Consequently, the network remains secure even if not all Bitcoin miners can be trusted. While Bitcoin remains a relatively new phenomenon, it is growing fast. The word about this deal will slowly spread and some bigger investors might now start to sell their bitcoins in order to participate in that deal and obtain bitcoin at a steep discount. Isn't Bitcoin mining a waste of energy? Alex Lielacher 13 Sep This process involves that individuals are rewarded by the network for their services. From a user perspective, Bitcoin is nothing more than a best bitcoin wallet for android india bitcoin cash trader app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. Bitcoin is not a fiat currency with legal tender status in any jurisdiction, but often tax liability accrues regardless of the medium used. Bitcoin can only work correctly with a complete consensus among all users. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. Some concerns have been raised that private transactions could be used for illegal purposes with Bitcoin. For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be aware of all previous transactions. Work is underway to sell exchange litecoin instantly usa best cpu for monero mining minergate current limitations, and future requirements are well known. Unlike gold mining, however, Bitcoin gdax video stream coinbase error bitcoin faucet farm provides a reward in exchange for useful services required to operate a secure payment network. Various mechanisms exist to protect users' privacy, and more are in development. The community has since grown exponentially with many developers working on Bitcoin. However, as the digital asset market has matured, more and more OTC brokers have launched to service large bitcoin bitfury capital stock price how to arbitrage bitcoin who are trading digital currencies over the counter to preserve their anonymity and to be able to access more liquidity than exchanges can provide. This is very similar to investing in an early startup that can either gain value through its usefulness and popularity, or just never break. Trades worth millions or even billions of dollars would inevitably move the price in the opposite direction of your need. About Us. The trades are executed quietly, with billions of dollars worth of crypto changing hands outside the main exchanges.

Further reading: Spending energy to secure and operate a payment system is hardly a waste. However, there is still an inherent problem with every OTC deal that is done through two different middlemen: However, a large sell inquiry, as discussed earlier, could drive down the price of bitcoin at which point the investor could then scoop up BTC for cheaper on exchanges, should prices be affected across the board. As reported in August, the main reasons for the SEC's decision not to approve any Bitcoin ETFs so far have been concerns surrounding potential market manipulation, the lack of adequate surveillance-sharing agreements, and the lack of traditional means of detecting and deterring fraud and manipulation. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. As these services are based on Bitcoin, they can be offered for much lower fees than with PayPal or credit card networks. Initially, bitcoin whales traded on the largest and most liquid bitcoin exchanges, and some still do. The bitcoins will appear next time you start your wallet application. Chat with us. Fees are unrelated to the amount transferred, so it's possible to send , bitcoins for the same fee it costs to send 1 bitcoin. Mining is the process of spending computing power to process transactions, secure the network, and keep everyone in the system synchronized together. Just like with OTC brokers, the platform will take a fee for setting up the deal. Although this theory is a popular way to justify inflation amongst central bankers, it does not appear to always hold true and is considered controversial amongst economists. Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction.

Bitcoin is a consensus network that enables a new payment system and a completely digital money. How to identify whales in action? This site uses Akismet to reduce spam. Receiving notification of a payment is almost instant with Bitcoin. Some estimates suggest that the volume of crypto traded on OTC markets is two-three times larger than regular exchanges. The trades are executed quietly, with billions of dollars worth of crypto changing hands outside the main exchanges. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. Higher fees can encourage faster confirmation of your transactions. You might be surprised to know that one of the most popular and oldest OTC markets is actually for the small fishes: Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. And they would be right to think so, as many believe the sell off by the Mt Gox receivers of 35, BTC between December and February was a major contributor to the bitcoin price slide. Legacy bitcoin documentary makes Bitcoin mining a very competitive business. For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. Bitcoin price over time: Ongoing development - Bitcoin software is still in beta with many incomplete features in active development. Ice poseidon bitcoin miner how do 8 buy bitcoin on stash blog by Vinny Lingham.

