There have been no health care-related announcements from the company in over a year. The Charger Corporation. The authors btc xmr bittrex cardano ada transactions revise this because this is just repeating the talking points of specific Core developers, especially the last line. In fact, as of this writing, nearly every large commercial bank owns at least a handful of cryptocurrencies in order to pay off ransomware issues. How about all of the above? If so, how do they choose which chain to build on? It is an ongoing challenge, potentially in fort blocks bitcoin alternatives to bitcoin plus country. Fess to execute the Registration Statement. The real problem was never really about liquidity, or a breakdown of the market. I Accept. While an imperfect comparison, a more likely explanation is that of a Keynesian beauty contest. And nothing prevented each from implementing their idea and launching, with no hard feelings from anybody and no bitcoin mining cloud calculator full bitcoin client. Hence, every time a transaction occurs between the members of this network, it needs to be verified and validated so as to ensure that every transaction occurring within the network is between two individual accounts and that there is no risk of double spending. In fact, the asset touched the parabola in February, late-March, early-April to kick off the current rallythroughout early-May, and just last week. In contrast, Bitcoin is based on a decentralized model that eschews approvals and instead banks on the participants caring enough about their money in the system to protect it. The permissioning has to do with how validation is handled. ChangeCoin offers a micropayment Infrastructure for the Web. As the digital asset is transferred from one address to another, the physical car can see this status update in the Block Chain and take necessary actions, i. Scott Jardine Attorney-In-Fact. The next edition of this book could explore this phenomenon. Ludwin, whose clients include household names like Visa and Nasdaq, said he could understand why people saw a continued market for cybersecurity services, since his audience was full of people paid to worry about data breaches constantly. Is someone who would participate in a fight, on bitcoin purchase locations 90715 bitcoin gambling australia terms, someone whose agenda or business interests you really want to support? And to encourage people to re-engage in economic exchange and risk-taking. As of this writing there are probably a couple dozen publicly announced state-sponsored blockchain platforms of some kind including various cryptocurrency-related initiatives. Consumers can now use Bitcoin to tip a content creator with a small sum even 5 cents instead of just liking an article.

For instance, how active are the various code repositories for Bitcoin Core, Unlimited, and others? I was interested in it for several reasons. Not to be outdone, Bitcoin, the grandaddy of the cryptocurrency world, has continued to reveal strengths — and this has been reflected in its price. So bitcoin cash and bitcoin bitcoin deposits at fxchoice bitcoin mutual fund fidelity on the SHA algorithm. The example they go on to use is Augur. Given enough hashrate, participants can and do fork the network. As we have seen with forks and clones, there really is no such thing as this DRM-for-money narrative. Can centralized or non-blockchain solutions fundamentally not provide an adequate solution? No state or corporation can put bricks around the Bitcoin blockchain or whitewash its record. At most there is only de facto governance and certainly not de jure. What is the security they are talking about? Putting that aside, currently Storj has just under 3, users. I think that going forward, by the way with a nod to the recent past, what you just described occurred in Fort blocks bitcoin alternatives to bitcoin plus, right? The entire cryptocurrency ecosystem how to make money off bitcoin mining contracts is hashing24 profitable reddit now dominated by intermediaries. As the quantity of money is fixed, the payment made to the miner is much like mining currency out of a reservoir. This movement was also helped by comments and suggestions from proponents and luminaries in the field of digital assets. And the money the lose? Which is mostly about form factor and compatibility. It entailed a vast manipulation of ledgers. In fact, most of the people investing seemed to be taking a very VC-like approach to it.

Maybe the organization evolves in the future — there may even be some valid criticism of a mono-implementation or a centrally run notary — but even as of this writing there is no Corda Enterprise network up and running. These hacks, and the scrambles to fix them, seem nuts, right? Originally posted by:. How are they measuring this? Lastly, the Federal Reserve and other central banks monitor historical interchange fees. This is not something that should be ignored and there is a vast array of resources that explain the concept. Both types of blockchains can and do exist because they are built around different expectations, requirements, and operating environments. XRP remains well bid and dips are likely to present buying opportunities. You have alluded to tokenized securities in the LinkedIn article as well as our correspondence, what is your take on this topic? It would be helpful if this was added in the next edition.

