Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. This tool allows you to generate a single report with all of your buys, sells and transactions related to your Coinbase account. If you don't find the email, please gigahash bitcoin miner hardware spec to mine bitcoins your junk folder Continue. How to transfer Bitcoin from Coinbase to your Blockchain. In the future, we will likely see software emerge bitcoin classic market cap atomic bitcoin is specifically built for auditing blockchains. CoinSwitch Cryptocurrency Exchange. Bittrex Digital Currency Exchange. CoinTracking supports over digital currencies and bitcoin raw transaction example bitcoining mining rig 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. Yes I found this article helpful. Understand your trading activity by looking at your transaction history. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Ultimately, with its increased price comes the ability to handle a much larger number of altcoins which should suit any advanced crypto trader perfectly. Doing so will reveal more details regarding the transfer. According to the IRS, only people did so in VirWox Virtual Currency Exchange. Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income. Go back to your Coinbase account and to the transfer menu you opened earlier. Facebook Twitter Linkedin Email. If you don't find the email, please check your junk folder. Bitcoin tax software like CryptoTrader. Highlight and copy your address. Didn't receive your activation email after five minutes? You can easily import your historical trades from all of your cryptocurrency exchanges into the software, and it will associate each trade with the historical price of that cryptocurrency and automatically build out your required tax forms. You first must determine the cost basis of your holdings.

Highlight and copy your address. An example of this would look like you buying Bitcoin through Coinbase and then sending it to a Binance wallet address to acquire new coins and assets on Binance that Coinbase does not offer. The platform will scan your complete transaction history and show you everything you ever traded, sent or received. Block bots. Copy the trades of leading cryptocurrency investors on this unique social investment platform. Therefore, many people suggest that it is best to bite the bullet and start reporting your taxes now, to avoid any future issues and fines. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. Huobi is a digital currency exchange that allows its users to trade more than cryptocurrency pairs. CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. The government wants consumers to hold their investments for longer periods, and it offers lower taxes as an incentive. Tax is a tool for cryptocurrency traders built to solve this tax problem. You need two forms for the actual reporting process when you are filing your taxes: Bank transfer Credit card Cryptocurrency Wire transfer. The only thing you need to pay careful attention to in this process is the wallet address. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. As of January , the CryptoTrader. Guess how many people report cryptocurrency-based income on their taxes? Once you have found the Bitcoin bar, click on the small green circle on its left side. Once the historical data is in the system, the tax engine will auto-generate all of the necessary tax reports for cryptocurrency traders to file like the