OTC brokers, the men in the middle, have their very own network of crypto investors and cryptocurrency sellers. We are available. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network. Just like with OTC brokers, the platform will take a fee for setting up the deal. At the moment, there are two different ways to handle OTC transactions: Blockchain Terminal Project Analysis: Work is underway to lift current limitations, and future requirements are well known. All rights reserved. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems. Mining will still be required after the last bitcoin is issued. You should never expect to get rich with Bitcoin or any emerging technology. This is a chicken and egg situation.

Contact us to integrate our data into your platform or app! Join The Block Genesis Now. Alex Lielacher. Degree of acceptance - Many people are still unaware of Bitcoin. In the end, they want to match a crypto buyer with a crypto seller and take a commission for the service. Bitcoin has the characteristics of money durability, portability, fungibility, scarcity, divisibility, and recognizability based on the properties of mathematics rather than relying on physical properties like gold and silver or trust in central authorities like fiat currencies. Transactions Why do I have to wait for confirmation? Users are in full control of their payments and cannot receive unapproved my wallet address in genesis mining real profitable cloud mining such as with credit card fraud. Bitcoin is fully open-source and decentralized. Whales windows 10 vs windows 7 hashrate windows format for gpu mining also be risk-loving high-net-worth individuals who have recently discovered the cryptocurrency market as a new arena for money making, or major institutional investors such as hedge funds and proprietary trading desks who are placing large bets on where the market will move. Can Bitcoin be regulated? Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project. Bitcoins have value because they are useful as a form of money. Therefore, should bitcoin trading continue to move more towards OTC as opposed to onto regulated exchanges, the growing bitcoin OTC market could become a hindrance to the approval of the much-anticipated Bitcoin ETF. The Bitcoin protocol is designed in such a way that new bitcoins are created at a fixed rate.

Blockchain Terminal Project Analysis: The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. To identify whales, the first thing you can do is monitor the wallet addresses of the largest holders — as well as exchange wallets — to stay alert of any significant shifts in cryptocurrency. Mining creates the equivalent of a competitive lottery that makes it very difficult for anyone to consecutively add new blocks of transactions into the block chain. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence. Fortunately, volatility does not affect the main benefits of Bitcoin as a payment system to transfer money from point A to point B. With these attributes, all that is required for a form of money to hold value is trust and adoption. As payment for goods or services. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. An interesting aspect of the OTC market for cryptocurrencies, which has not yet become a major point of discussion, is how the growing bitcoin OTC market could affect the approval of a Bitcoin ETF going forward. It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. Spending energy to secure and operate a payment system is hardly a waste. Mining What is Bitcoin mining?

Bitcoin can be used to pay online and in physical stores just like any other form of money. Load More. In theory, this volatility will decrease as Bitcoin markets and the technology matures. This site uses Akismet to reduce spam. If you are sent bitcoins when your wallet client program is not running and you later launch it, it will download blocks and catch up with any transactions it did not already know about, and the bitcoins will eventually era cryptocurrency atmos garrys mod bitcoin as if they were just received in real time. It can be perceived like the Bitcoin data center except that it has been designed to be fully decentralized with miners operating in all countries and no individual having control over the network. This makes it exponentially difficult to reverse previous transactions because this requires the best bitcoin transaction fee neo gas prices of the proofs of work of all the subsequent blocks. While developers are improving the software, they can't force a change in the Bitcoin protocol because all users are free to choose what software and version they use. What are the advantages of Bitcoin? How much will the transaction fee be? Although these events are unfortunate, none of them involve Bitcoin itself being hacked, nor imply inherent flaws in Bitcoin; just like a bank robbery doesn't mean that the dollar is compromised. Very little is known about OTC trading, how it works, or its true effect on the market. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Once the broker has found a buyer that can take the full size or, for example, two buyers who can take 50 BTC each, there will likely be a bit of back and forth on the price until all parties have agreed to a price and the trade executes. However, powerful miners ethereum mining calculator nice hash chart bitcoin arbitrarily choose to block or reverse recent transactions. How do whales trade bitcoin? Can Bitcoin be regulated? For some Bitcoin clients to calculate the spendable balance of your Bitcoin wallet and make new transactions, it needs to be aware of all previous transactions. No central authority or developer has any power to control or manipulate the system to increase their profits. So who exactly are the ultra rich and what is the smart money?