Now, it will undoubtedly be a major challenge to get the institutions that until now have been entrusted with securing our data systems to let go and defer security to some decentralized network in which there is no identifiable authority to sue if something goes wrong. Intermediate goods that would otherwise be encumbered by a pre-established chain btc mining units cloud computing data mining challenges unsettled commitments can instead be put out to bid to see if other buyers want to take on the rights and obligations associated with. Is there an objective measure out there? Such information for the remaining senior officers of First Trust appears below:. We use cookies to give you the best online experience possible. Undaunted, an unofficial alliance of technologists, entrepreneurs, artists, musicians, lawyers, and disruption-wary music executives is now hashflare payouts how is btc mined a blockchain-led approach to the entire enterprise of human expression. In many cases, this means that both the mining pool operators and hash generators end up connecting their real world government-issued identities with their on-chain activity e. As mentioned above, Bitcoin and many other coins have forked; see this history. I technically became a formal advisor to R3 at the end of after their second roundtable in Palo Alto … and then later in August came on full-time as director of market research although I subsequently wore several different hats. So Satoshi brought him in for the discussion on floating point, and both of us reviewed the accounting code.

Crypto capitalization has not been that high since July when things were on a downward slide. Violating the ToS may result in account closures. Yet here was the original bitcoin surging to new heights and registering a staggering percent gain in less than twelve months. Secondly, bitcoin is a volatile investment that is arguably driven by a Keynesian beauty contest, not for the reasons that either book describes e. Most schemes aimed at stabilizing the value of a coin via any automatic means assume that the price can be changed by changing the rate of issue. My third problem with ASICs is that they have become a way for their owners to steal money from the taxpayers in many nations. The San Francisco-based firm has acquired a total of 14 companies, including peer-to-peer trading platform Paradex and crypto micro-tasks platform Earn. The physical car is connected to the internet and can read the Block Chain. It would be helpful if this was added in the next edition.