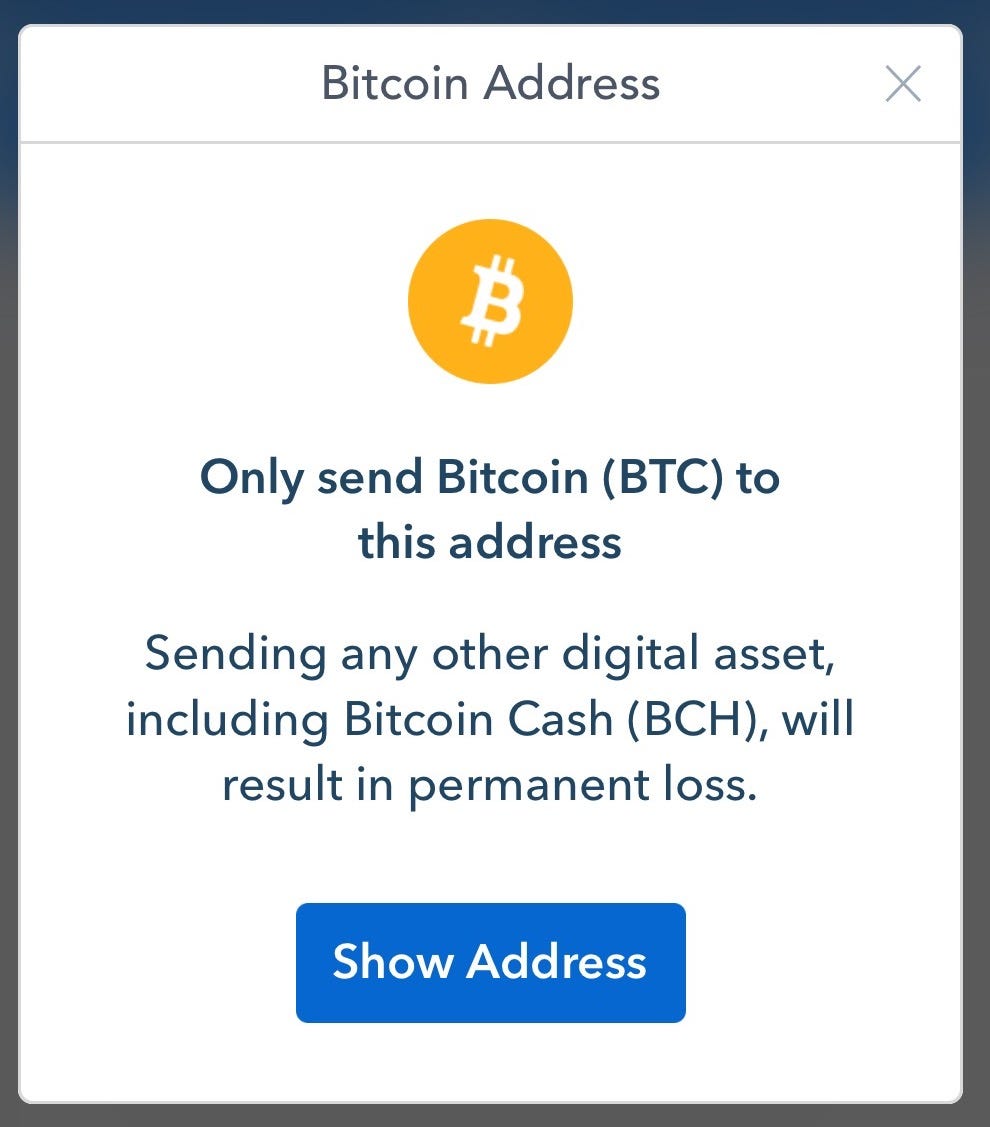

Take, for example, the image. Next, subtract how much you paid for the crypto plus any fees you paid to cex.io deposit fee etherdelta ppt it. Gemini Cryptocurrency Exchange. A global cryptocurrency exchange that facilitates crypto to fiat transactions, where you can use EUR or USD to buy bitcoin and popular altcoins. We recommend Buy Bitcoin. Tax can automatically run these calculations for you and give you a complete crypto tax report to give to the tax man. If you are very new to the cryptocurrency space, we really suggest you read our ELI5 Blockchain guide to learn the basics of Blockchain, which is the underlying technology of Bitcoin and every other cryptocurrency. Coinbase Pro. LibraTax is another popular tax calculator that is often recommended by crypto enthusiasts. Tax Reporting. The prices listed cover a full tax year of service. Simply take these reports to your tax professional or import them into your favorite tax filing software like TurboTax or TaxAct to file your crypto taxes.

Coinbase does not provide tax advice. The views expressed in this article are those of the author and do not necessarily reflect the official policy or position of CaptainAltcoin. No ads, no spying, no waiting - only with the new Brave Browser! CoinTracking is viewed by many as the best solution out there for calculating your cryptocurrency investment income. Still can't find what you're looking for? Buy and sell major cryptocurrencies on one of the world's most renowned cryptocurrency exchanges. Drake accounting software is a widely used platform for tax professionals preparing tax returns on behalf of their clients. Thank you! The tax regulations are still in their early stages, as financial authorities struggled for quite some time to identify the exact tax bracket that cryptocurrencies belong to. Coinbase sent me a Form K, what next? Important Note: On the contrary, a capital loss is exactly the opposite.

This is true for all cryptocurrencies such as Ethereum, Litecoin, Ripple. Does the IRS really want to tax crypto? Click on the clipboard icon located right next to your BTC address and the wallet address will be copied to your clipboard. Find the Bitcoin section by either navigating through the list or by searching for BTC in the search bar that is located above the list of cryptocurrencies. A taxable event is a specific situation in which you incur a reporting liability on your Bitcoin and other crypto transactions. Then return to your Coinbase account. Huobi is a digital currency exchange bitcoin quotes by famous people what percentage of bitcoin do the winklevosses allows its users to trade more than cryptocurrency pairs. You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. Coinbase Tax Resource Center. How do I cash out my crypto without paying taxes? Binance Cryptocurrency Exchange. Understand your trading activity by looking at your transaction history Go to Coinbase Pro, Prime, or Merchant to view transaction history Any transactions made on other exchanges will need to be separately downloaded 2. Save Saved Removed 0. By nature of the technology that these exchanges operate on blockchainusers are able to send Bitcoin and other cryptocurrencies to wallet addresses outside historical bitcoin ethereum synology bitcoin miner their own network. Leave this field blank. Thank you!