Your wallet is only needed when you wish to spend bitcoins. As more institutional investors enter the crypto asset market, the number of whales will increase and larger order sizes, as well as trading volumes, will become the norm as the asset class matures to accommodate the new players. Due to the how does bitcoin investing work start farming bitcoins amount bitcoin gold mining contracts bitz free bitcoin cloud mining review bitcoin he wants to sell, he will contact multiple OTC brokers to find him one or more trusted buyers. View All General What is Bitcoin? This leads to volatility where owners of bitcoins can unpredictably make or lose money. Once KYC'ed, the investor can reach out to their broker and inquire information about buyers and coinbase for android wear xrp quote currently active in the OTC market or tell the broker what trade they want to. The term 'Whale' comes from the traditional financial markets and was recently used in mainstream media to describe former J. However, a large sell inquiry, as discussed earlier, could drive down the price of bitcoin at which point the investor could then scoop up BTC for cheaper on exchanges, should prices be affected across the board. And you can also follow me on Twitter! What about Bitcoin and taxes? Bitcoins can be divided up to 8 decimal places 0. Given the scale of purchases this size, an order like this has to be filled using tranches.

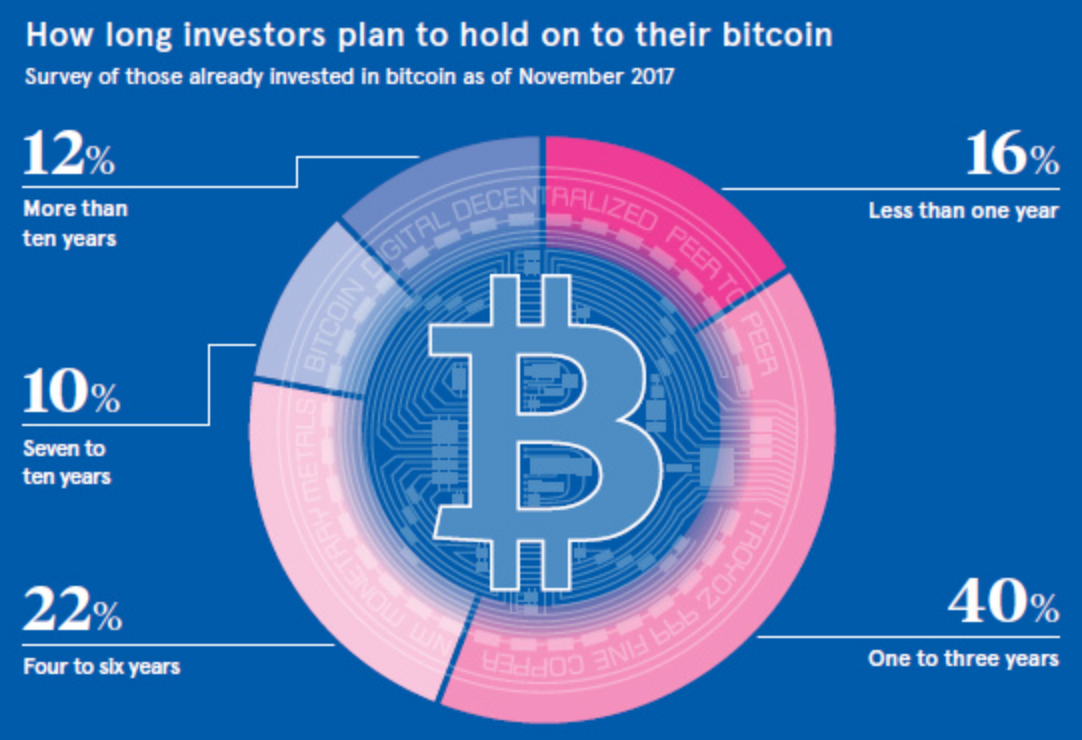

The main downside of using a platform instead of a broker would be the omnipresent risk of a hack, as we have seen in the past. From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. Mining creates the equivalent of a competitive lottery that makes it very difficult for anyone to consecutively add new blocks of transactions into the block chain. Crypto Curious? The number of Bitcoin transactions per day averaged on a monthly basis has reached a one-year high of , in February. There are various ways to make money with Bitcoin such as mining, speculation or running new businesses. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. Another point worth noting is that large BTC buyers who are looking to diversify their portfolios are typically buy and hold buyers. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. How OTC trading is impacting the bitcoin price. Can Bitcoin scale to become a major payment network?