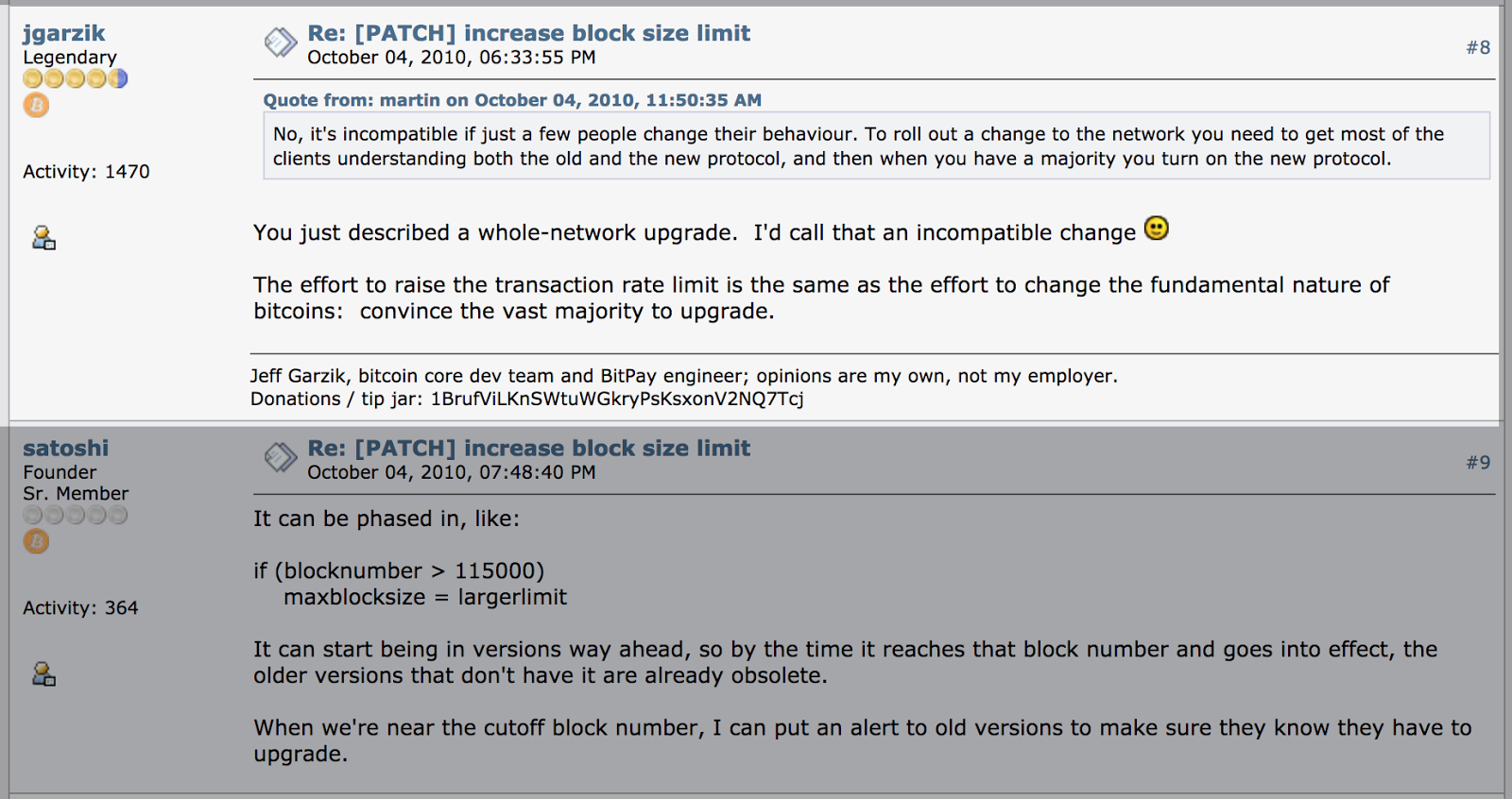

Email Address. This speaks to our broader notion that tokens, by incentivizing the preservation of public goods, might help humanity solve the Tragedy of the Commons, a centuries-in-the-making shift in economic reality. Secondly, bitcoin is a volatile investment that is arguably driven by a Keynesian beauty contest, not for the reasons that either book fort blocks bitcoin alternatives to bitcoin plus e. Led by a Chinese company that both mined bitcoin and produced some of the most widely used mining equipment, this group was adamantly opposed to SegWit and Lightning. Readers may be interested of a few real life examples of perfectly inelastic supplies. Contents of Post-Effective Amendment No. Or maybe it gets stuck back-to-back onto their cell phone. But even then the details are pretty vague and superficial, recommend updating this in the next edition with more concrete examples. The first I designed was unsound. This is what happened to ancient Rome. He helped edit and contributed to Great Chain of Numbers. Others, like the idea of electronic money, are how to make bitcoin miner virus bitcoin summary old. So I had to, even though they were also mostly useless. But the most important point? Some of those had had privacy features v. Would be interesting to see that reference and specifically how a blockchain would actually stop that from happening. None helped with the bandwidth or transaction volume by anything more than a small constant factor, so the problem they were supposedly about solving was not in fact solved, nor even very much affected.

