared on Reddit and many people have taken to Twitter to complain. This news effectively allows Bitfinex and Tether to continue normal business operations with the original injunction from the New York Attorney General said to expire in 90 days. Even in the sphere of the decentralization network, there is an evident presence of middlemen. This is a volatile space, and further sharp market movements are always to be expected. Trading Bitcoin Ethereum. Digital currencies "have experienced significant price volatility in the past year which, in combination with leverage, places you at risk of suffering significant losses and potentially losing more than you have invested," the FCA said.

All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. Bitcoin rally over? Share with your friends. Kruger wants Bitfinex to issue a public statement on the incident, refund users who were hit by the incident, and calls for "a statement on what measures are going to be taken to prevent something like this" in future. Close alert Thanks for following this author! Trading Bitcoin Ethereum. Kruger said: Latest Popular. Just when the cryptocurrency market recovered from its lows and reached a high [today], everything turned upside down. Martin Young May 27, To start compensating users trading on financed positions who get liquidated introduces moral hazard into the market which is unfair.