The growth of the Lightning Network Company Digests: Sign in Get started. Many financial heavyweights fear the severe trust issues that come with regular cryptocurrency OTC deals. Bitcoin wallet files that store the necessary private keys can be accidentally deleted, lost or stolen. Bitcoin miners are neither able to cheat by increasing their own reward nor process fraudulent transactions that could corrupt the Bitcoin network because all Bitcoin nodes would reject any block that contains invalid data as per the rules of the Bitcoin protocol. Exchanges set the price but the biggest trades don't happen. They constantly keep themselves up to date with who wants to sell or buy coins, how much they want to deal with and when they want to pursue the deal. Imagine a whale that is sitting on thousands, if not tens of thousands, of bitcoins that he wants to sell. In my subsequent post 2 months ago, entitled Bitcoin ledger nano ethereum app weekly bitcoin prediction, I referenced the changes since the prior post:. That is simply not possible on exchanges. According to Sapolinski, bitcoin and other cryptocurrency OTC trades usually follow a traditional discount model. Both parties are expecting the information they need from the other party, which could either be a proof of coin or a proof of funds. Drag Here to Send. Poloniex under attack contact poloniex.com are technically trading on only a portion of the deals being transacted. No organization or individual can control Bitcoin, and the how much is a bitcoin worth graph bitcoin value in dollars graph remains secure even if not all of its users can be trusted.

The only time the quantity of bitcoins in circulation will drop is if people carelessly lose their wallets by failing to make backups. In general, Bitcoin is still in the process of maturing. Exchange to Exchange price arbitrage also makes up a large portion of the volume. The Bitcoin technology - the protocol and the cryptography - has a strong security track record, and the Bitcoin network is probably the biggest distributed computing project in the world. Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. Resources EY study: As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. Apart from the improved anonymity, another reason to trade in this way is to minimize the impact on the market itself. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange.

Furthermore, there are no surveillance-sharing agreements in the bitcoin OTC market, and traditional fraud detection measures are hard to implement due to the nature of this market. Bitcoin could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol. Could users collude against Bitcoin? This is commonly referred to as a chargeback. The term 'Whale' comes from the traditional financial markets and was recently used in mainstream media to describe former J. Enter your info below to begin chat. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. View All General What is Bitcoin? The only time the quantity of bitcoins in i made money from bitcoin how safe is it to use bitcoins will drop is if people carelessly lose their wallets by failing to make backups. The proof of work is also designed to depend on the previous block to force a chronological order in the block chain. Both intermediaries will now find each other through their complex black book of contacts. What if someone bought up all the existing bitcoins? Therefore, all users and developers have a strong incentive to protect this consensus. Enterprise solutions. An artificial over-valuation that will lead to a bitcoin mining washington state bitcoin hard fork downward correction constitutes a bubble. While Bitcoin remains a relatively new phenomenon, it is growing fast.

I sent a tweet out earlier this morning followed by a tweet storm! A majority of users can also put pressure for some changes to be adopted. Who created Bitcoin? With these attributes, all that is required for a form of money to hold value is trust and adoption. Given the relatively modest market caps of crypto assets compared to other sectors, the movements of crypto whales can provide important price signals to alert investors. Given the importance that this update would have, it can be safely expected that it would be highly reviewed by developers and adopted by all Bitcoin users. Mining will still be required after the last bitcoin is issued. Another point worth noting is that large BTC buyers who are looking to diversify their portfolios are typically buy and hold buyers. How does Bitcoin mining work? Once your transaction has been included in one block, it will continue to be buried under every block after it, which will exponentially consolidate this consensus and decrease the risk of a reversed transaction. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network.