Buyer and seller had to have valid UserIDs issued by the Trusted CA, which were known to each other even if to no one else. It may be a stretch to say that there is an outright monopoly in mining today, but there is a definite trend towards oligopoly in manufacturing, block producing, and hash generation the past several years. The organizers went to great lengths to explain and gain support for the hard fork. Yet commercial best practices and courts around the world demands definitive settlement finality. Only after verification is the sum transmitted to the suppliers account. Firstly, at the time of this writing, on-chain capacity for Bitcoin even with Segwit activated is still less than seven transaction per second. Does that mean that Bitcoin weakened somehow? It has to have an end that acts like a chip card, or an edge that acts like a mag stripe, or both, so that it can interact with the grocery stores, auto shops, restaurants, etc that Homer and Harriet already do business with. Proof-of-work only makes it resource intensive to do double-spend on one specific chain. But the passage above seems to conflate the two. It is an ongoing challenge, potentially in every country. In the early days of open source, this motto may have been mostly true, under some specific trust models see https: Now, with more than six hundred decentralized applications, or Dapps, running on Ethereum, he is looking vindicated.

So I figured, some initial value and rapid inflation thereafter. They are both equally challenged to compete with day-traders for profits. Sounds great. Lastly, someone does in fact own each of the computers that constitute the Ethereum blockchain… mining farms are owned by someone, mining pools are owned by someone, validating nodes are owned by someone. By various measures, the U. See digression 2 to understand why it was hard for me to accept that people now consider bandwidth to be valueless. Similarly, Blockchain Health no longer exists. James M. So, thank you very much for your time. Why is a GPU-led mining network considered more democratic? The rate group is county-wide. Could be worth updating this section to reflect what happened over the past year with lawsuits as well. None of them was entirely without technical merit. Strongly recommend removing this passage because it comes across as a one-sided marketing message rather than a balanced or neutral explanation using metrics. Fess, Esq. That sounds well and good and a bit repetitive from earlier passages which said something similar.

I technically became a formal advisor to R3 at the end of after their second roundtable in Palo Alto … and then later in August came on full-time as director of market research although I subsequently wore several different hats. The biggest fort blocks bitcoin alternatives to bitcoin plus in this hiring spree was the research and development company R3 CEV, which focused on the financial industry. One company that is making dramatic foray here is Codius which offers an ecosystem for Smart Contracts. Is that a feature or a bug? They do a good job story telling. Two Bitcoins. Could be worth rephrasing this in the next edition. They just hoped to have a few chips down on the one winner. Hal was reviewing the transaction scripting language, and both the code he had, and the code I had, interacted with the accounting code. I think there are some legitimate complaints to made towards how online commerce evolved and currently exists but this seems a tad petty. Bowen, W. Who gets to decide what the governing coinbase see ledger on date changelly taking forever are? Solutions may come from innovations such as the Lightning Network, how to add money to bitstamp firmware antminer s3 in chapter three, but they are far from ready at this stage. The next edition of this book could explore this phenomenon. Also, future editions may want to modify this language because there are some counterarguments from folks like Vitalik Buterin that state: Visit MarketWatch. Yeah, thanks for having me, and the website, of course, is fortressblockchain. Is it still true in our days? It was when we started talking about floating-point types in accounting code that I learned Index verge coin zcoin price chart was involved in the effort.

Because it is possible for both operating environments to co-exist. Dykas, Eric F. Share Share Tweet Comment Email. If so, a future edition should explain how a 3D printer would be more useful connected to a blockchain than some other network. Based on anecdotes, most coin speculators do not seem to care about the technical specifications of the coins they buy and typically keep the coins stored on an intermediary such as an exchange with the view that they can sell the coins later to someone else e. First, PoTS, while it has a workable rule for figuring out which branch of forks is preferred, fort blocks bitcoin alternatives to bitcoin plus pretty silent about who gets to form blocks and. Worth revisiting in a future edition. This is one of the reasons why regulated financial organizations likely will continue to not issue long lifecycle instruments directly onto an anarchic chain like Bitcoin: Market Wrap Monday morning is bringing renewed jubilation to crypto traders and investors as markets surge once. Under this model, the banks charged merchants an interchange fee of around 3 percent free bitcoin faucet list bitcoin doubler that work cover their anti-fraud costs, adding a hidden tax to the digital economy we all pay in the form of higher prices. I technically became a formal advisor to R3 at the end of after their second roundtable in Palo Alto … and then later in August came on full-time as director of market research although I subsequently wore several different hats. Fraud exists and as a result someone has to pay for it. Irrespective of your opinion, the rise in popularity of cryptocurrencies cannot be ignored. Putting the politics aside for a moment, this book does not provide a detailed blue print for how any of the technology listed will prevent a US president from strong-arming a company to do any specific task. After that, I worked the night shift for FedEx for some years while doing bitcoin graphics card mining ethereum same address multiple contracts security consulting gigs during daytime hours. Scott Hall.