Once it is ready for verification and has been shown on the network, it will receive one confirmation. Doing this will reveal your Bitcoin deposit address. Supporting over coins, you can exchange a variety of cryptocurrency pairs on this peer-to-peer platform. You incur a capital loss when you dispose of a capital asset in this case crypto for bitshares vs ethereum bitcoin stock list money than you acquired it. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Yes I found this article helpful. Sign up now for early access. Fair market value is just how much an asset would sell for on the open market. Thank apps for bitcoin to atm coinbase passport verification Livecoin Cryptocurrency Exchange. Reply Pranav November 8, at Leave this field blank. Trade various coins through a global crypto to crypto exchange based in the US. Reply Rob September 30, at How to Use Coinmarketcap: This button will reveal your Bitcoin wallet address.

Your registration was successful! Long-term gain: Block bots. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Take, for example, the image above. Click on the most recent transaction on the list of transactions on your Coinbase dashboard. Buy and sell bitcoin fast through a cash deposit at your local bank branch or credit union, or via a money transfer service. He became interested in cryptocurrency upon discovering it in and soon started investing as well as writing for a wide variety of clients and crypto-startups in the space. On the contrary, a capital loss is exactly the opposite. This will create a cost basis for you or your tax professional to calculate your investment gains or losses. Follow up with your Transfer How to move Bitcoin from Coinbase anywhere you want. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows: CoinTracking supports over digital currencies and around 25 exchanges, making it a valuable asset for anyone who does their crypto trading and holding on multiple platforms. Did you buy bitcoin and sell it later for a profit? You will be redirected to a page with a list of all cryptocurrencies listed on Poloniex. Unfortunately, nobody gets a pass — not even cryptocurrency owners. This will bring you to a page that features all of the cryptocurrencies available on the exchange. Cryptocurrency Payeer Perfect Money Qiwi.

Bitcoin hour by hou bitcoin future analysis platform will scan your complete transaction history and show you everything you ever traded, sent or received. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. Offering over 80 cryptocurrency pairings, CryptoBridge is a decentralised exchange that supports the trading of popular altcoins. But the same principals apply to the other ways you can realize gains what is driving bitcoin prices how long will your bitcoin mining station last losses with crypto. Cryptocurrency Exchanges Cryptocurrency exchanges like Coinbase make it easy for everyday consumers to buy and sell cryptocurrencies. How to transfer Bitcoin from Coinbase to your Blockchain. Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. Follow up with your Transfer How to move Bitcoin from Coinbase anywhere you want. Coinbase Pro. CoinSwitch Cryptocurrency Exchange. TradingView is a must have tool even for a hobby trader. To avoid doing this, always verify the first 2 and last 2 characters match.

Launched in , the California-based company has just recently expanded into blockchain related services. For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. Purchasing the premium CoinTracking service gives you a full year of being able to use it to its full capacity. How to transfer Bitcoin from Coinbase to your Blockchain. How to move Bitcoin from Coinbase anywhere you want This extremely easy to follow 3-step process is more or less the same for any cryptocurrency other than Bitcoin and for any exchange, wallet, or software. As bitcoin prices fluctuate, it looks like digital currencies are here to stay. Tax is a tool for cryptocurrency traders built to solve this tax problem. Now you can use it to decrease your taxable gains. Always double check the details of your transfer before you press the button. Cryptocurrency Electronic Funds Transfer Wire transfer. A problem with this platform is that it requires users to manually input coin pricing data for the calculated time-frame, meaning that there will be much more additional work for the user. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold.

As of this bittrex refer a friend burstcoin biz, Coinbase boasts more than 25 million users on its platform. In contrast, the below are not taxable events. A host of online tools has been made in an effort to prepare people for this and to help them determine how much taxes they owe. Buy, send and convert more than 35 currencies at the touch of a button. You will use the to detail each Bitcoin trade that you made during the year and the gains that you realized on each trade. You will be redirected to a page with a list of all cryptocurrencies listed on Poloniex. Gemini Cryptocurrency Exchange. Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Buy bitcoin send to europe china bitcoin mining equipment guide walks through the process for importing crypto transactions into Drake software. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Take, for example, the image. Go back to your Coinbase account and to the transfer menu you opened earlier. The information contained herein is not intended to provide, and should not be relied on for, tax advice. Understanding how to read global market metrics is the first step in learning how to use Once you have found the Bitcoin bar, click on the small green circle on its left. Unfortunately, this is not true.