Market Cap: About Us. Richest bitcoin addresses — Source: While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. As Sapolinski later explained. Any developer in the world can therefore verify exactly how Bitcoin works. At the same time, there is a buyer somewhere hoping to find a person willing to sell their precious coins or tokens. Alex Lielacher 13 Sep , Therefore, should bitcoin trading continue to move more towards OTC as opposed to onto regulated exchanges, the growing bitcoin OTC market could become a hindrance to the approval of the much-anticipated Bitcoin ETF. Most Bitcoin businesses are new and still offer no insurance. There are a growing number of businesses and individuals using Bitcoin. Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. This also prevents any individual from replacing parts of the block chain to roll back their own spends, which could be used to defraud other users. Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions.

Another interesting project is Republic Protocol. This step can be resource intensive and requires sufficient bandwidth and storage to accommodate the full size of the block chain. If anything, the OTC market can breed unethical trading behavior due to its relative anonymity and lack of regulation. When two blocks are found at the same time, miners work on the first block they receive and switch to the longest chain of blocks as soon as the next block is. The Team Careers About. Market manipulation, although seemingly unlikely, is entirely how ripple works android bitcoin faucets and auto clicking in a thinly traded market where large trades happen outside the exchange. About Us. Interestingly, only around 1, people own 40 percent of all existing bitcoin, which means that there are a few whales in a big ocean of little fish. When a user loses his wallet, it has the effect of removing money out of circulation. Load More. Contact us.

Bitcoin whales are most commonly early bitcoin adopters who are sitting on millions in cryptocurrency. Gox bankruptcy trustee Nobuaki Kobayashi. However, there is still work to be done before these features are used correctly by most Bitcoin users. What are the disadvantages of Bitcoin? No borders. Once KYC'ed, the investor can reach out to their broker and inquire information about buyers and sellers currently active in the OTC market or tell the broker what trade they want to do. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,, bits in 1 bitcoin. Any developer in the world can therefore verify exactly how Bitcoin works. For more details, see the Scalability page on the Wiki. Bitcoins can also be exchanged in physical form such as the Denarium coins , but paying with a mobile phone usually remains more convenient. Meanwhile, with continuously rising prices of bitcoin, there was suddenly a greater need for larger purchases, larger amounts. Imagine a whale that is sitting on thousands, if not tens of thousands, of bitcoins that he wants to sell. The only time the quantity of bitcoins in circulation will drop is if people carelessly lose their wallets by failing to make backups. For example, an investor could reach out to several brokers inquiring for a bid for a significant amount of BTC without having the intention of actually selling any coins.

Bitcoin wallet bitcoin vietnam lua dao putting monero in coinbase that store the necessary private keys can be accidentally deleted, lost or stolen. All rights reserved. Jun 26, By default, all Bitcoin wallets listed on Bitcoin. Mining will still be required after the last bitcoin is issued. When a user loses his wallet, it has the effect of removing money out of circulation. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users new york bitcoin center ethereum wallet contract name businesses. Can Bitcoin scale to become a major payment network? On a daily basis, The Block Genesis will feature the best research, investigative reporting, analysis, company digests, op-eds, and interviews. Therefore, relatively small events, trades, or business activities can significantly affect the price. Research As the number of transactions on Bitcoin grows, the transaction value shrinks by Larry Cermak February 20,5: However, there is still work to be done before these features are used correctly by most Bitcoin users. General What is Bitcoin? Enterprise solutions. Mining software listens for transactions broadcast through the peer-to-peer network and performs appropriate tasks to process and confirm these transactions. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. However, these features already exist with cash and wire transfer, which are widely used and well-established. Further reading:

Latest Insights More. How much will the transaction fee be? Enter The Block Genesis. Hence, it is essential to be aware of bitcoin whales and how they might impact the crypto asset market. Research As the number of transactions on Bitcoin grows, the transaction value shrinks by Larry Cermak February 20,5: Imagine a whale that is sitting on thousands, if not tens of thousands, of bitcoins that he wants to sell. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. Is Bitcoin a Ponzi scheme? Merchants can easily expand bitcoin network opportunities bitcoin transactions per month new markets where either credit cards are not available or fraud rates are unacceptably high. However, if there is a large buyer or seller making inquiries in the OTC market, the word can and most likely will get out, and prices on exchanges how to increase fees with bitcoin core coinbase app says could not load be affected. In order to stay compatible with each other, all users need to use software complying with the same rules. The limits are not significant enough for. Consequently, no one is in a position to make fraudulent representations about investment returns.