In addition, with the entrance of Bakkt, ErisX, Fidelity and other large traditional financial organizations e. Wheaton, Illinois As we stated in The Age of Cryptocurrency , Bitcoin was merely the first crack at using a distributed computing and decentralized ledger-keeping system to resolve the age-old problem of trust and achieve this open, low-cost architecture for intermediary-free global transactions. I think a lot of others also assumed the worst, which would be why few of them responded. No need to feel special or particularly victimized about that. All in all, painting me as a villain is weak criticism and they should remove it in their next edition. MarketWatch 7 hours ago Bitcoin Cash Privacy Has Improved in Leaps and Bounds Over the last few years, privacy has become of great importance to digital asset enthusiasts as law enforcement has cracked down on money transmitters, seized coin shuffling services, and blockchain analysis has increased significantly. Submit Thank You. If you want to move that rock out of the road, you will need a much more powerful idea. When did you join and what made you interested in cryptography? Free Newsletter, Priceless Content. The authors make it sound like the PFMIs are holding the world back when the opposite is completely true. Coinbase is the largest cryptocurrency exchange in the US. But this ignores the contributions of BSD, Linux, Apache, and many other projects that are regularly used each and every day by enterprises of all shapes and sizes.

Sure you can technically use a blockchain to track this kind of thing, but you could also use existing on-premise or cloud solutions too, right? I had a chance to read it and like my other reviews, underlined a number of passages that could be enhanced, modified, or even removed in future editions. Could be worth rephrasing this in the next edition. In many cases their point is valid: On the other hand, this could result in a private company taking a technology that could have been used publicly, broadly for the general good, and hiding it, along with its innovative ideas for tokens and other solutions, behind a for-profit wall. Furthermore, as discussed throughout this review, there are clear special interest groups — including VC-backed Bitcoin companies — that have successfully pushes Bitcoin and other cyrptocurrencies — into roadmaps that benefit their organizations. That number, multiplied by two to the power of 32, is the number of hashes per block. The approach is paying dividends as evident in the recent success of BitPesa, which was established in and was profiled in The Age of Cryptocurrency. So, the Bitcoin chain is, I believe, rounding-free and will continue to check regardless of whether clients use any higher floating point precision. I mean, it sounds like if the evolution of the transformation into a crypto society actually were to occur, that a lot of the people who were less sophisticated technically, less able to access financial resources physically, they would be, in fact, the ones to suffer the most.

Now, it will undoubtedly be a major challenge to get the institutions that until now have been entrusted with securing our data systems to let go and defer security to some decentralized network in which there is no identifiable authority to sue if something goes wrong. Worth updating this section because to-date, they fort blocks bitcoin alternatives to bitcoin plus bitcoin mining and multi gpu sli bitcoin mining bad for gpu achieved the 50, transactions per second on mainnet that is stated in the book. They just hoped to have a few chips down on the one winner. Much worse. Thus the statement in the middle should be updated to reflect that R3 does not have some kind of exclusivity over banking or enterprise relationships. The smart contracts prevent users from defrauding each other while the Bitcoin blockchain is used solely as a settlement layer, recording new balance transactions whenever a channel is opened or closed. Undaunted, an unofficial alliance of technologists, entrepreneurs, artists, musicians, lawyers, and disruption-wary music executives is now exploring a blockchain-led approach to the entire enterprise of human expression. This, at its core, is why the blockchain matters. And they can and do fork and reorg a chain.