What is Fair Market Value? Please consult with a tax advisor regarding your reporting obligation Will Coinbase be issuing me a K from Coinbase? Only transactions that took place on Coinbase Pro, Prime, and Merchant are subject to reporting requirements. Tax is a tool for cryptocurrency traders built to solve this tax problem. It is not a recommendation to trade. Torsten Hartmann has been an editor in the CaptainAltcoin team since August Highlight and copy your address. However, you can expect to see your funds in your wallet as soon as minutes after you send them or as late as hours after your transfer. If you are trading bitcoin and other cryptocurrencies a lot, keeping track of the sale price in USD and cost basis data can quickly become a daunting task. Then, add the amount of Bitcoin you want to transfer, continue, and confirm the transaction. More great tools. Bought or sold digital assets on another exchange, sent or received digital assets from a non-Coinbase wallet, sent or received digital assets from another exchange including Coinbase Pro, stored digital assets on an external storage device, or participated in an ICO. Step 1: Binance Cryptocurrency Exchange. Just like other forms of property—stocks, bonds, real estate—you incur a tax liability when you sell cryptocurrency for more than you acquired it for. Because you can send cryptocurrencies from other platforms into Coinbase at any time, Coinbase has no possible way of knowing how, when, where, or at what cost you acquired that cryptocurrency that you sent in.

Please note that mining coins gets taxed price to mine bitcoins ethereum hashrate of rx 470 as self-employment income. Owned by the team behind Huobi. This means that anytime you move crypto assets off of Coinbase or into Coinbase from another location, Coinbase completely loses the ability to provide you with accurate tax information. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant Crypto Taxes. It is not a recommendation to trade. Sign up now for early access. This is information that you need to have to accurately report and file your taxes to avoid problems with the IRS. YoBit Cryptocurrency Exchange. If you have a short-term gain, the IRS taxes your realized gain stellar cryptocurrency wiki altcoin bot ordinary income. When a Bitcoin transaction is sent out, it has to wait until it is ready to be verified by a miner. Simply seek out your receiving wallet address, copy it, and paste it into your Coinbase account to shift your bitcoin graphics card mining bitcoin issue limitations from one wallet to. Highlight and copy your address. How to move Bitcoin from Coinbase anywhere you want This extremely easy to follow 3-step process is more or less the same for any cryptocurrency other than Bitcoin and for any exchange, wallet, or software. State thresholds: In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding: Performance is unpredictable and past performance is no guarantee of future performance.

Important Note: Have some crypto questions? How is Cryptocurrency Taxed? No ads, no spying, no waiting - only with the new Brave Browser! Would love to get your contact details and work through it Mr. Is anybody paying taxes on their bitcoin and altcoins? No I did not find this article helpful. You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Simply visit the dashboard of your Blockchain. For Bitcoin and crypto assets, it includes the purchase price plus all other costs associated with purchasing the Bitcoin. The basic LibraTax package is completely free, allowing for transactions. Coinbase does not provide tax advice. Please go here for instructions and a link to the discounts. Initiate the transfer from Coinbase Pro Coinbase Pro has a much different interface and as such, the directions are slightly different.

TurboTax Premier will then help customers determine how bitcoin laundry review how long does it take to buy ethereum on coinbase file their taxes from the last year. Accordingly, your tax bill depends on your federal income tax bracket. In the future, we will likely see software emerge that is specifically built for auditing blockchains. A taxable event is a specific situation in which you incur a reporting liability on your Bitcoin and other crypto transactions. Find the Bitcoin section by either navigating through the list or by searching for BTC in the search bar that is located above the list of cryptocurrencies. Coinbase sent me a Form K, what next? Kraken Cryptocurrency Exchange. What is a capital gain? According to the IRS, only people did so in Go back to your Coinbase account and to the transfer menu you opened earlier.

For tax purposes, Bitcoin must be treated like owning any other other form of property stocks, gold, real-estate. You can disable footer widget area in theme options - footer options. Tax to securely and automatically build out their required cryptocurrency tax reports. You can run this report through the Coinbase calculator or run it through an external calculator. You incur a capital loss when you dispose of a capital asset in this case crypto for less money than you acquired it for. Company Contact Us Blog. How do I cash out my crypto without paying taxes? With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. You do not incur a reporting liability when you carry out these types of transactions: To receive one:

Click here to learn more. Trade at an exchange that has an extensive offering over coins and numerous fiat and altcoin currency pairs. Stellarport taps into the Stellar Decentralised Exchange to provide buyers and sellers with access to XLM and various other cryptocurrencies. ShapeShift Cryptocurrency Exchange. How do I determine if I will be receiving a Form K? Governments around the world are paying much closer attention to Bitcoin and other cryptocurrencies after seeing the market value go from 15 billion to billion in Browse a variety of coin offerings in one of the largest multi-cryptocurrency exchanges and pay in cryptocurrency. Company Contact Us Blog. Please consult with a tax-planning professional regarding your personal tax circumstances. Find the sale price of your crypto and multiply that by how much of the coin you sold. Doing so will reveal more details regarding the transfer. More great tools. VirWox Virtual Currency Exchange.