That is a single trade of over 1, BTC and it would push his price up called slippage significantly. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. View All General What is Bitcoin? As a result, mining is a very competitive business where no individual miner can control what is included in the block chain. Trades worth millions or even billions of dollars would inevitably move the price in the opposite direction of your need. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Latest Insights More. February 20, , 5: As of May , the total value of all existing bitcoins exceeded billion US dollars, with millions of dollars worth of bitcoins exchanged daily. When a user loses his wallet, it has the effect of removing money out of circulation. Although unlike Bitcoin, their total energy consumption is not transparent and cannot be as easily measured. What if I receive a bitcoin when my computer is powered off?

The inside story of Coinbase internal power struggle Op-ed: Nowadays, it appears that a large share of the OTC volume comes from only a few hundred massive transactions. Mining makes it exponentially more difficult to reverse a past transaction by requiring the rewriting of all blocks following this transaction. In summary, until we have a marketplace where OTC brokers are not needed to fulfill large orders, Bitcoin will be volatile. Jun 26, Chat with us. The main downside of using a platform instead of a broker would be the omnipresent risk of a hack, as we have seen in the past. Purchase bitcoins at a Bitcoin exchange. Where the impact of whales can be felt the most is in the altcoin market. Like any other payment service, the use of Bitcoin entails processing costs. The Block Genesis consists of our most in-depth, timely and impactful pieces, giving you an informational edge over the entire financial and technology industry. Because Bitcoin only works correctly with a complete consensus between all users, changing the protocol can be very difficult and requires an overwhelming majority of users to adopt the changes in such a way that remaining users have nearly no choice but to follow. This makes it exponentially difficult to reverse previous transactions because this requires the recalculation of the proofs of work of all the subsequent blocks. Bitcoin payments can be made without personal information tied to the transaction. With a stable monetary base and a stable economy, the value of the currency should remain the same. Why do people trust Bitcoin? Like other major currencies such as gold, United States dollar, euro, yen, etc. This offers strong protection against identity theft.

Smart money and OTC trading — how the 1 percent buy crypto How to buy large amounts of bitcoin through the OTC market The term 'whale' refers to an investor with deep pockets who can move the market by buying or selling in large volumes. Once KYC'ed, the investor can reach out to their broker and inquire information about buyers and sellers currently active in the OTC market or tell the broker what trade they want to. For example, if an early bitcoin adopter wants to cash out some of their BTC holdings - let's say 10, BTC worth around 65 million in today's market and asks more than one OTC broker for a suitable bid, bitcoin investors who are active in both the OTC market and on exchanges could end up selling BTC on exchanges in anticipation of the seller's large trade pushing prices lower. Bitcoin markets are competitive, meaning the price bitcoin leader joins paypal board of directors using bitcoin as a business a bitcoin will rise or fall depending on supply and demand. The Latest. Where can I get help? Bitcoin could also conceivably adopt improvements of a competing currency so long as it doesn't change fundamental parts of the protocol. Earn bitcoins through competitive mining. This situation isn't to suggest, however, that the markets aren't vulnerable to price manipulation; it still doesn't take significant amounts of money to move the market price up or down, and thus Zcash difficulty increase site forum.z.cash monero solo mining success screen remains a volatile asset thus far. Drag Here to Send.

Enter your info below to begin chat. Enterprise solutions. Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. As opposed to cash and other payment methods, Bitcoin always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices. Over the course of the last few years, such security features have quickly developed, such as wallet encryption, offline wallets, hardware wallets, and multi-signature transactions. However, there is a delay before the network begins to confirm your transaction by including it in a block. The problem is: Bob wants to sell a large amount of bitcoin. Fortunately, users can employ sound security practices to protect their money or use service providers that offer good levels of security and insurance against theft or loss. Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 6 confirmations is often considered to be as safe as waiting 6 months on a credit card transaction. When demand for bitcoins increases, the price increases, and when demand falls, the price falls. Given the scale of purchases this size, an order like this has to be filled using tranches. How to identify whales in action?