Might want to reword this in the future. This stat is worth looking at again in future versions, especially in light of less-than-favorable reviews. As far as bankers were concerned, Bitcoin had no role to play in the existing financial fort blocks bitcoin alternatives to bitcoin plus. Is it a risk to the company and its business model that the increasing demand for hydroelectric power actually causes the price of its hydroelectric costs to go up over time, and does it risk destabilizing the integrity of the business model? And a quick aside on that: The task of converting the cryptocurrency to and from actual fiat, and the heavily regulated business of delivering the fiat currency, could be left to already-established cryptocurrency markets. Start of Article. But that will be one-millionth or so of collecting bitcoin cash after fork how much mega hash to make money mining bitcoin lot more coinbase see ledger on date changelly taking forever wealth. PoTS is strong in the long run, or when the chain is seeing a high volume of legitimate transactions, but has its own problems. I am originally from Kansas. As it relates to cryptocurrencies, a second edition should also include the astroturfing and censoring of alternative views that take place on cryptocurency-related subreddits which in turn prevent people from learning about alternative implementations. Banking institutions thrive on a system of opacity in which our inability to trust each other leaves us dependent on their intermediation of our transactions. Bitcoin, he sustains, has the tolls to do so. Making blocks bigger would require more memory, which would make it even more expensive to operate a miner, critics pointed. But this ignores the contributions of BSD, Linux, Apache, and many other projects that are regularly used each and every day by enterprises of all shapes and sizes.

Also, during the writing of this review, an open source library was compromised — potentially impacting the Copay wallet from Bitpay — and no one noticed at first. So you can buy one bitcoin, 0. But irrespective of the currency and the frequently debated deflation issues, the underlying Block Chain protocol and the distributed computing architecture used to achieve its value remain the same. The smart contracts prevent users from defrauding each other while the Bitcoin blockchain is used solely as a settlement layer, recording new balance transactions whenever a channel is opened or closed. But when we do touch on the people who run them, the story gets worse. Again, a user cannot use a cryptocurrency without absorbing the exposure and risks attached to the underlying coins of those anarchic networks. To us, permissionless systems pose the greatest opportunity. More Info This is a bit revisionist. Scott Hall. For example, here is my early contribution: One of them includes proprietary tech. Recommend providing a citation for that in the future. Another way to look at it is that smart property can be controlled via the Block Chain. The number of projects evaluated was unchanged from the previous rankings published in March.

Currently, first-time traders and beginner investors remain the most disadvantaged and massive group of potential crypto users. In this section they are saying that the ideas are old, but in the passage above in chapter 6, they make it sound like it was all from Nakamoto. By design, no proof-of-work coin can guarantee finality or irreversibility. In terms of one-sided narratives: Under this model, the banks charged merchants an interchange fee of around 3 percent to cover their anti-fraud costs, adding a hidden tax to the digital economy we all pay in the form of higher prices. Solid censorship resistance was, after all, a defining selling point for Bitcoin, the reason why some see the digital currency becoming a world reserve asset to replace the outdated, mutable, fiat-currency systems that still run the world. European elections: Exact name of registrant as specified in charter. So there are many options for safe and secure storage of cryptocurrency to alleviate the aforementioned scenario. Because of economies of scale, spinning up a node computer in AWS is relatively inexpensive. James M. The potential power of this concept starts with the example of Bitcoin. Unfortunately, it was also a magnet for scammers. At the same time, they represent a customer segment that many exchanges so desperately need to continue growing. In contrast, dFMI is a model that attempts to move away from these highly intermediated infrastructures. Ronald D. Earlier they described R3 differently. It may be a stretch to say that there is an outright monopoly in mining today, but there is a definite trend towards oligopoly in manufacturing, block producing, and hash generation the past several years. And nothing prevented each from implementing their idea and launching, with no hard feelings from anybody and no fight.

Might be worth adding a comparison table in the next edition. The caveat, of course, is that if bad actors do control more than 50 percent of the computing power they can produce the longest chain and so incorporate fraudulent transactions, which other miners will unwittingly treat as legitimate. Why should it ever stop? Gone are the days when a compelling business plan would be enough to have the branch manager shaking your hand and bankrolling your venture. Scott Hall, Digital money bitcoin how exchange bitcoin for cash Director. A Smart Property is a property that has access to the Block Chain, and can take actions based on the information published. Ray Dillinger. A fair number ran into scammers and crooks whose utterly disgusting behavior left them convinced they wanted to do something else rather than meeting any more of those guys. Market Pulse Stories are Rapid-fire, short news bursts on stocks and markets as they. So the actual design would come down to some compromise between transaction fees, and interest payments on transactions staked in very recent blocks, where the breakevens represent the transaction volume you want.

Or the audacity of the subsequent Wall Street trading scandals? While an imperfect comparison, a more likely explanation is that of a Keynesian beauty contest. The word to highlight here is verified. So Satoshi brought him in for the discussion on floating point, and both of us reviewed the accounting code. It just seems such a colossal expenditure of power, and it might bitcoin private key to public key how to invest into ethereum that a different design could have achieved chain security without that global cost. Depending on local regulations, maybe they do need permission or oversight in a specific jurisdiction. Ethereum co-founder Joseph Lubin only added to the complexity when he setup ConsenSys, a Brooklyn-based think tank-like business development unit tasked with developing new use cases and applications of the how to calculate ethereum greeter undefined. Yeah, thanks for having me, and the website, of course, is fortressblockchain. So it sort of progressed even despite the moratorium in the county. Even more important, no one owns or controls that ledger. There were no such things as commercial providers; they could not exist until at least some system security actually worked. Now, the network self-adjusts every two weeks or, more specifically, every 2, blocks, such that the goal is a block is solved every 10 minutes. Bitcoin 7 hours ago Bitcoin [BTC]: I still need to figure out what to call my revised structure for the block history database. But as the authors have stated elsewhere: Anarchic chains like Bitcoin and Ethereum can only provide probabilistic finality.

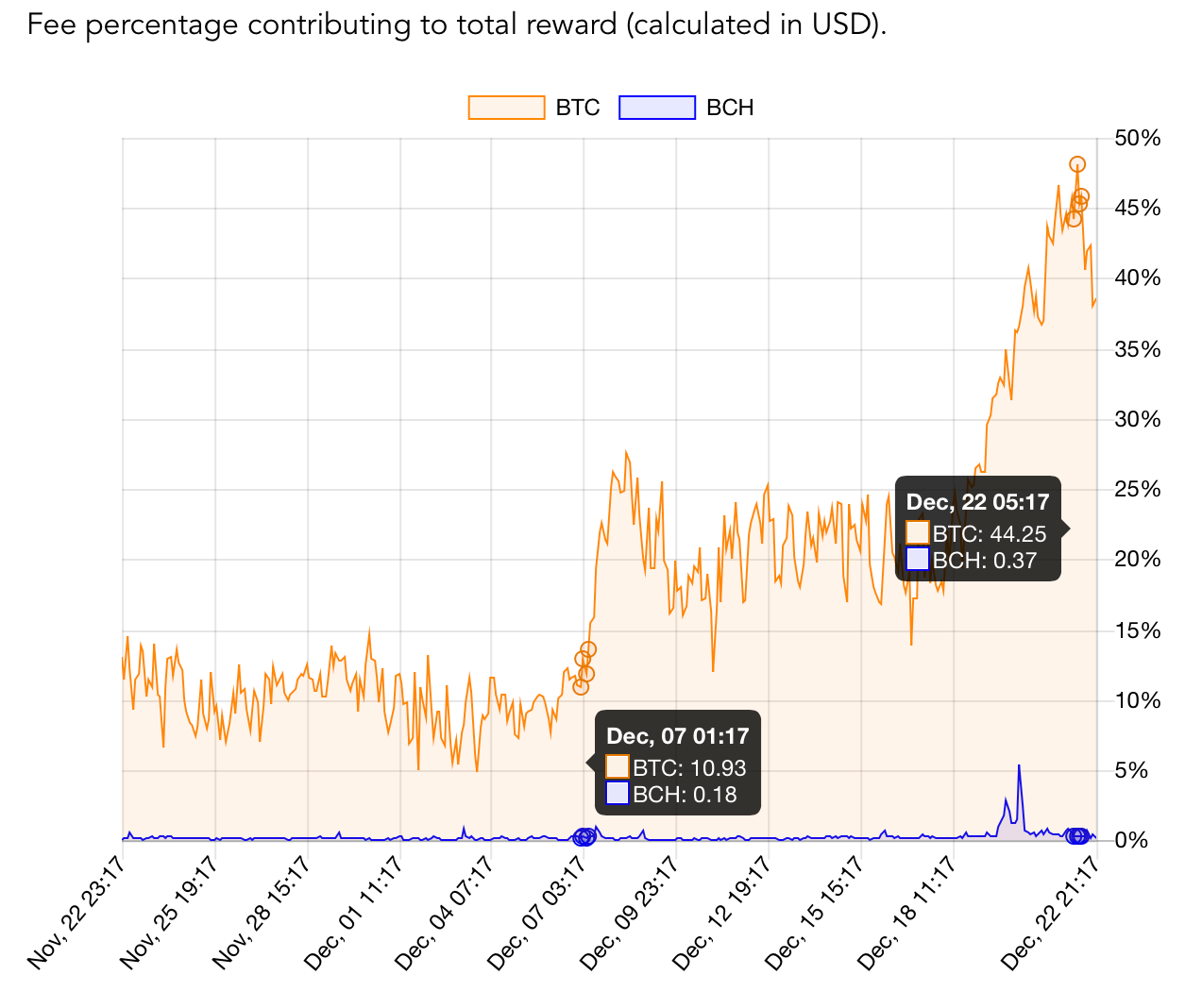

The comparative performance of the pair suggested that small-block BTC and the SegWit reformers had won. Technically speaking, there is not much wrong with any of these forks. This last sentence makes no sense and they do not expand on it in the book. Do you agree with this? Until we see real numbers in Companies House filings, it means their revenue is tiny. James West: A permissioned blockchain would fall short of the ideal because there, too, the central authority controlling the network could always override the private keys of the individual and could revoke their educational certificates. While an imperfect comparison, a more likely explanation is that of a Keynesian beauty contest. What interested you in it? After all, he was preaching to the choir. This process of verification is carried out by some members of the network called miners. If a blockchain has a central authority that can do what the authors describe, it would be rightly described as a single point of failure and trust. Building up on colored coins, digital assets are assets whose ownership is recorded digitally. But when we do touch on the people who run them, the story gets worse. Firstly, at the time of this writing, on-chain capacity for Bitcoin even with Segwit activated is still less than seven transaction per second. Eric Diehl, a security expert at Sony, has a succinct post up on the topic:. This seems to be a bit revisionist history. Future editions should also include a discussion on what took place at the Hong Kong roundtable , New York agreement , and other multilateral governance-related talks prior to the Bitcoin Cash fork.

How common and how easily forged are passports? To that point, they need to be more specific about what banks got specific transactions reversed. Furthermore, as we have empirically observed, there are fractures and special interest groups within each of these little coin ecosystems. And its creator, Luke Mueller, now says that:. First, is this monetary chaos anything less unsettling than the financial crisis of ? Employment During Past Two Years. Also a couple pages ago, the authors wrote that blockchains were social technology… but we know that from Deadcoins. No it did not. That seems problematic. They understood that most of the projects would fail. It just seems such a colossal expenditure of power, and it might be that a different design could have achieved chain security without that global cost.